Headlines of the Day

Indian IT amid a strong hiring boom

Jefferies sees a “strong hiring boom” on account of the post-pandemic rush for the outsourcing of IT jobs to India, local traditional businesses laying more emphasis on digital strategy and growth of e-commerce and startups.

That, the research firm said, is leading to sharp wage hikes after a long gap.

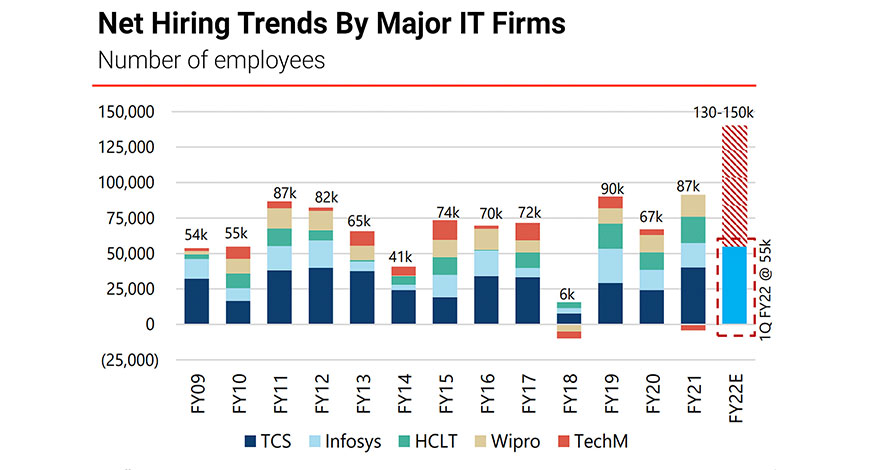

The top five IT companies, representing about 30% of the 44 lakh employed in Indian IT and BPO industry, hired 55,000 in the first quarter of the ongoing fiscal.

They could end the year with 1.3-1.5 lakh net hires, nearly 50% higher than the best year in the last decade, Jefferies said in its Trespassers Will Be Recruited report, co-authored by equity analysts Mahesh Nandurkar and Abhinav Sinha.

Besides, the internet, e-commerce, startup boom is maturing, and is absorbing significant talent.

More than 20 startups have reached unicorn valuations so far this year, large internet initial public offers are underway and around $12-billion (Rs 90,000 crore) venture capital have been raised in the first half of the year, higher than 2020, Jefferies said.

“As startups acquire sale and large corporate houses also enter fray, anecdotal evidence of a fight for talent, including large joining bonuses, gifts, attractive ESOPs and salaries are rising,” it said.

“Several tech skills are also reportedly seeing sharp salary hikes. This is also in attempts to limit rising attrition.”

Further, the broader organised sector employment trend, too, is encouraging.

“Organised employment held well through FY21. Our analysis of employment data suggests that organised employment as tracked through pension fund payrolls (net 77 lakh additions), listed company employees (up 2% year-on-year) etc. proved resilient in FY21,” Jefferies said.

Faster job growth and salary hikes, according to the research firm, could help in urban sentiment recovery.

“Urban indicators are now recovering faster than the broader index. We see this as a positive for urban consumption such as passenger vehicles, high-end two-wheelers, restaurants and the property sector,” it said.

“Unorganised sector jobs will be a function of construction sector revival and we remain hopeful as India is at the cusp of a multi-year housing upcycle.”

Based on that, Jefferies has raised its stance on consumer discretionary stocks to ‘neutral’ and added Eicher Motors Ltd. to its model portfolio with a two-percentage-point weight.

That was funded by slashing one percentage point each from Tata Steel Ltd. and Concor Ltd.

“We still remain ‘overweight’ on the latter two though to a lesser degree now. Eicher has underperformed Nifty by 4.8% and 16.3% in the last month and year-to-date, respectively. We do not expect any material negative business impact from the CEO resigning recently,” Jefferies said. BloombergQuint

You must be logged in to post a comment Login