Company News

NetApp: The hallmarks of a successful tech re-invention

As the markets continue to trade in a choppy fashion, investors would be wise to double down on value-oriented plays, especially those that can allow us to maintain or increase our exposure to a declining tech sector. NetApp (NTAP), a storage company that has made a recent resurgence by focusing on cloud product sales, is an under-the-radar name that makes for a perfect “safe” investment in the current market.

Few tech companies ever age as NetApp has. Founded in 1992, NetApp has now been around for three decades. It was a leader in the storage market before its dominance was supplanted by companies like Pure Storage (PSTG) which specialized in higher-performance flash storage solutions; for several years, NetApp suffered from revenue declines and stagnation.

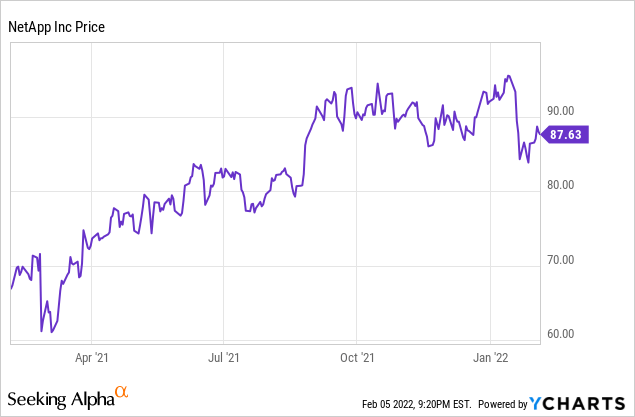

But though late to the cloud game, NetApp has seen a turnaround. As proof: its stock is up 25% over the past year, a big outperformance versus many high-flying tech stocks that have cratered since November. Down 5% since the start of the year in sympathy with other stocks, it’s a good time to buy into the slight dip on NetApp:

I first recommended going long on NetApp during the thick of the pandemic, in September 2020. Since buying into NetApp at around $40 per share, the stock has more than doubled as well as avoiding the steep crash seen in other tech stocks over the past quarter. Despite this long stretch of outperformance, I remain solidly bullish on this name.

NetApp has optimized itself for the cloud-first IT environment. The company offers data management and storage solutions compatible with the three largest public cloud vendors: Amazon AWS (AMZN), Microsoft Azure (MSFT), and Google Cloud (GOOG). For customers looking to adopt a “hybrid cloud” solution (with some assets in the cloud, and others remaining behind in private data centers), NetApp has products that offer cloud-like agility even in on-prem environments as well. And, the company continues to offer a full stack of storage solutions, from flash to data storage solutions specifically made for unstructured data. Backup and recovery, as well security and analytics tools, make NetApp a one-stop shop for data storage and management needs.

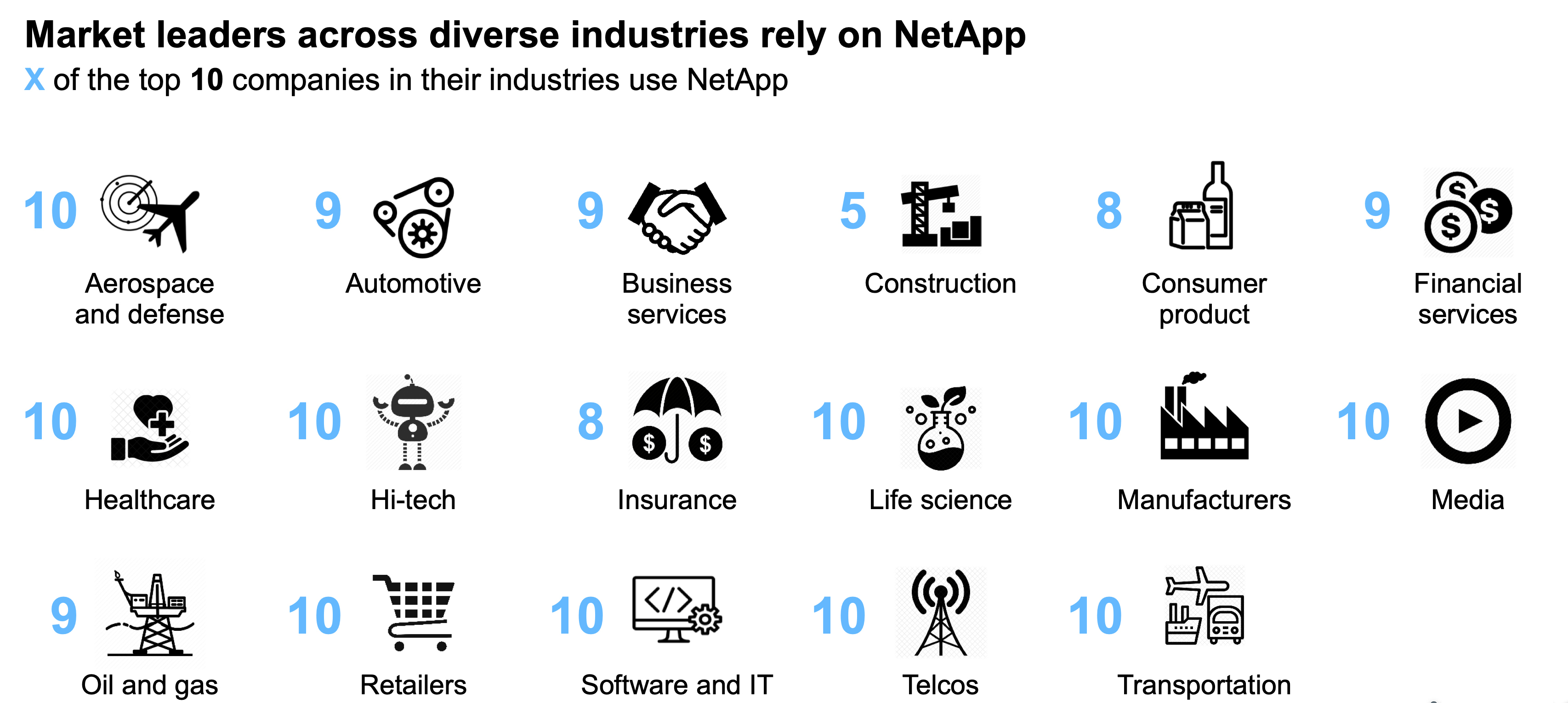

Despite a potentially undeserved reputation as a “legacy” tech provider, NetApp counts some of the top companies in various industries among its customer base. The slide below showcases the diversity of NetApp’s vertical offerings, and the numbers in blue represent the portion of the top-10 largest companies of each industry that are NetApp customers:

By far the biggest appeal to NetApp, however, is its relatively rare orientation as a value stock within the tech sector. At current share prices near $87, NetApp trades at a relatively modest 15.8x P/E ratio versus FY23 pro forma EPS expectations of $5.54 (data from Yahoo Finance). Considering NetApp is currently on a roll with double-digit earnings growth (driven both by high single-digit/low teens revenue growth plus margin expansion), I’d say this is quite a steal – especially on top of the ~2.2% yield that NetApp currently offers with its $0.50 quarterly dividend.

The bottom line here: while the rest of the tech sector is going belly-up, NetApp looks like a great, under-recognized value play to hold onto as market volatility continues. Use the recent slight dip as a buying opportunity, and consider this a long-term hold with a 1-2 year horizon.

Q2 download

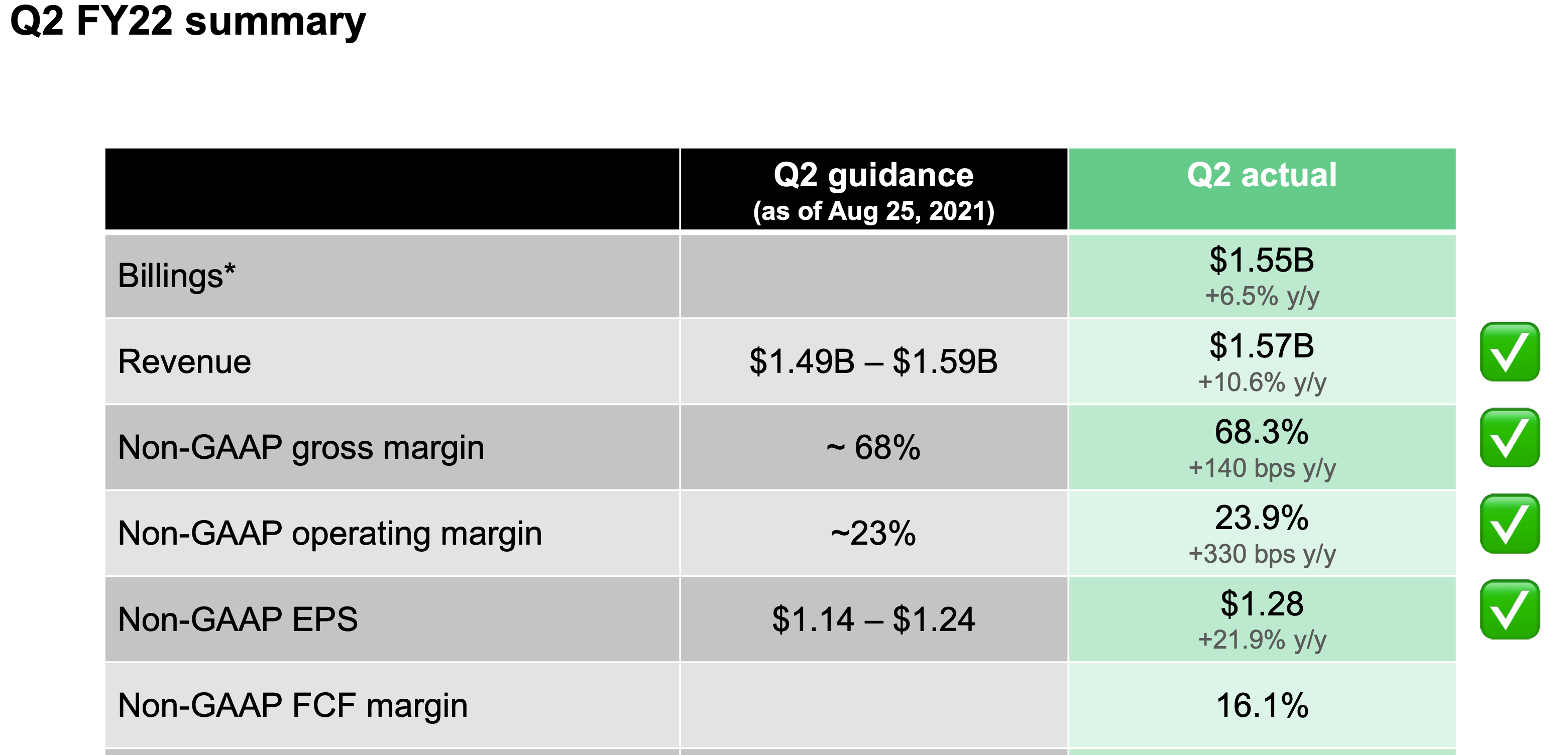

Let’s now go through NetApp’s latest quarterly results for the fiscal second quarter (which for NetApp is the quarter ending in October). The earnings highlights are summarized in the chart below:

As seen above, NetApp met or exceeded its guidance on all metrics. Revenue grew at an 11% y/y pace to $1.57 billion, beating Wall Street’s expectations of $1.55 billion. We note that NetApp’s revenue growth has picked up markedly in FY22 – in FY21, the company had only seen low single-digit growth rates; and in FY20, the company had actually suffered revenue declines.

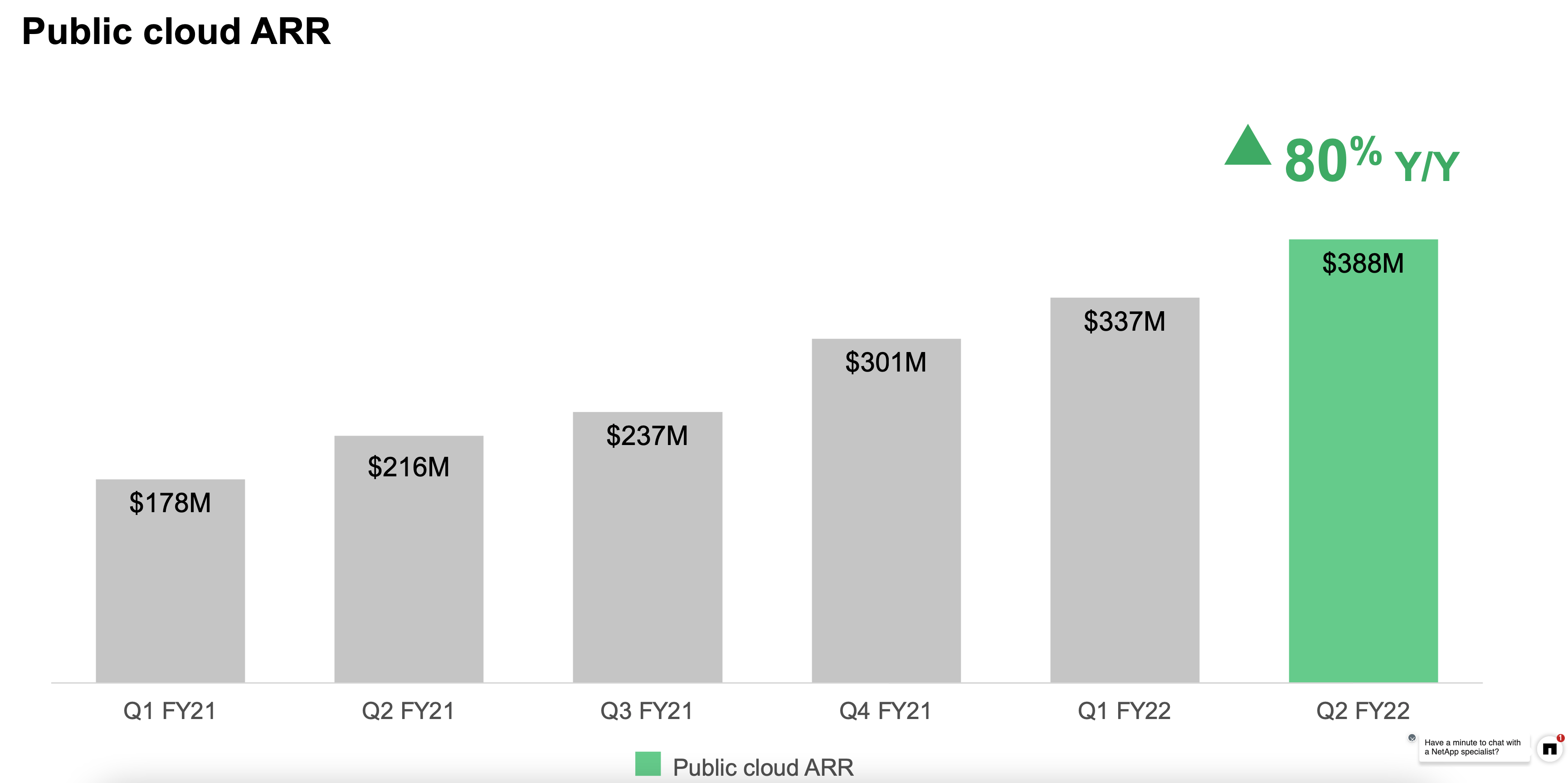

It’s the cloud focus that is driving success for NetApp. As seen in the chart below, the company has consistently built up a strong base of annualized recurring revenue for its public cloud-oriented products, reaching $388 million in ARR in Q2 – up 80% y/y. The company expects to exit FY22 with a public cloud ARR of $510-$540 million, up from a prior view of just $475-$500 million.

Meanwhile, the annualized revenue run rate for NetApp’s flash storage products, an area in which NetApp has historically lost versus competitor Pure Storage, is up 22% y/y to $3.1 billion – putting flash storage at roughly half of NetApp’s total annual revenue.

Here’s some helpful commentary from CEO George Kurian’s prepared remarks on the Q2 earnings call, detailing the company’s cloud progress and how its strategy is being received by customers:

NetApp is uniquely positioned to solve organizations’ most significant challenges in both modern and traditional applications, on-premises, and in hybrid, multi-cloud environments. As I’ve said many times, our Public Cloud services not only allow us to participate in the rapidly growing cloud market, but they also make us a more strategic data center partner to our enterprise customers, driving share gains in our Hybrid Cloud business. We are seeing this play out in the strong results from both our Public Cloud and Hybrid Cloud segments […]

During Q2, we advanced our cloud agenda significantly, and we remain confident in our ability to achieve our goal of reaching $1 billion ARR in fiscal year ’25, with a gross margin profile that is accretive to the corporate average. In Q2, Amazon Web Services, AWS, announced the general availability of Amazon FSx for NetApp ONTAP, a native, fully managed AWS storage service powered by ONTAP.”

Management also noted that Q2 represented the fifteenth straight quarter of deferred revenue growth, which is a forward-looking indicator of continued recurring revenue growth as the company succeeds in billing customers for multi-quarter, multi-year deals.

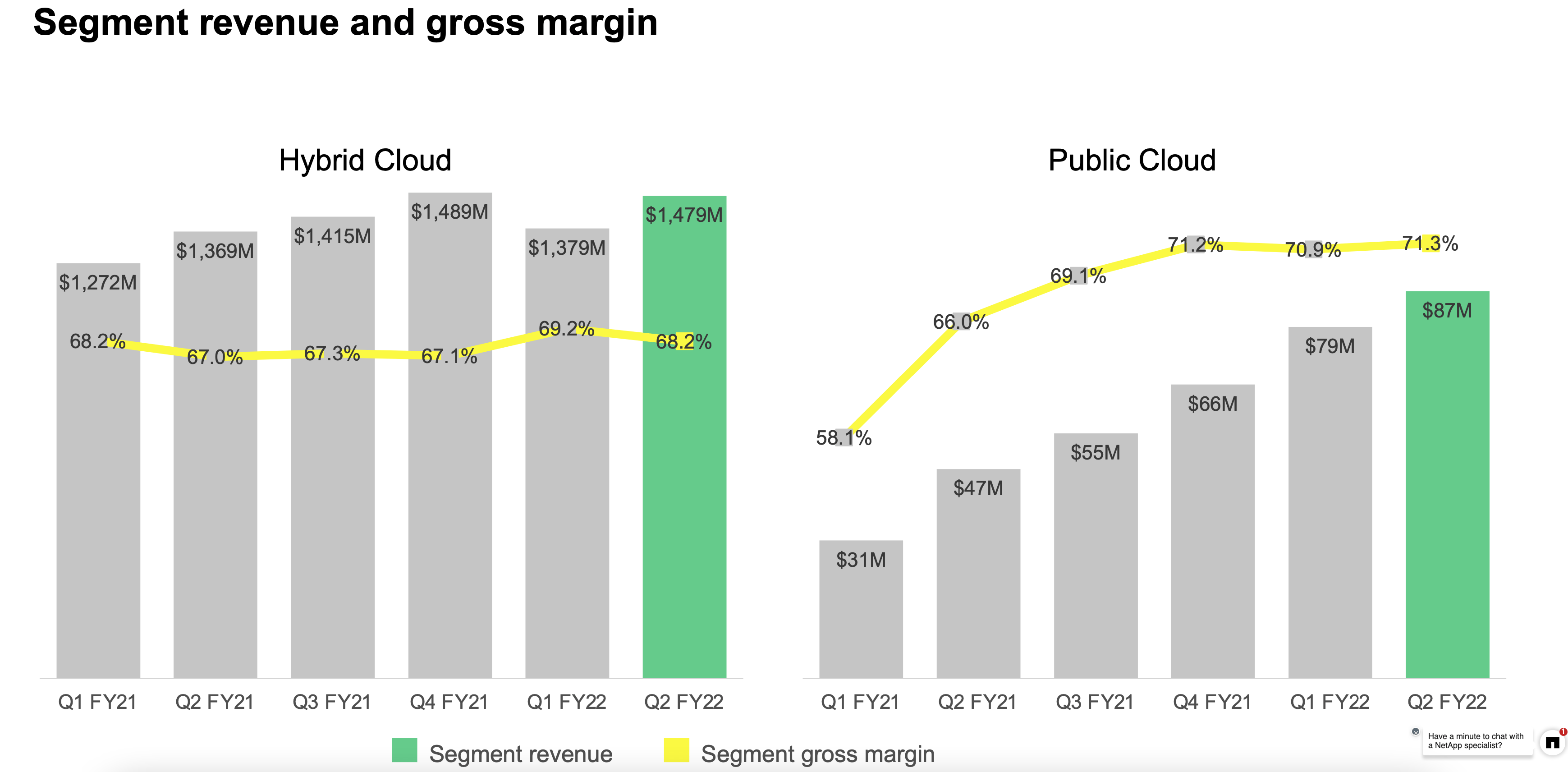

Profitability also shone for NetApp in the quarter. As can be seen below, both hybrid cloud and public cloud products saw gross margin gains in the second quarter, pulling overall company gross margins up by 140bps to 68.3%:

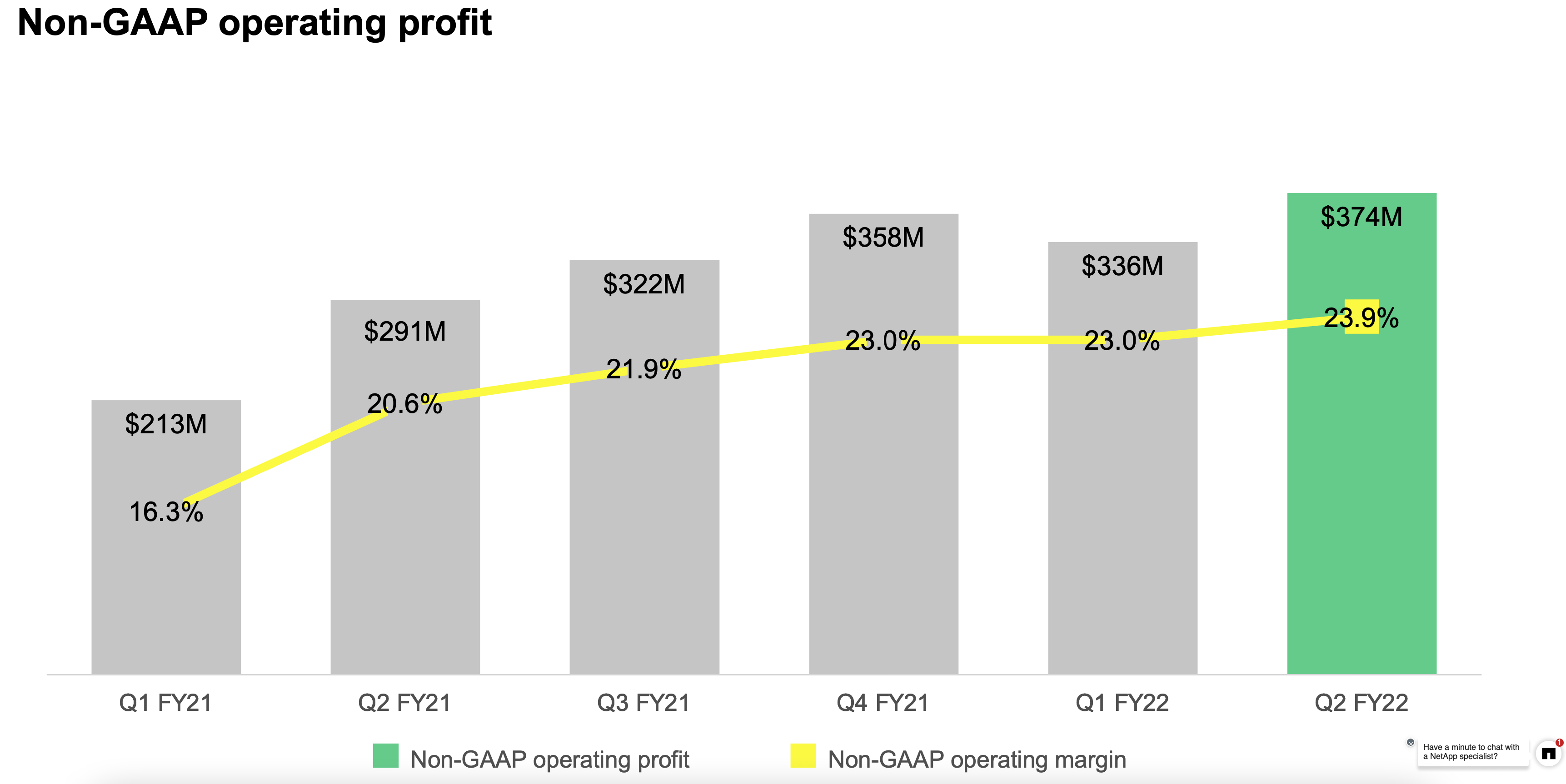

Alongside low-teens revenue growth, this has allowed NetApp to grow its pro forma operating income by 29% y/y to $374 million, representing a rich 23.9% pro forma operating margin – 330bps better than the year-ago quarter.

In turn, the company’s pro forma EPS also grew 22% y/y to $1.28, beating Wall Street’s expectations of $1.21 with 6% upside. Seeking Alpha

You must be logged in to post a comment Login