Headlines of the Day

Is Bharti Airtel Limited popular amongst institutions?

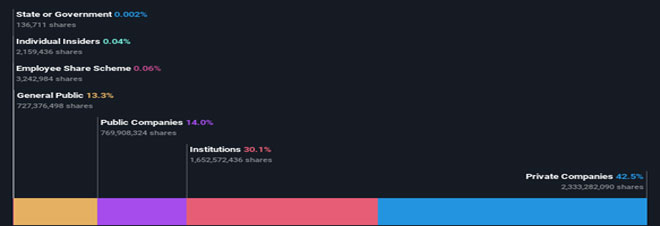

If you want to know who really controls Bharti Airtel Limited, then you’ll have to look at the makeup of its share registry. Large companies usually have institutions as shareholders, and we usually see insiders owning shares in smaller companies. Companies that have been privatized tend to have low insider ownership.

With a market capitalization of ₹3.3t, Bharti Airtel is rather large. We’d expect to see institutional investors on the register. Companies of this size are usually well known to retail investors, too. Taking a look at our data on the ownership groups (below), it seems that institutional investors have bought into the company. Let’s delve deeper into each type of owner, to discover more about Bharti Airtel.

View our latest analysis for Bharti Airtel

What does the institutional ownership tell us about Bharti Airtel?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

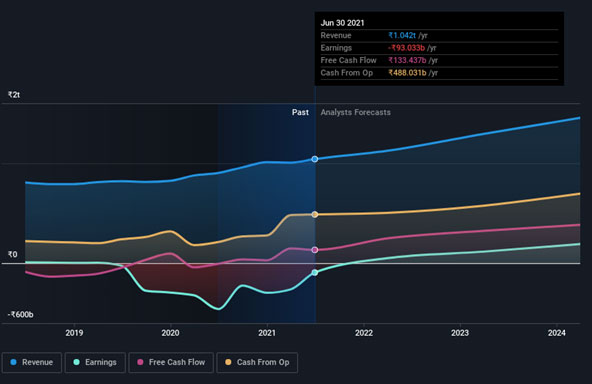

Bharti Airtel already has institutions on the share registry. Indeed, they own a respectable stake in the company. This suggests some credibility amongst professional investors. But we can’t rely on that fact alone since institutions make bad investments sometimes, just like everyone does. It is not uncommon to see a big share price drop if two large institutional investors try to sell out of a stock at the same time. So it is worth checking the past earnings trajectory of Bharti Airtel, (below). Of course, keep in mind that there are other factors to consider, too.

Hedge funds don’t have many shares in Bharti Airtel. The company’s largest shareholder is Bharti Enterprises Limited, with ownership of 42%. Meanwhile, the second and third largest shareholders, hold 14% and 4.3%, of the shares outstanding, respectively.

A more detailed study of the shareholder registry showed us that 2 of the top shareholders have a considerable amount of ownership in the company, via their 56% stake.

Researching institutional ownership is a good way to gauge and filter a stock’s expected performance. The same can be achieved by studying analyst sentiments. There are plenty of analysts covering the stock, so it might be worth seeing what they are forecasting, too.

Insider ownership of Bharti Airtel

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. The company management answer to the board and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

Our most recent data indicates that insiders own less than 1% of Bharti Airtel Limited. But they may have an indirect interest through a corporate structure that we haven’t picked up on. It is a very large company, so it would be surprising to see insiders own a large proportion of the company. Though their holding amounts to less than 1%, we can see that board members collectively own ₹1.3b worth of shares (at current prices). It is good to see board members owning shares, but it might be worth checking if those insiders have been buying. Simply Wall St News

You must be logged in to post a comment Login