Headlines of the Day

Indian IT sector well-prepared, as long as is temporary slowdown

The Indian investing community had high expectations for the Nifty 50 index to reach the significant milestone of 20,000 last week. However, these hopes were dampened by Infosys’ financial results, which caused a pullback just before reaching the target.

The Indian IT sector’s earnings season commenced with a cautious tone. TCS, a major player in the industry, acknowledged that global macroeconomic headwinds were impacting their revenue and margins. Earlier, Morgan Stanley had predicted a modest performance for the Indian tech industry in Q1FY24, with expectations of improvement in the second half of FY24.

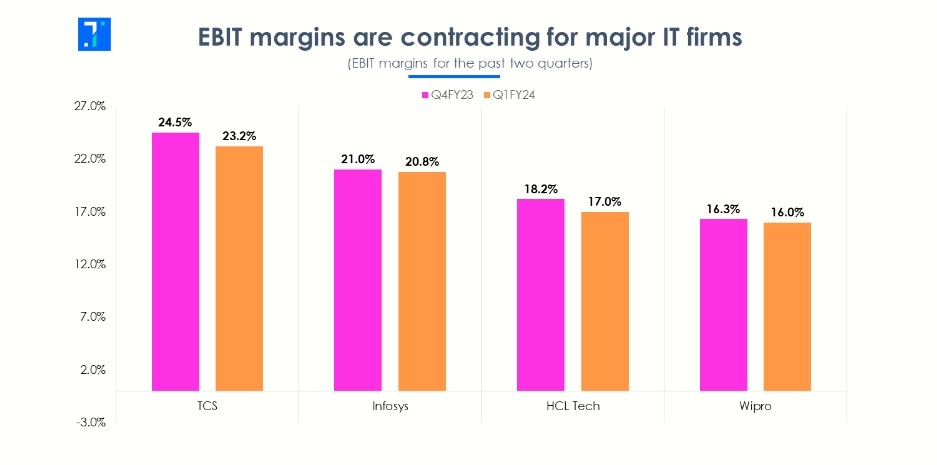

India’s software services have been a crucial driving force behind the country’s economic growth, contributing nearly 19% of overall exports and experiencing a notable 20% growth in FY23. However, the Q1FY24 earnings season has been underwhelming, with the top four IT firms (TCS, Infosys, Wipro, and HCL Technologies) reporting lackluster earnings and providing lower revenue guidance due to the ongoing global economic slowdown.

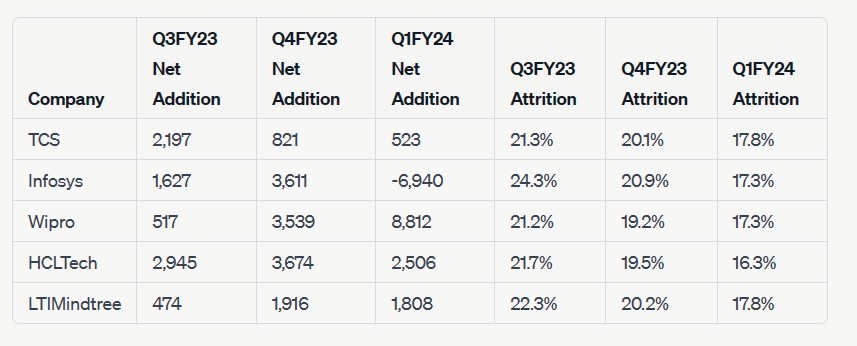

Here is the table summarizing the employee metrics of the major Indian IT companies for Q3FY23, Q4FY23, and Q1FY24:

During the April-June 2023 quarter, Nifty IT experienced a modest 3% increase as investors re-evaluated the once-booming sector. In contrast, the broader Nifty 50 index rose by approximately 11% during the same period, clearly indicating that the IT sector has become a laggard. The industry’s growth outlook is being questioned due to recessionary pressures, global financial turmoil, spending cuts, and the increasing prominence of technologies like AI. These factors have cast uncertainty over the IT sector’s future growth prospects.

Winners and losers screener

During the Q1FY24 earnings season, the performance of Indian IT firms was mixed, with TCS and HCL recording moderate results, while Infosys and Wipro reported weaker numbers, highlighting the ongoing slowdown in the sector.

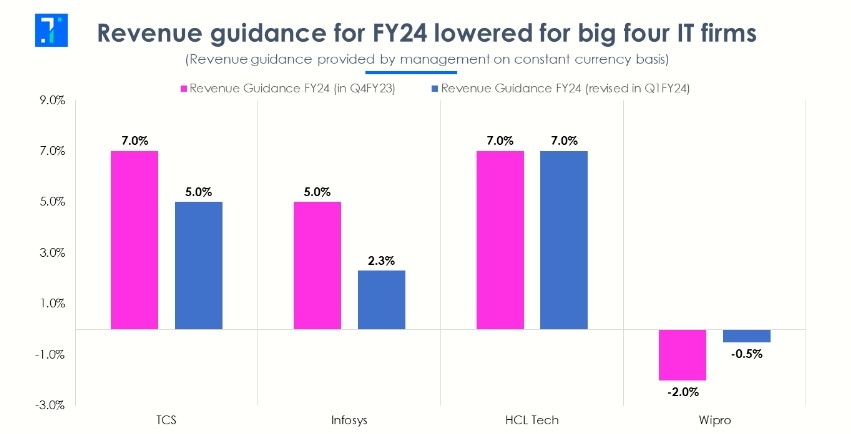

Notably, a significant development during this season was the revision of revenue guidance by IT companies. For instance, Infosys adjusted its FY24 revenue guidance from the earlier estimate of 4-7% constant currency growth to a narrower range of 1-3.5%.

Commenting on the reasons behind the lower guidance, Infosys CEO Salil Parekh mentioned that some clients have been reducing or halting work on transformational programs and projects in the short term.

This trend has been particularly noticeable in various industries, including financial services, mortgages, asset management, investment banking, payments, telecom, high-tech, and parts of the retail sector. These adjustments in revenue outlooks indicate the challenges the IT industry is facing in the current economic environment.

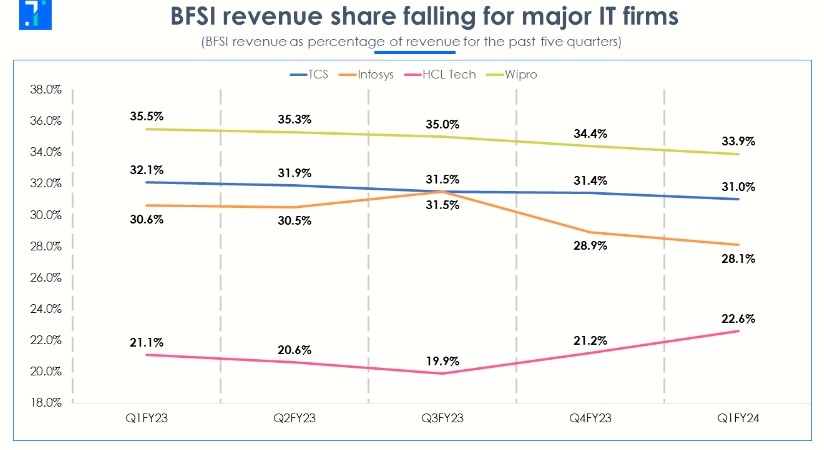

Wipro indicated a revenue guidance ranging from -2% to 1%, whereas HCL and TCS projected their numbers at approximately 5% to 7%. The primary factor influencing the lower revenue guidance is the slowdown in the global BFSI (Banking, Financial Services, and Insurance) sector. This particular vertical accounts for nearly 30% of IT services revenue and has experienced reduced spending on discretionary technology services. The impact of this spending cut in the BFSI sector has had a significant effect on the overall revenue outlook for IT companies.

All IT firms, except HCL, have experienced a decline in revenue from BFSI clients, prompting them to diversify into other sectors like retail, pharmaceuticals, and automotive. Over the past three years, the BFSI sector’s share of revenue has notably decreased from 40%.

Additionally, the telecom sector has also witnessed a reduction in its revenue share. On a positive note, the retail, energy, and manufacturing sectors are showing increased interest in adopting higher technology solutions post-pandemic.

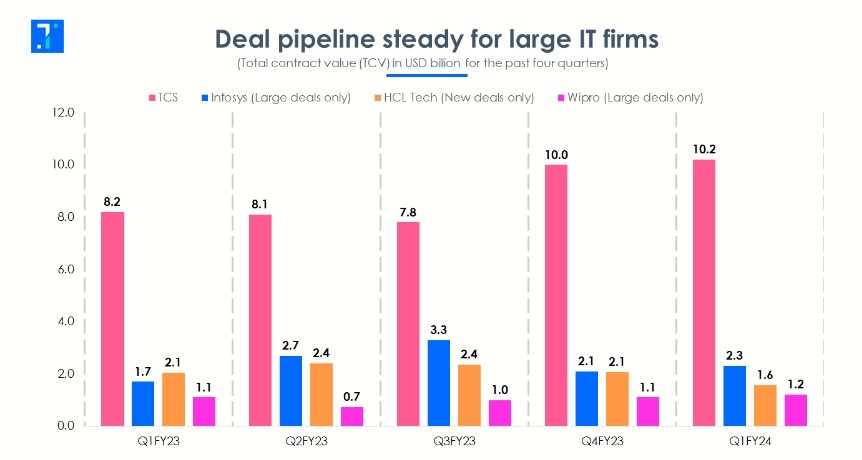

However, the tech companies are facing challenges due to slower decision-making processes, which are clogging up the deal pipeline. Rising interest rates and the collapse of financial institutions like Silicon Valley Bank and Credit Suisse have led banks and finance companies to delay new IT spending until the economic situation stabilizes.

As a result, large deals are still happening, but they are taking longer to finalize as decision-making authority gets elevated to CEOs and CTOs in client companies. Previously, when interest rates were low, customers were funding many ambitious tech projects, but the situation has now changed. Clients have become more cautious, adopting a month-to-month approach, leading to uncertainty and reduced visibility on their future spending.

According to TCS CEO K Krithivasan, macro uncertainties have prompted clients to prioritize projects that offer faster ROI realization and are business-critical. As a consequence, the conversion rate for new deals has decreased, and it is expected that order inflow may slow down in the future.

During the Q1FY24 results, IT companies have faced various performances compared to their revenue and net profit estimates. Here’s a summary of notable stocks:

Tanla Platforms surpassed expectations with a 12.6% QoQ growth in net profit, reaching Rs 135.4 crore, beating Trendlyne’s Forecaster estimates by 16.2%. Its revenue also rose by 9.3% YoY to Rs 911.1 crore, surpassing estimates by 7.6%. The company’s revenue growth was supported by the enterprise and platform segments, driven by a recovery in transaction volumes and an international long-distance (ILD) rate hike.

Tata Consultancy Services (TCS) managed to beat Forecaster estimates for net profit, despite a 2.8% QoQ decline to Rs 11,047 crore in Q1FY24. However, its revenue remained flat at Rs 59,381 crore, in line with estimates. The muted growth in the BFSI and retail segments, along with delays in non-critical projects, contributed to the flat revenue performance.

HCL Technologies faced the largest margin of miss among the big four in Q1FY24. Its net profit declined by 11.3% QoQ to Rs 3,534 crore, missing Forecaster estimates by 8.3%. Similarly, revenue fell by 1.5% QoQ to Rs 26,640 crore, missing Forecaster estimates by 1.9%. The slowdown in revenue from the technology and telecommunications segments resulted from cuts in discretionary spending and delays in decision-making.

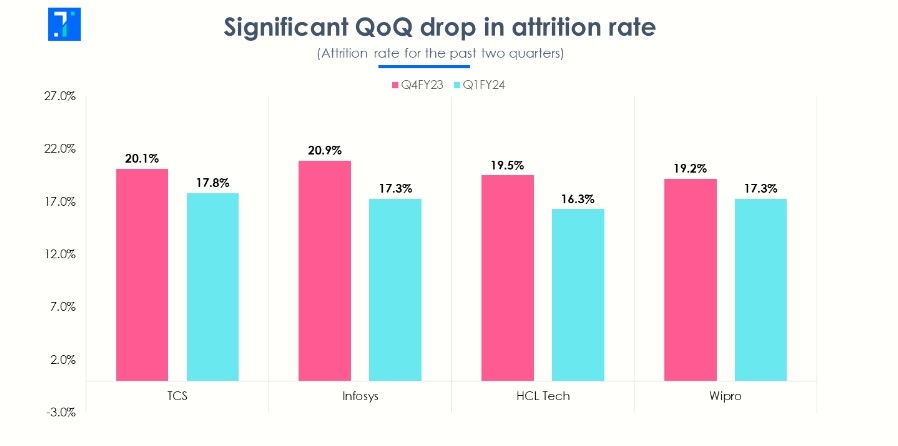

Overall, IT companies are dealing with various challenges, including slower decision-making affecting the deal pipeline, reduced revenue from BFSI and telecom sectors, and uncertainties surrounding AI adoption. However, efforts to retain talent and focus on margin improvement are being made to navigate through the global slowdown effectively. The Indian IT sector remains well-prepared to handle the current economic conditions, as long as it is a temporary slowdown. Trendlyne

You must be logged in to post a comment Login