5G

Day 4 5G Auction – The action is only in UP-East

UP East has become a bone of contention in the 5G spectrum auction being held. As the stakes are high, the three telcos are bidding to preserve their leverage in this crucial market. Most likely each bidding 5MHz. The bidding is expected to continue for many more rounds, and bid price continue to rise till someone withdraws.

In all the other circles the bids have been closed.

Status UP-East

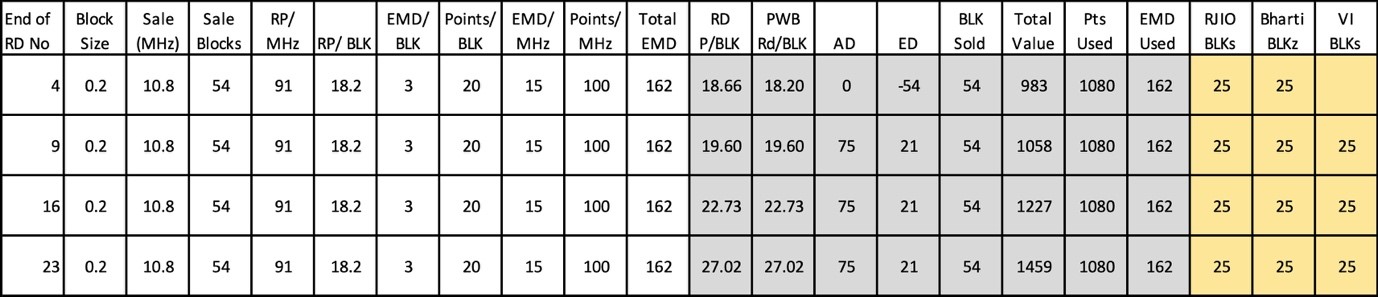

Excess Demand is the same i.e 21 blocks, which means no one is relenting. The valuation has increased from Rs 169 crore to Rs 232 crore. Hence the total outflow is Rs 149623 crore (Day 3 value) plus Rs 232 crore, Rs 149855 crore

Importance of UP-East

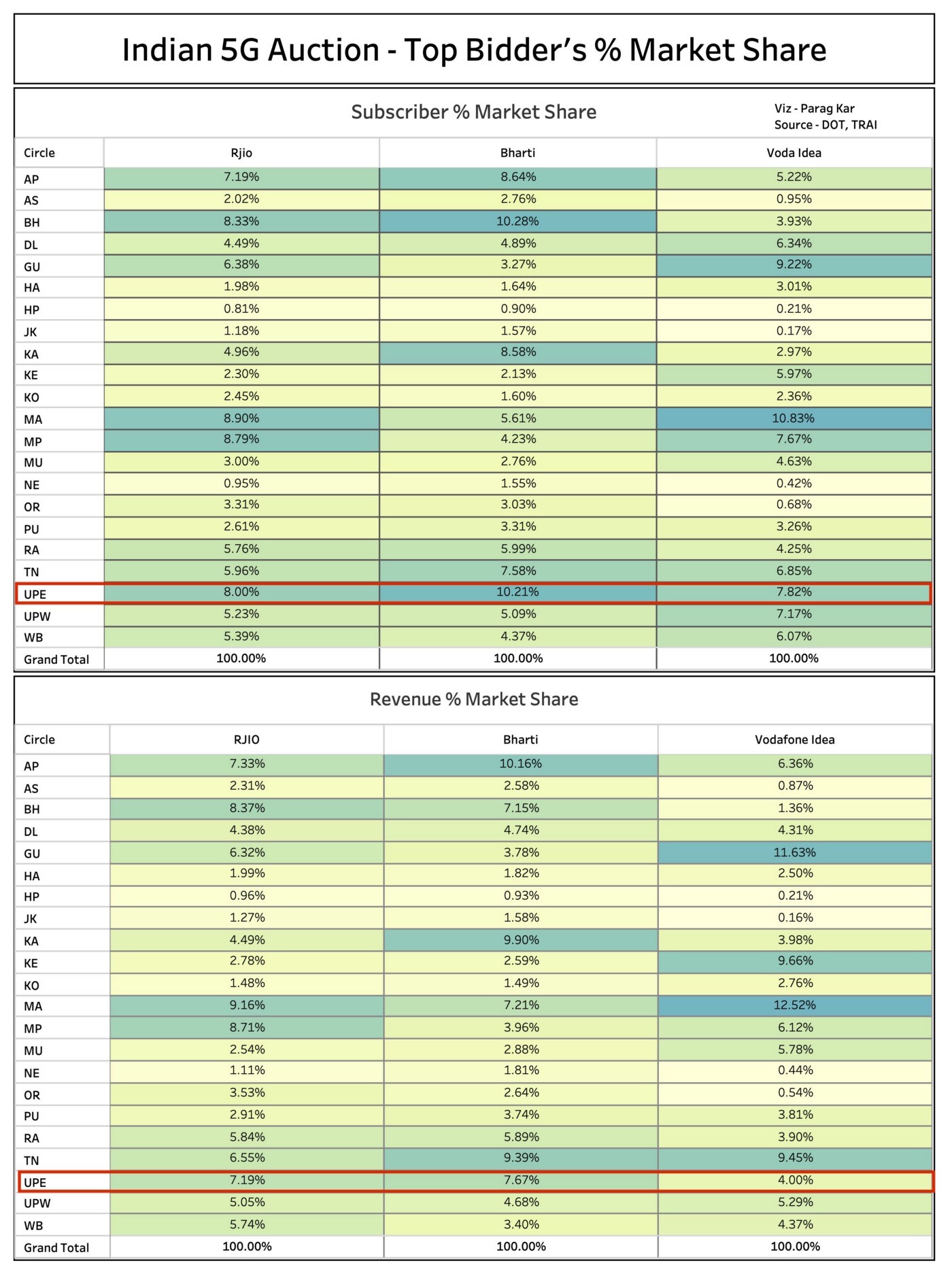

The importance of UP-East can be evaluated by looking at the operator’s % market share on two fronts- a) Subscribers; b) Revenue. The following table captures these two matrices.

A) Subscriber & Revenue % Distribution

Operator’s Subscriber & Revenue % Share-Compiled by Parag Kar, Vice President, Government Affairs, India and South Asia at Qualcomm

UP-East is important for all three bidders. For Airtel, UP-East’s subscriber share of its overall tally stands 2nd just after Bihar. For RJio, the situation is almost similar. For Vi also UP-East is an important circle. The same story repeats if we look at the revenue market share distribution of all the three bidders.

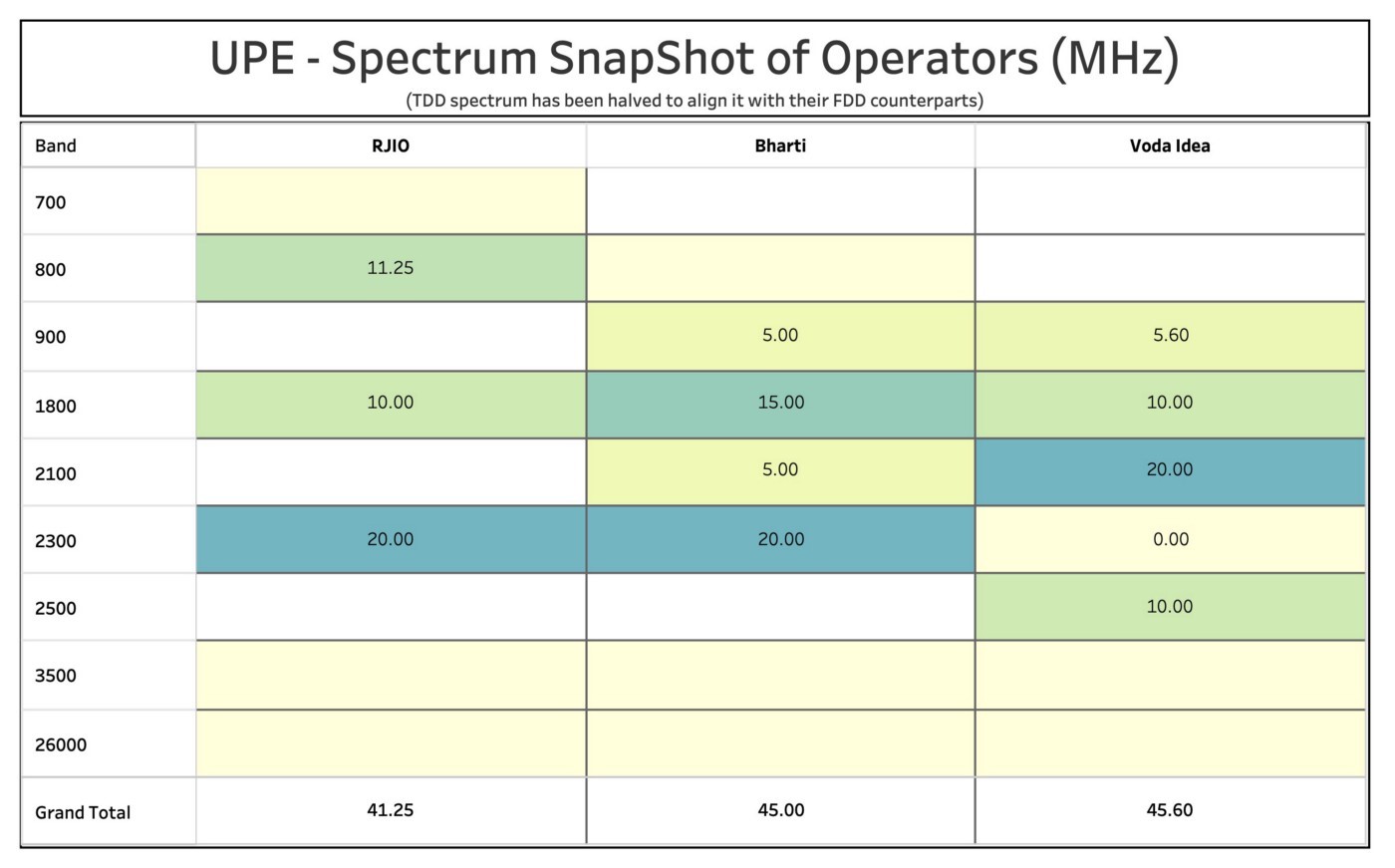

B) Spectrum Holdings

The existing spectrum holdings of the bidders in this circle.

Figure 3 — UP-East :Existing Spectrum Holdings (Liberalized)

The above picture tells us that liberalized spectrum holding in UP-East is almost similar for all the three bidders. But in the 1800 MHz band, Airtel has an edge with 15 MHz of spectrum followed by both RJio and VI with 10 MHz each. Note in 900 MHz Airtel and VI have 5 MHz & 5.6 MHz of liberalized spectrum. Airtel additionally has 6.2 MHz in 900 MHz of the un-liberalized spectrum which is expiring in 2024.

Also, in this auction 900 MHz has zero spectrum for sale in UP-East. This puts Airtel in a precarious situation. It might want to make up the 1800 MHz band by grabbing additional 5 MHz of the spectrum more than it already has (which is 15 MHz). That is why Airtel might be bidding 5 MHz in the 1800 MHz band in order to preserve its leverage in the market.

The 1800 MHz band is also important for RJio. If Airtel gets 5 MHz then its overall tally in the FDD band (900, 1800, 2100 MHz) will become 30 MHz. For RJio will be 25 MHz (800, 1800) and additional 10 MHz in the 700 band — an assumption based on EMD data submitted. Hence, it is clear that RJio’s leverage will decrease (compared to Airtel) in 4G (25 MHz vs 30 MHz of Airtel). Hence, bidding for 5 MHz in the 1800 MHz band is crucial for RJio.

Coincidentally, for Vi also the situation is desperate. It has no means to take additional spectrum in 900 MHz (none is up for sale) and increasing its kitty to 1800 MHz further can help to maintain competitive leverage.

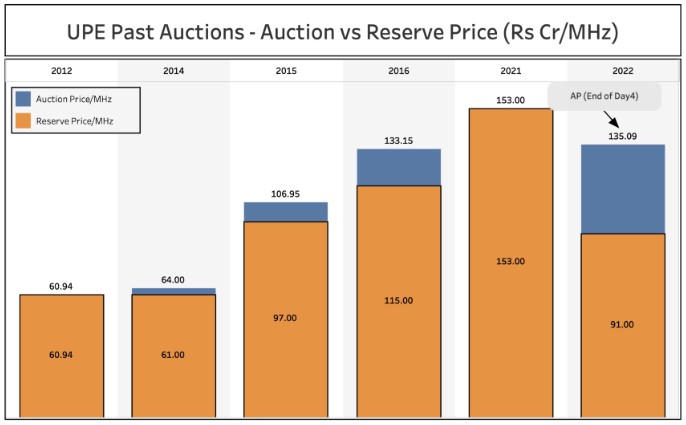

UP-East Past Auctions. Auction vs Reserve Price. This will give an idea of where we stand as per valuation, and why the auction is not ended as the current price (till day 4) is cheaper than what was in the year 2021 (last auction)

The article was first published in Medium, authored by Parag Kar

You must be logged in to post a comment Login