Headlines of the Day

Underlining the state of telecom and enterprise-Economic Survey, 2021-22

The Economic Survey, tabled in the Parliament, one day before the Union Budget by the Finance Minister is a much-awaited document. Primarily authored by the principal economic adviser and his team, the Survey is a Department of Economic Affairs (DEA) document that underlines the state of the economy and outlines suggestions for policy actions.

Key highlights from the Economic Survey 2022 for the telecom, enterprise networking and electronics.

Sectoral trends

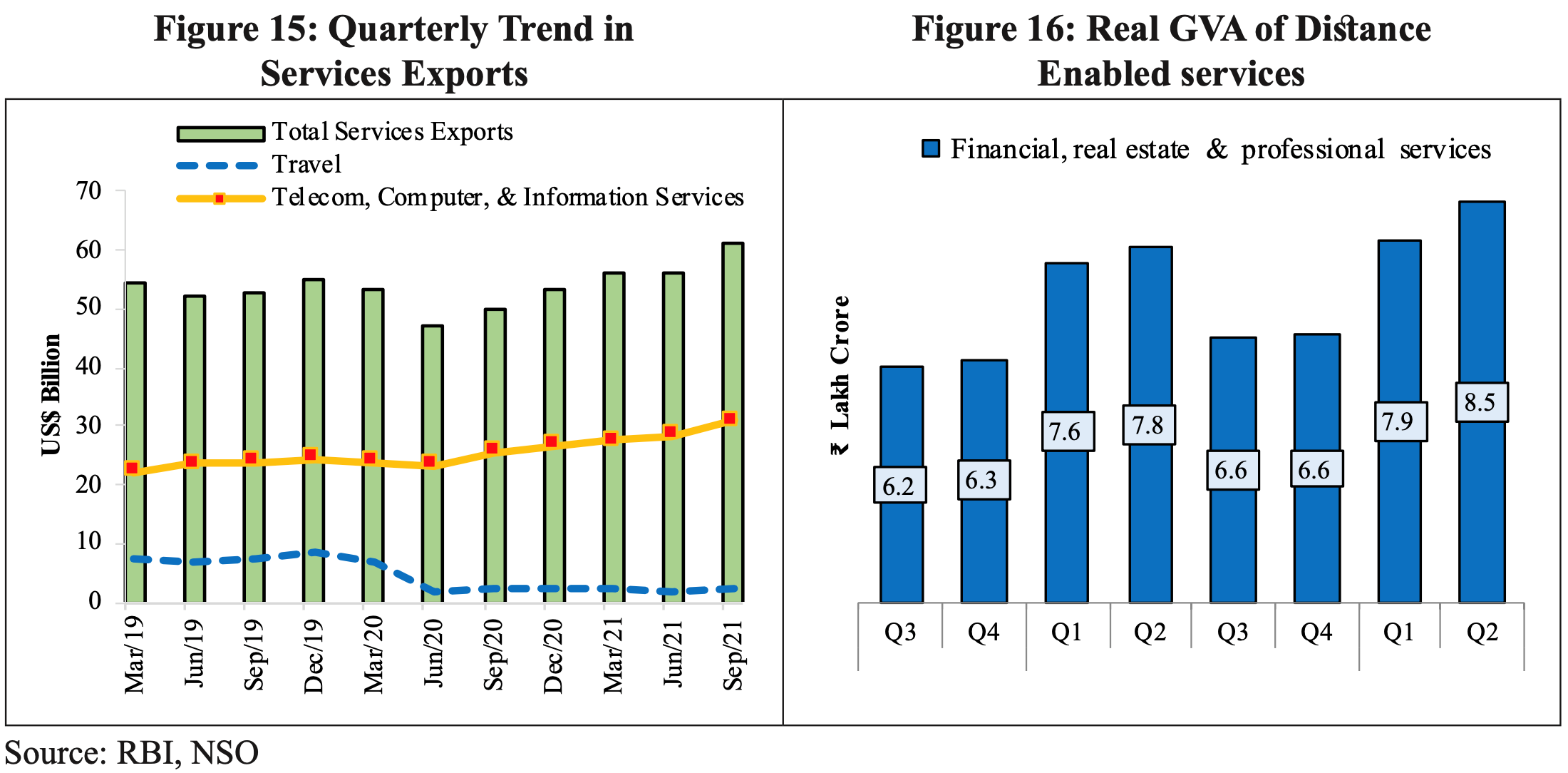

In contrast to contact-based services, distance-enabled services have increased their share with the growing preference for remote interfaces for office work, education and even medical services. Indeed, there has been a boom in software and IT-enabled services exports even as earnings from tourism have declined sharply (Figures 15 & 16).

Exports and Imports

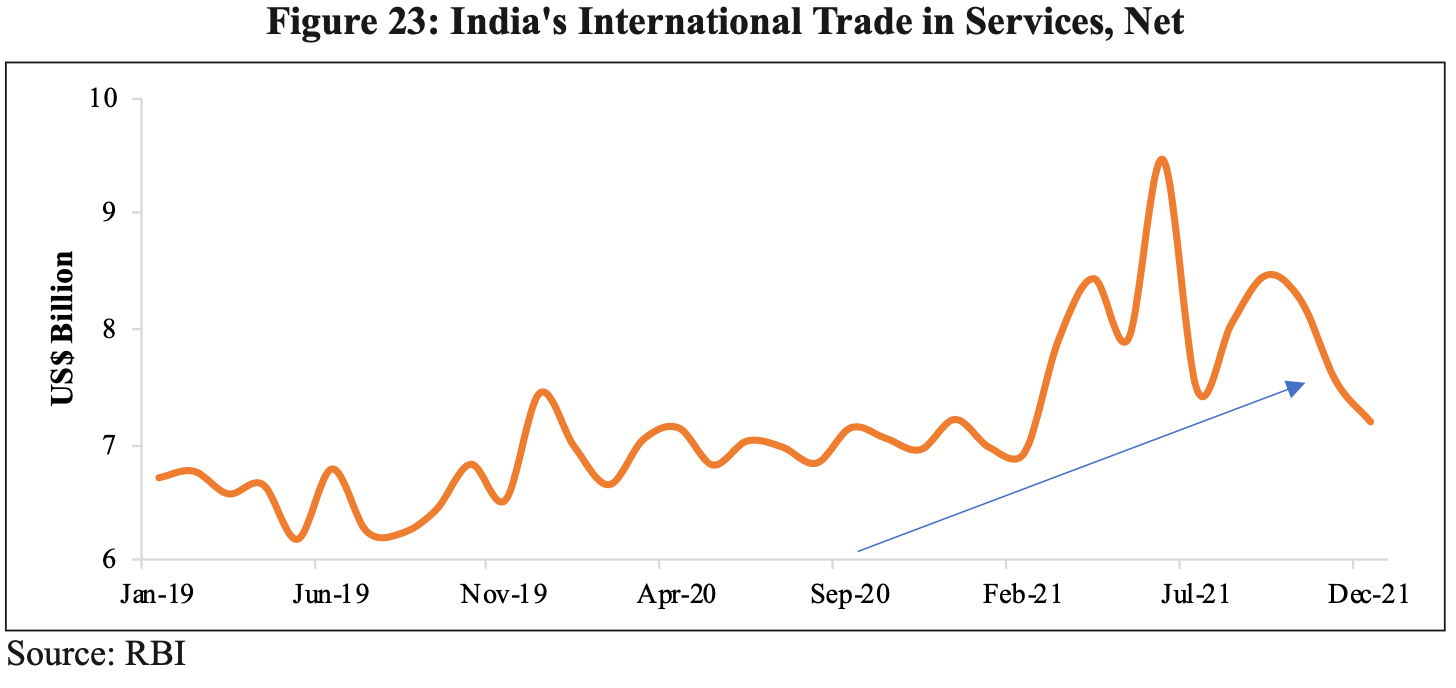

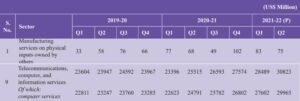

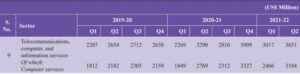

India’s exports of both goods and services have been exceptionally strong so far in 2021-22. Merchandise exports have been above US$ 30 billion for eight consecutive months in 2021-22, despite a rise in trade costs arising from global supply constraints such as fewer operational shipping vessels, exogenous events such as blockage of Suez Canal and COVID-19 outbreak in port city of China etc. (Figure 22). Concurrently, net services exports have also risen sharply, driven by professional and management consulting services, audio visual and related services, freight transport services, telecommunications, computer and information services (Figure 23).

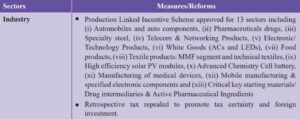

Supply side reforms

Another distinguishing feature of India’s economic response has been an emphasis on supply-side reforms rather than a total reliance on demand management. These supply-side reforms include deregulation of numerous sectors, simplification of processes, removal of legacy issues like ‘retrospective tax’, privatisation, production-linked incentives and so on. Some of these have been listed in Table 7, and have been discussed in detail in the respective chapters. Even the sharp increase in capital spending by the Government can be seen as both demand and supply response as it creates infrastructure capacity for future growth.

An important theme that has been discussed through the course of the Economic Survey is that of ‘process reforms’. It is important to distinguish between deregulation and process reforms. The former relates to reducing or removing the role of government from a particular activity. In contrast, the latter broadly relates to simplification and smoothening of the process for activities where the government’s presence as a facilitator or regulator is necessary. Chapter 2 discusses the reforms undertaken in the public procurement policy- launch of Government e- Marketplace (GeM) in 2016 for standard routine use items and the new procurement guidelines issued in October 2021 for non-standard items and projects. Chapter 4 discusses for the need for simplification of voluntary liquidation process for corporates and for institutionalising a standard process for Cross Border Insolvency Process. Similarly, chapter 9 discusses the simplification of Drone rules and reforms in telecom sector, and the need for reforms in the patent application regime.

The emphasis given to the supply-side in India’s COVID-19 response is driven by two important considerations. First, Indian policy-makers saw the disruptions caused by travel-restrictions, lockdowns and supply-chain breakdowns as an interruption of the economy’s supply-side. Although this also squeezed demand, it is not correct to see the pandemic related economic slowdown as just a demand problem as happens with most economic cycles. Second, the post-Covid world will be impacted by a wide variety of factors – changes in technology, consumer behaviour, geo-politics, supply-chains, climate change and so on. All of these factors will also interact in unpredictable ways with each other. Therefore, the post-Covid economy will not be merely a re-inflation of the pre-Covid economy. Simply building it back with demand measures is not a solution.

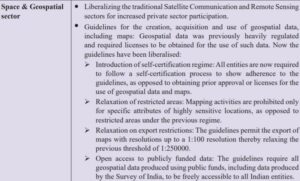

There are two common themes in India’s supply-side strategy: (i) Reforms that improve flexibility and innovation in order to deal with the long-term unpredictability of the post-Covid world. This includes factor market reforms; deregulation of sectors like space, drones, geo- spatial mapping, trade finance factoring; process reforms like those in government procurement and in telecommunications sector; removal of legacy issues like retrospective tax; privatization and monetization, creation of physical infrastructure, and so on. (ii) Reforms aimed at improving the resilience of the Indian economy. These range from climate/environment related policies; social infrastructure such as public provision of tap water, toilets, basic housing, insurance for the poor, and so on; support for key industries under Atmanirbhar Bharat; a strong emphasis on reciprocity in foreign trade agreements, and so on. Some commentators have likened the Atmanirbhar Bharat approach to a return to old school protectionism. Far from it, the focus on economic resilience is a pragmatic recognition of the vagaries of international supply-chains (see discussion in Box 2).

The two pronged approach of “flexibility” and “resilience” is analogous to the Barbell strategy used for the short-term response to the pandemic. This should not be surprising as they are both attempting to deal with the same issue – uncertainty about the future flow of events.

Key supply side measures/reforms

Asset Monetization

The National Infrastructure Pipeline (NIP) envisaged a projected infrastructure investment of Rs. 111 lakh crores during FY 2020 to FY 2025. The NIP task force report has estimated that about 15-17 per cent of this outlay is to be met through innovative and alternative initiatives such as asset monetisation, funding through a new Development Finance Institution (DFI) etc. The Union Budget 2021-22 also emphasized monetization of assets as one of the three pillars for enhanced and sustainable infrastructure financing in the country.

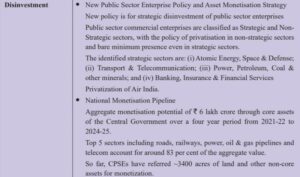

Based on the mandate for Asset Monetisation under Union Budget 2021-22, the National Monetisation Pipeline (NMP) has been developed by NITI Aayog in consultation with infrastructure line ministries. It is envisaged to serve as an essential roadmap for the asset monetisation of various brownfield infrastructure assets across roads, railways, shipping, aviation, power, telecom, oil & gas, and warehousing sectors. The NMP will also form a baseline for the asset owning ministries for monitoring and tracking performance of the potential assets.

The NMP estimates aggregate monetisation potential of ₹ 6.0 lakh crores through core assets of the Central Government, over a four-year period, from FY 2022 to FY 2025. The top 5 sectors which capture around 83 per cent of the aggregate pipeline value include: Roads (27 per cent) followed by Railways (25 per cent), Power (15 per cent), oil & gas pipelines (8 per cent) and Telecom (6 per cent). Around 15 per cent of assets with an indicative value of ₹ 0.88 lakh crore are envisaged to be rolled out in the current financial year (FY 2021-22).

Global Economic Environment

The impact on trade in value terms varied significantly across different types of goods. Trade of manufacture goods, agricultural products and fuels & mining products witnessed positive and higher year-over-year (y-o-y) growth during Q2 of 2021 than in Q1, before moderating in Q3. The trade value of fuels and mining products was boosted by a four-fold rise in natural gas prices. Among manufactured goods, some sectors showed strong y-o-y increase, including iron and steel, electronic components and pharmaceuticals while others such as automotive products and telecommunications equipment showed stagnation or decline, reflecting the recent shortage of semiconductors.

Overall, the balance of risks for global trade is tilted to the downside. The biggest downside risk emanates from the pandemic itself, particularly with resurgence of new variants such as Omicron. Further, in addition to the surge in global inflation, as outlined above, longer port delays, higher freight rates, shortage of shipping containers, shortage of inputs such as semiconductors, with supply-side disruptions being exacerbated by recovery in demand, pose significant risks, inter alia, for global trade.

Against this backdrop, India’s external sector has shown immense resilience during the year, which augurs well for growth revival in the economy.

Production-Linked Incentive (PLI) scheme: An outlay of Rs. 1.97 lakh crore (US$ 26 billion) was announced in Union Budget 2021-22 for Production-Linked Incentive (PLI) scheme for 14 key sectors starting from 2021-22. The scheme provides incentives to companies on incremental sales for products manufactured in domestic units, which is expected to create minimum production of over US$ 500 billion in 5 years. Automobiles and auto components, pharmaceutical drugs, telecom & networking products, electronic/ technology products, etc., are some of the sectors covered under PLI scheme. The scheme is expected to give a push to both domestic manufacturing capabilities and exports.

Trade in services

Exports. Computer services exports continue to be the largest exported service in H1: FY 22, constituting about 49 per cent of total services exports. They exhibited positive sequential growth since Q2: FY 21 on account of increasing demand for digital support, cloud services and infrastructure modernisation owing to new pandemic challenges. Exports of business services – the second major segment – also showed recovery underpinned by improvement in professional, management and consultancy services. The transportation services exports grew by 40.7 per cent in H1: FY 22 to US$ 14.3 billion due to increase in cross-border trade activity and the shortage in shipping containers impacting transport costs. The quarterly component- wise services exports data is presented in Annexure II.

The strong growth witnessed in services exports may also be attributed to key reforms undertaken by Government, which inter alia include liberalizing the Other Service Providers (OSPs) in November 2020 and further in June 2021 announcing reform package for Telecom sector to infuse liquidity, encourage investment and reduce regulatory burden on the telecom service providers.

India’s Exports of Services

India’s Imports of Services

Sectors attracting highest FDI Equity Inflows

Coalition for Disaster Resilient Infrastructure

India’s call for promoting disaster resilience of infrastructure through the Coalition for Disaster Resilient Infrastructure (CDRI) has been receiving global attention. Since CDRI’s launch in September 2019, its membership has expanded to 28 countries and seven multilateral organizations, with several member countries committing to provide technical assistance and financial resources. In addition to India’s seed funding of USD 70 million, the United Kingdom, United States and the Netherlands have pledged GBP 1 million, USD 9.2 million and 100,000 Euro respectively for CDRI’s programmes and projects.

In March 2021, the Hon’ble Prime Ministers of India, UK, Italy and Fiji launched the third International Conference on Disaster Resilient Infrastructure (ICDRI), which discussed key global issues around resilience of critical infrastructure sectors such as power, telecommunications and health as well as urban infrastructure systems and disaster risk financing.

In November 2021, the Hon’ble Prime Ministers of India, UK, Australia, Fiji, Jamaica and Mauritius launched the Infrastructure for Resilient Island States (IRIS). This is a dedicated initiative for Small Island Developing States (SIDS) that provides quality technical and financial services to make SIDS infrastructure resilient to climate change and disaster events. India has pledged USD 10 million, while Australia and the UK have pledged AUD 10 million GBP 7.3 million respectively for the IRIS initiative.

Further, CDRI has launched two other initiatives. CDRI’s Global Flagship Report on Disaster and Climate Resilient Infrastructure aims to engage and focus global attention on the critical and multi-faceted challenges posed to disaster and climate-resilient infrastructure. DRI Connect is a “network of networks” enabling stakeholder access to knowledge resources and collaborative opportunities with their peers and other actors. These initiatives are in addition to CDRI’s ongoing programmes on enhancing the power sector’s resilience in Odisha and the global study on disaster resilience of airports.

FDI Policy reforms and Other Measures during the Covid-19 Pandemic period

The changes in the FDI policy can be broadly categorized into measures taken to improve foreign participation while protecting Indian industry from opportunistic takeovers, to enhance transparency and rationalization of processes and steps to monitor and expedite implementation.

a. Measures taken to allow greater foreign participation

(iv) Telecom sector: Press Note 4 (2021) dated 06.10.2021 has been issued to permit foreign investment up to 100percent under automatic route in Telecom services sector.

b. Curbing opportunistic acquisitions/takeovers. Vide Press Note 3 (2020) dated 17.04.2020, Government amended the FDI policy according to which an entity of a country, which shares land border with India or where the beneficial owner of an investment into India is situated in or is a citizen of any such country, can invest only under the Government route. Further, in the event of the transfer of ownership of any existing or future FDI in an entity in India, directly or indirectly, resulting in the beneficial ownership falling within the restriction/purview of the said policy amendment, such subsequent change in beneficial ownership will also require Government approval.

c. Measures to improve transparency and to rationalize processes include amendment of the Standard Operating Procedure (SOP) to improve ease of processing FDI proposals.

d. ‘FDI Monitoring Cell’ has been formed which follows up with applicant/ investor, to expedite FDI proposals with a view identify and hurdles if any. An Inter-Ministerial Committee (IMC) has been constituted under the Chairpersonship of Secretary, Department for Promotion of In- dustries and Internal Trade to take appropriate decision on delayed proposals and those escalated by Administrative Ministries/ Departments.

Electronics Industry

World over, electronics is recognised as a ‘meta-resource’. Electronics industry is the world’s largest and fastest growing industry and is increasingly finding applications in all sectors of the economy. With its impact in developing infrastructure, raising productivity, increasing efficiency in delivery of services, and enabling social transformation, it is accepted as a key enabler in the country’s economic development.

Government accords high priority to electronics hardware manufacturing. The government has therefore notified the National Policy on Electronics 2019 (NPE 2019) on 25.02.2019 to position India as a global hub for Electronics System Design and Manufacturing (ESDM) by encouraging and driving capabilities in the country for developing core components, including chipsets. Additionally, NPE 2019 attempts to catalyze the growth of Indian electronics ecosystem through the (i)Production Linked Incentive (PLI) Schemes for Large Scale Electronics Manufacturing, (ii) PLI Scheme for IT Hardware; (iii) Scheme for Promotion of Manufacturing of Electronic Components and Semiconductors (SPECS); and (iv) Modified Electronics Manufacturing Clusters 2.0 (EMC 2.0).PLI for Large Scale Electronics Manufacturing has been notified on April 01, 2020 which provides an incentive of 4 to 6 percent on incremental sales (over base year)to eligible companies involved in mobile phone manufacturing and manufacturing of specified electronic components, including Assembly, Testing, Marking and Packaging(ATMP) units (See box 3 for details on PLI scheme). As per June 2021 Quarterly Revenue Recover (QRR) the scheme has resulted in investment of Rs. 2,595 crore and production worth Rs.67,275 crore of which, 31 percent or Rs. 20,568 crore was exported. PLI scheme for IT Hardware was notified on March 03, 2021 which extends an incentive in the range of 1 to 4 percent on net incremental sales (over base year) of goods manufactured in India and covered under the target segment, to eligible companies, for a period of four years. The target segment under PLI Scheme includes (i) Laptops (ii) Tablets (iii) All-in-One PCs and (iv) Servers. As per Q2:FY21-22QRR, total sales of manufactured goods in target segment stood at Rs. 503 crores with Rs. 16.50 crore investment. Further, the government has through the SPECS scheme and the EMC 2.0 provided an enabling environment in the form of financial incentive for capital expenditure and by creating plug and play facilities with the view of attracting major electronics manufacturers.

Production Linked Incentives Schemes

PLI Schemes launched in March 2020, are a cornerstone of the Government’s push for achieving an AtmaNirbhar Bharat. The idea is to provide support to the sectors, regain dominance in global trade and be more prepared for the volatilities and shocks in global supply chains as opposed to the protectionist approach of the pre-1991 era. The objective of the scheme is to boost domestic manufacturing in sunrise and strategic sectors, improve cost competitiveness of domestically manufactured goods, enhance domestic capacity and economies of scale. The scheme is specifically designed to attract investments in sectors of core competency and cutting-edge technology. The selection of sectors has been done based on the sectors’ abilities to introduce latest technology, generate direct and indirect employment by reaching global scales while increasing competitiveness to ensure penetration of Indian companies in the global value chains.

This scheme is expected to make domestic manufacturing globally competitive and will create global champions in manufacturing. The Government has already committed Rs.1.97 lakh crores, over 5 years starting from 2021-22 in 13 sectors. Recently, PLI in the 14th sector – drones and drone components has been included with an additional layout of Rs. 120 crores. The initial 13 sectors are Electronic/Technology Products, Medical devices, Drug intermediaries and APIs, Mobile Manufacturing and Specified Electronic Components, Pharmaceuticals drugs, Telecom & Networking Products, Telecommunications, Food Products, White Goods (ACs & LED), High Efficiency Solar PV Modules, Automobiles & Auto Components, Advance Chemistry Cell (ACC) Battery, Textile Products: Man Made Fabrics segment and technical textiles and Specialty Steel.

So far, the 13 initial schemes have been notified and guidelines have been issued where required. The first three schemes notified were for mobile phones and specified electronic components, APIs/Drug intermediates and medical devices. In case of mobile phones and specified electronic components, in the first round, 16 applications worth Rs. 36440 crores were approved and in the second round, 18 applications worth Rs. 483 crores were approved by the competent authority. In case of APIs/drug intermediates and medical devices, 42 applications worth Rs. 4347.26 crore and 13 applications with a committed investment of Rs. 798.93 crores have been approved so far by the competent authority, respectively.

National Infrastructure Pipeline (NIP). Public Private Partnership in infrastructure has been an important source of investment in the sector. As per the database of the World Bank on private participation in infrastructure, India is ranked second among developing countries both by the number of PPP Projects as well as the associated investments. Much of the Indian success in PPPs is attributed to development of robust institutional structure, financial support, and use of standardized documents, both process documents like Model Request for Qualification and Model Request for Proposal as well as substantive documents like the Model Concession Agreements across infrastructure sectors.

The Public Private Partnership Appraisal Committee(PPPAC) which is responsible for the appraisal of PPP projects has cleared 66 projects with a total project cost of Rs. 137218 crores from 2014-15 to 2020-21. The government launched the Viability Gap Funding (VGF) scheme for providing financial assistance to financially unviable but socially/ economically desirable PPP projects. Up to 20percent of the project cost is funded under this scheme as a grant. Based on the above, the total VGF amount disbursed between 2014-15 to 2020-21 by DEA is Rs. 2943 crores. Further, the Government of India has in November 2020 approved continuation of and revamping of the Scheme for Financial Support to Public Private Partnerships (PPPs) in Infrastructure Viability Gap Funding (VGF) Scheme till 2024-25. The revamped VFG scheme is expected to attract more PPP projects and facilitate private investment in social sectors such as health, education, waste water, solid waste management, water supply etc.

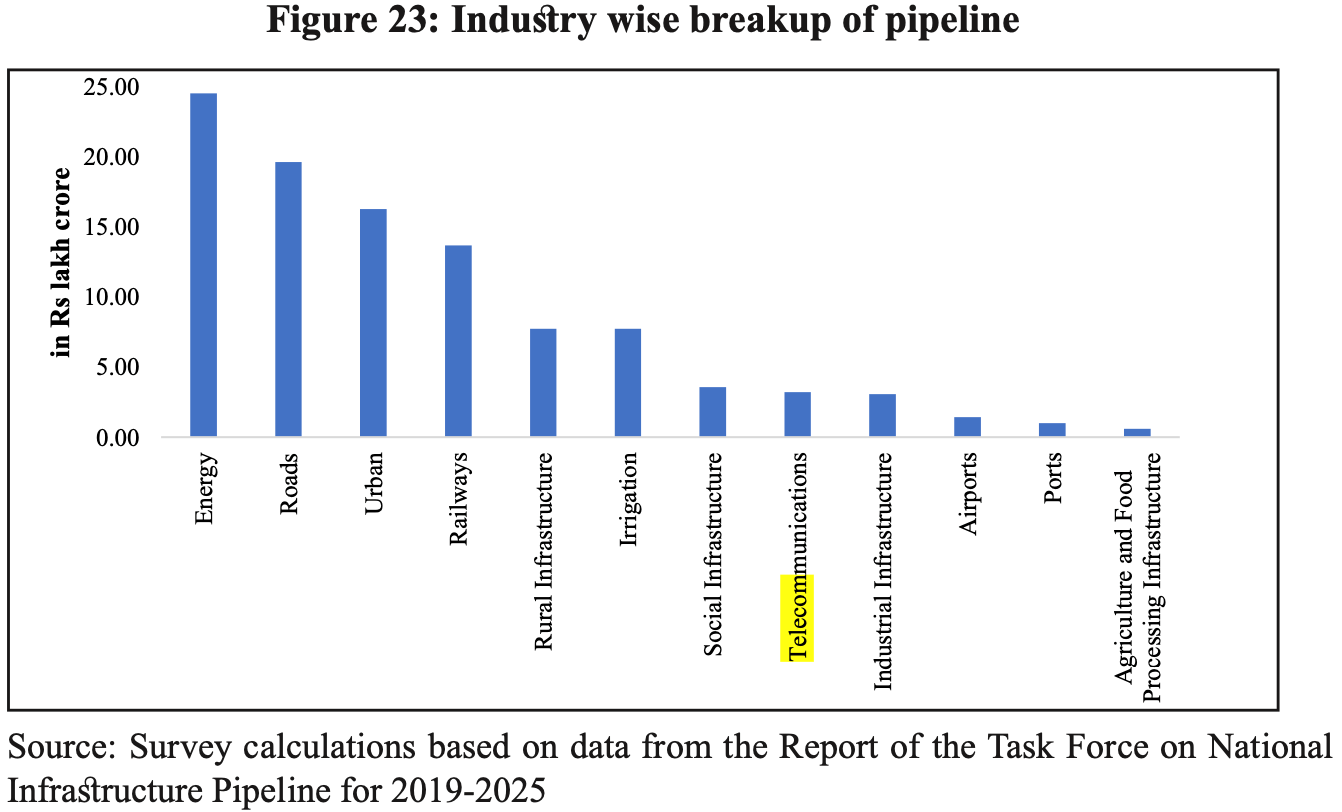

In order to achieve theGDP of $5trillion by 2024-25, India needs to spend about $1.4 trillion over these years on infrastructure. During FYs 2008-17, India invested about US$1.1 trillion on infrastructure. However, the challenge is to step up infrastructure investment substantially. Keeping this objective in view, National Infrastructure Pipeline (NIP) was launched with projected infrastructure investment of around Rs. 111 lakh crore (US$ 1.5 trillions) during FY 2020-2025 to provide world-class infrastructure across the country, and improve the quality of life for all citizens. It also envisages to improve project preparation and attract investment, both domestic and foreign in infrastructure. NIP was launched with 6,835 projects, which has expanded to over 9,000 projects covering 34 infrastructure sub-sectors. During the fiscals 2020 to 2025, sectors such as energy (24percent), roads (19percent), urban (16percent), and railways (13percent) amount to around 70percent of the projected capital expenditure in infrastructure in India. Sector wise break-up of the pipeline for the period 2019-20 to 2024-25is given in figure 23. NIP has involved all the stakeholders for a coordinated approach to infrastructure creation in India to boost short-term as well as the potential GDP growth.

Connecting PILLARS OF INDIA PM-GATI SHAKT

Another milestone achieved which has heralded a new chapter in governance is the PM Gati Shakti an integrated plan ensuring multi-modal and seamless connectivity for people, goods and services. It covers16 ministries and infrastructure like Bharatmala, Sagarmala, inland waterways, dry/land ports, UDAN etc. It is also expected to include social infrastructure like hospitals and universities. With continuous improvement in digital infrastructure along with development of economic zones like textile clusters, pharmaceutical clusters, defence corridors, electronic parks, industrial corridors, fishing clusters, agri zones, GATI-SHAKTI will improve connectivity and make Indian businesses more competitive. It will also leverage technology extensively including spatial planning tools with ISRO imagery developed by Bhaskaracharya National Institute for Space Applications and Geoinformatics. This is a constant endeavor to build next generation infrastructure to improve ease of living as well as ease of doing business.

Telecom

India is the world’s second-largest telecommunications market. The telecommunication sector is one of the most powerful sectors impacting social and economic development of a country. A strong and a responsive regulatory framework has kept the service access at reasonable prices. The Government has taken further measures to ensure fair competition among service providers with the view to benefit the consumers (BOX 8).

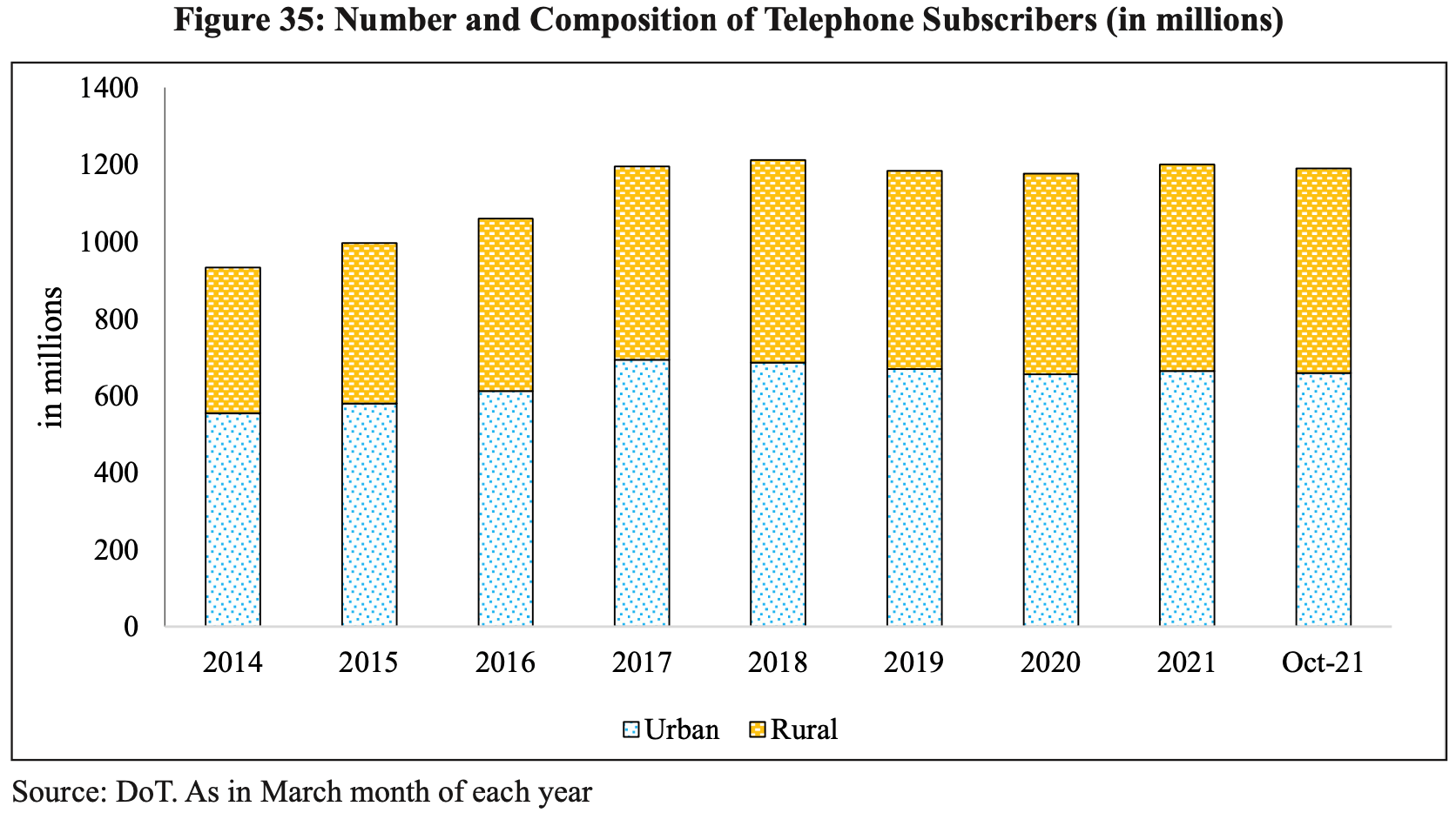

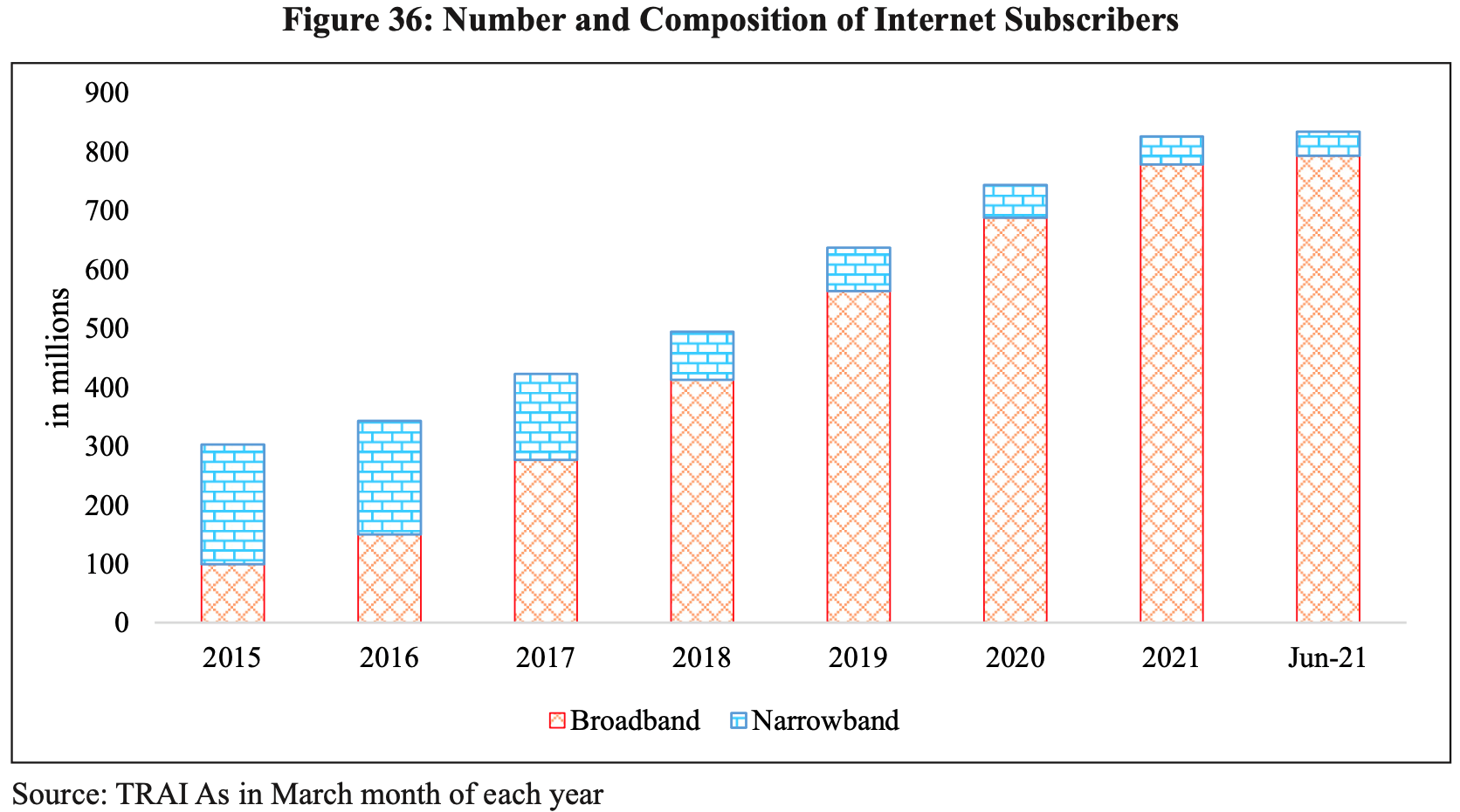

The relevance of telecom sector has increased immensely. This can be gauged from the fact that the total telephone subscriber base in India has increased from 933.02 million in March 2014 to 1200.88 million in March 2021.In March 2021, 45 percent of subscribers were based in rural India and 55 percent in urban areas (figure 35). Internet penetration in the country is increasing steadily with internet subscribers increasing from 302.33 million in march 2015 to 833.71 million in June 2021. While 67.2 percent of internet subscribers had narrow- band connections and 32.8 percent had broadband connections in 2015, the composition had reversed by June 2021 with only 4 percent of subscribers having narrowband and 96 percent with broadband connections (Figure 36).

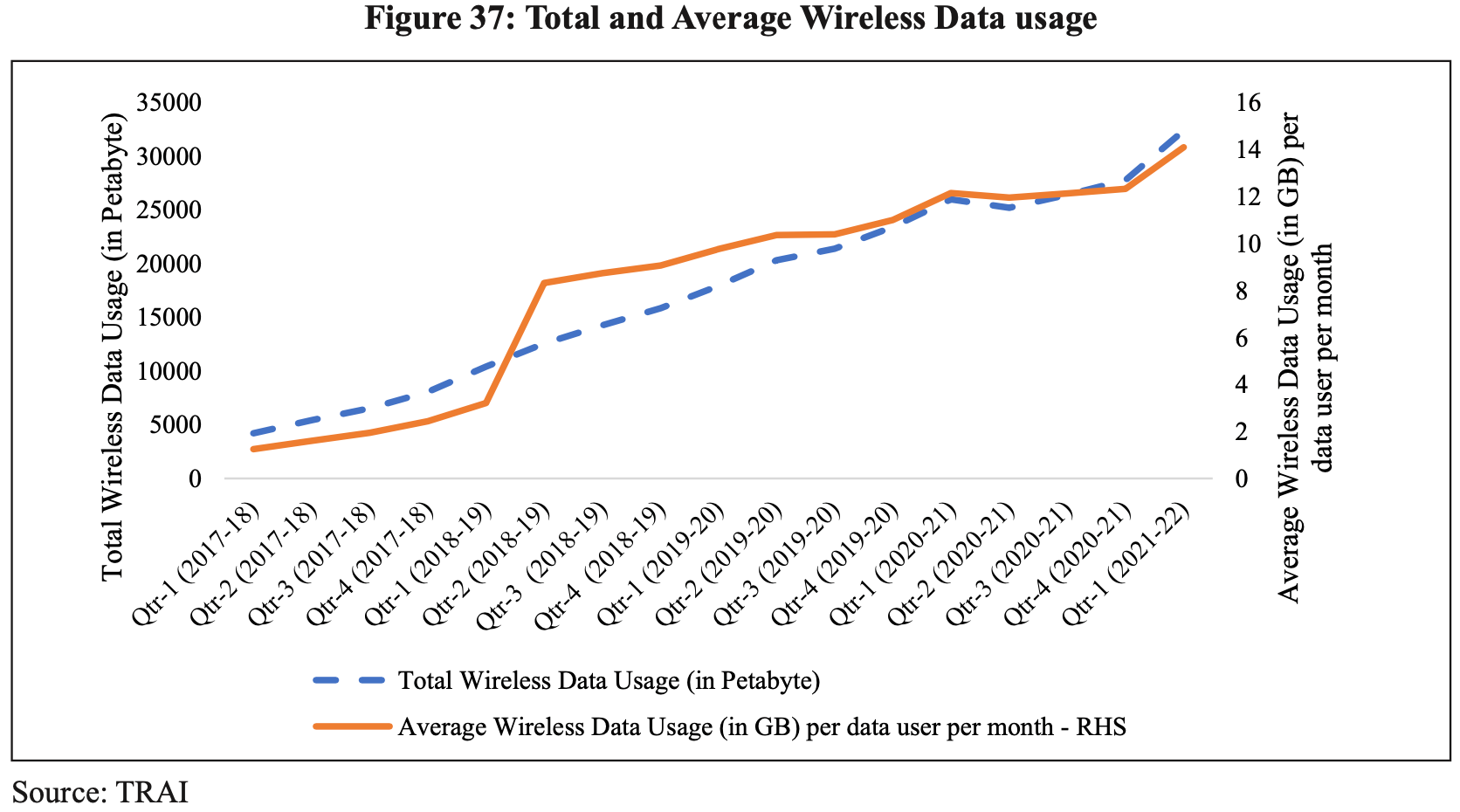

Over the last few years, telecom sector in India has become data driven and reducing costs of data due to the fierce competition in the sector. This has boosted data usage even further. Total volume of wireless data usage increased by more than 7 folds from 4206 petabyte in Q1:FY18 to 32397 petabytes in Q1:FY22. Average wireless data usage in gigabyte (GB) per data user per month has also increased tremendously from just 1.24 GB per month in Q1:FY18 to a whooping 14.1 GB per month in Q1:FY22 (Figure 37).

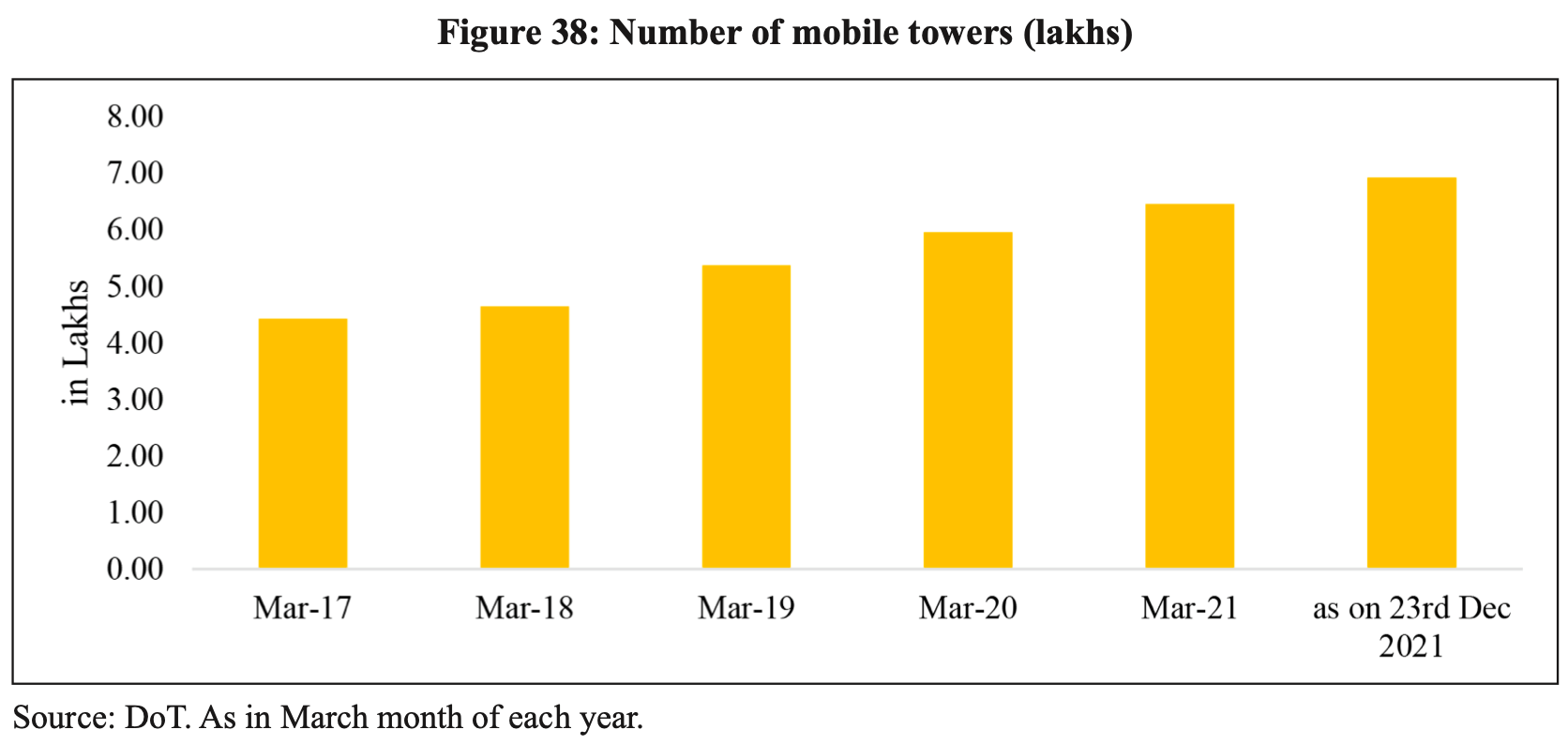

The number of mobile towers has also increased substantially (Figure 38) reaching 6.93 lakhs towers in December 2021, reflecting that the telecom operators have well realized the potential in the sector and seized the opportunity to build up an infrastructure that will be fundamental in boosting the Government’s Digital India campaign.

Under the flagship BharatNet project, as on 27 September 2021, 5.46lakh km Optical Fiber Cable has been laid, a total of 1.73 lakh Gram Panchayats (GP) have been connected by Optical Fiber Cable (OFC) and 1.59 lakh Gram Panchayats are service ready on OFC. In addition, 4173 GPs have been connected over satellite media. Wi-Fi hotspots have been installed at 1.04lakh Gram Panchayats of which services are being provided at 0.64 lakh Gram Panchayats, catering to more than 16.17 lakh subscribers with a data usage to the tune of 5670.42 TB per month. The scope of BharatNet has now been extended to cover all inhabited villages beyond Gram Panchayats. On 30.06.2021, Government accorded approval for a revised strategy for implementation of BharatNet through Public-Private Partnership (PPP) model in 16 States of the country covering about 3.61 lakh villages (including 1.37 lakh GPs). Other projects include improving connectivity in 354 villages in the border areas of Jammu & Kashmir, Ladakh, Himachal Pradesh, Uttar Pradesh, Bihar, Rajasthan, Gujarat and Uttarakhand. As on 27.9.2021, around 161 villages out of 354 villages have been covered with mobile service. A boost to the telecom infrastructure is also being given under the aspirational district scheme.

The Government of India is implementing a Comprehensive Telecom Development Plan (CTDP) for the North-Eastern Region and Comprehensive Telecom Development Plan for Islands to provide mobile connectivity in the uncovered villages and along National Highways in the North-east. As on 30.08.2021, towers at 1,358 sites have been installed and are providing services. The undersea 2,313-km optic fiber-based telecom connectivity between Chennai and Andaman &Nicobar Islands was inaugurated in August 2020. Government has approved the proposal for provision of submarine Optical Fiber Cable Connectivity by laying approximately 1891km of cable between Kochi and Lakshadweep Islands. With the implementation of this project, the high- speed internet/ broadband connectivity will be available in Lakshadweep Islands.

In addition to the expansion in the telecom infrastructure, a number of measures have been taken to bring about structural and procedural reforms (see Box 8 for details). In the backdrop of the outstanding performance of the telecom sector in meeting COVID-19 challenges and with huge surge in data consumption due to online education, work from home, interpersonal connect through social media, virtual meetings etc., the reform measures will further boost the proliferation and penetration of broadband and telecom connectivity. The reforms are also expected to boost 4G proliferation, infuse liquidity and create an enabling environment for investment in 5G networks.

Reforms in the Telecom Sector

Structural Reforms

- Rationalization of Adjusted Gross Revenue: Non-telecom revenue will be excluded on prospective basis from the definition of AGR.

- Bank Guarantees (BGs) against License Fee (LF) have been rationalized. One BGs in different Licensed Service Areas (LSAs) regions in the country has been allowed.

- Interest rates rationalized/ Penalties removed: From 1st October, 2021, delayed payments of License Fee (LF)/Spectrum Usage Charge (SUC) will attract interest rate of SBI’s MCLR plus 2percent instead of MCLR plus 4percent; interest compounded annually instead of monthly; penalty and interest on penalty removed.

- For Auctions held henceforth, no BGs will be required to secure instalment payments.

- Spectrum Tenure: In future auctions, tenure of spectrum increased from 20 to 30 years.

- Surrender of spectrum will be permitted after 10 years for spectrum acquired in the future auctions.

- No Spectrum Usage Charge (SUC) for spectrum acquired in future spectrum auctions.

- Spectrum sharing encouraged- additional SUC of 0.5percent for spectrum sharing removed.

- To encourage investment, 100 percent Foreign Direct Investment (FDI) under automatic route has been permitted in Telecom Sector with all safeguards applying.

Procedural Reforms

- Auction calendar fixed – Spectrum auctions to be normally held in the last quarter of every financial year.

- Ease of doing business promoted – cumbersome requirement of licenses under Customs Notification for wireless equipment has been removed. This is replaced with self-declaration.

- Know Your Customers (KYC) reforms: Self-KYC (App based) permitted. E-KYC rate revised to only one rupee. Shifting from prepaid to post-paid and vice-versa does not require fresh KYC.

- Customer Acquisition Forms (CAF) in physical form will be replaced by digital storage of data. This is a cost saving measure as it would allow the Telecom Service Providers (TSPs) to release several warehouses that was being required to store 300-400 crore paper CAFs. Further, with this measure, warehouse audit of CAF would also not be required.

- Standing Advisory Committee on Radio Frequency Allocation (SACFA) clearance for telecom towers eased. Department of Telecommunication will accept data on a portal, based on self- declaration basis which is to be linked to portals of other Agencies (such as Civil Aviation).

Addressing Liquidity requirements of TSPs: The Government approved the following for all the TSPs:

- Moratorium/Deferment of up to four years in annual payments of dues arising out of the AGR judgement, while protecting the Net Present Value (NPV) of the due amounts.

- Moratorium/Deferment on due payments of spectrum purchased in past auctions (excluding the auction of 2021) for up to four years with NPV protected at the interest rate stipulated in the respective auctions.

- Option to the TSPs to pay the principal and the interest amount arising due to the said moratorium/ deferment of payment by way of equity.

Initiatives under Atma Nirbhar Bharat including introduction of structural and procedural reforms, record vaccinations, various PLI scheme designed to attract investments in sectors of core competency and cutting edge technology, Make-in-India programme to boost domestic manufacturing capacity, reduction of corporate tax rate, etc and steps to improve operational efficiency have helped the industrial sector to keep up its ante. The sector has started to recover steadily and according to the National Statistical Office, is expected to grow at 11.8 percent in 2021-22.The performance of the Index of Industrial Production while a little subdued at 1.4 per cent in November 2021 vis a vis the same month in the previous year must be viewed along with growth of 17.4 percent in April-November 2021 as compared to -15.3 percent in the corresponding period of last year. Most components of IIP have recovered to the pre-lockdown level.

FDI inflows into services sector

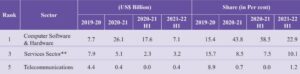

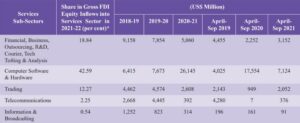

Services sector is the largest recipient of FDI inflows in India. According to the World Investment Report 2021 by the UN Conference on Trade and Development (UNCTAD), India was the fifth-largest recipient of Foreign Direct Investment (FDI) in 2020 improving its rank by four places, from ninth position in 2019. In 2020-21, India registered highest ever annual FDI inflows of US$ 81.97 billion. The country has received US$ 43.12 billion FDI inflows in the first six months of 2021-22. FDI equity inflows, i.e., FDI inflows minus re-invested earnings, were US$ 31.15 billion during April-September 2021, growing by 3.8 per cent over the corresponding period last year.

During H1 2021-22, services sector received US$ 16.73 billion FDI equity inflows. This is over 29 per cent lower than the FDI equity inflows into services in the corresponding period last year. This fall was driven by Computer Software & Hardware sub-sector. In H1 2020-21, FDI equity inflows into ‘Computer Software & Hardware’ sub-sector was US$ 17.55 billion. It has declined by US$ 10 billion to reach US$ 7.12 billion in H1 2021-22. However, this is still 77 per cent higher than the FDI equity inflows into this sub-sector during H1 2019-20. On the other hand, ‘Financial, Business, Outsourcing, R&D, Courier, Tech Testing & Analysis’, ‘Education’ sub-sector witnessed strong inflows amounting to US$ 3.16 billion and US$ 2.25 billion respectively in April-September 2021. Nonetheless, the services sector still accounts for over 50 per cent of the total FDI equity inflows into India during this period (Table 4).

Gross FDI Equity Inflows into Services Sector

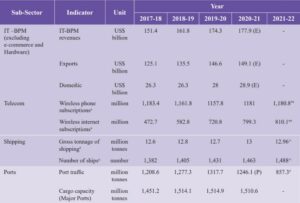

Performance of Key Sub-Sectors in India’s Services Sector

Sources: Telecom Regulatory Authority of India (TRAI), Department of Telecom, Ministry of Tourism, Ministry of Shipping, Airports Authority of India, Ministry of Electronics and Information Technology, NASSCOM.

IT BPM Services

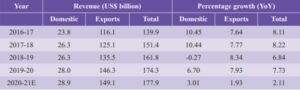

The Information Technology-Business Process Management (IT-BPM) sector is a major segment of India’s services. During 2020-21, according to NASSCOM’s provisional estimates, IT-BPM revenues (excluding e-commerce) reached US$ 194 billion, growing by 2.26 per cent YoY, adding 1.38 lakh employees.

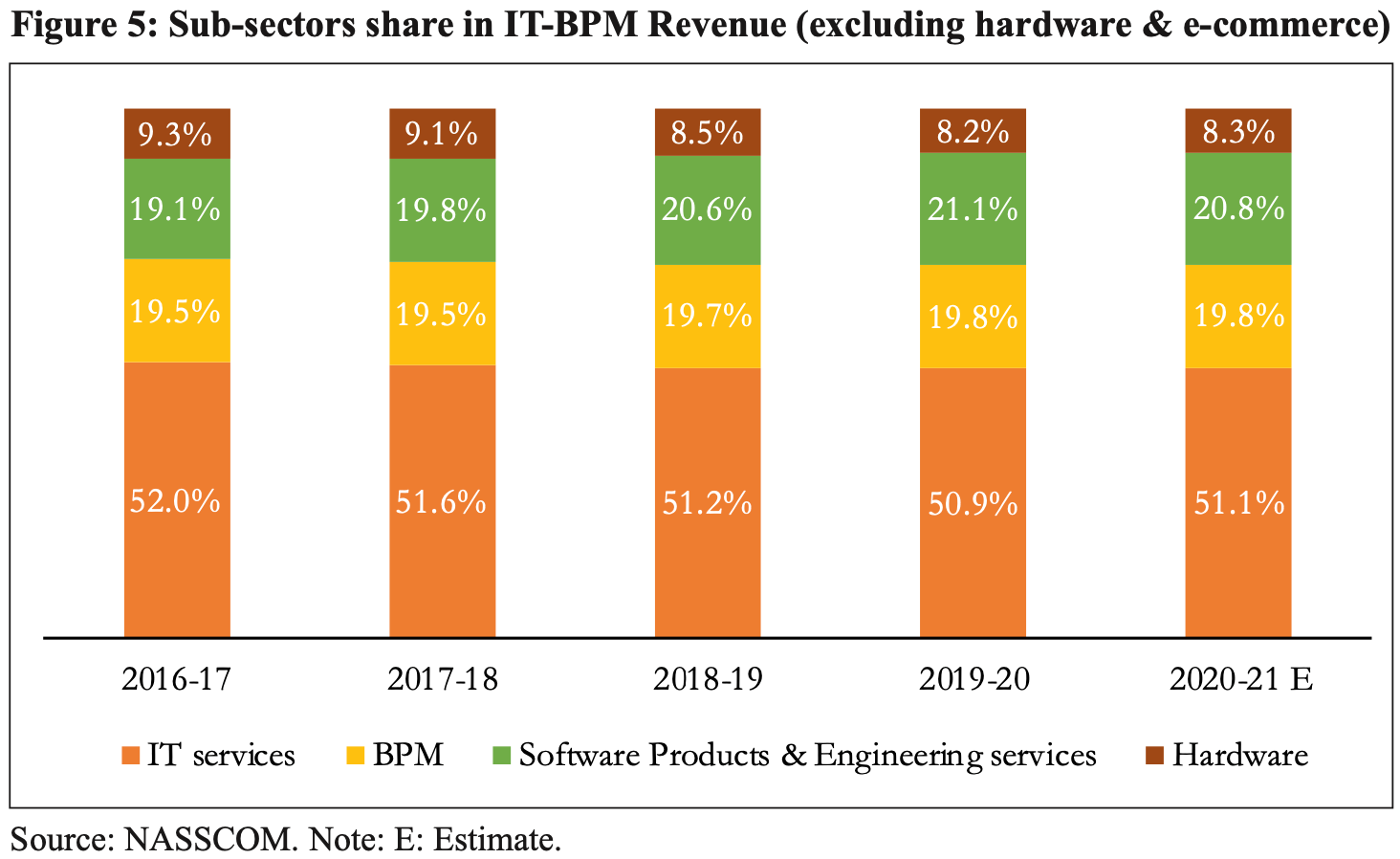

Share of IT-BPM Sub-sectors

Within the IT-BPM sector, IT services constitutes the majority share (> 51 per cent) (Figure 5). Its share has been consistent over the last many years. The share of Software & Engineering services in the IT-BPM sector, which was consistently growing each year, saw a slight decline to 20.78 per cent in 2020-21. BPM services share remained same at 19.8 per cent, while that of Hardware services slightly improved to 8.3 per cent. In 2020-21, IT services, Software & Engineering services, BPM services, and Hardware services earned revenues of US$ 99.1 billion, US$ 40.3 billion, US$ 38.5 billion, and US$ 16.1 billion, respectively.

Share of Exports in IT-BPM Sector

9.37 During 2020-21, the total revenue in IT-BPM sector (excluding hardware and e-commerce) grew at 2.1 per cent (YoY). A significant portion of this revenue comes from exports. During 2020-21, exports revenues grew by 1.93 per cent to reach US$ 149.1 billion.

Exports and Domestic Market Size of Indian IT-BPM Industry (excluding hardware & e-commerce)

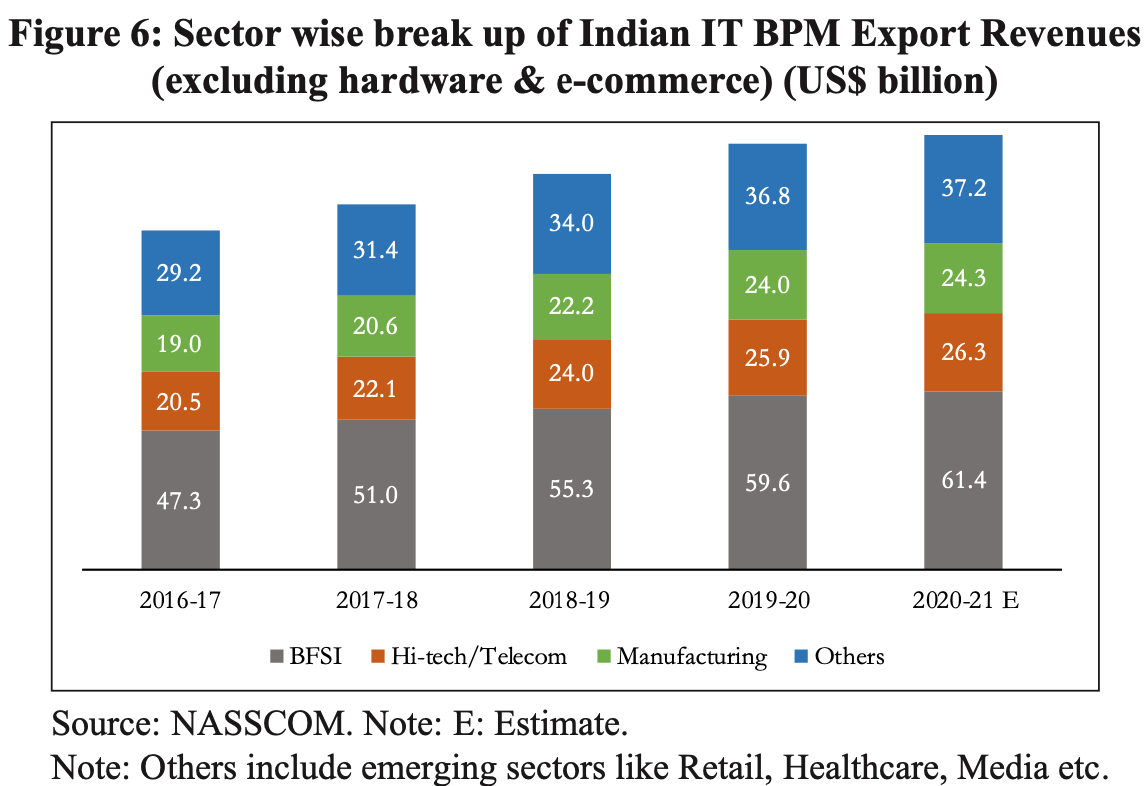

Out of the total US$ 149.1 billion in exports of the IT-BPM sector (excluding hardware and e-commerce) in 2020-21, Banking, Financial services and Insurance (BFSI) contributed US$ 61.4 billion, accounting for over 41 per cent of the exports. Hi-tech/Telecom and Manufacturing services contributed US$ 26.3 billion and US$ 24.3 billion, accounting for a share of 17.65 and 16.28 per cent respectively (Figure 6). All the three sub-sectors witnessed a marginal increase in export revenues in 2020-21 YoY, with BFSI growing by 3 per cent, Hi-tech/Telecom services by 2 per cent and Manufacturing services by 1 per cent.

Over the last year, a number of policy initiatives have been undertaken to drive innovation and technology adoption in the sector, including relaxation of Other Service Provider regulations (See Box 1), Telecom Sector Reforms and Consumer Protection (e-commerce) Rules, 2020. This would significantly expand access to talent, increase job creation, and catapult the sector to the next level of growth and innovation.

Removal of Telecom Regulations in IT-BPO Sector

Last year, the Government undertook a major reform of liberalizing the Telecom regulations in the IT-BPO sector. In legal parlance, these are called Other Service Providers (OSPs). New revised and simplified OSP guidelines were first issued in November 2020 and further in June 2021. Prior to this, the OSPs were regulated under the Revised Terms and Conditions- Other Service Provider 2008.

IT and IT enabled service companies carrying out services like tele-medicine, e-commerce, call centre, network operation centre and other IT Enabled Services, by using Telecom Resources provided by Authorised Telecom Service Providers were required to be registered as Other Service Provider (OSP) and comply with the onerous obligations of the OSP Regulations. The application and approval processes were cumbersome and compliance obligations such as in relation to the sharing of infrastructure, work from home arrangements, use of EPABX and internet connectivity, etc. were tedious and made compliance challenging.

The revised guidelines which resolve these issues are as follows:

Clear definition of OSP: The applicability of new guidelines is limited to entities that provide “Voice based BPO services” to its customers. Voice based BPO services is defined to mean call center services. The new guidelines have explicitly clarified that non-voice-based entities will not be governed by the OSP regime.

Removal of registration requirement No registration certificate will be required for OSP centres in India.

Removal of requirement of bank guarantee: No bank guarantee whatsoever will be required for any facility or dispensation under these guidelines.

Removal of distinction between domestic and international OSPs: The categorization of OSPs has been done away with and one single OSP category has been introduced regardless of their domestic/ international business operations.

Work from home and remote locations allowed: The agents at home/anywhere shall be treated as remote agents of the OSP centre. The interconnection between remote agents is permitted using any technology including broadband over wireline/wireless. The remote agent can now directly connect to customer Electronic Private Automatic Branch Exchange (EPABX) /centralised EPABX without the need to connect with the OSP centre.

Interconnectivity between OSPs allowed: Interconnection between two or more OSP centres of the same or unrelated company is now permitted.

Sharing the infrastructure: Infrastructure sharing among OSPs is now allowed. The guidelines allow the use of EPABX at foreign locations.

This reform will provide a big stimulus for growth of IT-BPO industry in India and help in creating more income and employment.

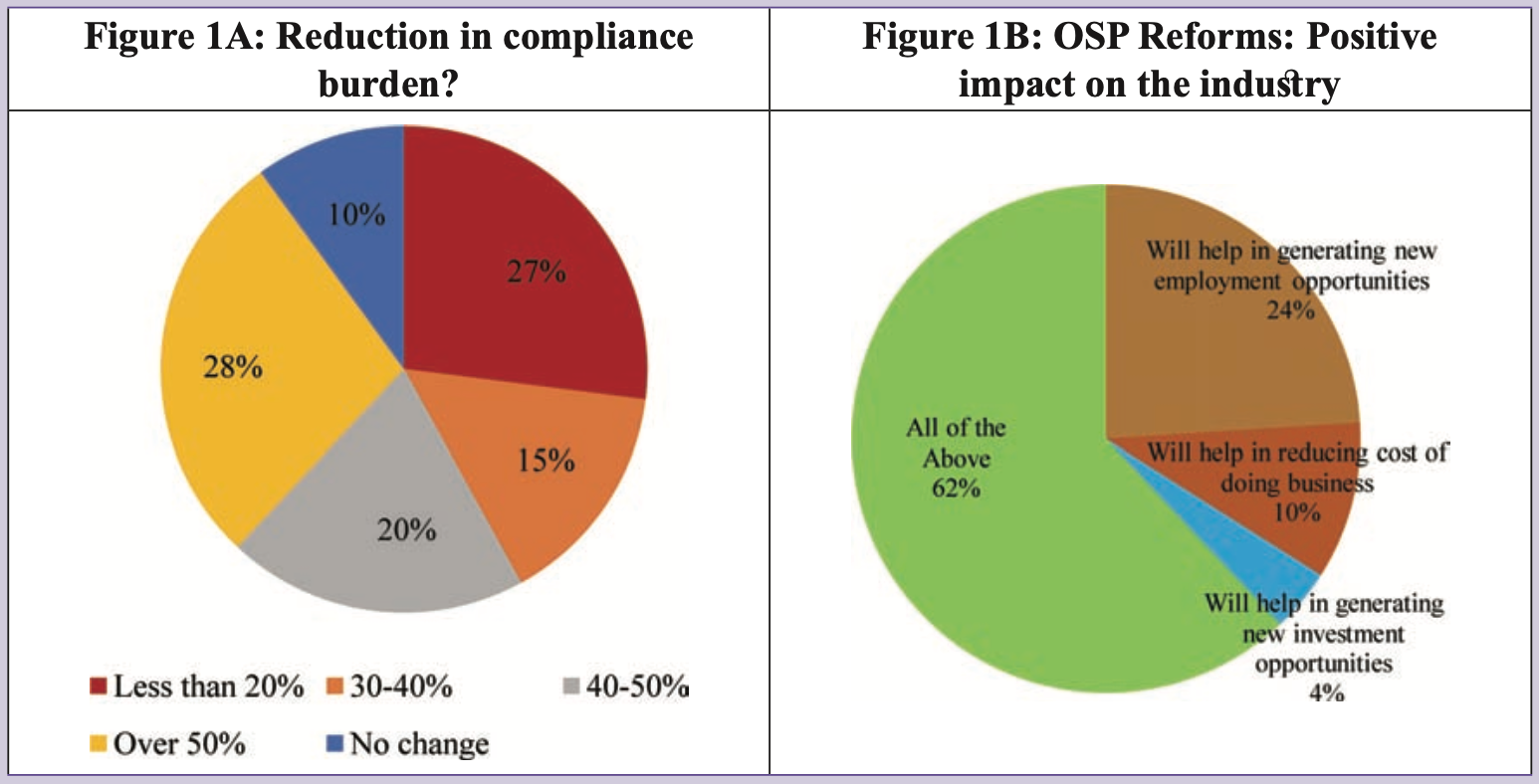

NASSCOM undertook a survey between October to November 2021 to assess the impact of OSP reforms on IT-BPM Sector. Its findings are as follows:

92 per cent of the participants stated that the OSP reforms have helped reduce compliance burden. While 28 per cent of the participants responded that their compliance burden reduced by more than 50 per cent, 20 per cent of participants acknowledged compliance reduced by 40-50 per cent. 15 per cent of participants responded that compliance reduction by 30-40 per cent (Figure 1A).

24 per cent of the respondents expect that OSP reforms will help in generating new employment opportunities, 10 per cent expect that it will reduce the cost of doing business in India, whereas 64 per cent expect all these benefits to accrue (Figure 1B).

Further, 83 per cent of the participants responded that these reforms will help in reducing the financial burden; 24 per cent of the respondents stated that these reforms have significantly enhanced productivity of their organization; and 94 per cent said that these reforms will increase competitiveness globally.

Almost all participants were satisfied with the work from home/work from anywhere relaxations’.

Over 62 per cent of the respondents indicate that they will increase their employment by 5-10 per cent annually over the next 5 years; and around 50 per cent of the respondents indicated expanding into new locations.

CT Bureau

You must be logged in to post a comment Login