Headlines of the Day

Data Centres — Will India take the plunge and seize the opportunity?

A worldwide shortage of available power is inhibiting growth of the global data center market. Sourcing enough power is a top priority of data center operators across North America, Europe, Latin America and Asia-Pacific. Despite new development, vacancy rates are declining in all four regions due to strong demand. Singapore—the world’s most power-constrained data center market—has less than 4 MW of available capacity and a record-low vacancy rate of less than 2%. Certain secondary markets with robust power supplies stand to attract more data center operators.

Statista

Large corporations are finding it increasingly difficult to find enough data center capacity. Low supply, construction delays and power challenges are impacting all markets. The worldwide shortage of available supply is leading to price increases for data center capacity. Singapore has the highest rental rates at $300 to $450 per month for a 250- to 500-kilowatt (kW) requirement, while Chicago has the lowest at $115 to $125.

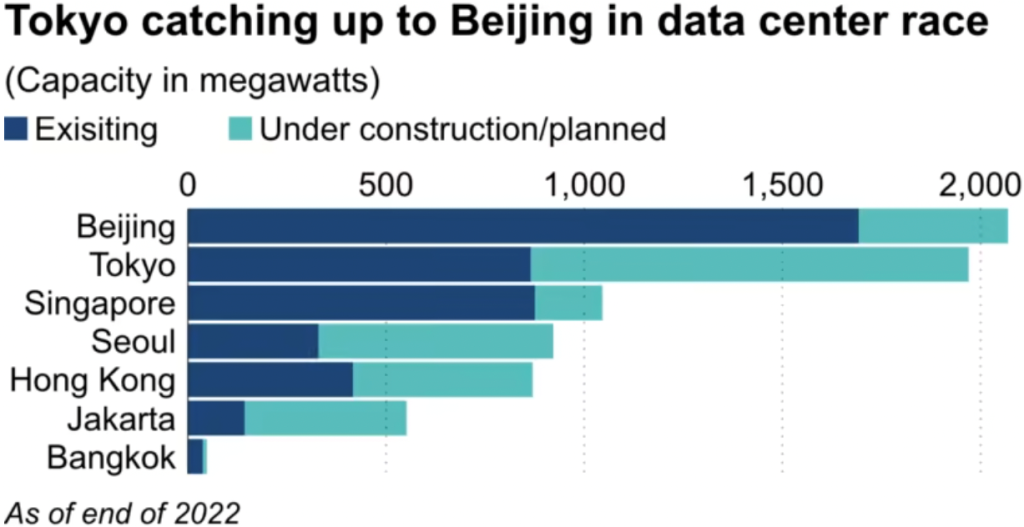

China’s position as Asia’s premier data hub is weakening. Technology companies and other businesses have turned away from Beijing due to growing security concerns and US-China tensions. The sharpening U.S.-China rivalry over trade and other issues is also making many businesses nervous about using data facilities in China.

Meanwhile, many construction projects in Beijing and Shanghai failed because of Covid-19 lockdowns. Cable projects meant to link Hong Kong with North America have also been suspended or revised since 2020.

Other countries are keen to close the gap. For instance, many data centers have sprouted in and around Tokyo, including the Tama district. Inzai, in Chiba prefecture, east of Tokyo, hosts numerous facilities used by IT giants, including Google, Amazon and NEC, all eager to take advantage of its proximity to the capital and the fact that the area is less prone to natural disasters and blackouts. The capacity of data centers in Greater Tokyo totalled 865 megawatts at the end of 2022, half that of Beijing, but could reach 1,970 MW in three to five years, according to Cushman & Wakefield.

Cushman & Weikfield

As the world’s most populous country, India presents a wealth of opportunities for data centre companies looking to utilise the country’s large population and rapidly expanding digital workforce. It has the numbers-The people, the engineering expertise, businesses, cities, farms, families, and communities. And the education and industries that need data centers to collect, process, and serve the vast amounts of data, computing, and networking that power them.

India is expected to have a surplus power generation to the tune of 56,796 million units in FY24, according to the Central Electricity Authority’s Load Generation Balance Report for the fiscal. The country as a whole is likely to have an energy surplus of 3.6% and peak surplus of 0.7 % with the generation programme finalised for the year 2023-24. While it is miniscule compared to what will be required, if it is to make a dent in the global data centre market, it is encouraging.

It has made great progress in generating and adopting renewable and carbon-free energy sources on a massive scale. Complementing India’s solar power, other renewable energy sources include wind, hydroelectric, and geothermal. Wind, for example, accounts for nearly 10% of the total installed utility power generation, with most of that generated between May and September, during monsoon season. India has committed to producing 50% of its electrical power from “non-fossil sources” by 2030, with 50GW of renewable energy capacity in the same timeframe.

The country is home to the world’s largest solar power plant and is activating a new solar park that may rank third in the world, capable of generating up to 2GW of solar power.

Favourable regulatory policies are playing a major role. During the pandemic, the government awarded infrastructure status to data centres, with even state governments offering subsidised land, power subsidies, exemptions on stamp duty, discounts on usage of renewable energy and procurement of IT components made locally, etc. The government’s initiative to build a backbone for digital transactions and authorisation with the JAM trinity (Jan Dhan-Aadhaar-Mobile), UPI, and India Stack APIs, proved to be a major catalyst in driving the explosion of data generation. And this could only be scaled on the backbone of domestic data centres.

No doubt, challenges abound. Though approval processes have improved quite significantly after the industry was granted infra status, it still takes a couple of months at times. Data centres demand huge investments, but the return on investment is very slow. The recurring costs in a data centre gain relevance, once the data centre has been set up. Hardware maintenance and upgrade, upkeeping of the facility and a skilled workforce costs are considerable.

Nasscom recommends faster implementation of government’s draft policy, encouraging use of renewable resources, level playing ground for all players, deemed regulatory approvals and digitization of RFPs.

“In the spirit of competitive federalism, the data centres policies framed by various states have sought to address the myriad concerns which an investor in the sector may have subject to the needs and capacities of the relevant state. Given that the draft national data centres policy has been in the public domain for more than two years, the MeitY may consider updating and releasing an operational national policy that supplements the state policies factoring in subsequent developments, including the Government’s focus on renewable energy and data security,” recommends S&R Associates, an Indian law firm.

The Telecom Regulatory Authority of India has made some recommendations:

- Data Centre Incentivization Scheme (DCIS) for establishing Data Centres (DCs) and Data Centre Parks (DC Parks);

- Data Centre specific portal on National Single Window System (NSWS);

- A national level Data Centre Readiness Index (DCRI) framework;

- Data Centre Economic Zones (DCEZs);

- Certification standards of green DCs in India;

- A suggestive list of DC related courses at diploma, undergraduate and post-graduate

- Level;

- A statutory body Data Digitization and Monetization Council (DDMC);

- A data sharing and consent management framework; and

- An overarching framework for ethical use of data.

Indian data centre market dynamics

The Indian data centre market has grown by 48 percent over the last three years from 540 MW in 2019 to over 800 MW of installed capacity in 2022.

With 138 data centres, India is currently the world’s 13th largest market. And 45 new data centres—covering 13 million sq. ft and 1,015 MW of capacity, are planned to be set up by the end of 2025. About 4,900-5,000 MW of data centre capacity is expected to be added in the next six years involving investments of nearly Rs 1.5 lakh crore, according to ICRA Ratings.

Companies are pouring in billions of dollars in capital to set up these power-guzzling infrastructure components. Many domestic infrastructure firms, from Adani Group to L&T to Hiranandani Group to global giants such as NTT, Google, Microsoft and Amazon, have plans to create greenfield data centres in the country or increase the capacity of their existing data centres.

Sify Technologies is expanding its data centre data centre services capacity driven by an exponential growth in data generated by India Inc as it embarks on digitisation and applying Artificial Intelligence to business. Sify Infinit Spaces Ltd, a subsidiary of Sify Technologies, has very recently entered into an agreement with KDCF for the expansion of new data centres. Following the agreement, KDCF would invest approximately USD 73 million in the form of compulsory convertible debentures of Sify Infinit Spaces Ltd. KDCF will invest upto Rs 6000 million in the form of compulsory convertible debentures of SIS. Sify Inifinit Spaces Ltd would use the proceeds from the issue of the debentures for the expansion of new data centres, including land acquisition, investment in procuring alternate source of power and repayment of debt.

Reliance Industries Ltd’s recently announced partnership with Brookfield Infrastructure and Digital Realty to collectively invest in special purpose vehicles (SPVs) for the development of data centres in India is no surprise. Reliance will hold a 33.33 percent stake in each of the SPVs, making it an equal partner in the venture. Digital Realty Trust holds the position as the leading global provider of cloud and carrier-neutral data centres, colocation, and interconnection solutions. With a vast network of over 300 data centres spanning 27 countries, the company has partnered with Brookfield Infrastructure to establish a joint venture. This collaboration aims to develop top-tier, well-connected, and flexible data centres in India, catering to the essential infrastructure requirements of enterprises and digital services firms.

Phillip Marangella, Chief Marketing and Product Officer for EdgeConneX, recently said that its company’s prospects in China were slowing, and yet the company’s stock had risen significantly since January 2023, only because of its presence in India. He noted that investors and market analysts understood that India might be the world’s largest market for this already-massive company within three years as the country is “furiously” building out its technical infrastructure. EdgeConneX powers the Adani group JV, AdaniConneX.

Avendus expects the sector to lead the next wave of Real Assets investments by growing at a CAGR of ~40 percent to reach a capacity of ~1,700 MW by 2025, on the back of investments worth USD 5 billion.

Currently, developers are addressing a pipeline of over 3,000 MW i.e. 300 MW per annum over the next 10 years, with a CapEx requirement of USD 23 billion.

Avendus Research

Now that 5G has been launched, the next leg of growth will be driven by the exponential increase in data consumption & storage, governmental thrust on data localisation and the need for high bandwidth.

You must be logged in to post a comment Login