5G Features

Rolling out 5G will be a balancing act

A successful 5G spectrum auction, with maximum home-grown network infrastructure is the task mapped out ahead to meet the government’s expectation of implementing 5G services in FY23.

The 5G market continues to gain momentum in 2022, with the market expanding in coverage to more cities and towns.

By end October 2021, GSA had identified 469 operators in 140 countries investing in 5G, including trials, acquisition of licenses, planning, network deployment, and launches. This number excludes nearly 200 additional companies awarded spectrum in the US CBRS PAL auction, which could potentially be used for 5G.

Of those, a total of 182 operators in 73 countries had launched one or more 3GPP-compliant 5G services. 173 operators in 69 countries had launched 5G mobile services. 65 operators in 36 countries had launched 3GPP-compliant 5G FWA services (36% of those launched 5G services). Five operators had announced soft launches of their 5G networks that are not counted in the above launch figures.

Ninety-seven operators are identified as investing in 5G standalone (SA), including those evaluating/testing, piloting, planning, deploying, as well as those that have launched 5G SA networks. GSA has catalogued 20 operators as having deployed/launched 5G standalone in public networks.

One of the biggest trends is the move to establish infrastructure for SA 5G networks that would lead to the deployment of millimeter wave (mmWave) technology.

Non-standalone (NSA) 5G technology, which has been the bulk of the 5G networks deployed worldwide, uses 4G infrastructure already in place and piggybacks on the 5G signal through this equipment. Because 4G infrastructure has been deployed globally, the NSA equipment is more plentiful than SA 5G equipment, currently installed worldwide. However, SA infrastructure is growing in deployment.

SA 5G uses new infrastructure put in place specifically to run 5G networks, allowing smart devices and other potential use cases to take advantage of the high download speed, high bandwidth, and low latency that the technology affords. SA 5G is expected to be where the bulk of mmWave deployments will begin and the true potential of 5G can be used by consumers and business.

Because NSA 5G technology has had most deployments, sub-6 GHz 5G technology has been the most popular spectrum bandwidth used for 5G. Sub-6 GHz uses the lower end of the spectrum to provide coverage of cellular connections. While this is higher in bandwidth and performance than 4G technology, it is not the full performance that is touted by 5G.

5G mmWave is considered true 5G to meet the speeds, expected from the next generation wireless technology – 10 times the speed, higher bandwidth, and lower latency than 4G. However, the technology is problematic in that it does not travel far in its current form, especially indoors. The higher frequency transmissions are interrupted while traveling between obstacles, such as trees, buildings, or walls, disconnecting the service from the user. While sub-6 GHz technology can flow through obstacles easier, it does not have the ability to generate the speeds promised by 5G.

Once these challenges are solved, mmWave will allow for the promised 10 times speeds of 4G, and companies are rapidly deploying mmWave to push the benefits of 5G and generate consumer interest.

When 5G arrives, it will usher in an era of high speeds, low latencies, and massive connectivity. While it stands to transform every industry, its impact will be especially felt in urban settings – and will pave the way for tomorrow’s smart cities.

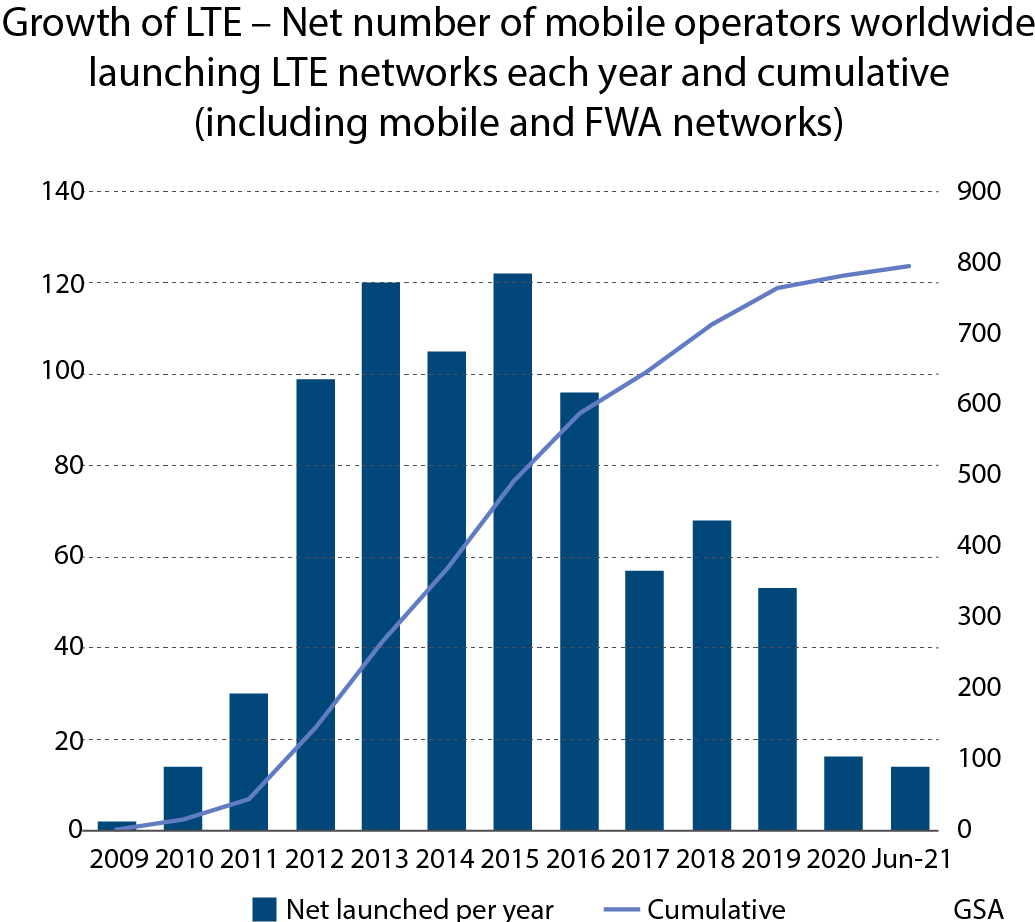

The hype and expectations around 5G continue to build, but the reality is that Long-Term Evolution (LTE) is still going to be a significant part of the mobile cellular landscape for several years to come. Not only does LTE support several of today’s mobile applications, but its infrastructure will also be an integral part of many 5G NSA and 5G SA architectures.

Several mainstream applications will continue to be supported by 4G/LTE mobile infrastructure. In particular, Mobile Broadband (MBB), the Internet of Things (IoT), Voice over LTE (VoLTE), and Fixed Wireless Access (FWA) will continue to rely on 4G/LTE.

The coverage and capabilities of LTE are important factors for a quality 5G user experience. In addition, sub-3 GHz offers an alternative for 5G, where mobile operators lack access to the 3.5 GHz band or face challenges in deploying 5G in the 3.5 GHz band. Therefore, the investment and infrastructure for LTE needs to be future-orientated to deliver the 5G capabilities. Mobile operators often need to classify their operations into coverage-centric areas, and capacity-build areas.

For coverage-centric areas, the telco can use the low band to meet its requirement of providing wide coverage, including in rural areas. This is because low bands, below 1 GHz, can propagate further compared to higher frequency bands. In addition, low bands can provide indoor coverage due to their ability to penetrate through walls, an issue faced by higher-frequency bands. This makes low bands a priced asset for mobile operators. To future proof their infrastructure, mobile operators can deploy a 4T4R base-station solution to meet demand. The 4T4R solution will be able to achieve better spectral efficiency and boost capacity compared to a 2T2R solution.

For capacity-centric areas, such as in urban centers, mobile operators face the challenge of high population density and mobility of their users. In these areas, the high band (i.e., mmWave) or the mid bands (e.g., 3.5 GHz bands) can be used to meet capacity demands and certain level of coverage. However, users tend to congregate in the same locations (e.g., in their offices) at the same time of the day, which creates network congestion. While mobile operators can choose to increase the number of sites in the area, it is often challenging and costly to do so. Therefore, to resolve the congestion and cope with future demands, operators can deploy massive Multiple Input, Multiple Output (MIMO) antenna solutions to expand network capacity. However, financial constraints may require mobile operators to consider alternatives, such as 8T8R antenna solutions, to boost capacity demand in urban areas. Both solutions are suitable for operators looking to future-proof their long-term network investments.

Evolution from LTE to 5G. LTE, a global success with over six billion subscriptions, connects nearly 64 percent of mobile users worldwide. Specified by 3GPP as a single global standard for paired and unpaired spectrum users, the vast majority of the standard is the same for FDD and TDD.

According to GSA, 907 operators in 243 countries/ territories have stated plans to invest or are actively investing in LTE for public networks, including those evaluating/ testing and trialling LTE and those paying for suitable spectrum licences (excludes those using spectrum licences exclusively for 2G or 3G services), as of end September 2021.

LTE has evolved through various 3GPP technology releases, covering the introduction of LTE-Advanced and then LTE-Advanced Pro that have significantly improved the capabilities of LTE networks. From 3GPP Release 15 onwards, the community has been defining 5G networks, starting with NSA 5G systems that integrate with existing LTE networks and then moving on to SA 5G systems with substantially different network configurations.

As the transitioning is taking place, mobile operators find themselves in a tough spot. For many, their legacy subscriber data management systems cannot provide the capabilities they need to monetize and access services as they make the gradual shift to 5G. That is because, in order to launch new services like network slices across public and private networks, operators need to be able to access application, profile, and subscriber data with low latency across several different sites in a decentralized way, and effectively manage their interworking with 4G.

Without this level of agility, or a common network layer, operators can quickly find themselves bogged down with duplicate and fragmented data. This makes onboarding new services cumbersome, and the rollout of new services far more difficult than it needs to be.

If there is one thing operators need to rapidly roll out services and provide a competitive package to consumers and enterprises, it is the ability to see and manage data seamlessly across data silos. Despite the imminent rollout of 5G, this is still a surprisingly common problem for operators in 2021. Many operators have to grapple with vendor lock-ins, and lack the sufficient control of their own data when transitioning from 4G to 5G.

Either they stick with a legacy 4G system, which makes transitioning to 5G slow and cumbersome, or they invest in 5G but lose the agility anyway because they still need access to application and subscriber data on the 4G layer. It would appear to be a lose-lose scenario for operators, and it is preventing many from realizing the true potential of both 5G and data. In a 5G cloud-native solution, applications must be allowed to be stateless and separated from the processing of the data.

Of course, data visibility is not the only challenge facing operators in 2021. Yesterday’s technology was designed and built in a way that only required data to be stored in large, centralized databases. It is not scalable by its very nature, requiring services at the edge to constantly make multiple paths back to the core just to get whatever data they need to function. Naturally, this results in latency and accumulated delay that undermine the very purpose of edge computing.

To address these issues, both in terms of data visibility and data access, operators need to embrace new data-management systems, such as a virtualized schema that allows full interoperability with 4G systems and the 5G core. Being able to access multiple data sources, which is crucial, when it comes to synchronicity and resolving latency issues, will create a more harmonized data layer for operators to work with. Given that 3GPP Release 16 stipulates the separation of 5G functions and 5G data, service providers are thus able to consider the best choice, based on their direction and vision. What is more, such solutions can cut hardware total cost of ownership (TCO) by up to 50 percent, and support operator sustainability initiatives to drive their green agendas.

Given issues with vendor lock-in, which is arguably holding this kind of innovation back, operators will instead have to turn to a virtual overlay or edge-based schema that will allow for secure, reliable, read-write capabilities from the core to the edge. Only then will operators have a 5G core system that gives them complete control and visibility over their entire data ecosystem, allowing them to focus on 5G-driven innovation instead of risk management and damage mitigation.

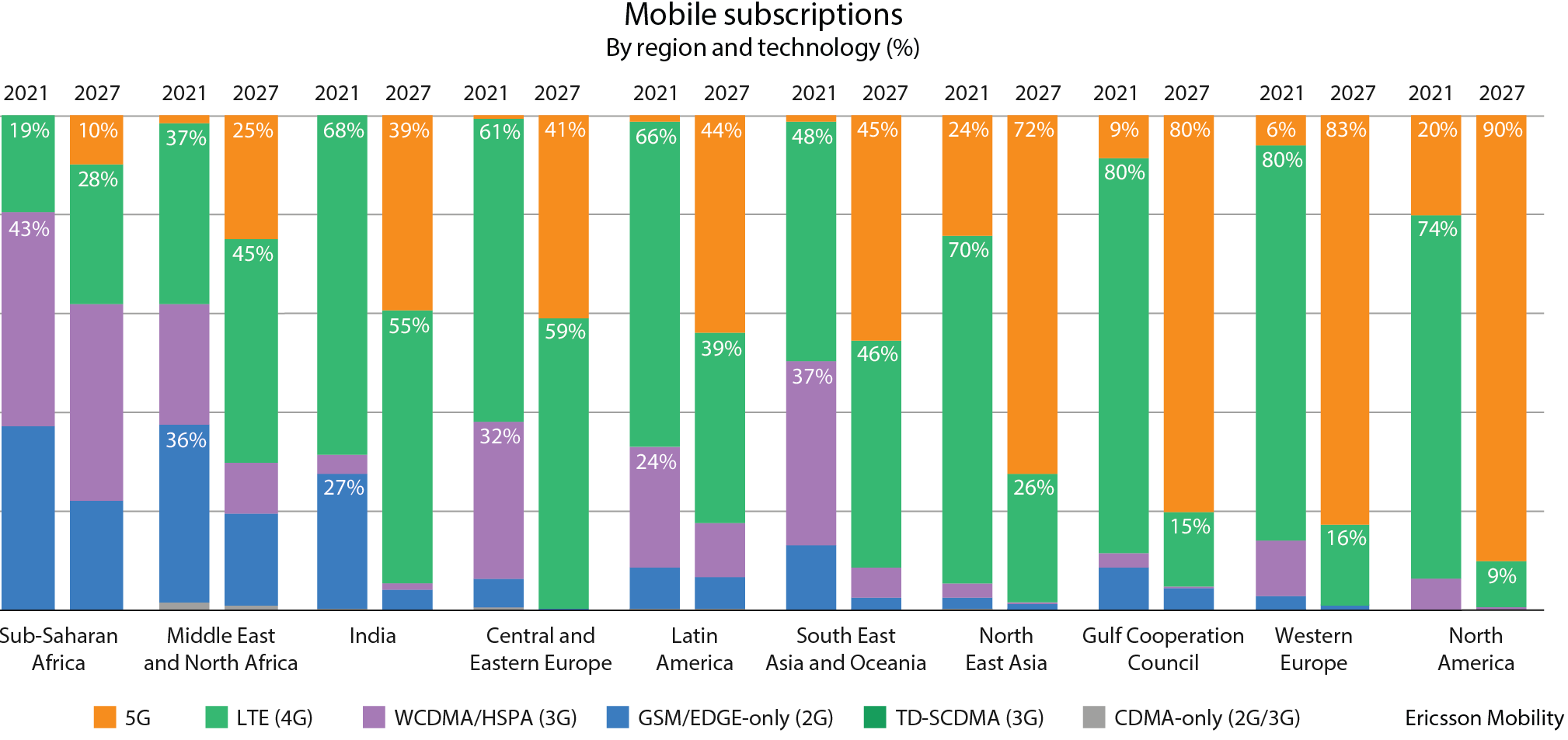

In the India region, 4G is expected to remain the dominant technology till 2027; however the 4G subscriptions are forecast to drop from 790 million in 2021 to 710 million in 2027, showing an annual average decline of 2 percent. Thus, 4G subscriptions are expected to reduce from 68 percent of mobile subscriptions in 2021 to 55 percent in 2027 as subscribers migrate to 5G.

In 2022, however, 4G is going to be earning the maximum revenues for the telcos. The telcos reach almost every part of India with their 4G services. While 5G services are poised to be launched soon, there remains a lot of headroom for expanding 4G coverage and bringing affordable connectivity for every Indian.

Indians still have not been able to experience what true 4G networks can deliver in a consistent manner. Network congestion and 4G go hand-in-hand in India because of the sheer number of people that live in the country. The telecom operators have spent thousands of crores on purchasing spectrum from the government in 2021.

Covid-19 increased reliance on telecom networks to fulfil personal and business needs – be it remote health consultations, online ordering, online education, content consumption, or video conferencing, amongst others.

The reliance on mobile networks to stay connected and work from home has contributed to the average traffic per smartphone increasing to 18.4 GB per month in 2021, up from 16.1 GB per month in 2020. The average traffic per smartphone in the India region is the second-highest globally and is projected to grow to around 50 GB per month in 2027. Competitive pricing by service providers for subscription packages, affordable smartphones, and increased time spent online all contribute to monthly usage growth in the region.

Total mobile data traffic in India has grown from 9.4 EB per month in 2020 to 12 EB per month in 2021 and is projected to increase by more than 4 times to reach 49 EB per month in 2027. This is driven by high growth in the number of smartphone users, including growth in rural areas, and an increase in average usage per smartphone.

The number of smartphone subscriptions, 810 million in 2021, is projected to grow at a CAGR of 7 percent, reaching over 1.2 billion by 2027. Smartphone subscriptions accounted for 70 percent of total mobile subscriptions in 2021, and are projected to constitute around 94 percent in 2027.

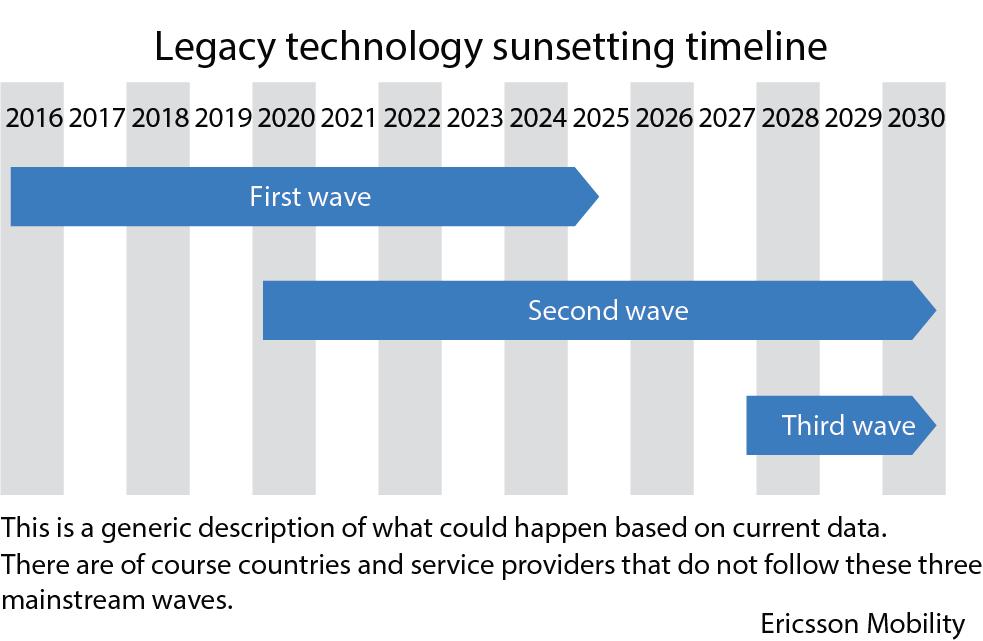

Network sunsets becoming a reality. Technologically, as the world is moving toward the 5G era, and 4G has become the mainstream mobile communication system, shortcomings of 2G/3G become increasingly obvious either regarding spectrum allocation efficiency, wireless performance, or operation and maintenance costs. The worldwide 2G/3G sunset is in progress with many countries giving their own timelines based on their needs for telecommunications networks.

The retirement of 2G/3G requires mature alternative technologies to meet the development needs of low and mid-speed loT applications that account for 90 percent of the overall cellular loT connections.

LPWA (Low Power Wide Area), including NB-loT and LTE Cat M, as well as LTE Catl, have become the main choices for wireless connectivity for low- and mid-speed loT applications after 2G/3G has started to withdraw from the stage.

According to GSMA, as of September 2020, the total number of deployed NB-loT and Cat M-based low- and medium-speed loT networks worldwide reached 112, of which 96 support NB-loT, 46 support Cat M, and 30 support both NB-loT and Cat M. In China, the three major operators are deploying LTE Cat 1 technology for the mid-speed loT businesses. Up to now, the scale of domestic LTE Cat 1 commercial chips in China has reached 10 million.

NB-loT, featuring wide network coverage and ultra-low power consumption, is suitable for low-speed loT applications that need long-distance, small amount of communication data transmission with mere latency demand. LTE Cat 1 and Cat M technologies are more suitable for loT applications that require relatively high mobility, high data rate and volume, as well as voice capabilities

Globally, this can be recognized in three different waves:

First wave. Mainly parts of North America, North-East Asia, Australia, and New Zealand are closing down 2G. This has, to a large extent, already taken place. The next step in these areas is the sunset of 3G, which is expected before the mid-2020s.

Second wave. In Western Europe there is a larger dependency on 2G, so the second wave has started with the sunsetting of 3G. This is expected to stretch until the mid-2020s, in parallel with the 3G sunset in the first wave. The second step is the sunset of 2G, which is not expected until closer to 2030. For this step, technologies like spectrum-sharing are important enablers to keeping a thin layer of 2G. This wave also includes parts of South-East Asia and the remaining parts of North America.

Third wave. This includes parts of the world with lower penetration of 4G and 5G technologies, mainly in Eastern Europe, Africa, the Middle East, and the remaining parts of South-East Asia. Here, 3G will still be important to provide mobile broadband for some years to come. Both 2G and 3G are then expected to reach sunset closer to 2030.

The Gulf Cooperation Council countries are an exception, where the plans are somewhere between the first and second waves.

In 2022 we expect to see:

Open networks. We will continue to see the shift to building networks with open hardware and software components to take advantage of a larger multi-vendor ecosystem, reduced costs, and reduced time-to-market. GSMA is embracing this trend too. Service providers are also continuing to lead many of the workgroups of the open industry organizations, such as the O-RAN Alliance, Open Networking Forum, Open RAN Policy Coalition, the Small Cell Forum, and others.

OpenRAN is being promoted by the industry and the governments from the US, Japan, Germany, the United Kingdom, and even Russia as trade policy and enterprise enhancements, though the OpenRAN market itself appears to be growing minimally.

OpenRAN is one of the most overhyped technical solutions since the launch of 3G in year 2000. While the OpenRAN promise to cut RAN CapEx by as much as half does not rise to the level of hyperbole that 3G would turn radio spectrum into gold, it comes close.

Having said that, OpenRAN will continue to be deployed across the world, but mobile operators will start paying more attention to RAN Intelligent Controller (RIC) and Service Management and Orchestration (SMO) platforms, as these can be deployed in brownfield networks. Infrastructure vendors as Ericsson and Nokia and networking platform vendors as Juniper Networks, and VMWare are expected to launch RIC/SMO platforms and start creating developer communities around them. This may lead to fragmentation in the market but will prove that openness can introduce agility and new types of applications in the network, predominantly for automation and optimization. 2022 is poised to be a major year for RIC/SMO announcements.

In December 2020, Strand Consult published a ground-breaking research note on the Chinese influence on the O-RAN Alliance. In August 2021, Nokia paused their work in the group for fear of violating US restrictions on the many Chinese members. Strand Consult has yet to find an OpenRAN proponent who can explain how the prevalence of 44 Chinese companies in the O-RAN Alliance does not compromise OpenRAN.

The OpenRAN and O-RAN are built on-top of 3GPP 4G/5G technologies. They are not solutions that can replace existing networks on a 1:1 basis. Nor do OpenRAN or O-RAN technologies support 2G and 3G, which most of the world still uses for machine2machine communications and telephony. If a legacy operator wants OpenRAN, it must likely maintain two sets of parallel base stations, one for 2G/3G and the other for 4G/5G. Running two parallel networks increases rental and energy costs over one network.

If OpenRAN gets the success its proponents predict, it will account for less than 1 percent of the 5G mobile sites in 2025 and not more than 3 percent in 2030. It looks like OpenRAN is too little, too late to make a difference in a world in which operators are deploying 10,000 classic 5G sites every month. 2022 will see continued OpenRAN advocacy, though it will be more difficult for its proponents to evade the tough questions about the hard reality.

As it is, the push for greater security is incompatible with OpenRAN technologies, which are increasingly influenced by the Chinese players. Both the US and EU have rolled out new policy and regulation to improve network security, including 5G. This includes the EU’s Toolbox and the US Secure Equipment Act, which empowers the Federal Communications Commission (FCC) to deny equipment authorizations to firms posing unacceptable national security list. These companies include Huawei, ZTE, Hytera, Hangzhou, Hikvision, and Dahua. It is likely that drone maker DJI will be added, and many national security experts propose restrictions should be increased for Lenovo, TikTok, and chip maker YMTC.

Geopolitics has turned China upside down and taken 30 percent of the world market away from many American suppliers. The Chinese government was forced to stop deploying high-performance C-band base stations, and they are deploying low-performance, low-band base stations, simply because the Chinese vendors cannot buy advanced semiconductors.

Huawei, in particular, still faces significant financial pressure, and public opinion about Huawei has not changed. Many countries see it as unsafe and unsustainable to use Huawei equipment in telecommunications networks. Many operators have experienced increased reputational and regulatory risk by using Huawei, and corporate customers do not want their sensitive and valuable data to be vulnerable to the Chinese government.

Huawei has pivoted to the cloud market and attempts to bill itself as a trustworthy IT supplier for the public and private sectors and as an alternative to the large IT software companies, which supply a combination of services and a cloud. Huawei will probably succeed with its strategy in China and in some countries sympathetic to the Chinese regime. However, in all probability, it will be a hard sell for Huawei to convince public sector buyers in the US and Europe to buy its solution of putting data into Chinese IT systems and the Chinese cloud.

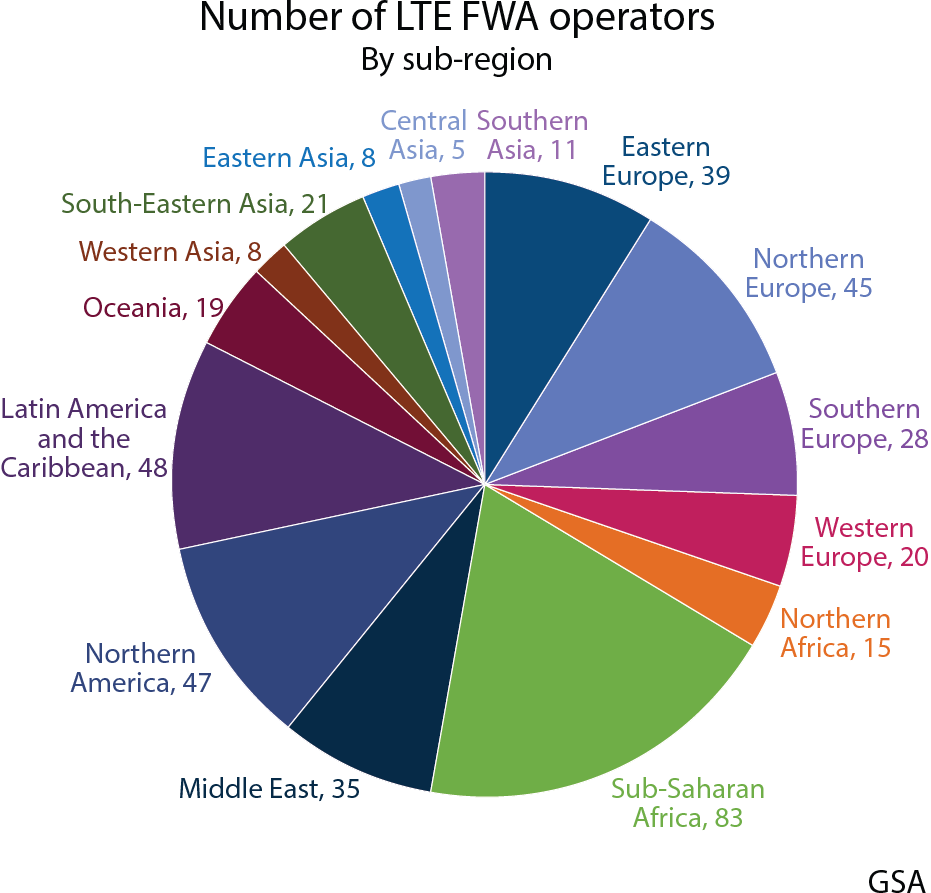

In 2021, fixed wireless access stepped more directly into the spotlight as major carriers emphasized new offerings with a stronger focus on the home broadband market.

As technology has improved, operators have been turning to mobile networks to deliver residential and business broadband services. They are using LTE, LTE-Advanced, and 5G networks to deliver services in locations that are poorly served (or not served at all) by fixed-line broadband technologies based on copper, coax, or fiber. Some are also offering mobile-based services as an alternative to fixed-line broadband technologies. The wireless residential/business broadband services on offer are no longer largely limited to legacy technologies, mobile data subscriptions associated with mobile phones, dongles, or even MiFi or hotspot devices. They now include the use of mobile technology to provide the main broadband connection for a home or business. This takes the form of a fixed wireless access service delivered to a mains-powered CPE device, which in turn provides local connectivity to other devices (typically over Wi-Fi). In a relatively short space of time, fixed wireless broadband access has become a mainstream service offer.

The promotion of LTE and 5G networks as a mainstream mechanism for the delivery of broadband services to homes and businesses is now established, with lots of services available from operators, supported by a wide range of devices from many vendors. FWA services are being offered as an alternative or complement to fixed broadband (with the nature of the messaging dependent on whether an operator already owns a large fixed broadband network it wishes to continue to sell). As more operator networks are upgraded to LTE-Advanced, as more 5G networks are built out, and as more (particularly 5G) customer-premises equipment (CPE) devices are commercialized, GSA expects the number of FWA services to rise.

While fixed wireless access got renewed attention in 2021, momentum is not expected to slow down in coming years.

By the end of 2021, Ericsson projects nearly 90 million global FWA connections. That figure is forecast to grow almost threefold through 2027 to reach nearly 230 million (representing 800 million individuals with access to a wireless broadband connection). Of those, about half are expected to be 5G FWA connections.

The market for private 5G networks is hot and crowded. It is a market in which many want to enter – everyone from mobile operators to IT companies to system integrators to infrastructure suppliers. Expect fierce competition, very low margins, and an inevitable shakeout.

2022 offers the telcos the platform to differentiate their service offerings, and to ensure that they capitalize on these opportunities. So far, they were focused on delivering speed, while over-the-top (OTT) players leveraged the pipes to offer revenue-generating entertainment services, such as Netflix, messaging services, such as Skype or WeChat, and video conferencing services, such as Zoom.

Now, with hyper-connectivity the norm and 5G networks being deployed globally to keep up with high-bandwidth, low-latency requirements for new applications and IoT devices, CSPs have an opportunity to deploy new value-added services to their customers in addition to the network itself. They can now offer services that help them differentiate from other service providers and from OTT players as well. This encompasses the residential customers with multiple family members now simultaneously working, learning, and being entertained at home; the business customers seeking audio and video conferencing services and collaboration tools; and partnering with enterprises and industry verticals to deploy private networks.

Taking this a step further, as artificial intelligence and machine learning mature, CSPs can create and deploy personalized AI-powered video bots that can provide real-time personal interaction with customers, represent their senior leadership, or even leverage celebrities as brand ambassadors.

New partnerships with hyperscalers are enabling the move to edge-computing applications for ultra-low latency applications. And new specifications and architectures from leading global industry organizations are enabling CSPs to leverage a multi-vendor ecosystem to build their next-generation networks with best-of-breed components. Now is the time for CSPs to make the most of these opportunities.

And then the good news – 2022 will show rising prices. After mobile and broadband prices have either fallen over time, 2022 should be the year when prices rise around the world. We also expect that many of the operators that have difficulty creating value for their shareholders through organic growth will raise prices in 2022. It follows that a highly valuable service like broadband telecommunications should increase in price. This is the law of demand, and without price increases, it will be difficult to invest in network upgrades.

The trend of breakup of telecommunications companies into infrastructure and service entities will be seen increasingly. Tower companies are an important part of the efforts to find profitability in an increasingly difficult telecom market. Many mobile carriers have discovered that they can sell off their towers and post unrealized assets. In Europe alone, it has contributed some €36 billion to the mobile industry.

Around the world we see these tower companies starting to spread in the value chain. In Brazil, they invest in fiber, while others consider whether to enter the spectrum market. During 2022, we will see much more of this.

A case for study is Denmark’s TDC. Three Danish pension funds PFA, PKA, ATP and Macquarie Infrastructure and Real Assets have chosen to split the telecom operator into an infrastructure company and a service company. The two new entities will be TDC Net for infrastructure and Nuuday for service.

Mobile Experts, a market research services company in the US, that supports more than 200 companies with strategic guidance and market data related to wireless infrastructure and devices, including mobile, Wi-Fi, edge computing, and IoT has taken all of the detailed individual forecasts in its portfolio on macro base stations, small cells, in-building wireless, virtual RAN, etc., and created a new model of the total mobile infrastructure market. It has back-modelled the market from 2011 through 2021 to be sure that the model is airtight. And then cross-checked to make sure that its bottom-up revenue matches with the revenue reported by mobile infrastructure vendors, to within 5 percent in each region, every quarter, for 10 years. Joe Madden, its founder and president, is confident that:

-

-

- CapEx in mobile networks will rise by 7 percent and RAN revenue will grow by 6 percent in 2022;

- China will surprise everyone with large numbers of low-band 5G base stations at 900 MHz and 1800 MHz, using massive MIMO in FDD bands. But they would not deploy any C-band 5G or mmWave base stations in 2022;

- Deployment of edge-computing data centers will rise by 65 percent in 2022, with a heavy lift from on-prem edge computing;

- Virtual RAN capacity deployment will grow by 60 percent over 2021, led by major operators in major markets; and

- Private LTE and private 5G will accelerate, with manufacturing applications coming out of nowhere to become one of the leading sources of private wireless revenue.

-

What won’t happen in 2022. Enterprise 5G will not gain the desired market traction in 2022. Enterprises are looking at 5G for two reasons. First and foremost, time-sensitive networking (TSN) will allow for millisecond latencies, and five-nines availability and reliability of network coverage. Second, deterministic networking protects the enterprise network from unauthorized access or interference. All these capabilities are standardized within the 3rd Generation Partnership Project’s (3GPP) so-called Release 16, which enterprises have been eagerly awaiting. While the 3GPP froze Release 16 in mid-2020, Release 16-capable devices are still not entering the market, and we will likely have to wait until 2023 to see any noticeable announcements.

Beyond the pandemic. The opportunities for communications service providers have never been greater. New technologies, such as artificial intelligence, machine learning, and computer vision are enabling CSPs to deliver new revenue-generating services that meet their residential and business customer demands. New partnerships with hyperscalers are enabling the move to edge-computing applications for ultra-low latency applications. And new specifications and architectures from leading global industry organizations are enabling CSPs to leverage a multi-vendor ecosystem to build their next-generation networks with best-of-breed components. Now is the time for CSPs to make the most of these opportunities.

You must be logged in to post a comment Login