Trends

India PC market promising sequential growth in Q2 2023

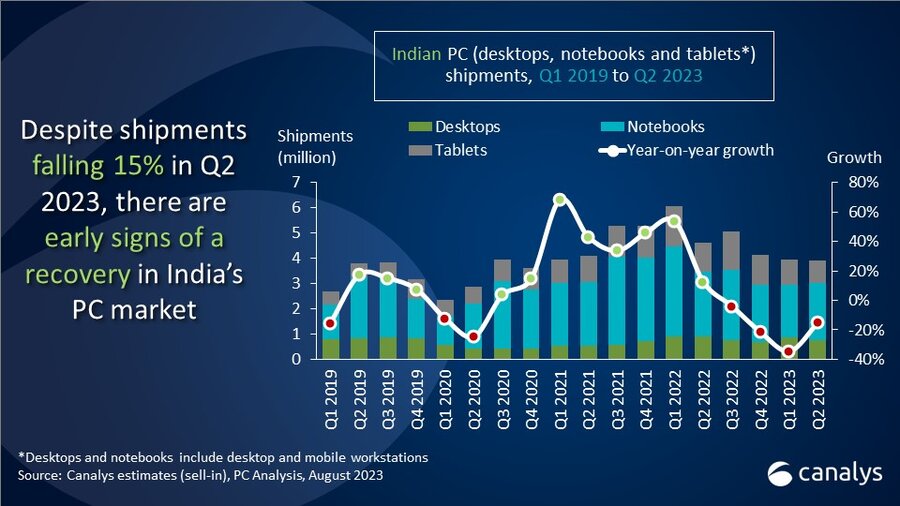

According to Canalys’ most recent data, vendors shipped 3.9 million PCs (desktops, notebooks and tablets) in India in Q2 2023, representing a 15% year-on-year decline. Notebook shipments fell 12% to 2.3 million units, while desktops dropped 17% to 764,000 units. Tablet shipments suffered the largest decline, down 22% to 873,000 units. But the PC market (excluding tablets) saw a promising 2% sequential growth, reigniting optimism within the industry.

In Q2 2023, all segment categories in India’s PC market underwent a year-on-year decline. “The education sector suffered a notable 23% drop, mainly due to delayed tablet deployments,” said Canalys Analyst Ashweej Aithal. “Nevertheless, new government initiatives to provide students with notebooks made some progress in states such as Gujarat, Tamil Nadu and Madhya Pradesh.” Despite improved economic sentiment, the commercial sector experienced a substantial decline, driven largely by SMBs. The public sector also saw a 9% decrease, but a few promising deals hint at potential growth by the end of 2023. “The anticipated closure of education tenders is in its final phase, with most deployments expected in October and spanning the next six months,” said Aithal. Though the consumer market declined by 13% year on year, it achieved 7% sequential growth, indicating positive signs of recovery as the festive season approaches.

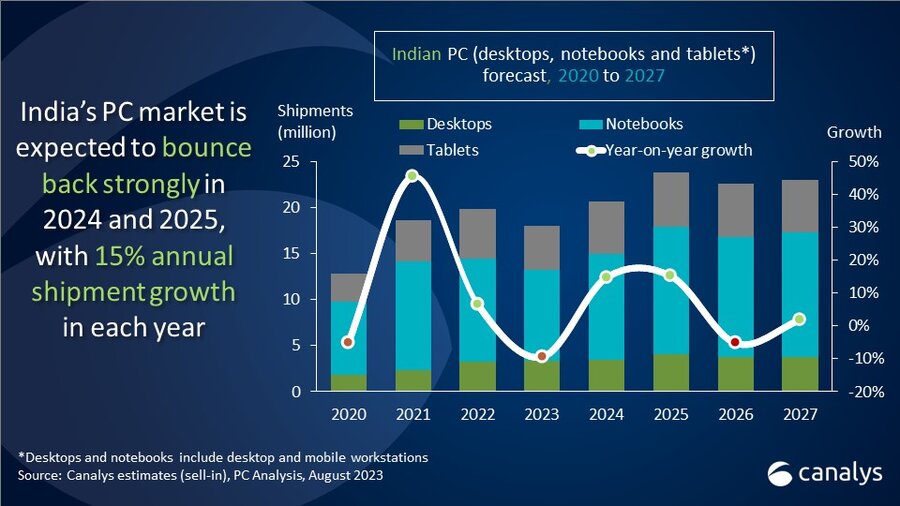

Canalys’ latest forecast for the Indian PC (including tablets) market predicts that shipments will fall by 9% in 2023. But there is optimism for a bounce back in 2024 and 2025, with shipments in both years expected to grow robustly by 15% year on year. This growth is expected to be widespread across all categories and end-user segments. The fundamentals around PC use and adoption in India remain strong and Canalys expects the shipment peak achieved in 2022 to be surpassed.

“The Indian government’s recent imposition of import restrictions on desktops, notebooks and tablets is set to disrupt the market, particularly affecting major foreign vendors that have yet to initiate local manufacturing,” said Aithal. “This disruption is anticipated to intensify toward the end of 2023, with restrictions slated to commence in November. Consequently, vendors are set to aggressively push inventory in both the consumer and commercial segments. In response to the impending scarcity of devices, there may also be an uptick in rapid deal closures. Vendors could face the need for additional import licenses, but the government is expediting the licensing process to mitigate price surges caused by the anticipated scarcity.

|

Indian PC (including tablets) shipments (market share and annual growth) Canalys PC Market Pulse: Q2 2023 |

|||||

|

Vendor |

Q2 2023 |

Q2 2023 |

Q2 2022 |

Q2 2022 |

Annual |

|

HP |

987 |

25.3% |

1,152 |

25.0% |

-14.4% |

|

Lenovo |

643 |

16.5% |

973 |

21.1% |

-33.9% |

|

Dell |

409 |

10.5% |

529 |

11.5% |

-22.6% |

|

Acer |

393 |

10.1% |

518 |

11.3% |

-24.1% |

|

Apple |

319 |

8.2% |

168 |

3.7% |

89.5% |

|

Others |

1,146 |

29.4% |

1,262 |

27.4% |

-9.2% |

|

Total |

3,896 |

100.0% |

4,601 |

100.0% |

-15.3% |

| Indian desktop and notebook shipments (market share and annual growth)

Canalys PC Market Pulse: Q2 2023 |

|||||

| Vendor | Q2 2023 shipments |

Q2 2023 market share |

Q2 2022 shipments |

Q2 2022 market share |

Annual growth |

| HP | 987 | 32.6% | 1,152 | 33.1% | -14.3% |

| Lenovo | 512 | 16.9% | 732 | 21.0% | -30.1% |

| Dell | 408 | 13.5% | 528 | 15.2% | -22.8% |

| Acer | 366 | 12.1% | 333 | 9.6% | 10.0% |

| Asus | 225 | 7.5% | 226 | 6.5% | -0.3% |

| Others | 525 | 17.4% | 508 | 14.6% | 3.3% |

| Total | 3,023 | 100.0% | 3,480 | 100.0% | -13.1% |

|

Indian tablet shipments (market share and annual growth) Canalys PC market pulse: Q2 2023 |

|||||

|

Vendor |

Q2 2023 |

Q2 2023 |

Q2 2022 |

Q2 2022 |

Annual |

|

Samsung |

246 |

28.2% |

267 |

23.8% |

-8.0% |

|

Apple |

152 |

17.4% |

114 |

10.2% |

33.0% |

|

Lenovo |

131 |

15.0% |

240 |

21.4% |

-45.7% |

|

realme |

68 |

7.8% |

– |

– |

– |

|

Lava |

65 |

7.5% |

160 |

14.3% |

-59.3% |

|

Others |

212 |

24.3% |

339 |

30.3% |

-37.6% |

|

Total |

873 |

100.0% |

1,121 |

100.0% |

-22.1% |

Canalys

You must be logged in to post a comment Login