Trends

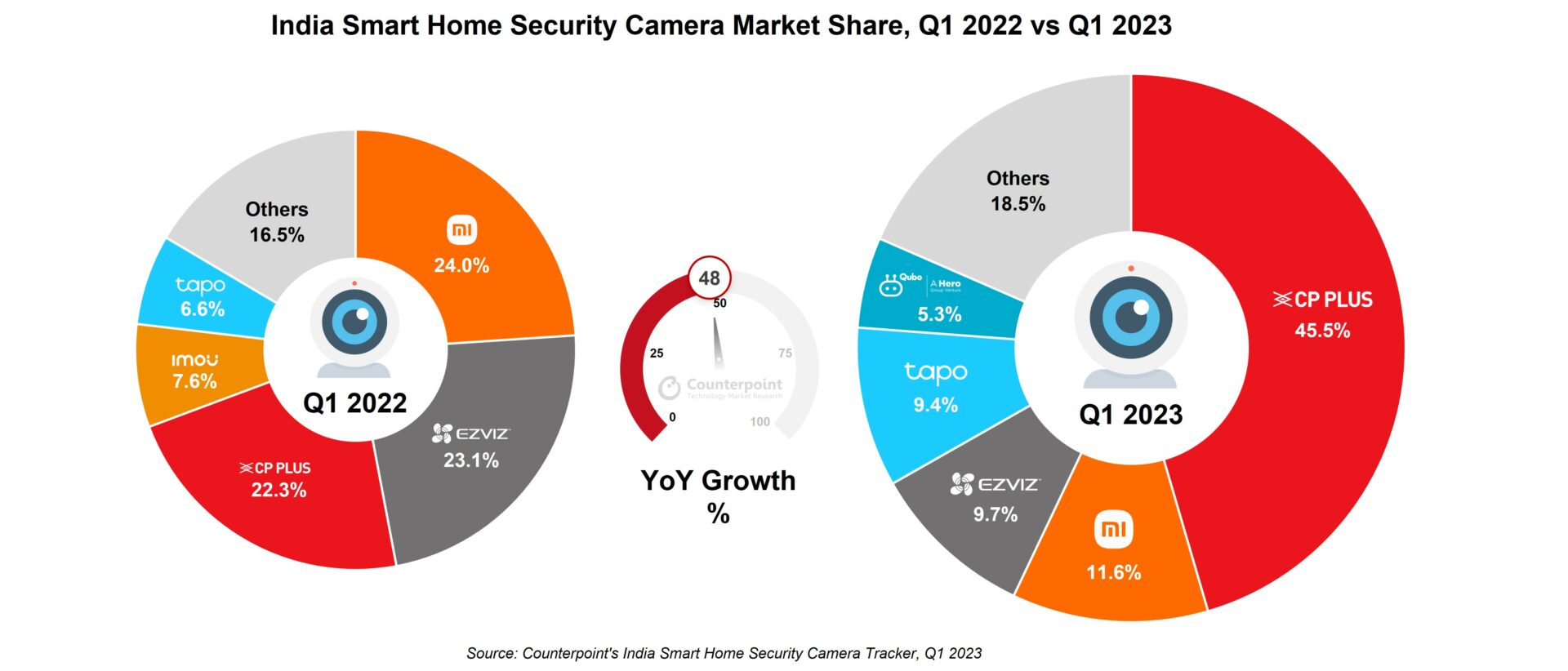

Smart home security camera shipments up 48% YoY in Q1 2023

India’s smart home security camera shipments grew 48% YoY in Q1 2023 (January-March), according to the latest research from Counterpoint’s Smart Home IoT Service. During the period, there was a strong increase in demand for home surveillance products as offices began reopening for working professionals. In Q1 2023, the average selling price of smart security cameras declined considerably YoY, with the INR1,500-INR 2,000 price range emerging as the most popular.

Commenting on the trend, Research Analyst Varun Gupta said, “Safety and security of homes have become a prime concern for most Indian households, which led to an increase in demand for smart security cameras and strong growth in shipments during the quarter. The industry has integrated AI into the devices to provide capabilities such as intrusion detection and motion detection, making household surroundings more secure. These functions have become more accessible in lower-cost cameras, driving overall demand. The shipment share of the INR1,500-INR2,000 price band jumped to 28% in Q1 2023 from 3% in Q1 2022. A decline in cost of components, especially those of memory and Wi-Fi chipsets, have led to a decline in the overall ASP.”

Gupta added, “The market remains consolidated. The top three brands took a combined market share of 67% in Q1 2023, with home-grown company CP Plus taking the top spot. Chinese brands, such as Xiaomi and EZVIZ, faced strong competition in the market due to the growth of existing and emerging players. TP-Link also launched smart cameras via its sub-brand Vigi to offer differentiated products to Small and Medium Businesses. Smart security cameras are becoming more popular among small retailers and enterprises due to their ease of use and minimal cost of ownership.”

Commenting on the overall market, Senior Research Analyst Anshika Jain said, “Indian brands now command nearly two-thirds of the Indian smart security camera market, with more than 60% of the products being manufactured in India. The market continues to perform well on online platforms and there has been a significant increase in the offline channels as well, with shipments exceeding 40% for the second consecutive quarter in Q1 2023. This indicates steady growth in the offline retail channels.”

Market Summary

- CP Plus by Aditya Infotech cemented its leadership position with 3x YoY growth in shipments in Q1 2023, which helped it capture a 45% market share. It launched several cameras in Q1 2023, particularly in 3MP and 4MP sizes. CP Plus was the top domestic manufacturer of smart security cameras with a 71% share. It has focused on making its products more affordable to consumers mostly via the offline retail market.

- Xiaomi ranked second with a 12% market share as its shipments fell 29% YoY in Q1 2023 mostly due to higher inventory levels and seasonal decline. Xiaomi’s Home Security Camera 2i was its best-selling model and second-best-selling camera model in the overall market.

- EZVIZ by Hikvision ended Q1 2023 at the third spot with a 10% share. Its shipments declined 38% YoY due to the aggressive pricing by competitors. It has focused more on offering made-in-India cameras to consumers with the C6N as the brand’s best-selling model. EZVIZ offers a wide variety of products and primarily focuses on cameras priced at >INR3,000.

- Tapo by TP-Link doubled its shipments YoY and captured the fourth spot with a 9% share. Although the brand has mostly focused on online retail channels, its visibility in the offline retail channels has also improved, especially in the large format stores. C210 was the brand’s bestseller in Q1 2023.

- Qubo by Hero Electronix grew 19% YoY and climbed to the fifth position with a 5% market share. It has focused on offering affordable indoor cameras, especially in the INR2,000-INR2,500 price band, while also aiming to improve product visibility in the offline retail channels. The Smart Cam 360 indoor camera was the brand’s best-performing model.

Other Emerging Brands

- Imou by Dahua Technologies fell 38% YoY mostly due to its lower popularity compared with other brands and poor visibility in the offline retail channels. Its Ranger series of cameras contributed to more than 60% of its total shipments.

- Kent grew marginally YoY in Q1 2023. It has focused on offline and online retail channels and has been a trusted water purifier brand for several years. All its cameras are manufactured in India, and we expect Kent to add more cameras to its portfolio this year.

- realme took a spot in the top 10 list in Q1 2023. However, it suffered an 18% YoY fall during the quarter, mostly due to a seasonal decline in demand for its cameras.

- Airtel has been one of the latest entrants in this space and is the only brand to offer cloud storage as a service. It aims to build on its existing brand presence to penetrate tier-1 and tier-2 cities.

- Zebronics grew significantly in Q1 2023 as it aims to offer affordable products to consumers and small retailers.

Counterpoint Research

You must be logged in to post a comment Login