Trends

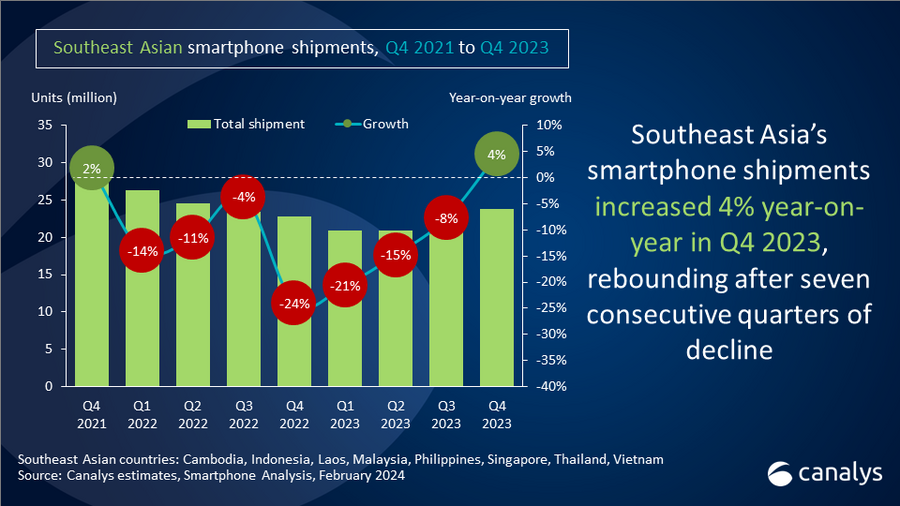

Southeast Asia smartphone market grows 4% YoY in Q4 2023 to 23.8m units

Canalys’ latest research reveals that the Southeast Asia smartphone market grew 4% year-on-year in Q4 2023 to 23.8 million units. The region experienced a weak start to the year, pelted by macroeconomic headwinds and inflationary conditions, resulting in a sharp decline in consumer spending. The market has since rebounded, leading to a recovery of consumer demand for smartphones, catalyzed by aggressive launches and channel incentives.

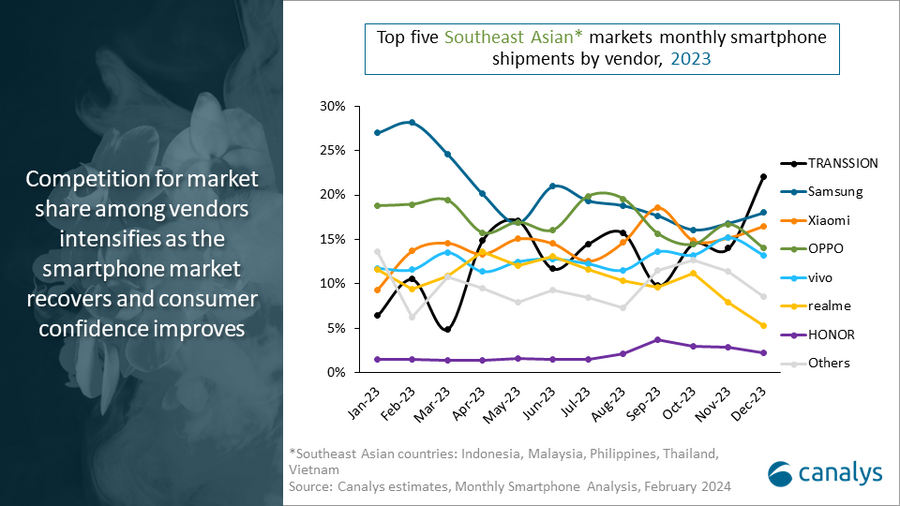

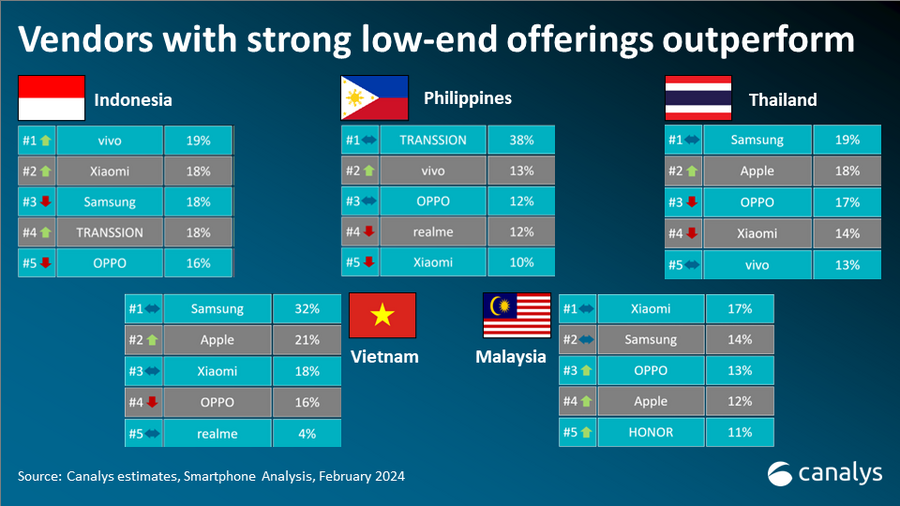

“Smartphone manufacturers are leveraging the upward trajectory of economic recovery,” commented Sheng Win Chow, Analyst at Canalys. “Samsung maintained its lead in Southeast Asia with an 18% market share, albeit experiencing a 17% year-over-year decline. Its strategic shift toward bolstering the premium segment has diminished the competitiveness of its lower-end A0x and A1x models against other Android brands. Notably, TRANSSION secured second place for the first time, capturing a 16% market share and achieving a remarkable 153% year-over-year growth, driven by strong performance in Indonesia and the Philippines as well as its expansion into new markets. Xiaomi and OPPO both held a 15% market share in the region, with Xiaomi witnessing a 44% growth and OPPO facing a 27% decline year-over-year. Xiaomi’s successful consolidation of its product lineup through a reduction in the number of models resulted in competitive pricing for its volume drivers, ultimately bolstering sales volume. Conversely, while OPPO’s branding efforts improved, driven by its premiumization strategy, it encountered challenges in volume competition due to the absence of a product tailored to the ultra-low-end market segment.”

“Following the earlier release of numerous premium and flagship devices throughout 2023, the focus for most vendors in Q4 shifted toward bolstering their market share through the introduction of volume drivers,” added Chow. “The price-sensitive Philippines market experienced the most significant resurgence, achieving a remarkable 32% year-on-year growth. TRANSSION spearheaded this recovery by increasing shipments of its Smart and Spark series and effectively utilizing social media platforms to promote its Phantom V Flip model. In Malaysia, the smartphone market exhibited robust growth at 11% year-on-year, driven by government initiatives aimed at encouraging widespread adoption of 5G. However, Vietnam’s smartphone market recovery progressed slower than expected, with key distributors such as Mobileworld and FPT redirecting their investments toward emerging sectors like AI. This transition presents Samsung, a longstanding partner, with a promising opportunity to capitalize on.”

“Devices priced below US$299 continue to drive the majority of sales in Southeast Asia, accounting for a combined 82% of total volume in Q4 2023,” stated Le Xuan Chiew, Analyst at Canalys. “Leading this charge is TRANSSION which topped smartphone shipments to the region in December for the first time. However, heightened price competition and market saturation pose challenges for vendors when it comes to pricing and positioning products within this segment. Premium-focused vendors such as Samsung and OPPO may find it difficult to directly compete with the affordability-centric model launches from brands like Infinix, Tecno, Xiaomi and realme. Instead, they aim to differentiate themselves beyond price by capitalizing on premium channels such as brand stores and telco partnerships, which are less sensitive to pricing. For instance, HONOR in Malaysia experienced a remarkable 184% year-over-year growth by expanding its 5G lineup through initiatives like the Rahmah program and operator channels. Balancing device affordability with inventory management remains the primary challenge for vendors, as channel partners remain cautious following a challenging start to the year.”

“Canalys predicts that smartphone shipments in Southeast Asia will grow by 7% in 2024,” said Chiew. “The sharp sales spike in 2021 will likely result in many customers changing devices in 2024 as part of a natural refresh cycle. However, vendors are wary of over-forecasting demand in 2024 as high interest rates and inflation mean consumers will hold off purchasing new devices. The demand for 5G devices has been revitalized, driven by improvements in affordability and government activity. 5G devices in the sub-US$300 grew more than double in 2023, from 6% in January to 14% in December, and is expected to continue momentum in 2024. It is increasingly difficult for vendors to differentiate themselves. In the longer term, trends like AI, ecosystem and channel optimization will be the new driving forces of the industry in the region and vendors will have to innovate to drive end-user adoption. Samsung’s introduction of Galaxy AI represents its strategy to differentiate itself and bolster its branding as a frontrunner in the market, which is expected to enhance its visibility as a household name in the region through its established ecosystem. Southeast Asia’s dynamic nature offers ample opportunities for smartphone vendors aiming to broaden their reach. Smartphone vendors need to adapt flexibly and collaborate closely with their channel partners to navigate through these evolving trends effectively. With increasing consumer confidence and strategic measures in place, the region presents fertile ground for growth and innovation within the smartphone sector.”

|

Southeast Asian smartphone shipments and annual growth |

|||||

|

Vendor |

Q4 2023 |

Q4 2023 |

Q4 2023 |

Q4 2023 |

Annual |

|

Samsung |

4.2 |

18% |

5.1 |

23% |

-17% |

|

TRANSSION |

3.9 |

16% |

1.5 |

7% |

153% |

|

Xiaomi |

3.6 |

15% |

2.5 |

11% |

44% |

|

OPPO |

3.6 |

15% |

4.9 |

22% |

-27% |

|

vivo |

3.2 |

13% |

2.8 |

12% |

13% |

|

Others |

5.3 |

22% |

5.9 |

26% |

-10% |

|

Total |

23.8 |

100% |

22.8 |

100% |

4% |

|

Southeast Asian smartphone shipments and annual growth |

|||||

|

Vendor |

2023 |

2023 |

2022 |

2022 |

Annual |

|

Samsung |

18.2 |

21% |

23.6 |

24% |

-23% |

|

OPPO |

14.9 |

17% |

18.1 |

19% |

-18% |

|

Xiaomi |

12.3 |

14% |

13.6 |

14% |

-10% |

|

TRANSSION |

11.0 |

13% |

8.0 |

8% |

37% |

|

vivo |

10.8 |

12% |

13.1 |

14% |

-18% |

|

Others |

20.1 |

23% |

20.7 |

21% |

-3% |

|

Total |

87.3 |

100% |

97.1 |

100% |

-10% |

Canalys

You must be logged in to post a comment Login