Headlines of the Day

Active subscribers drop again

The Telecom Regulatory Authority of India’s (TRAI) subscriber data for Jun’20 indicates that active subscriber base of telcos has declined again after the limited recovery witnessed in May’20. It remains to be seen whether the number of subscribers would return to the previous level with the opening up of the economy or it would permanently decline by 3% from the pre COVID-19 level. Key highlights below:

- Gross subscribers shrunk by 3.2m MoM to 1.14b in Jun’20 (v/s 5.6m loss in May’20). Bharti/VIL lost 1.1m/4.8m while RJio added 4.5m subscribers. Further, active subscriber base declined again by 2.8m in Jun’20 after limited recovery of 2.9m in May’20 to reach 958m, thereby, eroding the gains. This was led by 3.7m/2.1m decline in VIL/RJio’s subscriber base, which was partially offset by 3.7m addition by Bharti.

- RJio continued to add gross subscribers at 4.5m (v/s 3.7m adds in May’20) to reach 397m. However, it lost 2.1m active subscribers (after adding 6.2m in May’20 post loss of 7.2m in Apr’20) to reach 310m. RJio continued to maintain its lead in terms of gross subscriber market share (SMS) with share of 34.8% in Jun’20 (v/s 34.3% in May’20). However, it slipped to the second spot after ranking #1 (for the first time in May’20) in active SMS with share of 32.4% (-10bp MoM).

- Bharti lost 1.1m gross subscribers (v/s 4.7m loss in May’20) to reach 317m while it added 3.7m active subscribers (v/s 0.2m/8m loss in May’20/Apr’20) to reach 311m in Jun’20. As a result, Bharti regained the top spot (after losing out in May’20) in terms of active SMS with share of 32.4% (+40bp MoM).

- VIL too continued to see subscriber churn and lost 4.8m/3.7m gross/active subscribers

(after 4.7m/2.8m loss in May’20) to 305m/273m in Jun’20. Subsequently, VIL’s gross/active SMS fell by 40bp/30bp MoM to 26.7%/28.5%.

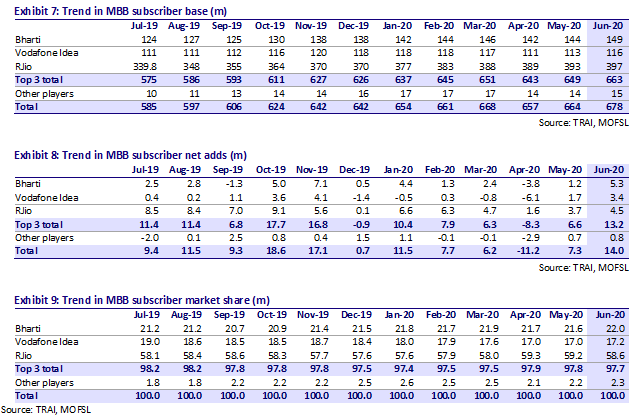

- Industry added healthy 14m MBB subscribers (v/s 7.3m in May’20) to 678m. MBB subscribers now account for 70.8% (+170bp MoM) of active subscribers.

- All players contributed to MBB subscriber addition – Bharti/VIL/RJio (incl. Jiophone) added 5.3m/3.4m/4.5m. Bharti/VIL’s MBB SMS increased by 40bp/20bp MoM to 22%/17.2% while RJio’s MBB SMS dropped by 60bp to 6%.

Limited recovery in active subscriber base in May’20 eroded

The telecom industry lost 3.2m gross subscribers in Jun’20 (v/s 5.6m loss in May’20) to reach a subscriber base of 1.14b. Jun’20 was the fourth consecutive month of decline in gross subscriber base due to the COVID-19 crisis. This was led by 1.1m/4.8m decline in Bharti/VIL’s gross subscriber base (v/s 4.7m for both in May’20) while RJio added 4.5m in Jun’20 (v/s 3.7m adds in May’20).

Furthermore, the industry witnessed 2.8m active subscriber churn in Jun’20 to reach 958m after gaining 2.9m subscribers in May’20. Thus, the benefit of limited recovery that happened in May’20 has eroded. This was led by 3.7m/2.1m decline in VIL/RJio’s subscribers, which was partially offset by 3.7m adds by Bharti.

Bharti regains top spot in active subscriber market

Bharti added 3.7m active subscribers in Jun’20 (v/s 0.2m/8m decline in May’20/Apr’20) to reach 311m. This led Bharti to regain the top spot (after losing it to RJio in May’20) in active SMS with 32.4% share (+40bp MoM). Despite adding healthy active subscribers, Bharti has not reached its pre COVID-19 levels of 315m Bharti’s gross subscriber base declined 1.1m in Jun’20 (v/s 4.7m loss in May’20) to 317m. However, its gross SMS remained flat at 27.8% and it continues to rank #2 in terms of gross SMS.

RJio slips to second spot in active subscriber market

RJio continued to add gross subscribers; it added 4.5m subscribers (v/s 3.7m adds in May’20) to reach 397m in Jun’20. Subsequently, its gross SMS grew 34.8% (+50bp MoM) and it continues to retain the top spot. However, its active subscriber base declined by 2.1m (after addition of 6.2m in May’20 and loss of 7.2m in Apr’20) to reach 310m in Jun’20. As a result, it slipped to the second position in active SMS with 32.4% share after reaching the top spot in May’20 for the first time. Like Bharti, RJio is also yet to reach its pre COVID-19 levels of 314m.

VIL – subscriber loss continues

VIL continued to see subscriber churn and lost 4.8m/3.7m gross/active subscribers (v/s 4.7m/2.8m loss in May’20) to reach 305m/273m in Jun’20. VIL maintained its pace of gross subscriber reduction while the pace of active subscriber reduction increased to 3.7m in Jun’20 from 2.8m in May’20. Its market share has fallen in terms of both gross/active subscribers in Jun’20 by 40bp/30bp to 26.7%/28.5%.

Furthermore, VIL stands at the last spot in terms of both active and gross SMS. We believe VIL’s continuous loss of subscribers is primarily led by its weak network capabilities and speculation around its business continuity, given its massive outstanding AGR dues. However, how its subscriber trend pans out remains to be seen now that the SC has given its verdict on the AGR matter.

Broadband subs data – MBB subscriber adds turn healthy

- Industry MBB subscribers increased by healthy 14m: Industry MBB subscriber addition stood at a healthy 14m in Jun’20 to reach 678m (after witnessing steep decline of 11.2m in Apr’20 and recovery of 7.3m in May’20). MBB subscribers now account for 70.8% (+170bp MoM) of total active subscribers in the market, rising continuously from 59% in Jun’19. The subscriber adds has been led by all players – Bharti/VIL/RJio added 5.3m/3.4m/4.5m

- Bharti – market share inches up 40bp: Bharti added 5.3m MBB subscribers (v/s 1.2m/-3.8m adds in May’20/Apr’20) to reach 149m in Jun’20. Bharti’s SMS expanded by 40bp MoM to 22%.

- RJio – pace of subscriber addition improves: RJio clocked 4.5m MBB subscribers (v/s 3.7m in May’20), taking its total subscriber base to 397m. Despite adding healthy subscribers in Jun’20, its market share shrank by 60bp (after declining 10bp in May’20) to reach 58.6%.

- VIL’s subscriber base sees improvement: After adding 1.7m MBB subscribers in May’20, VIL added 3.4m in Jun’20, taking its total subscriber base to 116m. Its market share inched up by 20bp to reach 17.2% – this is the first time, VIL’s market share has improved since Sep’18.

Motilal Oswal Financial Services

You must be logged in to post a comment Login