Trends

Thailand smartphone shipments down 10% YoY in Q1 2022

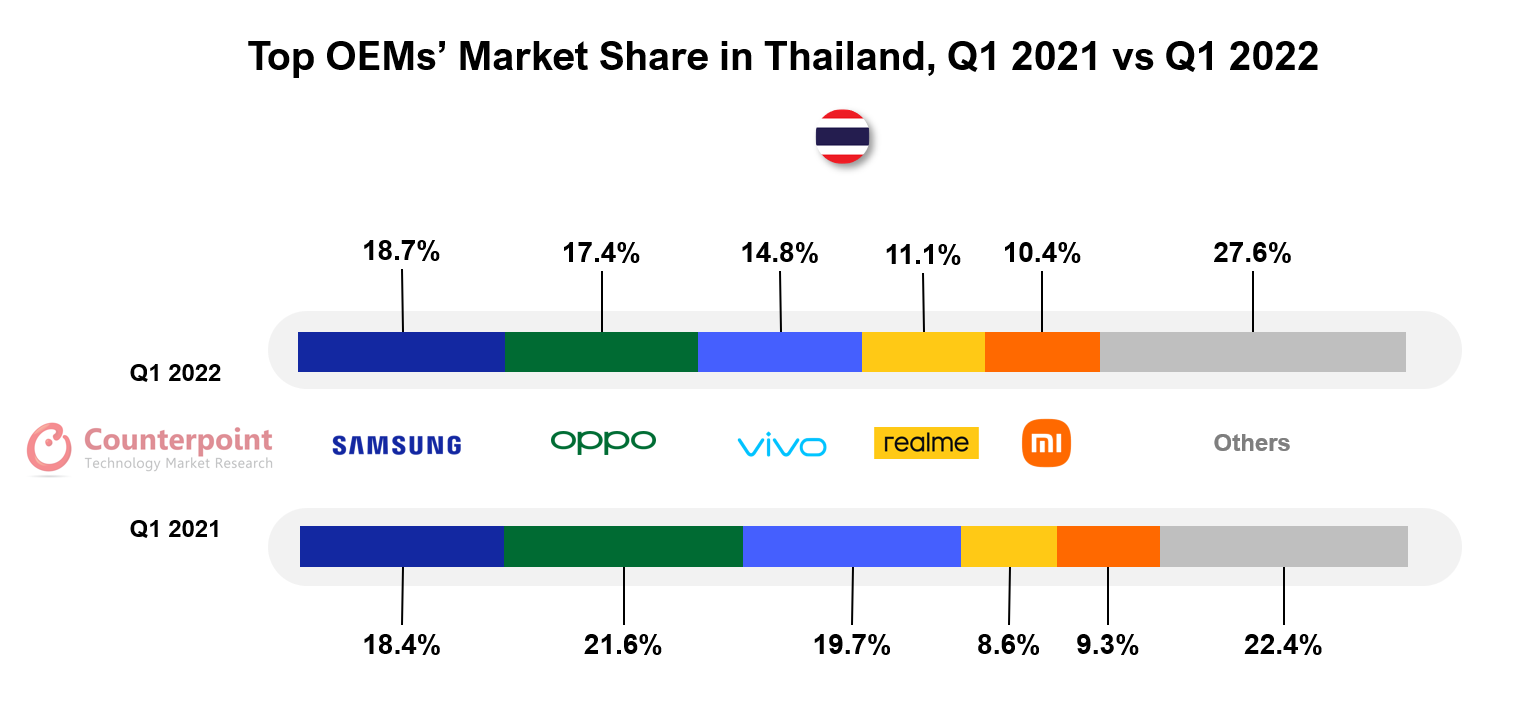

Thailand’s smartphone shipments fell 10% YoY in Q1 2022, according to Counterpoint Research’s Southeast Asia Monthly Smartphone Channel Share Tracker. Various factors contributed to the decline, including a sluggish economy, supply constraints, rising inflation and a tight-fisted consumer. Thailand’s sustained economic weakness continued in Q1 2022 due to COVID-19 and its after-effects. The government and industry struggled in reviving the consumer sentiment and bringing the purchasing power back to normal levels.

Focusing on the factors that affected the shipments in Q1 2022, Senior Analyst Glen Cardoza said, “New models launched in Q1 2022 pushed volumes in the Thai market but the demand in the low-to-mid-level segments saw a slowdown. Tourism was supposed to pick up in Q1 but instead, the government was only able to loosen the restriction on international travel in Q2. While the industry initiatives continue, consumers are reeling under rising inflation levels and a large number of them are holding on to their wallets.”

Samsung managed to plan and execute its shipments in a much better way than other brands. As a result, it was able to grab the biggest market share. The brand’s S22 series sold more than its previous generation, with the Thailand market giving a better reception to this premium model family compared to the other Southeast Asian markets. OPPO and vivo concentrated on their marketing campaigns and offers. vivo also concentrated on its offline channel growth. Xiaomi continued with its offers and its close online association with JD central.

The 5G share of smartphones in Thailand’s overall shipments reached 48% in Q1 2022 and will keep increasing in the coming months. 5G industrial test cases and applications are being accelerated to make sure domestic efficiencies and export levels improve. Operators are closely working with smartphone OEMs on bundles and packages.

Players have started offering more experiential value adds over and above their conventional services. Operators like AIS are partnering outside their industry and branching into big data utilization and AI applications while retailers like Jaymart are looking to engage more with consumers by starting ‘digital cafés’ to keep consumers within stores. OEMs’ associations with online channel players have continued over the last year. The online share of shipments made up 22% in Q1 2022, growing 15% YoY. Shopee and Lazada grabbed 61% of platform shipments through online channels.

Commenting more on the ecosystem, Cardoza said, “Apart from supply constraints, China’s COVID-19 situation is affecting Thailand’s imports. While international tourism might take some time to get back to normal levels, the government and industry are focused on increasing domestic tourism and exports. With increased borrowing, the government does not want the common consumer to suffer from increased inflation. Under these conditions, the coming months should see a gradual improvement in consumer buying behavior and subsequently, OEM shipments.”

The coming two quarters are essential for Thailand to rise from this economic turbulence. We might just see a push in shipments and sales in the coming months due to pent-up demand.

CT Bureau

You must be logged in to post a comment Login