Headlines of the Day

India has highest tariffs on electronics’ inputs amongst competing economies, ICEA

ICEA, India’s leading electronics industry association, has conducted a 5-nation study of input tariffs in electronics sector across India, China, Vietnam, Thailand and Mexico covering 120 key components. The Study shows that high tariff induced costs accentuates India’s cost disability vis-à-vis the four competing economies. The Study is critical to evaluate India’s competitiveness to reach the $300 bn electronics production goal by 2025-26 – including $120 bn of exports.

Key highlights:

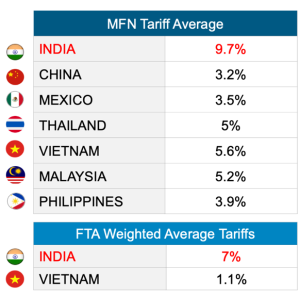

- A line-by-line comparison of India’s non-zero tariffs shows that India’s tariffs are higher for up to 98% lines compared to Vietnam (for FTA tariffs) and 90% of the lines compared to Thailand.

- The competing economies have approximately double or more zero tariff lines than India. India’s MFN tariff average is 9.7%, compared to averages from 3.2% in China.

- Over 80% of Vietnam’s imports for 120 tariff lines are under free trade agreements (FTAs). The average tariff in Vietnam (considering their FTA imports) is much lower – close to 1%.

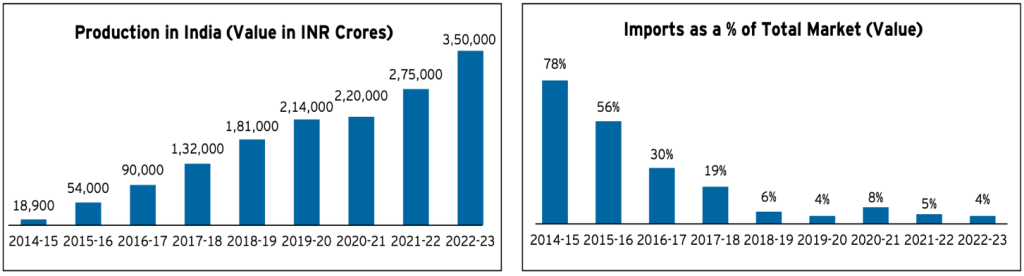

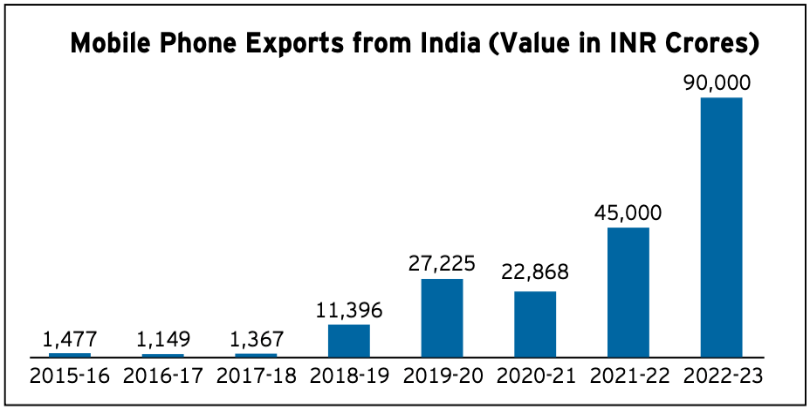

The Study also shows that instead of building a domestic ecosystem, high import duties perpetuate imports as it results in uncompetitiveness of the domestic ecosystem. Tariffs act in the reverse direction to their intended purpose by adversely impacting costs, growing domestic production and exports. High tariffs only work in an import substitution phase, not when a sector like electronics has entered the phase of export-led growth. India’s mobile phone exports increased nearly 100% to $11.1 billion, and electronics exports by ~56% to $23.6 billion by March 2023.

The Study shows that between 2015 and 2021, while India’s electronics tariffs have risen in general, those of the competing economies have decreased. In 2022, for smartphone components, the import duty on lens glass of cameras was reduced from 2.75% to zero in India, while others remained unchanged and generally higher than competing economies.

India and Mexico have trade deficits, while China, Thailand and Vietnam have moved to an overall trade surplus. Despite lower tariffs in 2022 and while tariffs continually decreased during 2015 to 2021, each of the four competing economies performed better than India in exports, trade deficit and surplus for electronics.

Comparing 120 Tariff Lines in Mobile Manufacturing: 8 Digit HS Code

Given these findings and its adverse impact on India’s competitiveness, the industry has requested the Department of Revenue to consider:

1. Increase competitiveness by reducing tariffs on inputs for mobile manufacturing: The current tariffs have outlived their utility. Mobile Phone sector has transformed as a 78% import-dependent sector in 2014 to complete Atmanirbharta (99.2% of phones sold in India are made in India) by 2021, to export led-growth – INR 90,000 crores of exports by March 2023.

2. Glidepath for input tariffs to match Vietnam/China: A glidepath to match input tariffs being offered by Vietnam/China over the next two years. This will also help prepare the domestic industry in the eventuality that the final decision in the WTO case on the ITA-1 matter is unfavourable.

3. Rationalization of Tariff Tiers: Currently, India, amongst the 4 competing economies, has the most complicated tariff regimes with six tiers/slabs – 0%, 2.5%, 5%, 10%, 15% and 20%, plus surcharges. Apart from being excessive, this leads to classification misinterpretation, and in turn, disputes between importers and customs authorities. Industry seeks a reduction in the number of tiers/slabs from six to three – 0%, 5% and 10%. This will considerably reduce arbitrage, misinterpretation and consequent disputes.

4. A joint Finance-MeitY structure to address tariff classification and resolve interpretation related issues: In case of an interpretation dispute, industry recommends that a structure consisting of Customs and MeitY (nodal Ministry for electronics) may jointly look at such cases to ensure proper technical classification under respective codes, based on established principles.

Mobile Phone Production, Imports and Exports 2014-2023

CT Bureau

You must be logged in to post a comment Login