Trends

Wafer fab equipment revenue grows to record $120 bn in 2022

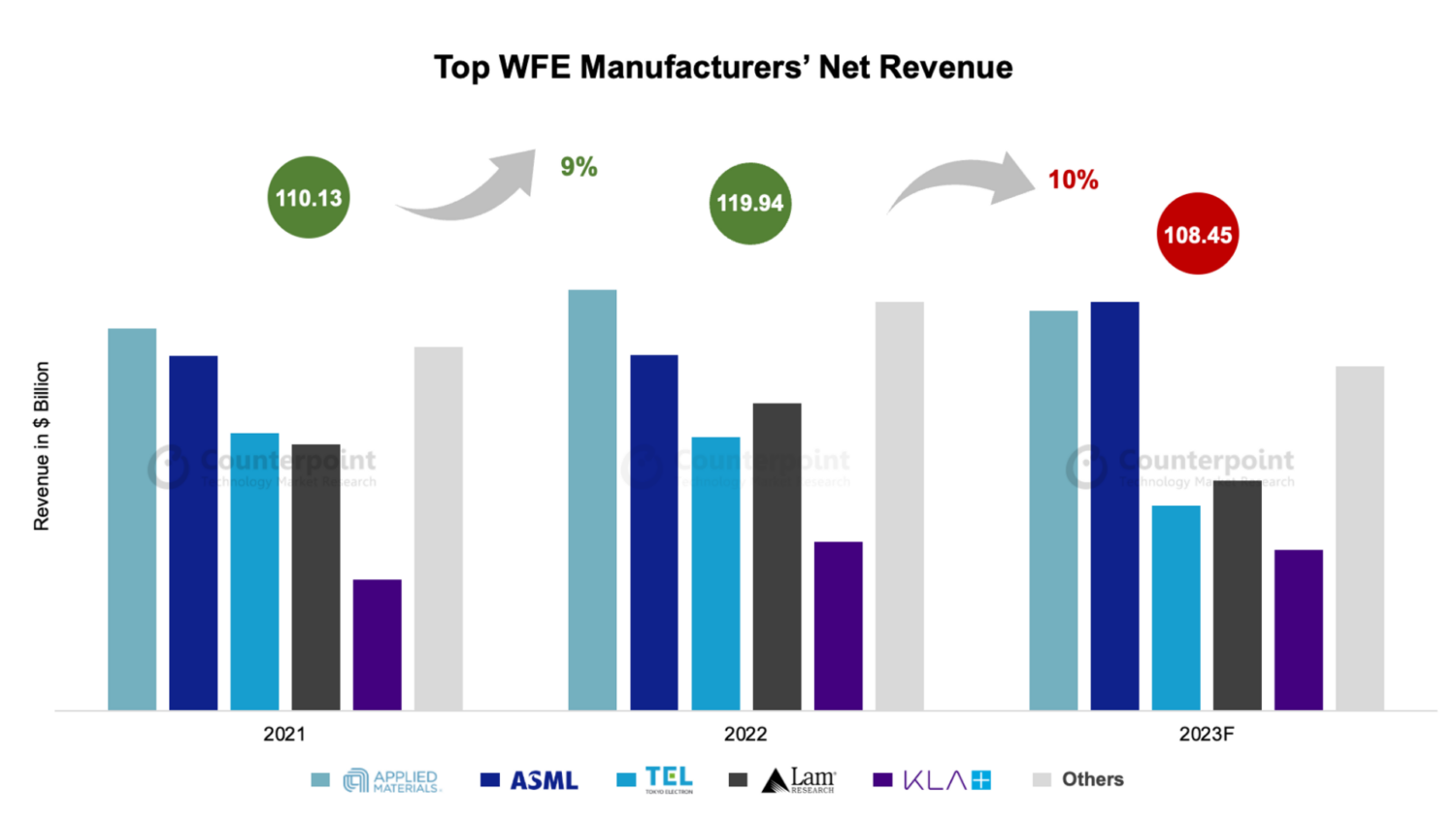

Wafer fab equipment (WFE) manufacturers’ revenue increased 9% YoY to a record $120 billion in 2022 despite the macroeconomic slowdown, currency fluctuations, component shortages and logistics disruptions. The increase was due to continued strength in investments by customers for both leading and mature node devices across segments, including IoT, AI, HPC, automotive and 5G. The top five suppliers’ systems and service revenue increased to a record $95 billion.

The WFE market’s revenue is expected to decline 10% YoY in 2023 to $108.45 billion after three consecutive years of growth. Despite a weaker WFE backdrop for 2023, the EUV lithography outlook remains strong due to the continued penetration of EUV into memory and logic, and foundries ramping up production of 3nm process nodes by applying Gate-All-Around transistor and FinFET architectures with increased EUV technology adoption.

Associate Director Dale Gai said, “During the past six months, TSMC has pushed out new capacities in 7/6nm and 5/4nm in the light of weaker market demand, while the capital spending on 3nm remains nearly the same as it planned at the beginning of 2023.”

Commenting on the WFE market, Senior Analyst Ashwath Rao said, “The size of the WFE market in US dollar terms contracted by more than 8% in 2022 due to the impact of currency fluctuations, especially depreciation in the yen and euro-denominated sales since the beginning of 2022. Increased R&D spending in 2022 ahead of the inflection positions the WFE market to outperform the semiconductor market in the long term as these new technologies transition to volume manufacturing.”

Commenting on the market dynamics playing out in 2023, Rao said, “Manufacturers are more skewed towards foundry-logic segments today unlike in 2019, and with overall backlog strength, increased visibility in terms of long-term agreements and subscription model will help limit the downside. The weakness in wafer fab equipment spending in 2023 will drive lead time and inventory normalization. The slowdown in memory-oriented investments will begin to recover gradually starting in the second half of 2023, and 2024 will be a big year for the equipment industry. Manufacturers are well positioned to take advantage of the opportunity.” Counterpoint Research

You must be logged in to post a comment Login