5G

5G SA core tracker shows steady growth in commercial deployments

Counterpoint Research’s recently published July update of the 5G SA Core Tracker is a culmination of an extensive study of the 5G SA market. It provides details of all operators with 5G SA cores in commercial operation at the end of H1 2023, including market share by region, vendor, and the popular frequency bands for deployments. Apart from that, it touches upon the potential monetization opportunities for telecom operators across different domains and uses cases.

Last year, there was steady growth in the commercial deployment of 5G Standalone (SA), with more than 20 operators moving to 5G standalone core. However, the pace slowed down in H1 2023 with the number of operators launching commercial 5G SA ranging in single digits. The primary reason for the slowdown in commercial deployment of 5G SA was the restraint arising from global macroeconomic factors and the lack of a clear picture of 5G monetization for operators. Although the pace of commercial deployment has slowed down in 2023, operators are working on monetization avenues, and are working on SA-specific use cases, including on-demand network slicing and FWA.

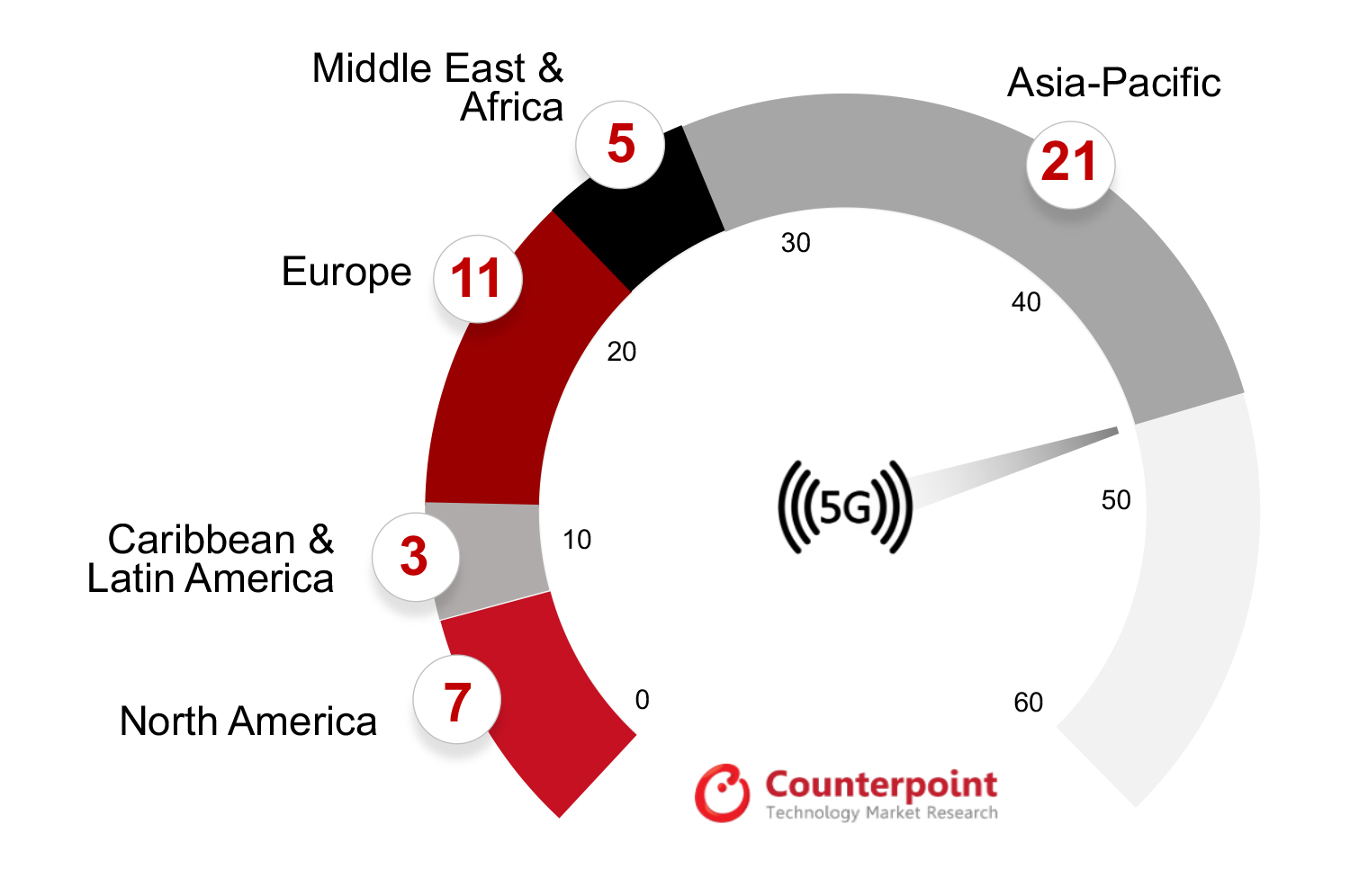

Most of the 5G SA commercial deployments have been in developed economies, and Counterpoint Research expects the next bulk of network rollouts will take place in emerging markets. This will drive the continuing transition from 5G NSA to 5G SA.

Exhibit 1: 5G SA Deployments by Region, H1 2023

Key Points

Key points discussed in the report include:

- Operators – 47 operators have deployed 5G SA commercially with many more in the testing and trial phase. Globally, most of the deployments are in developed economies with those in emerging economies lagging. Although the pace of deployment is steady in developed markets, it is progressing slowly in emerging markets, and in some markets, operators are biding their time and looking for evidence of successful use cases before switching from 5G NSA to SA. The ongoing economic headwinds also delayed the commercial deployment of SA, which was seen in H1 2023.

- Vendors – Ericsson and Nokia lead the 5G SA Core market globally and are benefiting from the geopolitical sanctions on Chinese vendors Huawei and ZTE in some markets. South Korea’s Samsung and Japan’s NEC are mainly focused on their respective domestic markets but are expanding their reach to Tier-2 operators and emerging markets, while emerging vendors Parallel Wireless and Mavenir are working with leading operators in Europe, and Middle East and Africa.

- Spectrum – Most operators are deploying 5G in mid-band frequencies, n78, as it provides faster speeds and good coverage. Some operators have also launched commercial services in the sub-GHz n28 and mmWave wave n258 bands. FWA seems to be the most popular use case at present but there is a lot of interest in edge services and network slicing as well.

- Use Cases – Operators are looking for avenues to monetize the 5G services, as they are struggling to make the RoI from their investments in 5G. Although FWA is a promised application for 5G SA monetization, there are many other use cases that operators can look into to increase their RoI, including network slicing, live broadcasting, XR applications, and private networks. Although eMBB is the most widely used 5G use case currently, MNOs need to move to 5G SA to leverage URLLC and mMTC use cases.

Counterpoint Research

You must be logged in to post a comment Login