Company News

RailTel- Good proxy to government digitisation, ICICI Securities

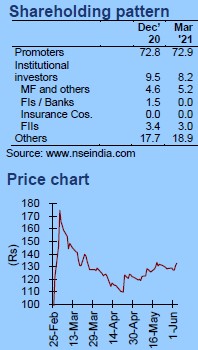

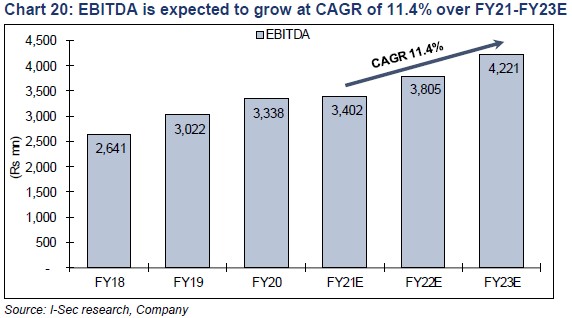

Railtel Corporation (Railtel) is well positioned to benefit from the digital transformation programme initiated by the government of India including Indian Railways, which significantly increases visibility on its earnings growth over the next decade. Company’s orderbook is very healthy at Rs44bn, which should help it grow both telecom services and project business. We expect revenues to grow at a CAGR of 11.5%, EBITDA at 11.4% and adjusted PAT of 17.8%. We see FCFE at 17-19% of sales and return ratios of >20% from FY22E onward. We initiate coverage on Railtel with a BUY rating and target price of Rs160, valuing the stock at 20x FY23E EPS. Downside risks: 1) higher concentration on government business, and 2) risk of AGR liability.

About Railtel. Railtel has exclusive right-of-way on 67,415-Rkm across railway tracks connecting 7,321 stations. It also has two data centres and mobile towers. Indian Railways is its anchor tenant, which makes infra easy to rollout. For last mile, it uses access service providers, which keeps capex under control, and has tie-ups with local operators for its FTTH services under RailWire brand. Company also provides system integration services (projects) wherein it helps implement ICT projects.

- Good play on government digitisation. India government is expected to spend US$7.3bn on IT services during 2021, up 9.4% YoY. Expenditure for data centres and telecom services will grow by 7.8% and 6.3%. Indian Railways, the company’s largest customer, has huge plans of spending on modernise railway systems. Post covid, we see government organisations heavily investing in digitisation benefiting Railtel.

- Steady growth in telecom services. Telecom services revenue would benefit from rising demand for data capacity. Though price erosion would restrict growth in NLD services, ISP services should benefit from rising FTTH and other services such as data centre, security, etc. We see revenue growth at a CAGR of 9.5% to Rs10.3bn, and EBITDA growth at CAGR of 9.7% to Rs3.3bn, over FY21-FY23E. We also see upside risk in projects under implementation.

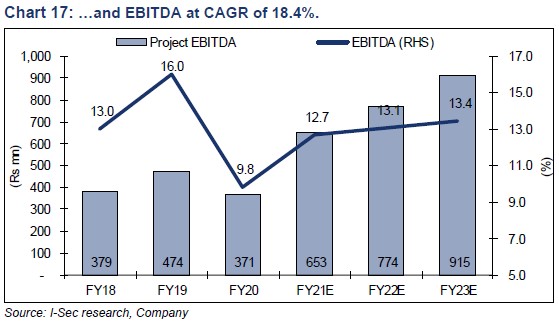

- Project revenues to grow robust. Railtel’s orderbook is strong at Rs44bn (12x FY20 revenues) as at Q3FY21, up 10% since Jan’21. Significant portion of the orderbook would be implemented over next 2-3 years, which gives us strong visibility on project revenues. We estimate revenue CAGR of 15% to Rs6.8bn, and EBITDA CAGR of 18.4% to Rs915mn, over FY21-FY23E.

- Higher FCF generation; and return ratios. Railtel’s FCF generation would remain strong on the back of: 1) likelihood of capex being lower than depreciation; and 2) reduced size of working capital drag on account of dip in deferred revenues. Our estimates suggest FCFE at 17-19% of revenues, which is very healthy. Railtel’s underlying pre-tax RoIC remains robust at >20% for FY22E – and this is on account of disciplined capital allocation. Further, the project business is highly profitable.

Introduction

Incorporated in CY2000, Railtel Corporation of India (Railtel) is majority-owned by the government of India and is under the administrative control of the ministry of railways. It was formed with the aim of modernising the existing telecom system for train control, operations and safety. It also aims to generate additional revenues by creating nationwide broadband and multimedia networks by laying optical fibre cable on the back of its exclusive right of way along railway tracks. It is a Mini Ratna (category-I) Central Public Sector Enterprise. It has grown to become a connectivity service provider to system integration project executor and cloud and security service provider. It has a full suite of products demanded by public sector enterprises.

Railtel has access to right of way for optical fibre cable network along 67,415 route-km of railway tracks connecting 7,321 railway stations. It has deployed high-capacity optical fibre cable network along 59,098 route-km covering 5,929 railway stations as at Jan’21. It has right of way permits for underground infrastructure, which was obtained from Indian Railways for a period of 30 years, or till it remains a public sector undertaking, whichever is earlier. In addition, it has citywide access network covering 18,000km. It operates data centres in Gurugram and Secunderabad to host and collocate critical applications for customers including the Indian Railways. It also provides FTTH services under RailWire brand, where it has 0.3mn customers as at Jan’21. Railtel pays ~7% of non-Railways telecom services revenue as royalty to Indian Railways. On its part, Indian Railways provides multiple projects to Railtel on nomination basis with fixed-margin arrangement.

Chart 1: Railtel’s optic fibre cable network

Source: Company

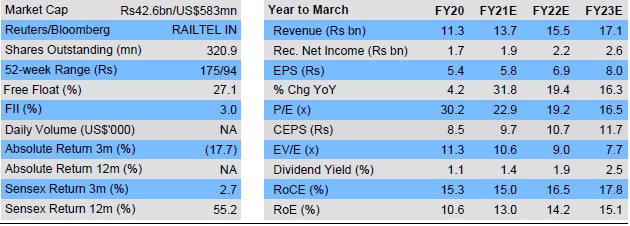

Railtel divides its revenues in two buckets: 1) telecom services, which includes telecommunication services including: a) NLD services comprising leased line and VPN services, b) ISP services comprising RailWire and ILL (internet leased line), and c) infrastructure services; and 2) project or system integration services. Telecom services are annual recurring revenue sources for providing bandwidth and other ICT services, while the project business involves execution of telecom and allied infrastructure for other enterprises, largely government entities.

Telecom services should see steady growth

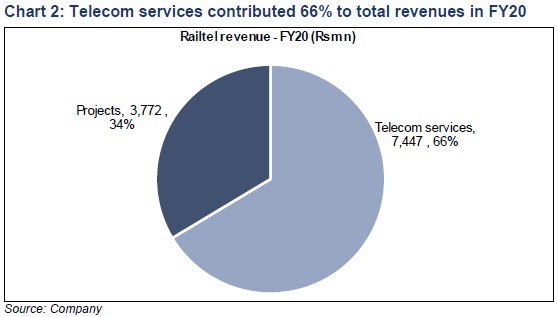

Telecom services can be divided into three segments and seven sub-segments to understand the growth opportunities and drivers. We see each segment would contribute to growth for the next three years.

NLD services – revenue growth acceleration possible

NLD services comprise two traditional connectivity solutions: leased lines, and VPN. Basically, Railtel provides data capacity on its fibre to external users and, theoretically, fibre has unlimited capacity which it can lease to users.

- Lease line: A leased line is a dedicated, fixed-bandwidth data connection. It allows businesses to have a reliable, high-quality internet connection with guarantees of upload and download speed, uptime and resilience. Leased refers to the connection, which is rented by the Internet Service Provider (ISP) directly to a business, resulting in a service above and beyond what standard broadband provides. It is symmetrical, which means it has the same upload and download speed. It is uncontended connections, i.e. it is not shared with other users. It is point to point connect, i.e. two points together, e.g. the ISP with a business location.

- Virtual Private Network (VPN): VPN uses public telecommunication infrastructure, such as the internet, to securely connect remote sites / users to an organisation’s network. These services cost less than alternatives, such as traditional leased lines or remote access servers. VPN technology is based on the tunnelling concept, which involves establishing and maintaining a logical network connection. In this type of connection, packets constructed in a specific VPN protocol format are encapsulated within another base or carrier protocol, and then transmitted between the VPN client and server, and finally de-encapsulated at the receiving end.

Railtel has connected 5,485 MPLS-VPN ports and 823 internet bandwidth ports for customers. In addition, it has 38Gbps and 25Gbps of provisioned bandwidth for enterprise VPN and internet bandwidth customers. It provides high-capacity bandwidth of up to 800G at 60 locations and has installed 5,600 points-of-presence (PoPs) across cities and towns in India.

NLD revenues have grown at a CAGR of 3.2% to Rs4.1bn over FY18-FY20 driven by revenue growth at 37% CAGR to Rs1.5bn in VPN. Leased line revenues decline by 7.4% p.a. to Rs2.7bn over the same period. In next few years, we expect growth to be higher due to rise in data demand, and implementation of projects such as VSS (video surveillance system) and e-office, which drive demand for connectivity. We expect NLD services revenue to grow at a CAGR of 7.1% over FY21-FY23E.

ISP services – RailWire is driving growth

Railtel offers internet leased line services with multiple bandwidth options ranging from 2Mbps and above. It also offers both retail broadband services under band RailWire, and internet connectivity to businesses.

RailWire: It provides Fibre to the Home (FTTH) services to retail customers. It has 0.3mn customers, which translates in subs market share of 1.3% in Q3FY21 (based on TRAI data), and 4.3% in FTTH segment. Despite aggressive tariff plans launched by Reliance Jio and later by Bharti Airtel, Railtel has maintained its market share in FTTH segment. It has built FTTH business in partnership with LCOs, which makes it asset-light as last mile capex is incurred by LCOs. Bharti is also aggressively expanding its reach using LCO partnership model.

Internet leased line: This provides internet connectivity to enterprise customers to connect to external websites, and public cloud service providers.

RailWire has entered into arrangements with access network providers (ANPs) to deliver last-mile connectivity services to customers. As of June 30, 2020, it has arrangements with 3,563 ANPs across India.

Internet demand has increased significantly from the covid situation driven by work-from-home and e-school. We believe digital adoption would continue to thrive even in post-covid era, and lower fixed broadband penetration in India offers huge growth opportunity.

Internet leased lines demand may also increase particularly, from government organisations where more offices will be connected.

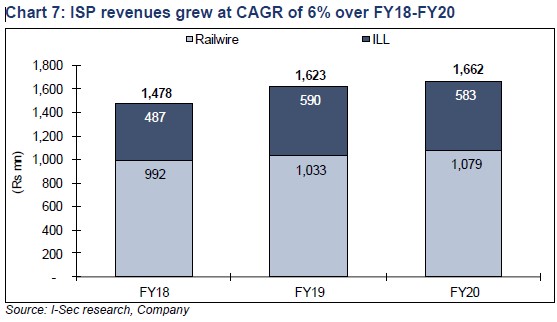

ISP revenues grew at a CAGR of 6% over FY18-FY20 driven by 9.5% growth in ILL services while RailWire grew at 4.3%. However post-covid, FTTH subs growth in India has accelerated, which has helped RailWire to grow it subs base 2.7x in past five quarters thereby helping drive ISP revenue growth. RailWire has maintained it market share of 4.3% in FTTH subs despite aggressive plan launches by Reliance Jio and Bharti Airtel.

We have baked ISP revenue growth of 15.5% over FY21-FY23E into our estimates helped by subs addition in FTTH segment.

Infrastructure services – strong industry growth tailwinds

Infrastructure services comprise multiple emerging revenue streams such as data centres and managed hosting services, telepresence as a service (TPaaS), and security operations centre as a services (SOCaaS). It also includes passive infrastructure sharing like towers and dark fibre. Below is a list of services offered by Railtel under this segment.

- Passive infrastructure (IP-1) services: 1) space on towers for collocating BTS for telecom operators, small cell sites for extending their mobile coverage and space for collocating mobile switching centres; and 2) provide single core dark fibre for transmission of digital video signals to MSOs for cable distribution.

- Data centre and managed hosting services: Data centre services including Infrastructure as a Service (IaaS), dedicated hosting, managed services, cloud computing, managed e-office services, disaster recovery services, Aadhar authentication services and other IT related services such as load balancing services, application hosting, bandwidth services and advanced firewall services.

- Telepresence services (TPaaS): End-to-end, high-definition, secure, hosted multitenant video conferencing facility bundled with required bandwidth as a service.

- Security operations centre as a services (SOCaaS): Security operations centre (SOC) provides centralised and consolidated cyber security incident prevention and security event monitoring services, it has detection response capabilities and supports requirements of other business units.

Fast growing data has led to strong demand for data centre requirement, and organisations are fast adopting cloud computing which is driving growth for managed hosting and allied services. Railtel is in the process of building another data centre, which should help drive growth for next few years in our view. Further, Indian Railways has been allotted 700MHz spectrum for building its own 4G network across railway tracks and railway stations, which may require building a tower every 8-10km. This should drive the number of towers for Railtel with Indian Railways as anchor tenant; (other two slots can be sold to private telcos – Bharti, RJio and Vodafone Idea).

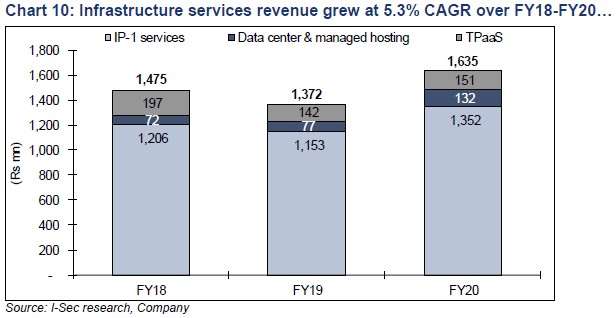

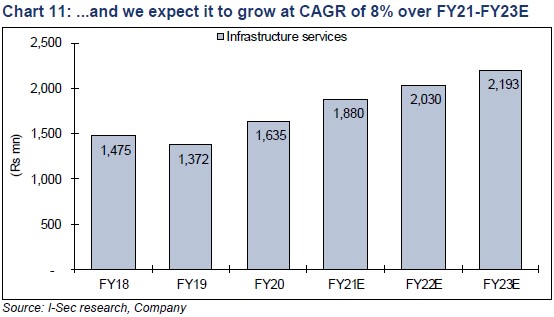

Infrastructure services revenue has grown at a CAGR of 5.3% to Rs1.6bn over FY18- FY20, and we believe the segment can grow by at least 8% CAGR over FY21-FY23E.

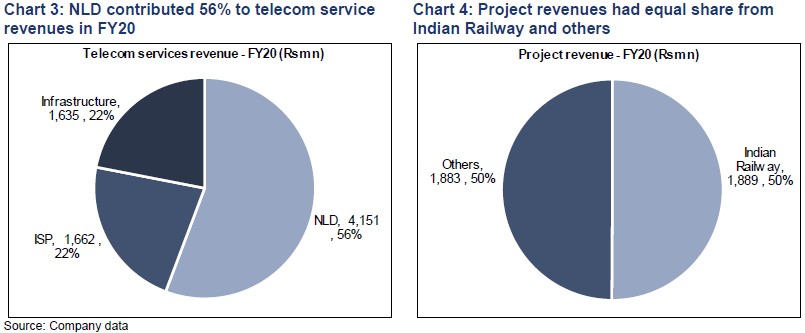

Projects: System integration services

Railtel collaborates with partners and OEMs to undertake ICT hardware implementation, software delivery and digital transformation projects including creation of state wide area network (WAN) and its maintenance, data centre and facility management services, Wi-Fi projects, city surveillance projects, laying of state-wide fibre optic networks, and its implementation and maintenance of end-to-end IT applications of enterprises.

Projects segment helps generate good profitability (high RoCEs) and also drive telecom service revenues in many cases for Railtel. For example,– Railtel is helping Indian Railways in implementing video surveillance systems across railway stations and coaches. Post completion of the project (each station), Indian Railways will require fibre capacity to source data, storage space and analytical tools, which would help drive telecom service revenues for Railtel.

Railtel gets multiple projects from Indian Railways on nomination basis with fixed profit margin of 8.5% while other projects (mostly government departments) have margins up to 20%.

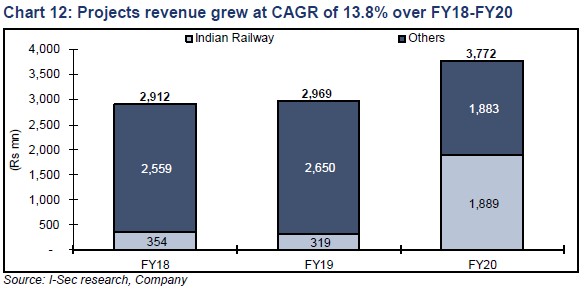

Projects grew at a revenue CAGR of 13.8% to Rs3.8bn over FY18-FY20, largely led by projects executed for Indian Railways. Other projects revenue has seen decline largely on account of completion of large projects from BharatNet (NOFN).

Railtel has an orderbook of Rs44bn as at Q3FY21-end, which is executable over 3-4 years. Orderbook is 12x FY20 revenues, which provides huge visibility on projects revenue over next few years. The large projects include: 1) video surveillance systems, 2) hospital management, 3) e-offices, 4) railway display network (RDN), and 5) high-speed networks for the railways, etc. We will discuss each of these projects in details.

Indian Railways–largest growth driver in coming years

Railtel provides a variety of services to Indian Railways and the portfolio will keep rising as it receives more projects, which would help Railtel drive higher connectivity and infrastructure revenues from the Railways.

- Railtel has implemented MPLS data networks for integrated payroll and accounting system, unreserved ticketing system, freight operations information system, and coaching operations information systems.

- MPLS-VPN for the Railways intranet aggregated to over 41Gbps capacity and internet to over 19Gbps.

- Railtel is responsible for upgradation of RailNet over a WAN by providing centralised mailing system and security systems through the supply, installation and commissioning of IP-MPLS network at divisions, zones, production units, and central training units of the Indian Railways.

- Railtel is working with the Indian Railways to transform railway stations into digital hubs by providing public Wi-Fi at railway stations across India. It has 5,677 railway stations live with RailWire Wi-Fi and has recorded >14mn unique users per day in FY20.

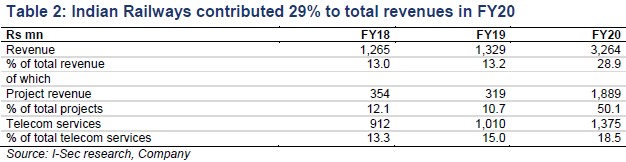

Indian Railways contributed to 28.9% of Railtel revenues in FY20. It had contributed 50% to projects revenue and 18.5% of telecom services revenue. Revenues from Indian Railways has grown 2.6x over FY18-FY20, majorly driven by projects revenue; nonetheless, the Railways has also helped drive higher telecom services revenue.

Projects under implementation for Indian Railways

Video Surveillance System (VSS): Railtel has signed MoU with Indian Railways to provide IP-based VSS at 6,049 stations with video analytics and facial recognition system, and in 14,387 coaches of premium trains and suburban EMU coaches. The project involves installing CCTV cameras and the recording of the video feeds from CCTV cameras to be stored for 30 days for playback, post event analysis and for investigation purposes. Railtel had commissioned 256 railway stations under VSS for the Indian Railways. Railtel earns mark-up of 8.5% on this project.

The Railway Board has approved works for provision of VSS covering 983 stations with Nirbhaya fund. In FY20, a budget of Rs2.5bn was allotted to Indian Railways from this fund for installation of VSS. The budget to complete entire project is seen at Rs10bn for railway stations and Rs4bn for coaches, totaling Rs14bn.

Hospital management information system (HMIS): In Oct’20, the ministry of railways assigned Railtel implementation of HMIS for over 125 health establishments and 650 polyclinics of the Indian Railways. HMIS is an integrated computerised clinical information system for improved hospital administration and patient health care. It will also provide an accurate, electronically stored medical record of the patient. Real-time HMIS will streamline the treatment flow of patients and simultaneously empower workforce to perform in an optimised and efficient manner.

Railtel is implementing HMIS for Northern Railway and South-Central Railway with four modules of patient slip for out-patient department, doctor desk, pharmacy and lab modules that have already been launched in initial seven hospitals / health units of Northern Railway and South Central Railway in Dec’20. This covers important Indian Railways hospitals of Northern Railway Central Hospital, Delhi, and Central Hospital, Secunderabad. The implementation at other hospitals will be done in a phased manner.

The average revenue per state is estimated at Rs1.5bn-2bn with Delhi, being a smaller geography, having revenue base of Rs1bn. Railtel sees possibility for HMIS implementation contracts for a few more states.

Content on Demand (CoD): It involves providing content on demand to passengers in trains by preloading multilingual content on media servers in trains. With CoD, passengers will be able to enjoy free or subscription-based high-quality streaming service on their personal devices during their train journey. The platform will also provide e-commerce and mobile commerce services across domains including travel bookings and provide various solutions in the digital marketing domain. The service will be available in 3,003 trains and 2,864 pairs of suburban train services across India. CoD will also be available at all Wi-Fi enabled railway stations. The contract period is 10 years, which includes first two years of implementation by Railtel.

Railtel has selected Margo Network, a subsidiary of Zee Entertainment, as the digital entertainment service provider for providing CoD on trains and at railway stations. We understand Margo Network would need to make fixed payment of Rs0.6bn annually to Railtel and a share of other revenue streams. Railtel will share 50% of this revenue with Indian Railways. In its Q4FY21 earnings call, Zee mentioned significantly lower capex outlay for the CoD project implementation, which is likely to impact execution.

Railway Display Network (RDN): Indian Railways proposes to install display screens at foot-overbridges, platforms, waiting rooms, amongst others, at railway stations under the RDN project. Railtel has been appointed to implement and manage the RDN system. RDN is a medium of communication with passengers, which will not only provide necessary information and social messages but also become a medium of enriched infotainment. Railtel will share 65% of revenues generated from RDN (ad revenues) to Indian Railways.

E-office (phase-II): Indian Railways in an active effort to adapt paperless office culture and for providing better services to public introduced National Informatics Center (NIC) e-office. NIC e-office is a cloud-enabled software developed by NIC that is being deployed/hosted on Railtel data centre. In phase-1, Railtel executed NIC e-office for 50,000 users in 58 units, and in phase-2 Railtel plans to register 39,000 users over 34 railway divisions.

Modern Train Control System: Indian Railways intends to migrate to LTE network from the existing GSM. Railtel intends to work with the Indian Railways to develop and manage their proposed LTE network that will create a private network along railway tracks. This network will provide connectivity for IoT initiatives of the Indian Railways as well. DoT has issued 5MHz of superior 700MHz band to Indian Railways. LTE-based mobile train radio communication system is the foundation for Indian Railway’s modern train control systems including the ETCS (European Train Control System) level-2 and the train collision avoidance system. Train collision avoidance system is an indigenously developed automatic train protection system for high-density networks and highly utilised network routes of the Indian Railways. LTE deployment would require tower at every 8-10km and Railtel intends to implement towers on colocation basis with Indian Railways as anchor tenant; and other two slots will be sold to private telcos.

Railtel is implementing a pilot project on four zonal railways covering about 640km and 500 locomotives at an estimated cost of Rs1.8bn.

Other projects –enabling diversification

Managed services for state government entities: Railtel is creating and providing managed services for two state government entities in relation to their state WAN and data centres. The value of the orders is Rs2.9bn.

National Knowledge Network (NKN): Railtel is providing high-capacity bandwidth pipes for connecting all higher education and research institutes across a common platform. It has commissioned 723 links of various bandwidths (10G, 1G, 100Mbps and 50Mbps) under the NKN project for NIC Services.

Campus Wi-Fi in Central universities: The project involves site survey, design, installation and maintenance of state-of-the-art carrier grade Wi-Fi network across campuses. It has commissioned and is maintaining campus Wi-Fi in 26 Central universities in India.

Network integrator for public sector banks in India: Railtel has received an order for supply, installation and integration of network, IT service management, asset and patch management solutions including maintenance for an Indian public sector bank for five years.

Project for steel sector PSU: Railtel has been awarded an order for creation of in-premise SD-WAN primarily through MPLS, internet-leased line and leased line, connecting their network of branch sales offices, warehouses and consignment agent offices with its headoffice and connecting its steel plants and corporate office. The SD-WAN network created for their central marketing unit would be used for video conferencing, online centralised business applications, ERP, e-mail, offline – data transfer, IP telephony and voice over internet protocol.

MPLS VPN network for coal sector PSU: Railtel has been awarded the work of managed MPLS VPN across various locations of multiple public sector undertakings in the coal segment. The total value of the various orders is Rs3.5bn.

Network and system integration projects in defence segment: The scope of these projects includes creating dedicated secured networks, connecting critical sites and their maintenance, providing dedicated secured point-to-point bandwidth and/or secured MPLS VPN of varied capacities, connecting critical locations of these organisations and commissioning ICT infrastructure, maintaining web portals and applications. The value of these orders is Rs2.6bn.

Investment thesis

Good proxy to growing spend on digitisation by government and its entities

Railtel is a good proxy to increasing government spend on ICT services. Per Gartner (link) Indian government is expected to spend US$7.3bn on IT services during 2021, up 9.4% YoY. The increased spend will be driven by the Digital India initiative, including the first-ever digital census for which the Union budget has allocated Rs38bn. Government spend on software, including applications, infrastructure, and vertical-specific software to grow 13.4%. Devices will grow at 11.8% followed by IT services at 11.2%. Expenditure for data centres, telecom services and internal services will grow by 7.8%, 6.3% and 5.7% respectively.

This said, Indian Railways has huge plans for spending on ICT to modernise railway systems, and it is in the process of upgrading the entire network to LTE from GSM. Post-covid, we may see government organisations heavily investing in digitization, which should benefit Railtel via more projects and rise in telecom services revenue.

Railtel shares strong relationship with Indian Railways, and it receives projects on nomination basis with a fixed profit margin of 8.5%. Company is uniquely placed to receive orders from Indian Railways as it has fibre running along railway tracks. It also benefits from projects from other government departments, though non-Railway projects are not on nomination basis, but many times competition is limited from other PSUs only, where Railtel probability of winning contracts is higher multifold. In NKN (National Knowledge Network), it competes with other PSUs like BSNL, PGCIL, etc.

Steady growth in telecom services; margins to remain healthy

Telecom services revenue would benefit from rising demand for data capacity from its key customers, and rising digitisation efforts by government entities. Though price erosion would restrict the growth in NLD services, but ISP services should benefit from rising home broadband users, and infrastructure services such as data centre, security services and telepresence from rising demand. Company has received an order for implementing SD-WAN network for a steel sector PSU, which should establish its credibility in fast-growing solutions as well. It is also creating AI-based identification solutions and, with Indian Railways’ ambition to implement IoT, it should provide good exposure to Railtel in next-gen technology.

We are baking-in a revenue CAGR of 9.5% to Rs10.3bn over FY21-FY23E for telecom services, and we see upside risk as many of projects under implementation also require connectivity solutions such VSS, RDN, etc. We have projected margins to remain in range of 31-32%, while incremental revenues should earn reasonably higher margins. Our estimates see EBITDA growing at a CAGR of 9.7% over FY21-FY23E to Rs3.3bn.

Robust growth in projects revenue; profitability to remain high

Railtel has a strong orderbook of Rs44bn as at Q3FY21, which has grown by 10% since RHP (Jan’21) which shows rising demand for implementation of ICT projects. The significantly larger projects are from Indian Railways such as VCC (Rs14bn), which would be implemented over next three years, pilot project for modern train control system (Rs1.8bn), e-office, and others. Railtel gets projects awarded by Indian Railways on nomination basis, and is well positioned to deliver services as it has fibre running across railway tracks, which is unlikely to be replicated, and exclusivity on right of way would prevent competition.

The significant portion of the orderbook would be implemented over next 2-3 years, which gives us strong visibility on projects revenue. However, we remain conservative in our estimates as Indian Railways is worst impacted from covid situation, and we fear delay in allocation of budget, or only partial allocation.

We are penning projects revenue CAGR of 15% to Rs6.8bn over FY21-FY23E, and EBITDA margin in range of 10-11%. EBITDA is likely to grow at a CAGR of 18.4% to Rs915mn in the same period.

Strong FCF generation to sustain on disciplined capital allocation

Railtel FCF generation would remain strong for these reasons: 1) capex is likely to be lower than depreciation. It does not incur huge capex on expansion of fibre reach; and prefers to lease fibre for last mile. This has kept capex below depreciation. Project business does not require any large fixed assets which is growing much faster; and 2) working capital drag due to dip in deferred revenues and customer advances has become small enough not to hurt any material FCF.

Our estimates suggest FCFE to be 17-19% of revenues, which is very healthy, and would only strengthen the balance sheet. The biggest complaint with many PSUs is inefficient capital allocation, but we don’t see that issue with Railtel, which should give huge comfort to investors.

Healthy return ratios may further expand with growth in projects biz

Railtel’s underlying pre-tax RoIC remains robust for a telecom business at >20% in FY22, and this is on account of disciplined capital allocation and being asset-light for last mile access. Further, projects business is highly profitable as the company does not require to deploy any significant capex for execution, and it generally prefers to subcontract many of the contracts with back-to-back payment arrangements.

Company has significant cash balance partially due to deferred revenues and advances. We have added that back to invested capital as: 1) advances are received from customers for projects under-execution, and 2) deferred revenues are revenues where services will be rendered over a year. Though these are committed revenues, we have deducted it from cash balance (added back to invested capital) to see the underlying RoIC. It is working capital benefit, which should be attributed to Railtel something like negative working capital helping lower capital employed for FMCG companies; but we have been conservative in analysis.

Reported pre-tax RoCE and RoE look lower due to higher cash balance, which is dragging return ratios down, while underlying ratios are very healthy. This is also exhibited by very high ‘FCFE to sales’ ratio of 17-19%.

Financials

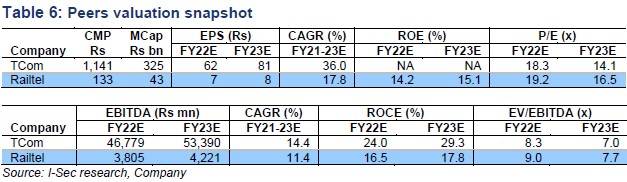

Valuations: Initiate with BUY

We initiate coverage on Railtel Corporation of India (Railtel) with a BUY rating with target price of Rs160, valuing the stock at 20x FY23E EPS.

Railtel is positioned well to benefit from the digital transformation programme initiated by government of India, and digital transformation efforts by Indian Railways, which significantly increases visibility for the company’s earnings growth over next decade.

Railtel has a steady telecom services business, which includes providing traditional data connectivity solutions such as leased lines, MPLS VPN and ILL services, and has seen strong pick-up in residential FTTH business under brand RailWire. Rising demand for data capacity should drive growth in connectivity solutions unlike global peers who are likely to see flattish connectivity business. We like Railtel’s strategy to grow business in an asset-light manner wherein it buys last-mile fibre capacity from access services providers. This has helped Railtel maintain strong balance sheet and healthy return ratios. It also ensures robust FCF generation.

Railtel has an infrastructure sharing business wherein it sells dark fibre to MSOs, telcos and others; it also has tower sharing business. It may see significant rise in demand for tower deployment with Indian Railways planning shift to LTE-based network from present GSM, which would require it to have towers every 8-10km, which means total tower demand many exceed >7,000 presenting a huge opportunity for Railtel. It is also seeing rising demand for data centres, which continue to drive growth for infrastructure services business. Railtel also provides managed hosting and telepresence services, which should see continued increase in demand.

Further, Railtel has large orderbook worth Rs44bn (12x FY20 project revenues), which would ensure multifold jump in project revenues. Also, these projects post deployment may also require connectivity solutions, which would help the company’s core telecom services business. Though project business has lower margins, Railtel does not require any material capital employed to grow this business, which means rise in contribution of project business will drive the already healthy return ratios higher.

Our valuation implies FCF yield of 4.6% for FY23E, and we see upside risk to dividend payout.

Risks

Downside risks

- Railtel’s business and revenues are substantially dependent on projects awarded by government establishments. Any adverse changes in policies and budgetary allocation resulting from a change in policies or priorities, could adversely affect Railtel and its ability to participate in competitive bidding or negotiations for future projects.

- Company significantly depends on other operators for last-mile capacity, where it has limited control, which affects its ability to provide reliable services.

- Though the company was saved from large AGR penalty in the previous SC verdict due to different licenses for NLD and ILD, we understand hearing on the license issue is pending. An adverse outcome would substantially impact Railtel.

- Company has large projects in the North-East, for which it has taken exceptional losses in past two years. Any such future event may significantly derate the stock.

Upside risks

- Higher than expected revenues in telecom services.

- Better than expected margin (telecom services business has substantially higher incremental EBITDA which we have not completely accounted in our estimates).

- Projects business has strong orderbook, and timely execution could prove projects business revenues to be significantly higher than estimated.

Financial Summary

CT Bureau

CT Bureau

You must be logged in to post a comment Login