Company News

Applied Materials: Supplying key hardware to a core industry

Semiconductor demand is rising at a strong clip while the industry is also being promoted from a policy perspective. (NASDAQ:AMAT) supplies the manufacturing hardware to this industry. The company not only has a large order backlog but strong fundamentals and a good chart.

Applied Materials, “provides manufacturing equipment, services and software to the semiconductor, display and related industries.” (from the company’s 10-K). According to Finviz.com, the company is the second largest in the semiconductor equipment segment.

The company has three segments:

Applied’s Semiconductor Systems segment develops, manufactures and sells a wide range of manufacturing equipment used to fabricate semiconductor chips, also referred to as integrated circuits (ICS).

The Applied Global Services® (AGS) segment provides integrated solutions to optimize equipment and fab performance and productivity, including spares, upgrades, services, remanufactured earlier generation equipment and factory automation software for semiconductor, display and other products.

The Applied Global Services® (AGS) segment provides integrated solutions to optimize equipment and fab performance and productivity, including spares, upgrades, services, remanufactured earlier generation equipment and factory automation software for semiconductor, display and other products.

There is currently a global chip shortage. The Semiconductor Industry Association explains why it takes some time for supply to meet demand:

To meet increased demand during the current global chip shortage, the semiconductor industry is substantially increasing its fab capacity utilization, a term that refers to the percentage of total available manufacturing capacity that is being used at any given time. Increasing semiconductor capacity utilization takes time, however. It is not as easy as “flipping a switch” and increasing chip output overnight.

When market demand runs high, such as in a cyclical market upturn like the one the market is in now, front-end semiconductor fabrication facilities, or fabs, will typically run above 80 percent capacity utilization, with some individual fabs running as high as between 90-100 percent. As the table below shows, the industry has been steadily increasing overall fab utilization over the past two years and is estimated to increase utilization even more during most of 2021 to meet demand. Higher fab utilization will increase chip output and allow the industry to fully meet the increased demand in the market.

As a result, AMAT has a large backlog of orders:

This is also showing up in the company’s income statement:

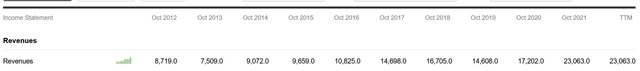

The company’s gross revenue increased sharply in its latest 10-K, rising just under $5 billion. The good financial news doesn’t end there:

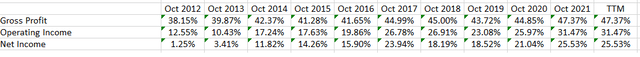

All three of its profit percentages are increasing.

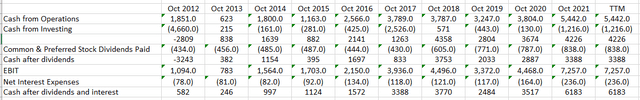

Above is my standard cash flow analysis. The third row shows the difference between cash from operations and cash expended on investments. AMAT has been cash flow positive since 2013, giving the company maximum financing flexibility. The fifth row shows the amount of cash the company has left after paying dividends. This total has been positive since 2013. Finally, the last row shows the remainder after AMAT pays for interest and dividends from EBIT. This number has been positive in each of the last 10 years.

So, we have a strong fundamental economic backdrop and the company is doing well. What do the charts say?

The weekly chart on the left shows that AMAT has been consolidating sideways since last Spring. The stock tried to break higher in November but has fallen back to support levels. The 1-year chart on the right shows the consolidation in detail. Prices are currently at the 200-day EMA for support.

The macro and fundamental environment are strong. The technical picture is a bit more tenuous because prices are right at a key technical indicator, which is occurring in a dicier market environment — the markets are down for the YTD and the Fed is raising rates. Still, it’s hard to see how the company doesn’t wind up doing well this year due to its order backlog, industry shortage, and Congressional highlight on chip makers. AMAT is a buy, but set sell-stops on your positions due to the macro backdrop. Seeking Alpha

You must be logged in to post a comment Login