Headlines of the Day

India’s subscriber additions -Growth momentum continues

The Telecom Regulatory Authority of India (TRAI) has released the subscriber data for Feb’24. The key highlights are as follows:

Gross subscriber base showing healthy momentum:

- The industry’s gross subscriber addition was healthy at 3.9m MoM (vs. +2.2m in Jan’24), taking the total base to 1,165m. The additions were led by RJio and Bharti, which added 3.6m/1.5m subscribers MoM. VIL lost 1.0m subscribers MoM (vs. 1.5m loss in Jan’24).

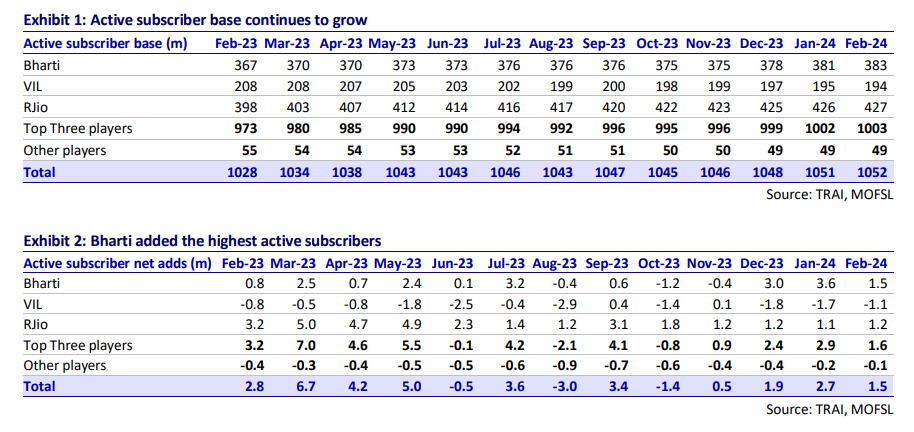

- The active subscriber base grew by 1.5m MoM to 1,052m (vs. +2.7m adds in Jan’24). For the last nine months, growth in the active subscriber base has slowed to an average addition of 1.0m per month. RJio and Bharti continued to gain by 1.2m/1.5m MoM (vs. 1.1m/3.6m in Jan’24). VIL lost 1.1m subscribers (vs. 1.7m in Jan’24).

- The industry’s rural subscriber base grew 1.8m MoM (vs. +1.7m in Jan’24) to 528.5m, led by RJio/Bharti, which added 1.6m/0.6m subs (vs. +1.9m/+0.9m in Jan’24). VIL continued to lose rural subscribers by 0.3m (vs. -0.6m in Jan’24). RJio continued to lead in rural markets with a 39.0% share (+20bp MoM), followed by Bharti at 35.3% (flat MoM) and VIL at 20.7% (-10bp MoM).

- 4G subscriber additions strong: The industry’s 4G subscriber addition was strong at 5.2m MoM (vs. 6.0m in Jan’24 and 6.1m in last nine months), taking the total to 876m (83% of active subscribers). RJio/Bharti added 3.6m/2.3m and VIL lost 0.2m MoM.

- Mobile number portability (MNP): Total requests for MNP have been consistently increasing, validated by a higher churn and SIM consolidation. The number of MNP requests in Feb’24 stood at 11.5m (vs. 12.4m in Jan’24), representing 1.2% of the total active subscribers.

- Bharti added 1.5m both gross/active subscribers (vs. +0.8m/3.6m in Jan’24). Its active market share increased 10bp MoM to 36.4%. The company’s 4G subscriber additions remained strong at 2.3m (vs. +2.4m in Jan’24), taking its total 4G subscriber base to 262m (68% of active subscribers).

- RJio maintained its peak position, with gross/active subscriber additions of 3.6m/1.2m MoM (vs. 4.2m/1.1m in Jan’24). Its active market share inched up by 10bp to 40.6% (highest in the industry). 4G subscriber additions stood at 3.6m MoM (vs. +4.2m in Jan’24) to reach 468m.

- VIL continued to lose subscribers, with a 1.0m/1.1m MoM decline in gross/ active subscribers (vs. -1.5m/-1.7m in Jan’24). Its active market share declined to 18.4% (-20bp MoM). Its 4G subscriber base fell 0.2m MoM (vs. -0.5m in Jan’24) to 127m (65% of active subscribers).

- Wired broadband subscribers for the industry increased 0.6m MoM to 39.5m (vs +0.5m in Jan’24), led by RJio/Bharti, which added 290k/110k subscribers MoM (vs. 250k/110k in Jan’24). BSNL’s net subscribers increased by 80k MoM (vs. 60k in Jan’24).

For report, https://www.communicationstoday.co.in/wp-content/uploads/2024/04/Telecom-Report_MOSL.pdf

CT Bureau

You must be logged in to post a comment Login