Headlines of the Day

Reinventing the Enterprise- Building intelligent and secure ecosystems, An IMC-COAI event

A virtual event organized by COAI (Cellular Operators Association of India) and IMC Connect on August 25, 2021, dived deep into the evolving future of enterprise. Sponsored by Airtel Business, Vi Business, Ericsson, and Mediatek, Communications Today was the media partner.

A review

Around the world, companies are embarking on costly but crucial digital transformations. Their goal everywhere is to leverage new and still emerging technologies to provide truly differentiated customer experience that will attract new customers, retain old ones, and drive revenue with increased efficiency, across all verticals.

Organizations are making continuous efforts to transform internal operations, as well as fuel the growing digital shift across various industry sectors. TMT services are expected to play a pivotal role in driving the shift in digital priorities of businesses. With convergence of 5G, artificial intelligence (AI) and Internet of Things (IoT), enterprise users can improve the speed, latency, reliability, agility, and scalability, amongst others, of the solutions in the Smart City, in automation, connected vehicles, smart factories, broadcasting, Industry 4.0, etc. The list is endless.

In this context, telecom operators and enterprises have a pivotal role to play in infrastructure development and service delivery. Also, this implies that telecom operators need to work very closely with enterprises to develop the required technological infrastructure.

The pandemic brought with it new challenges as well as opportunities, and pressed the need for reinvention, resulting in a big shift in engagement and buying patterns of enterprises.

Supply chains are being redesigned to cater to the new normal. And a clear shift in the manufacturing activity is taking place. Machines are getting more intelligent to increase efficiency, productivity, and generate new revenue streams. Workplaces are increasingly expected to be hybrid. Enterprises that have been over the years adapting to digital found the digitization agenda an imperative.

Telecom network is the essence for digital transformation. It is a platform for digital society. The telcos were relied on to steer the enterprise customers through digital transformation that had become a survival issue. An organization’s ability to adapt quickly to supply chain disruptions, and time-to-market pressures and rapidly changing customer expectations had become extremely critical. Evaluation of new digital use-cases and new business models and cross-industry partnerships had become the order of the day. As neatly summed up by Kartik Narayan, Executive Vice President & Head–Large Business, Vodafone Idea Limited, “Digital transformation is an absolute imperative now and in the future. It’s important to have a clear company-wide plan and strategy, know the pitfalls, skill, budget, and culture. And the execution phase needs to be flexible and transformed with progress.”

Enterprises have always needed to reinvent themselves. Emerging technologies, and their impact in the relevant businesses have always existed. Emerging technologies are now seeing a dramatic shift that need not be seen in isolation, but in the context of a larger network of connected ecosystems. Connectivity of emerging technologies with their ecosystem enables collection of data interpretation of data and insights. The use of Edge and Cloud has become more relevant, and the with the emergence of 5G as an important driver, the enterprise will see a transformational shift in digital transformation.

Every enterprise is looking for a secure, fast, cloud=-agnostic, and user-relevant, connected-enterprise solution. KPMG estimates the global services market at USD 213 billion. And, it is equally relevant from an Indian context as well. A 25 to 32-percent CAGR growth driven by Industry 4.0 and transformed through the use of 5G is expected by the professional services firm.

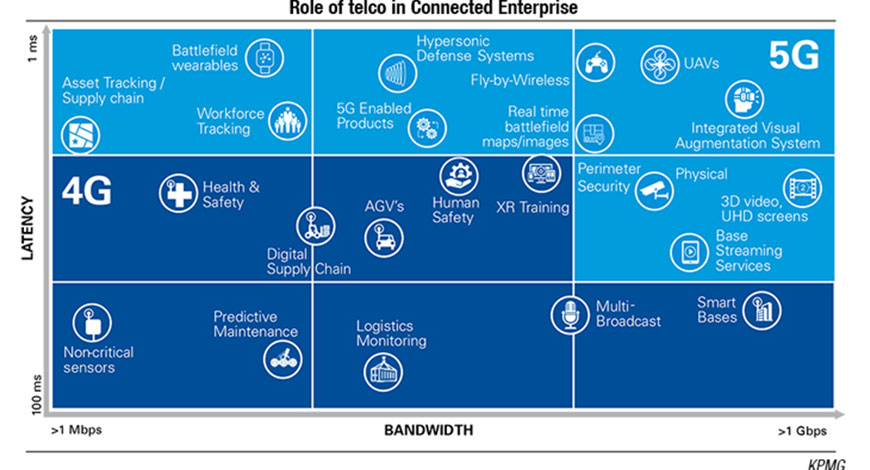

Industry 4.0 did exist even without 5G. Technologies like LoRa, NB-IoT, and Zigbee are already being used by enterprises for digital transformation. What make 5G so transformational? There are multiple use-cases, still relevant in the 4G ecosystem, that are also relevant in the 5G ecosystem. The use-cases are more beneficial if applied through the 5G connected ecosystem. For example, connected vehicles, also relevant in the 4G ecosystem, will see transformed benefits with autonomous vehicles in the 5G ecosystem. Similarly, predictive maintenance, smart surveillance, and automated warehouse systems that are already existing in the 4G environment will see superior benefits transforming and flowing to the enterprises in the 5G environment.

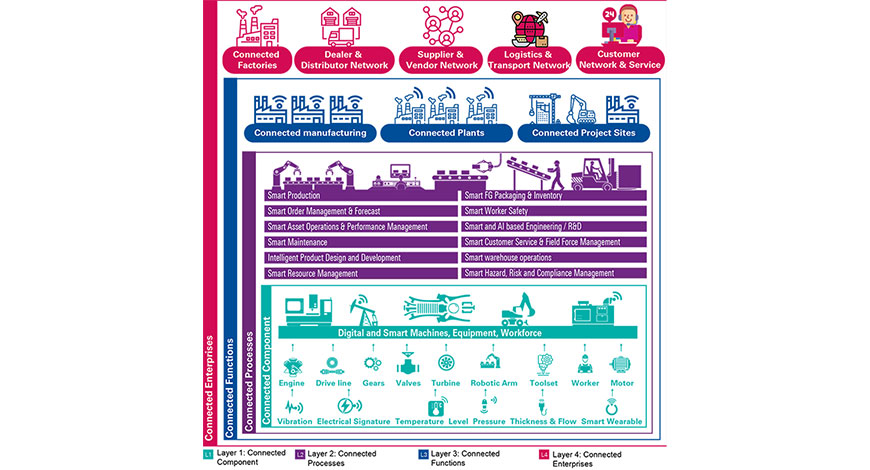

Connected technologies that make the connected enterprise have four layers.

To unlock the potential value, the KPMG study https://www.communicationstoday.co.in/the-connected-enterprise-a-world-of-possibilities/ revealed that what held back the enterprise were unclear strategies; lack of teaming not only within the organization, but also with ecosystem partners; and future-proofing. Enterprises need to ensure that the solutions are scalable, have areas around cloud edge, connected technologies mapped, and the architecture studied before deployment, as well as evaluate use-cases that will make it scalable and achievable. And, this is where the telcos are stepping in and are playing that role across countries as not only enablers, but as disruptive partners.

And, for that to happen, telcos need to ensure they harness the core. The core of a telco enterprise is driving-connected categories in connectivity. They can partner and help organizations to pivot as a digital telecommunications service provider by not only innovation within the telco world, but also at enterprises. For instance, there are superior partnerships that have been established between telcos and healthcare companies and also with logistics companies. And, these are only evolving by the day.

Telcos are best suited to have a connected ecosystem because of the sheer experience of managing large network solutions and connected ecosystems and can work very closely with different industry partners in driving this ecosystem forward.

Should enterprises ask certain questions, which are relevant for their own businesses before getting into this kind of a journey? KPMG has tried to ask some of them as part of its thought leadership. The most important may be listed as:

- Is your current technology architecture scalable and futuristic to unlock the next phase of transformation?

- Can we identify use-cases that are scalable and will yield exponential results in the 5G enforcement?

- Are you able to effectively measure the ROI for use-cases in your transformation journey? Are your benchmarks aligned to leading practices?

- Do you have a mechanism/model to measure the right ROI for the industry use-cases that have been set up?

- What are the potential barriers in the implementation and deployment of Industry 4.0/5G?

“Have the potential barriers that one sees between traditional ecosystems, traditional technologies, and new technologies been really addressed? What are those barriers? How can telcos finally take a leap with industry 4.0 and 5G? How can telcos enable enterprises to identify new use-cases? How can they solve the real difference on using specific use-cases across the other connectivity platforms, including the use of Wi-Fi 6, LoRa, NB-IoT, etc.? Can we really identify and help enterprises differentiate between small automation versus a digital transformation? How can telcos work with enterprises on measured outcomes? And finally, can telcos help enterprises in identifying relevant use-cases for their own industry and learn and grow with them?” asks KG Purushothaman, Partner, KPMG India.

This change and the magnitude of change, however, could be different for different enterprises, be it large enterprise, medium and small, or even government organizations. And this emanates from the changing need of the enterprise and their end customers. In large enterprises, as the workload shifts from office premises to the cloud rebalancing the IT and telecom architecture focus on security, remote working, collaboration, and remote asset management will see huge growth; on the government side, the slew of programs and initiatives around Smart Cities, Startup India, Atmanirbhar Bharat are changing the way the government and citizens are interacting with each other; and in the SMB space, the largest segment, and deeply impacted by pandemic, the rate of adoption of tools as internet presence, cloud telephony, focus to reach to the end customers of the SMB in a hyper local way – all will get accentuated. This reinvention, while making the enterprises and businesses more customer-centric would bring three clear benefits to the enterprises – productivity enhancement, efficiency increase, and cost optimization. In the process of reinvention, and digital adoption by connectivity, where it all started, the basic backbone will get enhanced by private LTE, SD-WAN, and 5G in coming times. And IoT and cloud, underpinned by security will play a large role.

“Service providers as Vodafone Business are also reinventing from being a traditional telco to being a tech company, and offering our customers not just enriched connectivity but also an array of digital products and managed services, including end-to-end integrated IoT or security solutions, collaboration tools, cloud, and many more such propositions. The ecosystem is rich and diverse, giving rise to an opportunity to build this together for our customers and partners. And this is going to be an exciting journey,” elaborates Abhijit Kishore, Chief Enterprise Business Officer, Vodafone Idea Limited.

India has one major issue to address. In spite of its intense focus on digitization, India is still in a nascent stage and what has been digitized so far is the front-end. “The critical part, the back-end has yet to be digitized,” elaborates Ganesh Lakshminarayanan, CEO, Airtel Enterprise Business in his keynote address. “We are still at a loss on real-time information, on where demand is being generated, which factories will meet how much supply, logistics of tracking once the goods are on their way, etc. Digitizing manufacturing and warehousing has also not been tackled yet.”

Early 5G deployments are expected to focus on enhanced consumer mobile broadband, but IoT and enterprise segments will become increasingly important over time as they look to benefit from low-latency services and improvements, such as network slicing and edge computing. Globally, operators are expected to invest around USD 1.1 trillion between 2020 and 2025, around 80 percent of which will be in 5G networks. IoT holds great promise, and from a revenue of USD 400 billion in 2020, with the number of connections poised to double to 24 billion and IoT devices using cellular to 3.7 billion by 2025, is expected to more than double to USD 900 million by 2025.

Almost every sector is considering using IoT, be it utilities, climate change, energy saving, smart cities, etc. GSMA as a mobile industry association is working very hard to promote this technology. GSMA IoT is an initiative to help operators add value and accelerate the delivery of new connected devices and services in the IoT. This is to be achieved by industry collaboration, appropriate regulation, optimizing networks as well as developing key enablers to support the growth of the IoT in the longer term. GSMA’s vision is to enable the IoT, a world in which consumers and businesses enjoy rich new services, connected by an intelligent and secure mobile network. The program has more than 16 members in more than 20 countries including Jio, Airtel, and Vodafone idea in India.

Some stakeholders’ plans. Airtel is in the process of digitizing the backend operations. “The telco is making major investments into offering and billing the customers for bandwidth that can be consumed as you need it, when you need it, and where you need it. This is very similar to the way cloud computing and storage is being consumed today. And this can also be done through video analytics, when the processing can happen at the edge, and not necessarily at a centralized data center. This would mean the main network is not physical but is software defined, with SD-WAN (or Airtel Intelligent VPN) coming into play. It virtualizes the network the same way the hardware gets virtualized. And, it must be secure all the way (with Airtel SOC), bringing the best of secure technologies to make sure ubiquitous connectivity, and digitization of factories and warehouses can happen without worrying about where the data is getting leaked.

Once the data comes in, it needs to be analyzed at the edge data centers, after which it needs to be communicated for further action on cloud communication platform (the Airtel IQ), which integrates it with IoT, so that the issue may be resolved. Of course, this will become much easier in the 5G world,” explains Lakshminarayanan.

The real challenge for CSPs is to identify which new areas to prioritize as the digitization opportunity grows that unlocks additional revenue streams to reach the forecast 48 percent growth of the CSP revenues of today by 2030.

Ericsson is at the forefront of 5G research, and development and has initiated partnerships with leading technology and manufacturing specialists in several countries, enabling to develop 5G technologies that are based on real business needs. This is while also being a major manufacturer of advanced equipment.

“Different industries have different needs and requirements. And we ensure that we are sensitive to those different needs and requirements when we put forward solutions. In the Indian context, 4G and 5G are both relevant for the Indian enterprise. 4G technology is upgradeable to 5G and Ericsson is fully geared to accelerating the enterprise opportunity in India with 5G, while already starting today with 4G,” explains Nadine Allen, Head of Enterprise Business South East Asia, Oceania & India, Ericsson.

Telcos already form the heart of the connected ecosystem – The next step is to enable that circulatory system by value-driven relationships

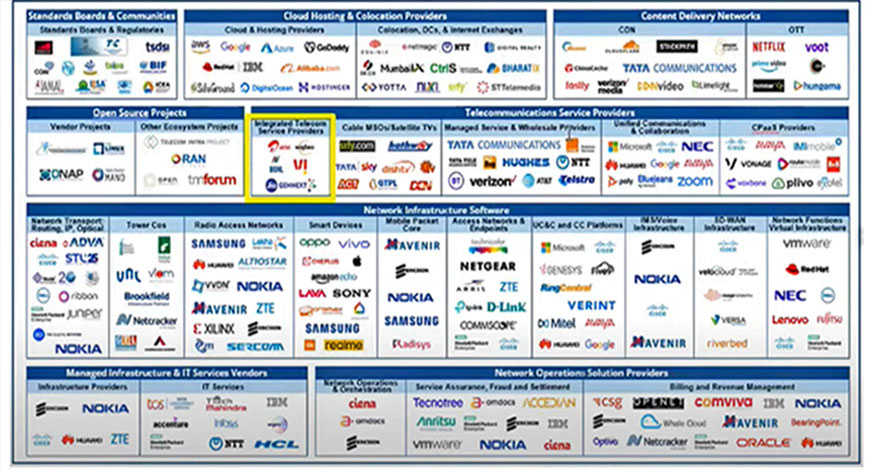

The telcos will need to look where they exactly stand in the ecosystem, and how they can go forward from there. A glance at the Indian scenario reveals eight categories and 27-plus subcategories, with 250-odd players. It clearly highlights many journeys for all the stakeholders including the telcos. This journey could be from very specific, security solutions to uniformly orchestrated and governed secure enterprise journeys. It could also mean moving from a limited data experience to pivoting to a data-centric enterprise. The journey also highlights a clear move toward a virtual-cloud-native infrastructure. It also enables telcos to move from digital services, using open APIs from various other suppliers. That is one way to look at it.

But the other way to look at it is through the tech buyers’ and tech suppliers’ eyes that are quite active across infrastructure, services, and the solutions space. And, there is an overlap in the ecosystem between the pureplay CSPs and Industry 4.0. It includes the satellite industry and the new spacecom policy that is shaping up in India. This will create a metaverse of opportunities in India.

Having visibility across each supply chain will be very crucial. And, under the Atmanirbhar initiative, there’s an aspect of reliability from the supplier to Tier-II and Tier-III suppliers in the network. And as the infrastructure keeps pushing boundaries, and infrastructure proliferates and straddles boundaries between services and applications, the Indian suppliers and Indian telcos need to take a very hard view on meeting quality standards.

Again, the opportunity of engaging with IT services players and startup community is huge.

As India moves toward self-sustenance, its relationships with global and regional counterparts will be a given here. Though, because of obvious reasons, India did not participate in the RCEP last year, it must now consider the opportunities arising out of restructuring and the China plus one strategy that will be immense. IDC estimates that by the end of the next year, the Top 2000 Asian enterprises will have re-shored at least 30 percent of their current offshore suppliers. And in that process, there is a two-way-street emanating from India. One, that is clearly focused on the Look East and the other, which is supporting plus-one strategy coming out of Asia-Pacific, including Japan, into India.

While India seeks to gain foothold in the global trade and finance through the region, the region will capitalize itself through PLI schemes. And, as the region itself connects to the world, and seeks dominance in global technology and business space, the West will need Asia more than ever, for importing that growth to enterprises and to the rest. We have seen that with Uber partnering with Grab locally, and letting it go eventually.

The need for local partnerships in India is huge. Going forward, a tight coupling is required between the telcos and the local tech giants. From an industry-diversification standpoint, telcos will form one bridge with bulk of consumer- and process-intensive businesses like IT, ITeS, BFSI, retail, etc., which is more business and innovation-led; and another bridge with manufacturing, transport and logistics, healthcare and asset-intensive industries, which are more mixed in terms of regional and national place. And lastly, through blockchain and satellite technologies tackle the government, which are more risk and intensive investments.

The session aptly closed with some key takeaways for CSPs and technology suppliers, elucidated by Yash Jethani, Research Manager, Telecom & IoT, IDC Asia-Pacific excluding Japan:

- Start low with future-of-work and future-of-operations type of engagements, help improve cash flows of the vendors but also engage with the government on future of trust initiatives, while maintaining a balance between data privacy and data sovereignty and also connecting the unconnected;

- India telcos are far behind their Asia-Pacific counterparts when it comes to improving their transport network. India must move away from the 5Gi standard, in order to take benefit of the 3GPP Release 17 and beyond as well as PLI schemes. There has been continued growth in IoT and SMB mobility-led enterprise offerings in the past 6 months and while 5G seems exciting with AR/VR and private networking, a clear roadmap for use-cases needs to be built (fixed-wireless access is favorable);

- But most importantly enforce TL9000 and other process standards (H/S/V) for Tier-I and Tier-II suppliers to bring parity with the PLI schemes for telecom equipment consumption and export;

- Embrace platforms and develop platform-led skills. We have seen that telcos have started on the digitization journey but there is a stitch required between the two planes – APIs, microservices, analytics, and cloudification and automation. Focus on platform operations, automation, DevOps, and use-cases to boost growth. Need skills for that. As Telecom Sector Skill Council builds a competency-based framework, suppliers need to collaborate under Skill India and NSDC to bring a holistic view; but only three-fifth companies in India advocate company-wide data strategy, so that is a cultural issue telcos have to face across the board;

- Enterprise infrastructure market will remain challenging for the next 12 months due to slow economic recovery and ongoing Covid-19 pandemic. Operators remain challenged with reducing OpEx and CapEx.

With about USD 30-billion telecom enterprise market in India (contributing 7% to the AP market), IDC foresees a gradual growth – driven by SMB (right funding partners like Facebook) and large enterprise segments.

Purpose-led mobile offerings will go a long way in a consumer-dominated market.

CT Bureau

You must be logged in to post a comment Login