Headlines of the Day

Private companies control 40% of Bharti Airtel; Institutions own 28%

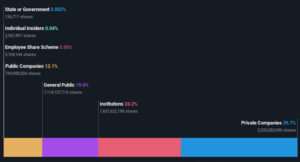

A look at the shareholders of Bharti Airtel Limited can tell us which group is most powerful. We can see that private companies own the lion’s share in the company with 40% ownership. Put another way, the group faces the maximum upside potential (or downside risk).

Meanwhile, institutions make up 28% of the company’s shareholders. Large companies usually have institutions as shareholders, and we usually see insiders owning shares in smaller companies.

Let’s delve deeper into each type of owner of Bharti Airtel, beginning with the chart below.

NSEI:BHARTIARTL Ownership Breakdown December 13th 2021

What does the institutional ownership tell us about Bharti Airtel?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

As you can see, institutional investors have a fair amount of stake in Bharti Airtel. This can indicate that the company has a certain degree of credibility in the investment community. However, it is best to be wary of relying on the supposed validation that comes with institutional investors. They too, get it wrong sometimes. If multiple institutions change their view on a stock at the same time, you could see the share price drop fast. It’s therefore worth looking at Bharti Airtel’s earnings history below. Of course, the future is what really matters.

NSEI:BHARTIARTL Earnings and Revenue Growth December 13th 2021

Bharti Airtel is not owned by hedge funds. The company’s largest shareholder is Bharti Enterprises Limited, with ownership of 39%. For context, the second largest shareholder holds about 13% of the shares outstanding, followed by an ownership of 3.6% by the third-largest shareholder.

After doing some more digging, we found that the top 2 shareholders collectively control more than half of the company’s shares, implying that they have considerable power to influence the company’s decisions.

Researching institutional ownership is a good way to gauge and filter a stock’s expected performance. The same can be achieved by studying analyst sentiments. There are plenty of analysts covering the stock, so it might be worth seeing what they are forecasting, too.

Insider ownership of Bharti Airtel

The definition of company insiders can be subjective and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

Our most recent data indicates that insiders own less than 1% of Bharti Airtel Limited. However, it’s possible that insiders might have an indirect interest through a more complex structure. Being so large, we would not expect insiders to own a large proportion of the stock. Collectively, they own ₹1.7b of stock. It is good to see board members owning shares, but it might be worth checking if those insiders have been buying.

General public ownership

With a 19% ownership, the general public, mostly comprising of individual investors, have some degree of sway over Bharti Airtel. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

Private company ownership

It seems that Private Companies own 40%, of the Bharti Airtel stock. It’s hard to draw any conclusions from this fact alone, so its worth looking into who owns those private companies. Sometimes insiders or other related parties have an interest in shares in a public company through a separate private company.

Public company ownership

It appears to us that public companies own 13% of Bharti Airtel. We can’t be certain but it is quite possible this is a strategic stake. The businesses may be similar, or work together.

Next steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too. Case in point: We’ve spotted 1 warning sign for Bharti Airtel you should be aware of.

Ultimately the future is most important. You can access this free report on analyst forecasts for the company. Simply Wall St

You must be logged in to post a comment Login