5G Reports

5G powers global business growth and productivity, Nokia

5G is a new dawn for industry. Faster, more agile, more powerful, and more transformative than any generation that has come before.

Explore Nokia’s cross-industry view of the path to 5G deployment, identifying the true value 5G can bring to individual organizations and the global economy in the wake of COVID-19.

Autonomous vehicles outnumber human drivers, making accidents and traffic congestion almost a thing of the past. Life-saving surgery is delivered by a team of experts, gathered from across the globe and assembled virtually. New products are delivered to consumers in days and weeks – not years. There is barely a distinction between the physical and virtual experience of a concert or sports fixture. In some cities, smart energy and pollution management means climate change has been reversed.

These are not futuristic fantasies, but examples of a world we could soon be living in: the world that 5G – the fifth-generation standard for cellular networks and wireless connectivity – will create.

What is 5G?

Much more than a new generation of wireless connectivity, 5G is the technology that will transform our experience of the connected world – unlocking a wave of innovation across every area of our lives. From virtual reality experiences that will revolutionize consumer entertainment to robotics that will rewrite the rules of manufacturing and AI that will transform the healthcare provision, 5G will provide the foundation for a raft of disruptive technologies to reach maturity.

“In a world that increasingly runs on the transfer of huge volumes of data, the step-change 5G will create in capacity, bandwidth and latency represents a megatrend that will catalyze multiple technological revolutions,” says Gabriela Styf Sjöman, chief strategy officer, Nokia. “Areas of innovation that have been gradually emerging – from blockchain to augmented and virtual reality, artificial intelligence, and robotics – will rapidly accelerate their development as 5G makes high speed, live-streaming data a reliable reality. In turn, our capacity to collaborate remotely, to operate autonomously and to manage resources more intelligently will increase by orders of magnitude. We will enter the era of digital-by-default.”

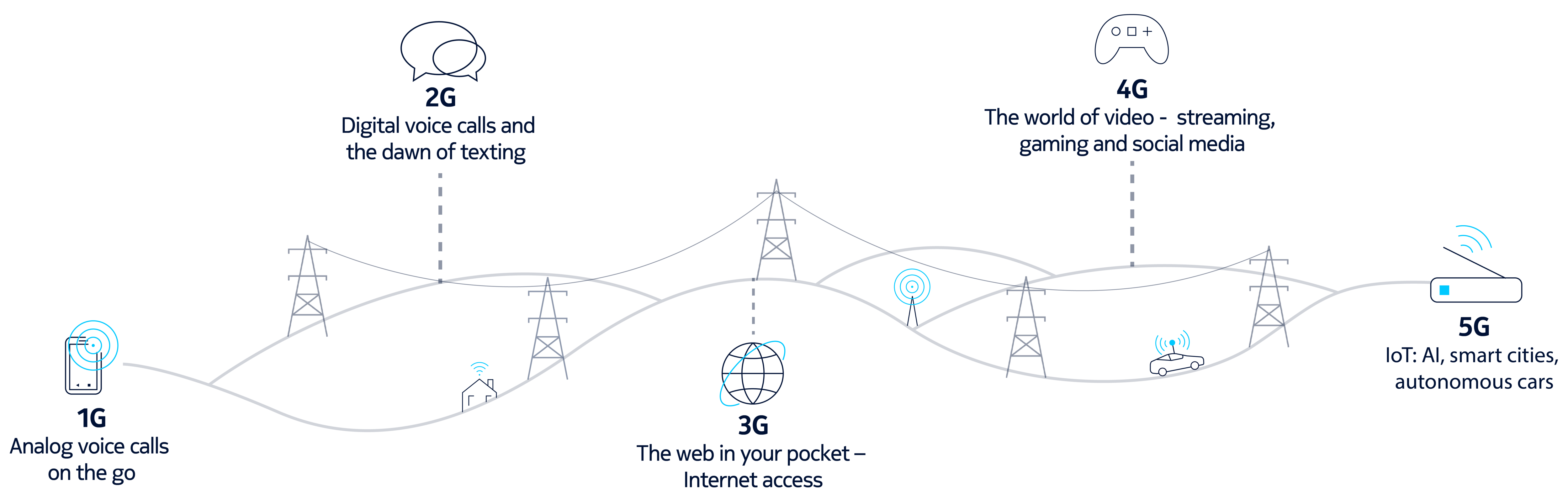

The path to 5G

Dr Sally Eaves, tech influencer and global strategic advisor, says that 5G is “not just an evolutionary development from 4G, it’s a transformational development, a big integrator and enabler. It’s empowering data and it’s offering us a whole new array of services, some of which we haven’t even imagined yet.

“5G provides the bricks that everything else is built on. Without it we can’t talk seriously about technologies like AI or edge computing. The infrastructure is transformative, like the advent of motorways or the electricity grid. They were stepping stones that allowed major changes to happen. We should view 5G in a similar light.”

In this way, 5G is set to provide not just new experiences but huge economic benefit: a study by Nokia Bell Labs Consulting (to be explored in full in the next chapter), has found that 5G has the potential to deliver $8tn in value to businesses, economies and societies globally by the year 2030.

Yet many technologies are cited as transformative, and the path from idea to implementation can be longer and more complex than first assumed. It is important to understand why 5G is not just hugely significant in principle, but ready to be implemented in practice.

Acceleration and innovation

It’s been a volatile and uncertain year. The spread of COVID-19 initially seemed to undermine expectations that 2020 would be the year when widespread 5G deployment took hold. The immediate focus shifted from exploration, expansion and deployment of new technologies into corporate rescue and recovery. In many cases, spending stalled, business leaders had to manage risk differently, and critical industry gatherings fell by the wayside.

“For a short period of time, it looked like we might go backwards, rather than forwards,” Sally recalls. “But then the world responded. Businesses moved to remote working, schools introduced remote learning, and healthcare providers switched to telemedicine. As we adapted to ‘the new normal’, technology held up well, people quickly began to see the imperative of technology, and the business case for 5G became stronger than ever.”

Research commissioned by Nokia and explored throughout the next five chapters underlines that, rather than stepping back from technology investment in the wake of the pandemic, large companies have doubled down. Of the IT purchasing decision-makers we surveyed in eight markets, 45% said they had accelerated their digital transformation programs as a result of COVID-19, compared to just 18% who have not.

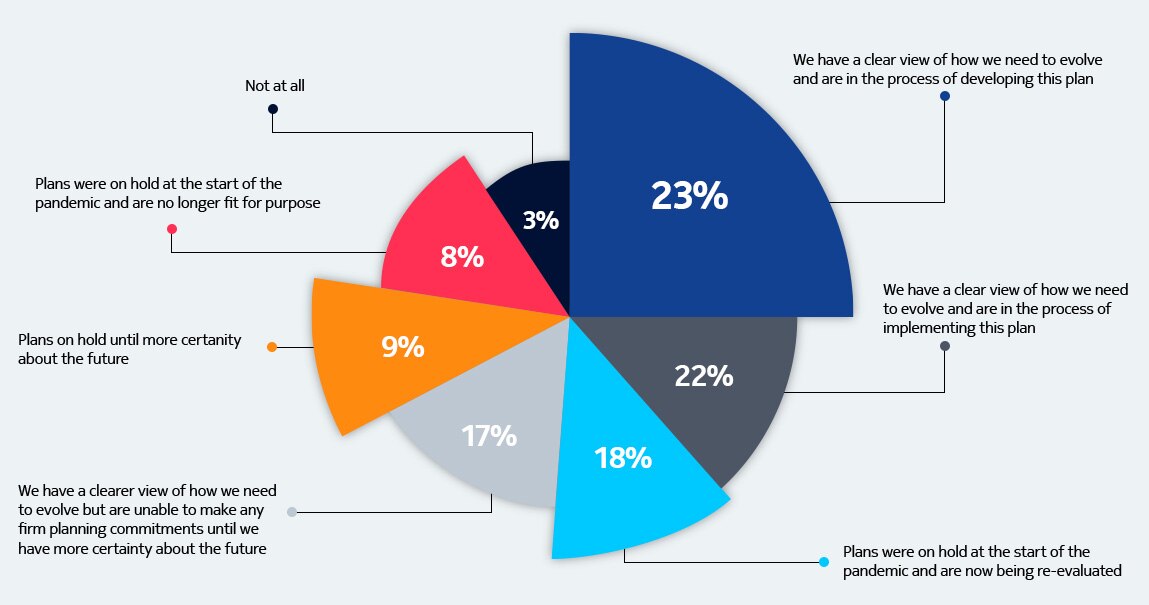

How has COVID-19 impacted organizations’ strategic technology planning?

With the pandemic reshaping consumer behavior and working patterns, companies have had to provide more virtual experiences to both their customers and employees. As the research suggests, that has made the imperative for technology investment greater.

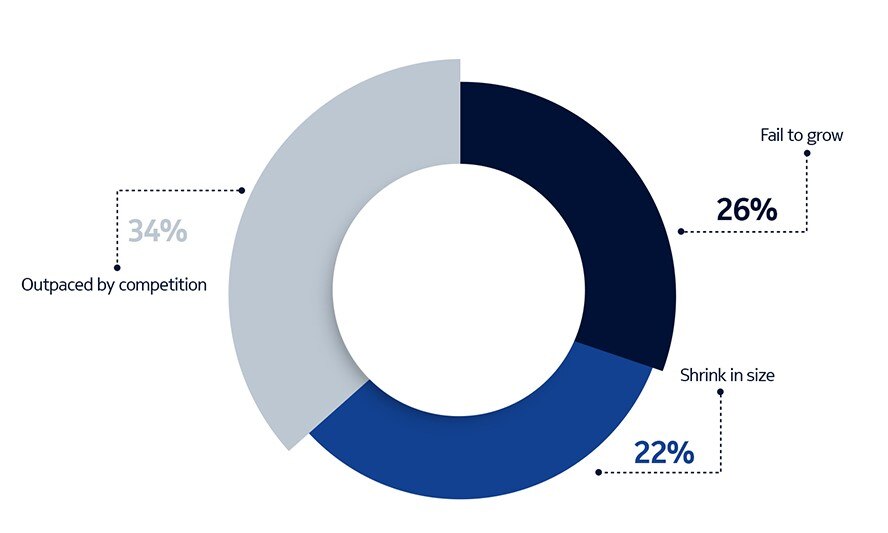

“The significant increase in demand for connectivity resulting from virtual working positions 5G as a growing necessity, not a luxury,” says Gabriela. “A third of decision-makers in our survey identified ‘improved connectivity of the workforce’ as a benefit they expect from future investment in 5G, likely due to the fact mobile connectivity of the workforce remains a number one priority for IT teams. 31% also pointed to increased workforce productivity and 28% increased collaboration. Meanwhile 34% said that they fear being outpaced by the competition if they don’t implement 5G and 28% said they believed growth will be impaired.”

Leaders’ fears for their organizations if they fail to invest in 5G in the next three years

A recent report by the European Commission’s 5G Observatory underlined the growing importance of 5G in a world more reliant on virtual interaction, noting that “in the medium to longer term, it is likely that this crisis will increase the awareness for the need for digital solutions, e.g. in telehealth, increased teleworking (which also calls for higher network capacity and bit rates), fixed wireless access and many features supported by 5G networks.”

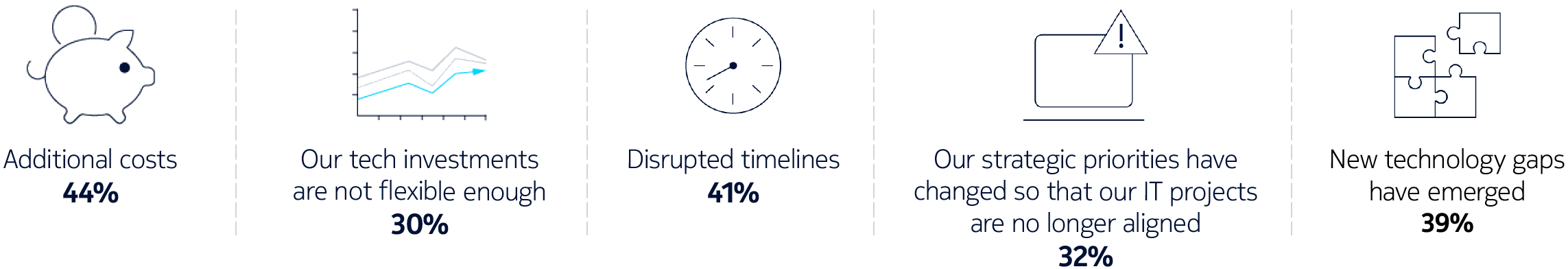

COVID-19 flagged these deficiencies in organizations’ technology road maps

While the pandemic has brought the need for next-generation wireless connectivity into the foreground, 5G’s emergence is also being expedited by specific regulatory and technical developments. By the end of this year, EU member states are mandated to have made ‘pioneer bands’ available to providers, and at least one spectrum auction is planned in all 26 countries. In the US, the Federal Communications Commission (FCC) held the largest spectrum auction in its history during August 2020, selling thousands of licenses, with more mid-band auctions planned for later in the year.

Governance has also progressed, with the publication of Release 16, a new set of global standards for 5G that will provide the foundation for some of its most important use cases, from allowing vehicles to connect and communicate directly, to single-tower location mapping, and private network capabilities that will be needed to unlock the intensive needs of Industrial IoT and robotics. Release 16, Sally comments, “is incredibly significant. It goes into so many different areas that weren’t covered under previous standards. The way this has been put together will open up so many new use cases for the future, especially in automotive and industrial IoT.”

It also, she believes, reflects a growing acknowledgement that collaboration is needed to unlock the full potential of 5G and the benefits it offers to society. “If we don’t collaborate, customers will suffer because there will be a slowdown in innovation, prices will go up and societal transformation will be held back. We need to foster more and more collaboration so we can avoid people being left behind. This is a business and societal issue.”

The tipping point

The combination of mature technological capability, spectrum availability, significant advances in governance, a reinvigorated appetite for innovation across the public and private sector, and cultural readiness for change at a global level, means that we are approaching a defining moment for 5G.

The combination of mature technological capability, spectrum availability, significant advances in governance, a reinvigorated appetite for innovation across the public and private sector, and cultural readiness for change at a global level, means that we are approaching a defining moment for 5G.

Yet barriers to adoption remain. According to our research, awareness, investment and adoption vary significantly between different countries and industries. While there are some successful early movers, many have catching up to do.

In other words, while the potential for 5G could not be clearer, there is still much work to be done.

The following chapters in this report will examine that path to progress – how the economic value of 5G will be realised, who is leading the charge, and how key challenges can be overcome.4

Potential value and growth

For this chapter, we invited our futurists at Nokia Bell Labs to explore the effect of 5G and associated technologies on industries, and the impact of the pandemic on the wider economy. Here’s what they found.

COVID-19 has greatly accelerated the need for physical industries to digitally augment. Mature digital industries, such as online retail, media and banking, have been the immediate beneficiaries of COVID-induced demand shifts. This is largely because of their underlying digital infrastructure, a result of several years of strong ICT investment. On the other hand, physical industries, such as manufacturing, utilities and healthcare, have lagged in digitalization, having failed to acquire new and emerging technologies necessary to make their supply infrastructure more resilient, adaptive and responsive to shifting demands.

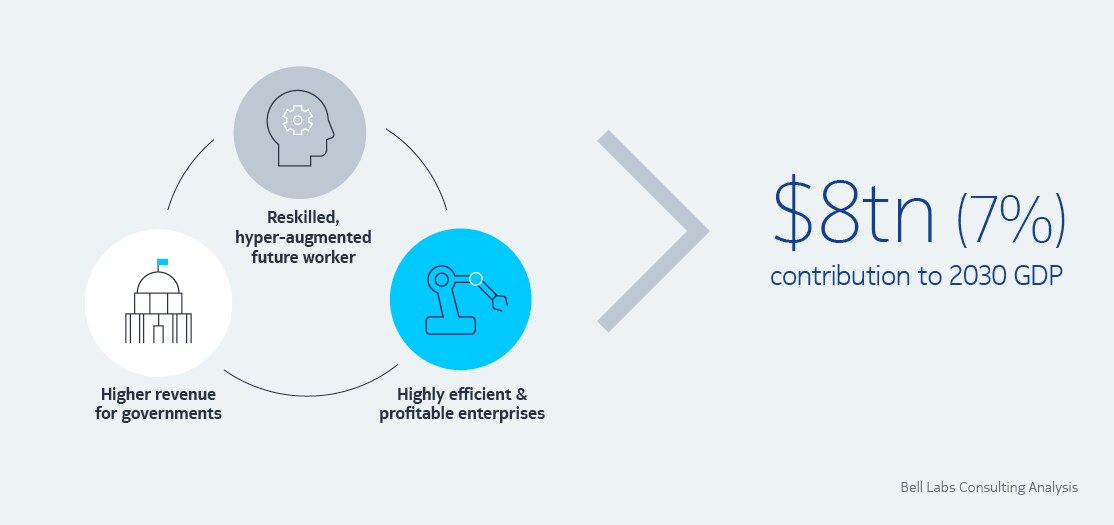

We expect physical industries to increase their ICT investment and adopt end-to-end 5G technologies extensively in the next decade, thus transforming themselves into augmented physical industries. This transformation will result in a big value inversion – realized through safety, productivity, efficiency and resiliency gains across enterprises, plus creation of new jobs, more employment, higher wages and an increase in revenues for governments. We expect the formulation of this economic equation – catalyzed through what we see as 5G+ enabled digitalization – will increase global GDP by $8 trillion in 2030.

Introducing 5G+

Bell Labs Consulting uses 5G+ as an umbrella term for a broad ecosystem of technologies that will unlock the future economic potential of industry. These technologies include end-to-end 5G, edge cloud infrastructure, private networks, augmented intelligence, automation, sensing and robotics, as well as platform and as-a-service business models. 5G+ is the new enterprise ICT and industrial operations technology (OT) infrastructure, designed to revive latent demands and trigger a new phase of growth across our physical industries.

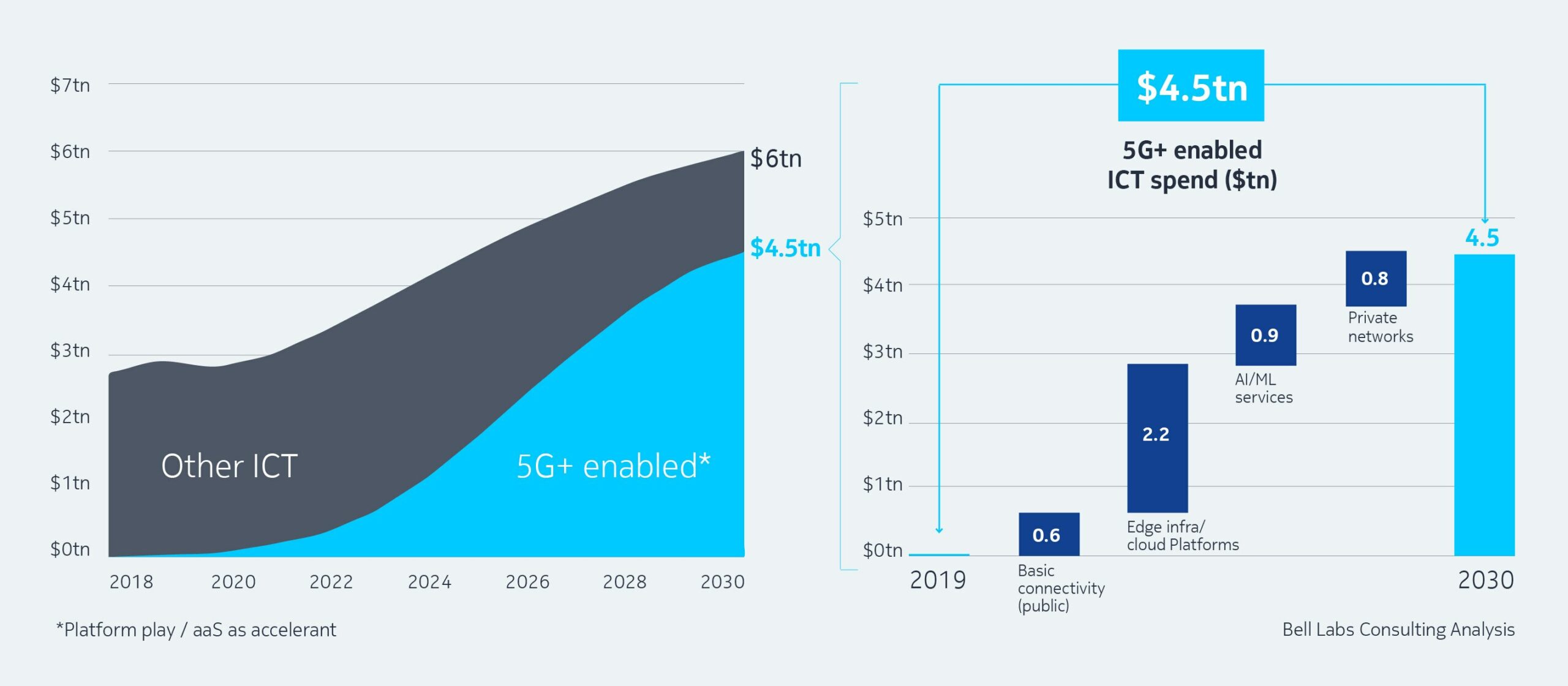

We expect new ICT spend enabled by 5G+ to grow significantly in the next decade, in keeping with growth in enterprise digitalization. Annual global ICT consumption is forecast to increase from $2.8 trillion in 2020 to $6 trillion by 2030. 5G+ will contribute the lion’s share of that growth; the share of 5G+ technologies and enabled applications and services in the total ICT spend is projected to be $4.5 trillion – or 75% of the total ICT spend – in 2030.

Below, we break down 5G+ enabled 2030 ICT spend into its key components. Edge infrastructure/cloud platforms have the largest share (49%) in keeping with their broad coverage of platform functionalities. While private networks (18%) are virtually on par with AI/ML services (20%) in their proportion of the 2030 spend, they end the year with a higher growth rate indicating a stronger future share of enterprise ICT outlay. Basic connectivity – which includes wide-area mobile-and fixed-network services, and unified communications – comprises a smaller portion of total spend.

5G-enabled ICT spend

Leaders and laggards

The story of digital transformation to date has been one of a widening gulf between leaders and laggards. Physical industries have been slower than digital industries in adopting digitalization systems and platforms that drive efficiency and innovation. This is largely due to the need to deploy new and emerging infrastructure and technologies required to meet the stringent performance needs placed on many of their operations. With several years of strong ICT spend – during which digital industries outspent physical industries 70:30 in spite of having only 25% of the workforce and only 30% of GDP contribution – digital industries have attained a level of digitalization maturity that enabled them to meet the COVID-19 challenge aggressively.

The three categories of digital adoption

The team at Bell Labs Consulting used metrics based on workplace digitalization and ICT spend to classify industries into three categories of digital maturity.

Digital mature

These digital industries are the farthest ahead in terms of their digital maturity. They include communications and media, banking and securities, and insurance.

Physical leading

Physical industries that have achieved a moderate level of digitalization, with strong potential to improve significantly. They include manufacturing, healthcare, transportation, retail trade, education, government and utilities.

Physical lagging

Physical industries with low ICT spend and limited automation potential, including construction, agriculture, mining, wholesale trade, live performance arts and entertainment, and accommodation and food services.

These categories both reflect current divides in digital maturity and investment, and provide a lens for discerning future trends, as investment accelerates in the wake of COVID-19.

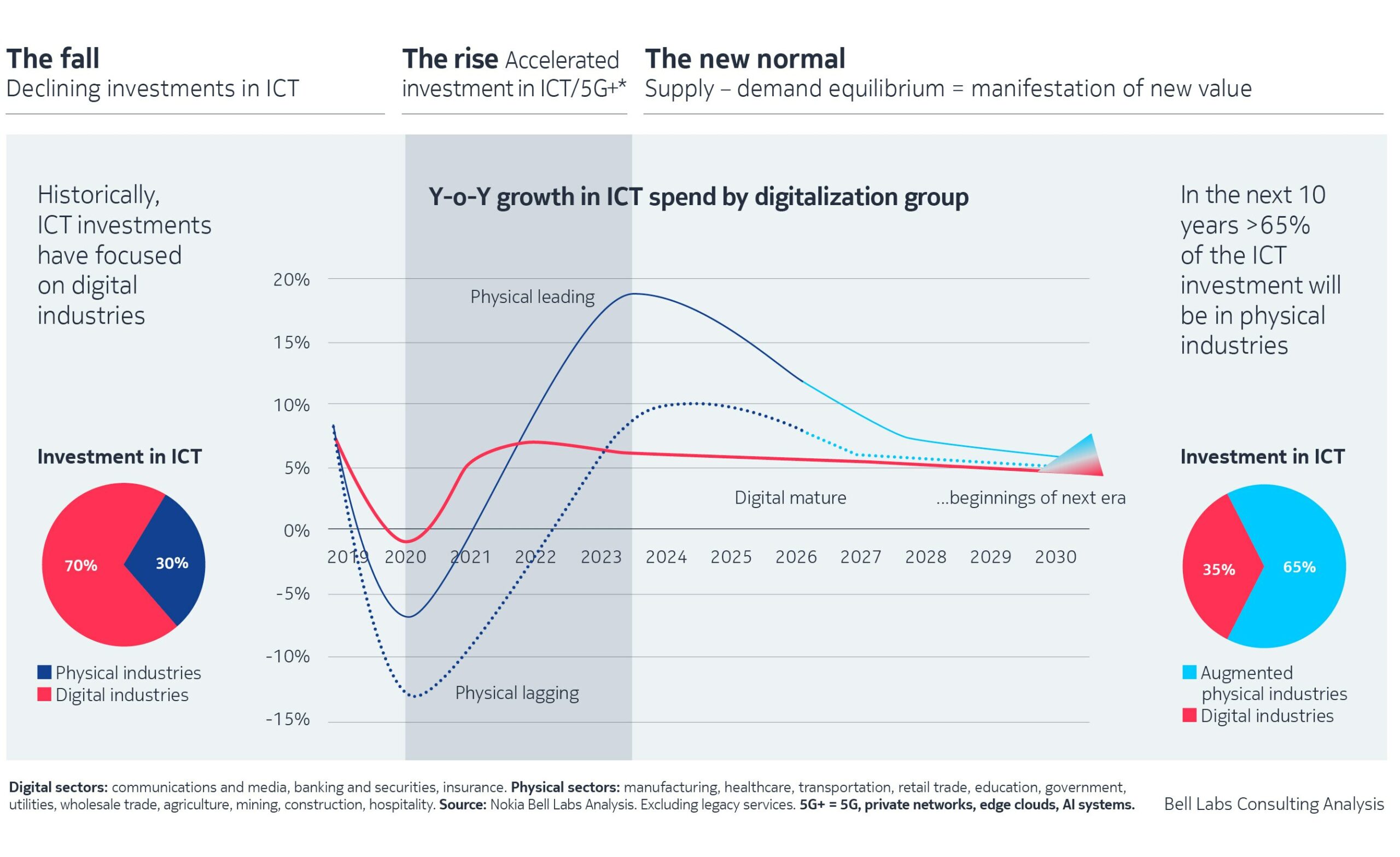

Investment growth and economic recovery

In assessing ICT investment and the future state of our industries following COVID-19, Bell Labs Consulting identified three phases: the fall, the rise and the new normal. The first of these reflects the near-term decline in investment as enterprises and industries reacted to the economic challenges of the pandemic; the second, a period of accelerated investment expected in the next three years as enterprises seek to expedite digitalization; and the third, a new, steady-state equilibrium.

Journey to a new normal

While overall ICT spend is projected to grow 6.5% annually over the next decade, that investment will be 40% greater in physical industries relative to digital industries. Analysis suggests that, while physical-leading and physical-lagging sectors have experienced a greater fall in ICT spending than their digital-mature counterparts (decreasing 6% and 12% respectively), they will see a more pronounced rise in the years ahead.

2030 will mark a significant value inversion point driven largely by the new transformed augmented physical industries through new ICT/5G+ investments. The historic 70:30 ratio of ICT spend between digital and physical industries will shift to a 35:65 ratio, thereby restoring parity with the GDP contribution of these two sectors.

New value creation

Direct ICT investment of $4.5 trillion towards digitalization of sectors, enabled by 5G+ technologies, will lead to new economic value creation. Higher industrial output and greater business activity throughout the ecosystem will lead to increases in enterprise profitability and government revenues. Greater digitalization also leads to the creation of re-skilled, hyper-augmented jobs and a workforce that commands premium wages, resulting in higher employment and overall income. That $4.5 trillion investment in 5G+ technologies will trigger a concomitant $8 trillion growth in global GDP in 2030, or a 7% increase in overall GDP, measured in terms of workers’ wage growth, enterprise profitability growth and government revenue growth.

As 5G becomes a general purpose technology (GPT) at the heart of the 5G+ innovation ecosystem, it will transform all industries, giving them the ability to meet burgeoning digital demand in a world where consumer habits and enterprise needs are changing frenetically. This will have two fundamental effects: parity will be achieved between the ICT investment and GDP contribution of industries, and value creation will be catalyzed across industries and, ultimately, throughout the global economy.

Business readiness for 5G

The role 5G can play in helping companies optimize their operations and drive innovation could not be clearer. Bell Labs Consulting’s research outlined in the previous chapter underlines the potential for organizations to use 5G to leapfrog multiple stages of their digital transformation. But while 5G might be ready for business, how ready is business for 5G?

In addition to the research by Bell Labs Consulting, we also conducted a study into how prepared businesses are to make the most of the opportunity ahead.

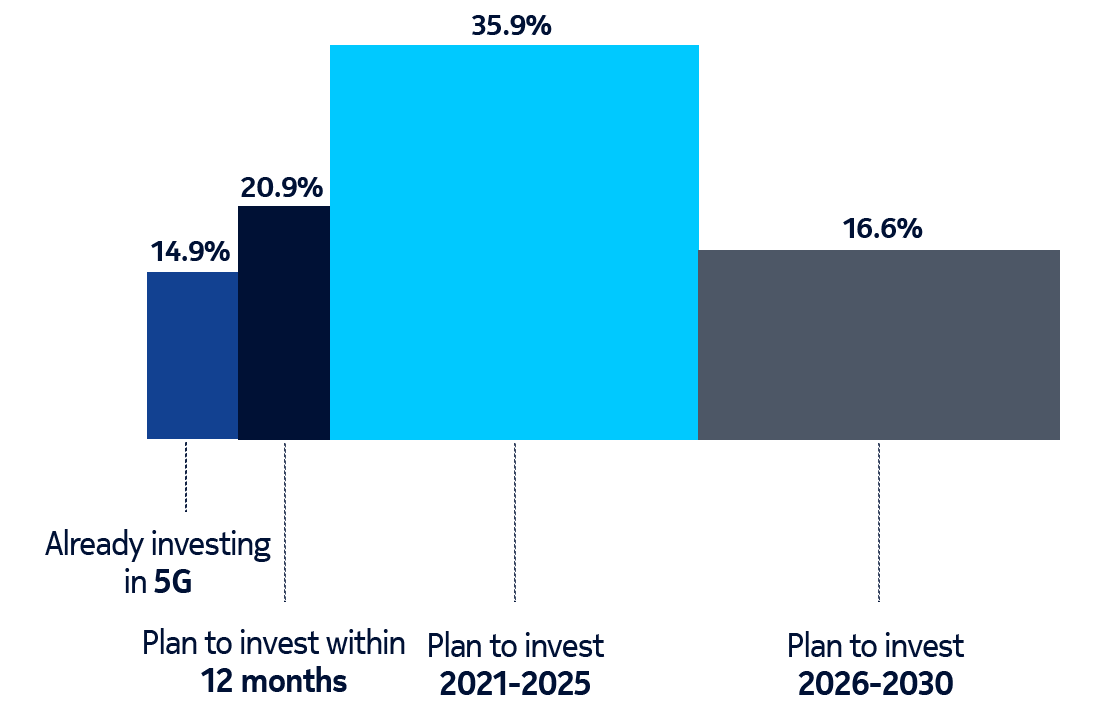

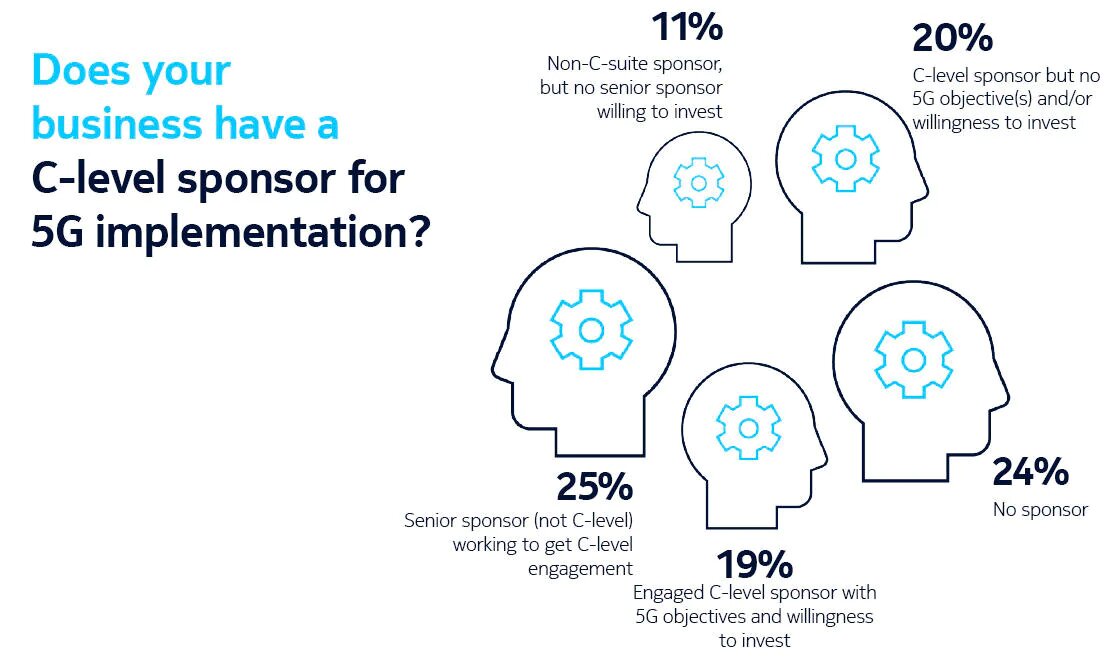

The study found that there is a gap between intentions and actions when it comes to any kind of 5G deployment for many companies. While 86% of decision makers said they have some kind of strategy for 5G, only 15% are currently investing in its implementation.

The fact that another 57% plan to invest within the next five years suggests companies are at the beginning of what will be a lengthy runway on 5G deployment, as they scope use cases and identify necessary resources.

The Nokia 5G readiness scale

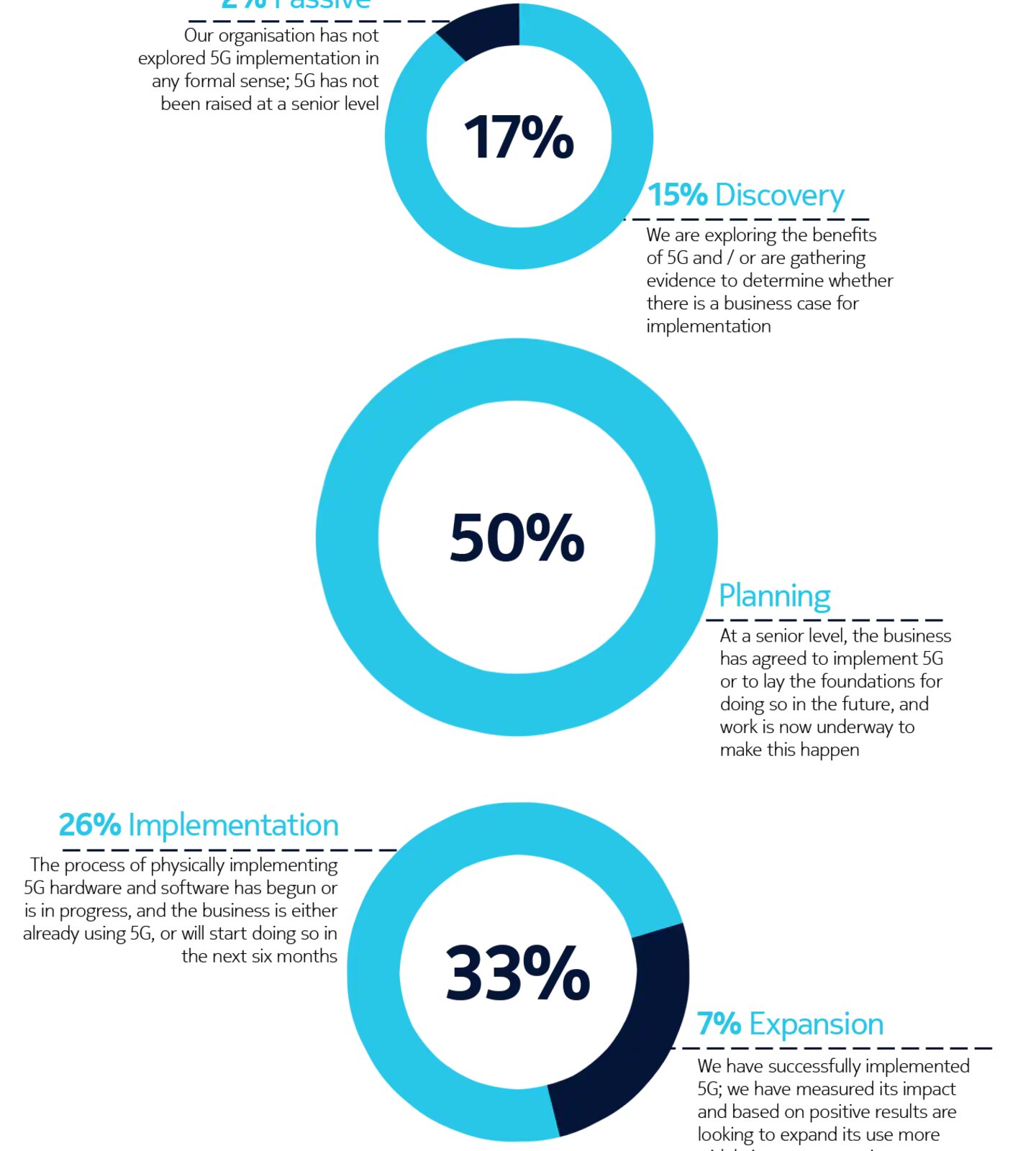

The upshot is that, while some companies, sectors and markets are advanced in their 5G preparations, most are at an intermediate point between initial planning, trials and deployment. Our 5G Business Readiness Model shows that 50% of companies are currently in the planning stage, suggesting they are at the midway level on 5G readiness. Meanwhile, 26% are at the Implementation stage, while 7% are now expanding their deployments – a phase we would describe as 5G mature, meaning a company has started to leverage 5G in at least one of its many use cases. Conversely, 17% are either in the Passive or Discovery phase, showing low 5G maturity.

The upshot is that, while some companies, sectors and markets are advanced in their 5G preparations, most are at an intermediate point between initial planning, trials and deployment. Our 5G Business Readiness Model shows that 50% of companies are currently in the planning stage, suggesting they are at the midway level on 5G readiness. Meanwhile, 26% are at the Implementation stage, while 7% are now expanding their deployments – a phase we would describe as 5G mature, meaning a company has started to leverage 5G in at least one of its many use cases. Conversely, 17% are either in the Passive or Discovery phase, showing low 5G maturity.

Findings underpinning the model included that only a third of decision-makers have a dedicated team for 5G within their organizations, and just one in ten of the technology buyers surveyed said their organization is fully resourced for 5G (across budget, personnel, software and hardware).

The survey also showed some distinct regional and industry variations. While 13% of organizations in Saudi Arabia and 12% in the United States rated as 5G mature, fewer than one in 20 were classed as such in Germany (3%), Finland (2%) and the UK (4%).

Take a look at the mastery model below to see how organizational readiness for 5G varies by sector and geography.

The five stages of 5G maturity

Passive: the business has not explored 5G implementation in any formal sense; 5G has not been raised at a senior level

Discovery: the business is exploring the benefits of 5G and / or are gathering evidence to determine whether there is a business case for implementation

Planning: at a senior level, the business has agreed to implement 5G or to lay the foundations for doing so in the future, and work is now underway to make this happen

Implementation: the process of physically implementing 5G hardware and software has begun or in progress, and the business is either already using 5G, or will start doing so in the next six months

Expansion: the business has successfully implemented 5G; it has measured its impact and based on positive results is looking to expand its use more widely into operations .

The benefits of 5G adoption

This relatively slow progress on 5G deployment could be limiting companies’ ability to boost their business performance, particularly in light of challenges arising from COVID-19. As well as assessing the 5G readiness of businesses across different countries and industries, our survey explored the relationship between 5G readiness and a company’s overall performance, confidence and technology strategy.

The findings suggest that 5G mature businesses have been better able to grow rapidly, maintain productivity, engage customers and instill confidence in employees. Notably:

5G mature companies are growing considerably faster than their peers: 49% of organizations in the Expansion phase companies and 37% in the Implementation phase said their organization achieved rapid growth last year, compared to 20% who classified as at the Planning phase, 11% in Discovery and 5% Passive.

Companies at the Expansion stage were the only sub-category to have experienced a net increase in productivity (+10%) following COVID-19, compared to Implementation (-3%), Planning (-15%) and Discovery (-40%).

Only 5G mature companies have been able to increase customer engagement (by 12%) during the pandemic, compared to no change for Implementation-stage organizations, -9% for companies at the Planning stage, -28% for organizations in the Discovery stage and -47% for Passive.

Across the board, only 22% of respondents said they have ‘total confidence’ in the ability of their organization’s leadership to cope with the impact of COVID-19, but that rises to 56% among those at the Implementation stage of 5G readiness, and 67% for those at the Expansion stage of 5G deployment.

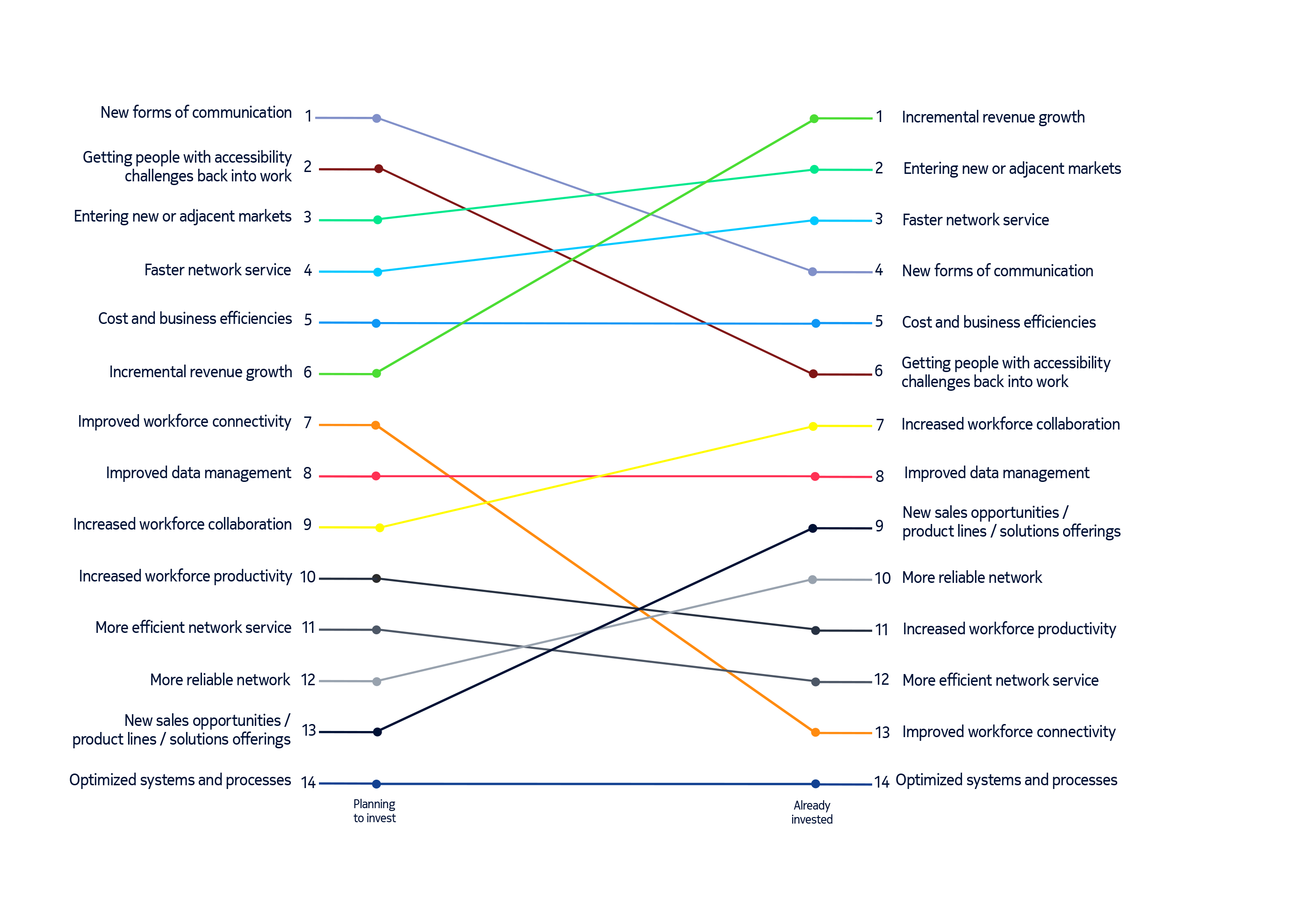

Expectation vs reality: the anticipated impact of 5G by organizations yet to invest, and the actual impact felt by those who have

5G is a key tool for industry 4.0 acceleration, and the companies most advanced in their digitalization journeys are likely to be most mature when it comes to 5G, which is one of many digitalization aspects fueling growth and positive business outcomes. However, these findings show that the companies who are most 5G mature, and therefore likely also the most advanced in their digital transformation, are showing the highest impact in overall business performance. This suggests that companies which are delaying their 5G implementation may be missing out on important benefits, including the ability to overcome the challenges of the ongoing pandemic. That correlation was also evident in sub-categories: both the market (Saudi Arabia) and the industry (healthcare) with the highest proportion of 5G mature companies also had the largest share of growing companies in each case (83% and 80% respectively, compared to an overall average of 73%).

But while success is evident, even the most advanced industries are only scratching the surface of what’s possible.

“While many companies evidently see 5G as a technology for the near future, deployment varies by organization, industry and geography,” says Raghav Sahgal, president, Nokia Enterprise. “As our research shows, most organizations are at the Implementation stage – for most, this means trials, pilots or early stage deployments, for example, in mining applications to improve the safety of workers, in power utilities remote control of physical assets to avoid wildfire ignition, or in manufacturing supply chain resilience. Yet, we still have to realize the true breadth, depth and potential of 5G.

“But this doesn’t mean organizations have to wait to reap the benefits. Those who have already prioritized and begun deployment of private 4.9G within their business appear to be deriving clear operational benefits today. We believe this demonstrates the importance of linking 5G as a technology to broader business outcomes. If an organization aims to capture revenue growth at some point, it needs to reinvent itself and look for new business and operational models, because an old one can only grow so far. By tying those business objectives to technology, the organization will set itself up for more sustained success.

“More importantly, becoming a 5G mature organization requires a strategic and holistic approach to planning and investment, prioritizing and converging IT and operational technology (OT) departments, which are often working in silos within an enterprise.”

Beyond the hype

As deployment grows and proofs of concept are explored, the benefits of 5G have started to become more tangible. But as research for this report has shown, adoption of 5G will not be linear or evenly balanced across sectors. In this chapter we will assess where its impact is likely to be most significant in the near future – exploring the use and investment cases that are already driving 5G implementation.

“While 5G holds huge potential for every company, in the short-term it is proving most relevant for asset-intensive industries that depend on ubiquitous connectivity to support continuous operations,” says Raghav Sahgal, president, Nokia Enterprise. “The shift to what has been broadly termed Industry 4.0 – heavy industry overhauling its systems and practices through a combination of data, connected devices, automation and artificial intelligence – provides the most immediate and meaningful catalyst for enterprise deployment of 5G.”

Across sectors including energy, transportation, manufacturing and mining, the growing reliance on IoT translates to increased demand for bandwidth, minimal latency and enhanced security. IT and OT (operational technology) are converging as companies seek to become more agile, productive and cost-effective in the emerging data era.

“As these industries pursue ambitious transformation plans, their need for secure, dependable, scalable connectivity is bringing 5G to the forefront of digital strategy,” continues Raghav. “Indeed, many companies in these areas have already taken steps in this direction, deploying 4.9G networks that allow them to connect billions of IoT-enabled devices and assets, and which will in turn provide a smooth evolution to 5G.”

In every area of industry, the relentless growth of connected devices and automated systems will necessitate adoption of 5G if organizations are to support their transformation plans. Gartner projects that, by the end of this year, the number of enterprise and automotive IoT endpoints will grow to 5.8 billion, a 21% increase on 2019.

As well as heavy industry, 5G is also becoming more relevant for services companies as they respond to the new needs of employees in the wake of COVID-19. According to Nokia customer Safaricom, Kenya’s largest mobile network provider, this has meant growing demand that is accelerating the roll-out of 5G.

“With more people working from home, we’ve had a lot of requests for reliable fixed network connectivity in areas where we did not have fiber coverage. Our strategy is to use fiber but complement it with 5G – because it’s easier, faster and cheaper.”

The smart home and home office, says James Maitai, Network Director at Safaricom, represents one of 5G’s most immediate consumer use cases. It is not just that 5G will provide faster and more reliable connectivity, removing familiar frustrations for remote workers. It will also expand what is possible from the home office – supporting immersive digital experiences that bring physical and virtual environments closer together, narrowing the gap between physical and remote presence.

“As digital transformation sweeps through all areas of the economy, 5G is providing the enabling infrastructure,” echoes Raghav. “From the smart factory to the home office, next-generation connectivity will help to unleash the full potential of connected devices, automated processes, converged systems and virtual experiences. In homes, on roads, at ports and across rail networks and power systems, 5G is helping to build the new working world.”

Safaricom’s 5G rollout

For Safaricom, the process of preparing to launch Kenya’s first 5G network has been extensive, involving a combination of network modernization, training and upskilling, customer education and device readiness.

“Safaricom is the market leader in Kenya, with an 80% market share,” says Network Director James Maitai. “We’ve always led in the adoption of new technologies, from 3G and 4G to M-Pesa, so this was a natural evolution.”

In addition to technical readiness and training its people to work with 5G, a strong focus has been helping enterprise customers understand the distinct advantages of 5G. “We are working with Nokia to help enterprises take a longer-term view and understand why they need to invest in new devices and new business strategy,” he says. “A lot of companies tend to focus on what is expensive or difficult now, when they need to focus on where to invest not just to optimize their business, but to be ahead of the competition.”

One challenge is overcoming a preference for fiber broadband. “We are trying to explain to enterprises that 5G will be a viable alternative to fiber. Many want to use fiber everywhere, even though it’s more expensive and takes longer to build, and is even more expensive to run. They don’t always see the areas where 5G will be more convenient and sustainable.”

As Safaricom’s 5G network is introduced, James anticipates the evolution of new, industry-specific use cases. “We see a lot of opportunity in use cases that are not developed yet. For example, with airports we can provide security solutions based on 5G connectivity, and 5G’s latencies mean we can create custom slices for these markets.”

What’s holding businesses back?

The gap between enterprise awareness of 5G’s benefits and current levels of adoption suggests a degree of inhibition when it comes to implementation. To understand why this might be, our survey explored what technology buyers perceive as the principal barriers to deploying 5G – whether their own concerns or organizational limitations beyond their control. In parallel, we asked experts what needs to happen to break these logjams and bring adoption of 5G firmly into the mainstream, through which we identified five principal barriers to 5G adoption for enterprises.

Barriers to adoption

Ecosystem availability

5G currently exists in pockets of availability. Some urban cities have 5G networks and a minority of organizations have developed private 5G networks – but it is not yet the network standard. As such, the most-cited barrier to 5G investment and implementation was ‘availability of 5G-enabled products’, mentioned by 28% of decision-makers. In turn, 22% of buyers surveyed said they are unsure which provider to use and 19% pointed to lack of coverage as a stumbling block.

But this shouldn’t hold businesses back, says global technology futurist, Daniel Burrus: “5G availability is rapidly growing on a global scale, starting in the largest cities where most businesses and people are. 5G usage is increasing in dense populations and will spread outward from there. Innovation is about looking ahead. While 5G may not be widely available now, it soon will be. The businesses who get ahead of the curve will be best placed to reap the benefits.”

Education and understanding

5G resourcing – progress to date

5G resourcing – progress to date% of organizations which have built the resourced needed to integrate 5G into their operations and services into their strategy and planning process

5G Integration resources

Companies may appreciate the benefits of 5G in theory, but not all understand how they would actually use it within their organization. In our survey, 17% said a key barrier is that decision-makers within the business do not understand 5G, while 14% said they don’t know enough about it themselves. “While there may be some appetite for 5G, business leaders don’t really understand how to make 5G happen for them: how do they do it? Who do they work with?” says futurist Bernard Marr. That is reinforced by the 36% who said that a better understanding of 5G, and the benefits it offers, would encourage them to invest more. Education is key – but so is proving the technology can deliver for the different possible use cases. Organizations should invest time to conduct early trials and validation testing – giving them the opportunity to fully explore and get to grips with the technology ahead of roll out.

Awareness

Over a fifth of technology buyers (22%) said that 5G implementation is not a current priority for their business, the third most-cited barrier after cost and availability. That, suggests Bernard, may underline a lack of awareness about its near-term potential. “Companies still believe that 5G is some time in the future. I think there’s a lack of awareness of how transformative 5G can actually be for businesses. I don’t think companies are aware of 5G’s potential and how it will change their business processes.”

Cost and complexity

Another hurdle for 5G investment is the complexity surrounding the related infrastructure and how to manage its installation. 15% of those surveyed said they were not confident their organization would be able to implement the necessary technologies, rising to 23% among technology buyers in the healthcare sector. Given that 5G involves some restructuring of internal operations to unlock benefits, 26% also cited high costs as a barrier to implementation.

Security

Unsurprisingly – as with any new concept – there are concerns about what the introduction of 5G might mean for organizational and network security. Over a third (34%) said that they are concerned about the security of 5G, rising to 40% in healthcare and 43% in the mining industry. In turn, 22% cited security risks related to 5G as a primary barrier to its implementation.

1 in 3

Concerned about the security of 5G

Transport

Sector least concerned about security as a barrier to implementation

28%

Technology buyers nervous to invest because of future uncertainty

Catalysts for change

Experts interviewed for this report highlighted some key interventions that could act as catalysts for improved understanding, confidence and ultimately adoption of 5G. They pointed to three critical success factors for wider 5G adoption:

Changes to regulation and government intervention

A third of technology buyers in our survey said that government investment in infrastructure or subsidies to drive down costs would encourage them to invest more in 5G. Indeed, our work with all parts of the ecosystem suggests that enterprises will not adopt 5G unless the supply from network operators is presented and priced appropriately, which in turn relies on governments and regulators making 5G spectrum in low, mid and high bands available in an affordable way.

“Governments can facilitate the deployment of telecom infrastructure by opening up access to physical real estate for 5G infrastructure (small cells), as well as simplification of installation regimes as networks become denser,” says Gabriela Styf Sjöman. “Allowing network slicing and differentiated quality of service (with balanced net neutrality rules) is important as well. As we head towards the ‘great re-set’ in the wake of COVID-19, national recovery budgets need to foresee adequate financing for improving connectivity where needed for 5G and very high capacity fixed networks (fiber).”

Improved information sharing

In parallel, says Bernard, the lack of understanding that exists within some businesses around 5G must be directly addressed. “People need to understand how 5G can benefit their business and wider society. Sharing real use cases of how 5G is helping people now – for example, enabling remote education during the pandemic – is key to helping people really get to grips with how the technology fits into our world and understanding 5G’s potential.”

Dr Sally Eaves echoes his call for a more collaborative approach: “People have to buy into the idea of sharing information in order to accelerate this. There are things being done that are advancing the industry, but we need more. We need to foster more and more collaboration.”

Daniel agrees that collaboration is a critical – but emphasizes that this must be proactive. “There’s a difference between cooperation and collaboration. Cooperation is a defensive move, to defend one’s piece of the economic pot out of necessity. Collaboration is openly working together to create a bigger pie for all.”

A bolder approach

For 5G deployment to become widespread, Bernard believes, businesses need to see the bigger picture of how it could change their business for the better. “They really need to think about their overall business strategy, think about the products and services they offer, and how 5G could potentially transform those customer offerings.

Alongside customer benefits, there is an opportunity for businesses to overhaul operations – for example, exploring how they could use 5G to streamline and more effectively monitor their mobile workforce, fleet or supply chain. Nokia’s Raghav Sahgal agrees: “In this context, 5G becomes more than a connectivity value-add and emerges as a catalyst for business transformation: a fundamental pillar of innovation and growth, helping enterprises both to optimize and diversify their business models.

Collaboration and confidence

5G is not a bolt-on technology but a complex ecosystem of moving parts, both technically and in terms of its participating ecosystem. One risk is that different stakeholders hang back, waiting for others to drive progress.

As this research underlines, there is no single barrier holding companies back from 5G adoption and as such no silver bullet solution to accelerate adoption. “Collaboration between different stakeholders is necessary to drive progress, helping create momentum throughout the ecosystem,” says Gabriela. “More collaboration, confidence and understanding on all sides is what will unlock the full potential of 5G deployment. We need to see more knowledgeable and proactive enterprises that dare to explore new business models as well as governments that provide the support that companies need.” Nokia

You must be logged in to post a comment Login