Trends

Philippines smartphone shipments down 5% in Q1

The Philippines smartphone shipments witnessed a 5% YoY and 13% QoQ decrease in Q1 2022, according to Counterpoint Research’s Monthly Philippines Channel Share Tracker. Shortages of critical components and COVID-19 restrictions in China contributed to the decline in shipments, while the opening of the market and new launches checked this decline. The quarter had a slow start following seasonal trends. However, new launches hitting the market in the latter half of the quarter saw most brands increasing their overall offline and online channel shipments.

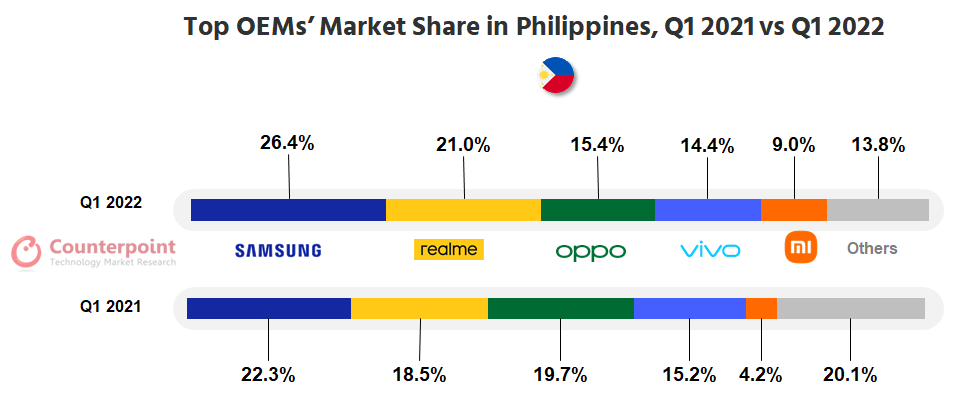

In terms of market share, Samsung took the top spot in Q1 2022 with 26.4% due to its newly launched A series and S22 series. realme followed with a 21% share driven by its C series. OPPO had a 15.4% share driven by the Reno A series and vivo had a 14.4% share driven by its V and Y series. Xiaomi saw the highest YoY growth in Q1 2022 at 104%, taking its share to 9%, as its Redmi phones performed well during the quarter.

Talking about the factors affecting the Philippines smartphone shipments, Research Analyst Akash Jatwala said, “Samsung maintained its lead in the market due to its promotions and better performance of its S22 series. realme’s performance improved due to its affordable smartphones, especially its C series. Chinese players including Xiaomi, OPPO, vivo and realme launched various promotion campaigns on the online channel, especially on Shopee and Lazada, which also contributed to their shipments. The e-commerce sector is growing fast in the region. The online channel accounted for around 19% of the total shipments in Q1 2021, growing about 28% YoY.”

Commenting on mobile gaming, Jatwala said, “The Philippines is fast emerging as a major gaming market in Southeast Asia and brands are not lagging in fulfilling the gamers’ demands. High-end gaming phones such as ZTE’s Nubia RedMagic 7, Asus ROG Phone 5s and 5s Pro, and the Black Shark 4 Pro are performing well in the market. Major brands are also not behind and are partnering with gaming leagues to become the official sponsor. Samsung has partnered with MLBB Professional Leagues, whereas realme has partnered with the Philippines national e-sports team SIBOL.”

Major telecom operators Dito, Smart and Globe Telecom have been actively expanding 5G coverage to face the competition and increase customer offerings. 5G device penetration also increased in Q1 2022 to reach 27.3% of the overall shipments. The Philippines has one of the fastest average 5G download speeds in the Asia-Pacific region.

In the coming months, COVID-19 restrictions in China and global inflation may impact smartphone shipments. As a result, Q2 2022 may see some YoY decline in shipments. The Philippines posted a GDP growth of 8.3% in Q1 2022 with recovering consumer sentiment. We expect a growth in YoY shipments in the coming quarters.

CT Bureau

You must be logged in to post a comment Login