Company News

The reason why Apple didn’t increase iPhone prices

Apple announced that is latest line-up of iPhones 14, while having enhanced qualities, will be sold all at the same prices as last year’s models, despite inflationary pressure that was leading many analysts to $100 price hike forecast.

This paints a picture that poses a danger for Apple: is the world’s largest company going to see its margins shrink and its profitability reduced?

In this article, I would like to highlight what I think Apple’s strategy may be to deliver yet again improving results that keep its high margins up.

The context

The research firm International Data Corp expects a worldwide decline in 2022 smartphone shipments of 6.5%. Nonetheless, the average price for new smartphones is expected to finish this year about 6% higher than last year, with the premium segment (where we find Apple) that is proving to be resilient to the economic turmoil with a 4% growth in market share to 16% of the total smartphone market.

The picture is somewhat mixed. On one side we have a weakening economy, on the other, we see Apple among the resilient businesses. But, by keeping iPhones prices the same, Apple will risk the undermining of its profits, given the fact that inflation drives up production costs. Some believe that Apple will take this hit, given its net income of $79 billion in the first three quarters of the year. However, I would like to show that we shouldn’t be too rash in stating that Apple will just give up a small percentage, yet big in absolute terms, of its profits without doing anything to prevent it.

Apple sold an estimated 106 million iPhones through the first half of this year, an 8% increase and still expects to reach 220 million iPhones for 2022. Furthermore, the annual revenue estimates see Apple reaching an $88.47 billion 4th quarter, which, in confirmed, is a 6% growth YoY.

The analyst Dan Ives has also pointed out that Apple’s initial order for 90 million iPhone 14 units has “stayed firm”. In fact, almost 25% of the 1 billion iPhone users across the world have not upgraded in 3.5 years and demand in China for the high-end devices continues to remain strong.

So, if sales are expected to grow 6% while inflation is around 8% it seems reasonable to expect Apple to suffer a bit. We could also account the strong dollar that is hurting Apple’s revenue outside the U.S. All of this leads us to the question about Apple’s next fiscal year.

The business model: from a transactional to a subscription company

If Apple were to rely only on its devices sales, then there wouldn’t be a way around it: keeping prices the same means shrinking margins. However, is Apple only a transactional company?

Before we dive into some math, we have to consider that Apple is changing its business model, leveraging the fact that it is able to place its hardware devices in every corner. Instead of profiting only from selling hardware, Apple is gradually shifting its focus on maximizing the way to monetize the huge base of installed devices it has all over the world. In other words, Apple is considering every device not only as product sales revenue, but also as the key to earn more money from its user during the device lifetime. If we want to make it even clearer, Apple wants to make more money from its devices, especially the iPhones, the iPads and the MacBooks.

How is Apple achieving this? Through services. Apple offers different subscription services that offer recurrent revenue from every device. This is why Apple has started breaking down its revenue between products and services. By doing this, Apple can show how its real growth driver at the moment is found in the offered services.

I think it is still to understand the leveraging power Apple has. While many subscription based companies need to prove to their customers the value of their services, Apple has the huge advantage of basing its subscriptions on material goods that millions of customers around the world already have and want to have. I think this is Apple’s real moat: it is materially present almost everywhere with its devices. Now it only needs to extract more money from their daily usage.

Seeking recurrent revenue

Back in March 2022, Bloomberg reported that Apple is working on a hardware subscription service for the iPhone which would not be equal to the full price split over 24 months, but that would really offer a new way of becoming an iPhone user. However, while this news is promising, we don’t have enough data to make a forecast of the positive impact if will have on Apple.

Things are different if we look at the current services. Back in 2016, the average Apple user was estimated to pay $1 per day for hardware and services. According to Katy Huberty, an Apple analyst, at present the average user spends $280 each year on Apple hardware and an additional $69 on services. It is also widely believed that there are about 1 billion Apple users who can give Apple recurring sales income as they adopt new service subscriptions.

According to the analyst Woodring, Apple users will spend in a few years $2 per day on Apple products or services, a figure already achieved by US iPhone owners. This means that Apple will see a daily revenue of $2 billion, which leads to an annual revenue of $730 billion, which is twice the size of the revenue Apple reported in 2021. It can be reasonable to expect that as the hardware subscription service kicks off, the program will boost the adoption of Apple’s first-party services, such as Music, iCloud, etc. This should have a positive impact on services growth but it should also diminish the company’s dependence on App Store sales. In fact, around 30% of Apple’s current services revenue comes from here. The more Apple sells its first-hand services, the larger the chunk of profits it can retain. However, third party apps are indeed a very profitable business, as Apple has very low costs to earn this revenue since it just needs to make its app store available.

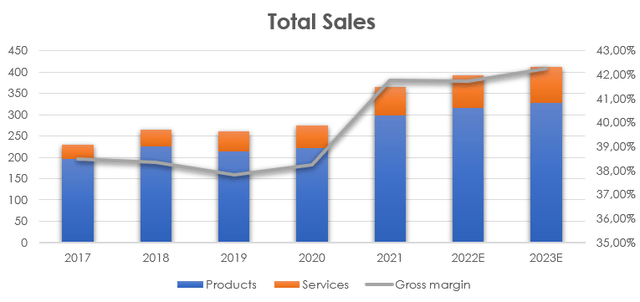

So far, we know that at the end of fiscal year 2021, Apple users had 785 million paid subscriptions across Apple’s first and third-party services. With a reasonable forecast of $76 billion revenue from services in 2022, Apple will reach a 235% growth from the $32.7 billion services revenue reported in 2017, the year when Apple started reporting its net sales with the breakdown between products and services. In the same time span, revenue from products increased 160% from $196.5 billion to the expected $315.9 billion at the end of fiscal year 2022. This growth is shown in the graph below where we see the annual sales split up in products and services.

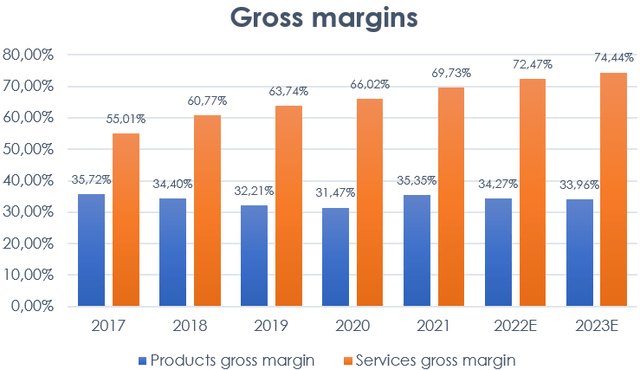

However, the importance of this graph is not only to highlight the growing chunk of the services revenue, but also to show that as services revenue grows, so does the gross margin. Currently, services account for about 20% of the total revenues, but the impact they have on margins is becoming more and more meaningful. In fact, the cost of services is decreasing as a percentage of total costs, moving from 10.43% in 2017 to 9.24% in 2022. In addition, and even more importantly, the gross margin Apple obtains from the services revenue is moving up from 55% in 2017 to around 72.5% at the end of FY22, as shown below. During the same period of time, the gross margin of the products revenue has seen actually a compression or around 2 pps.

Nonetheless, even if the products gross margin shrunk, the increase in services gross margin, even if it has an impact on only 20% of total revenues, has been so meaningful to drag upwards the total gross margin of Apple that moved up from 38.5% in 2017 to almost 42% at the end of last year, with a forecast for this fiscal year to be still around this level.

So, why can Apple afford not to raise prices this year? For sure, part of is a marketing expense that wants to make customers perceive the iPhone as somewhat in reach in an inflationary environment where everything costs more. But, the impact on the revenue will not be as great as we may expect because Apple knows that it is monetizing better all its users. Therefore, Apple knows that even though purchase price of the iPhones remains the same, the company is extracting more money from a device compared to what it was able to do just a year ago.

In fact, if we divide last year’s services revenue by Apple’s users we see that in 2021 every user spent around $68 in annual services (keep in mind that the $2 per day reported above takes into account products and services together). This year Apple should see at least an 11.7% growth to $76 annual services revenue per user. Clearly, the annual services revenue per user is meaningful.

We can also look at this revenue from another point of view to understand the possible growth for this segment. During the last earnings call, Tim Cook reported that

We now have more than 860 million paid subscriptions across the services on our platform, which is up more than 160 million during the last 12 months alone.

If we divide the $76.8 billion services revenue by the 860 million paid subscription we get that the revenue per subscription is $89, which proves once more that Apple knows it has room to turn more users into paying subscribers.

In any case, this services growth is enough to offset the current inflation rate, which, as many believe, is set to come down during 2023, where services should have at least a 21% weight on total revenues. Thus, even if the products revenue stays flat (and this would be somewhat of a surprise given the fact that the premium segment is growing), we would have a fifth of total revenues bump up another 10-13%, with a very low cost of sales. The impact on the revenue might still be just around 2%, however the impact on the gross margin will be already more tangible, lifting it up above 42% thus leading Apple to new record profits.

To this strategy, we could also add that Apple is developing its direct to consumer sales through its e-commerce. Some estimates show that around 15% of iPhone shipments, 30% of Mac/iPads, and 20-25% of Wearables (AirPods and Apple Watch) are sold directly through this channel which brings Apple to enjoy more margins while decreasing sales costs.

We mentioned briefly that Apple could also a FX problem. While I think the company may expect a little weakening of the dollar, given the point it has reached this year, I think that the fact the company didn’t raise prices show how much Apple relies on the shift towards services revenue. SeekingAlpha

You must be logged in to post a comment Login