International Circuit

Japan looks to revive semiconductor industry

Japan is under great pressure to find solutions to revive its semiconductor industry, as the ongoing chip shortages and high semiconductor supply chain disruption risks remain major challenges for governments around the world.

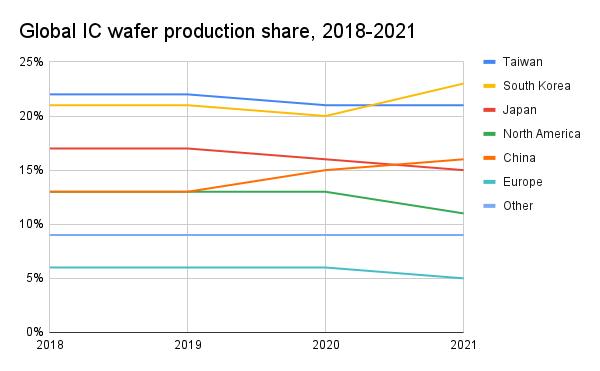

The global market share of Japan-based semiconductor companies has been on the decline in recent years, with the number dropping to below 10% from the 50.3% in 1988. To develop an effective industry revival strategy, the Japanese government and domestic semiconductor players are now reflecting on why Japan’s semiconductor industry has been losing ground to foreign competitors in the global marketplace.

Five causes of Japan’s “Lost Decades”

According to Nikkei and Mynavi, the Ministry of Economy, Trade and Industry (METI) of Japan has mentioned potential strategies to revive the country’s semiconductor industry in its “Strategy for Semiconductors and the Digital Industry” released in June last year.

The ministry has narrowed the causes of Japan’s “Lost Decades” down to five.

- To minimize trade conflicts with the US, Japan signed a semiconductor agreement with Washington in 1986. The agreement included several restrictions on Japan’s semiconductor industry and consequently led to Japan losing its dominance in the global market. As Japan’s share in the semiconductor market decreased, Intel’s share rose and it became the company with the highest revenue in the industry.

- The manufacturing and design of logic semiconductors have shifted from vertical division of labor to horizontal integration, and Japan-based chipmakers are having difficulty keeping up with the trend. Renesas did not complete the integration of the MCU and LSI semiconductor businesses of Hitachi, Mitsubishi Electric, and NEC until 2010.

- Japan’s digital market has been performing poorly and failed to serve as a cultivation base for the semiconductor industry. As a result of Japanese businesses’ limited investment in digitalization, there is a lack of clients for semiconductor companies. The delayed development of IC design forces companies to import advanced semiconductors from overseas.

- The pursuit of self-sufficiency after the 1990s has prevented Japan from connecting to global innovative ecosystems. Although the country began launching public-private semiconductor R&D partnership projects in 2001, the results of the projects have been limited.

- Japanese companies have invested less in semiconductors than those in South Korea, Taiwan, and China. Since the Japanese economy suffered a recession in the 1990s, businesses have been reluctant to invest in the country’s semiconductor industry.

Japan’s three-phase strategy to revive semiconductor industry

In response to the US-China trade war, governments around the world began pushing for semiconductor localization. Japan’s METI has also come up with a three-phase strategy to revive the country’s semiconductor industry over the next 10 years.

Strengthen semiconductor production infrastructure for IoT devices

Japan must ensure a stable supply of advanced semiconductors such as logic ICs and memory chips for economic security reasons. To accomplish this, the government will need to attract foreign chipmakers to establish plants in Japan and boost domestic semiconductor production through incentives and subsidies.

METI is no longer insisting on Japan producing its own semiconductors. In fact, the ministry had planned to attract foreign chipmakers to set up advanced wafer factories in Japan even before chip shortages worsened in 2019.

Media reports in Japan suggested that the Japanese government had considered attracting TSMC, Intel, and Samsung Electronics to Japan. However, after Japan imposed tighter controls on exports of semiconductor materials to South Korea in 2019, Samsung is no longer a candidate. Eventually, TSMC agreed to set up a wafer fab in Kumamoto prefecture, with investments from Sony and Denso.

Develop next-generation semiconductor technologies with the US

Japan’s National Institute of Advanced Industrial Science and Technology (AIST) has initiated an R&D alliance to develop 2nm and below manufacturing processes. Intel and IBM are among the investors of the alliance, and the R&D results should be available around 2025. METI’s future semiconductor R&D projects will also involve collaboration between Japanese and foreign companies.

Plan for larger-scale international collaborations, enhance future semiconductor technologies

Japan will move towards photoelectric fusion technologies with higher accuracy and computing efficiency. The technologies could transform the semiconductor industry after 2030 and bring about a new round of national R&D projects.

TSMC’s JASM shifting to 16/12nm

METI’s three-phase semiconductor industry revival strategy has yielded some results.

JASM, TSMC’s subsidiary in Kumamoto, originally planned to bring 28/22nm processes to Japan. However, after Sony and Denso invested in JASM, the company announced in February 2022 that it will now produce 16/12nm processes in the country instead.

Akira Amari, a member of the Liberal Democratic Party who heads its policy group on semiconductors, pointed out that the Taiwanese government will try to keep its most advanced semiconductor technologies in Taiwan. Therefore, Japan must form an international alliance to develop 2nm and below advanced processes, he said.

Amari expressed hope that the Japanese government and businesses will invest a combined JPY 7-10 trillion (US$60.5-86.5 billion) to help the country improve its semiconductor production capacity and related technologies over the next 10 years. He suggested that the country should revive its semiconductor industry through decade-long projects, which are aligned with the revival strategies conceived by METI. DigiTimes

You must be logged in to post a comment Login