Trends

China’s cloud infrastructure expenditure surges 18%, hits $9.2 billion in Q3 2023

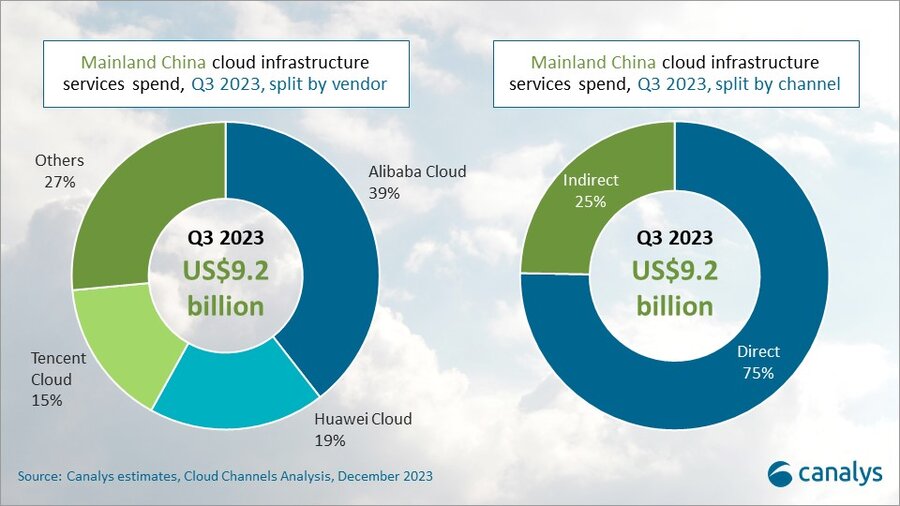

According to Canalys estimates, cloud infrastructure services spend in mainland China grew 18% year on year in Q3 2023, reaching US$9.2 billion and accounting for 12% of global cloud spend. The Chinese cloud services market remains conservative, relying heavily on government and state-owned enterprises to drive growth. Nevertheless, cloud vendors remain relentlessly focused on AI innovation and investments, consistently unveiling new AI products and solutions.

Alibaba Cloud, Huawei Cloud and Tencent Cloud, the top three cloud vendors in Mainland China in Q3 2023, collectively grew 22% to account for a combined 73% share of customer spending. The emphasis on nurturing and prioritizing partner ecosystems is on the rise among Chinese cloud vendors. In Q3 2023, cloud revenue generated via channels in the Chinese market accounted for 25% of total revenue, against 23% in the previous quarter.

The Chinese cloud market may be reaching a phase of stable growth, but the top cloud vendors continue to invest heavily in AI technology, underscoring their collective commitment to embracing this growing trend. Recognizing that the progress of AI technology is intricately tied to the support of partnerships, most vendors are acknowledging the importance of fostering partner ecosystems. The innate complexity of AI technology presents challenges in terms of adoption and deployment, yet simultaneously unlocks opportunities for a broader AI ecosystem. This quarter, Alibaba Cloud and Huawei Cloud introduced AI model development platforms, allowing for the integration of third-party open-source AI models and enabling developers to access and train various models on their respective cloud platforms.

“Achieving widespread deployment of AI technology is a nearly impossible task for vendors without the help of a range of partners. This relies heavily on an AI ecosystem that includes developers, ISVs and experts, which will be vital to deliver value for customers at scale,” said Yi Zhang, Analyst at Canalys. “Partnerships such as the ones between Salesforce and Databricks with cloud hyperscalers, including AWS and Google, indicate that cooperation between cloud vendors and service providers, as well as among different cloud vendors, is a strategic necessity. Combining technical offerings and expertise is vital for seizing market growth opportunities and driving value.”

Alibaba Cloud was the market leader in Q3 2023, with a 39% market share. In its recent earnings report, Alibaba announced the abandonment of its plan to spin off its cloud business unit. Concurrently, Alibaba Cloud is undertaking initiatives to optimize profitability through the reduction of project-based operations with low-margin profiles. Despite experiencing decelerated revenue growth, Alibaba Cloud remains committed to rolling out new AI products. It launched the “Bailian” platform in October 2023, a one-stop AI foundation model development platform. This platform streamlines intricate tasks for users, including model selection, fine-tuning, training and development, by providing access to diverse AI foundational models. In terms of capital investments, Alibaba Cloud announced the official availability of its first data center in the Central China region in September, located in Wuhan.

Huawei Cloud maintained its position as the second largest cloud service provider in Q3 2023, with a 19% market share after it grew by 16% year on year. Huawei Cloud unveiled the AI Gallery platform in September 2023, which integrates various open-source AI foundation models. This platform is open to global enterprises and developers, facilitating the customization of AI model applications. In a strategic move for global business expansion, Huawei Cloud organized the Huawei Connect Conference in Paris in November 2023. The conference aimed to strengthen its partner ecosystem in Europe, as Huawei Cloud revealed a 400% year-on-year increase in the number of Huawei Cloud partners in Europe for 2023. Looking forward, Huawei Cloud hopes to support the growth of 1,000 European startups on the cloud over the next five years.

Tencent Cloud grew 14% in the latest quarter and accounted for a 15% market share. Tencent Cloud’s business performance exceeded expectations, following its decision to shed low-quality, low-value projects. As competitors intensified their focus on building partner ecosystems, Tencent Cloud also announced updates to its partner development in September. It revealed plans to expand the range of cloud services available for channel partners to sell from 80 to over 110 this year, with the aim of eventually granting partners the sales rights for all products. Tencent Cloud is also investing in its channel ecosystem by enhancing support for partners and adding 30% more channel managers and architects to its headcount, to help foster collaborative engagements with its partners. Canalys

You must be logged in to post a comment Login