Company News

Nokia Corporation financial report for Q4 and Full Year 2021

Nokia ends with a solid and transformational year. 2021 was a transformational year for Nokia, including refocusing on and strengthening our technology leadership. In Q4, Nokia’s underlying business performed largely as expected with other operating income being above expectations.

Q4 net sales declined 5% y-o-y in constant currency as expected with strong growth in Network Infrastructure of +10% offset by Mobile Networks at -16%. Full year net sales grew 3% y-o-y in constant currency.

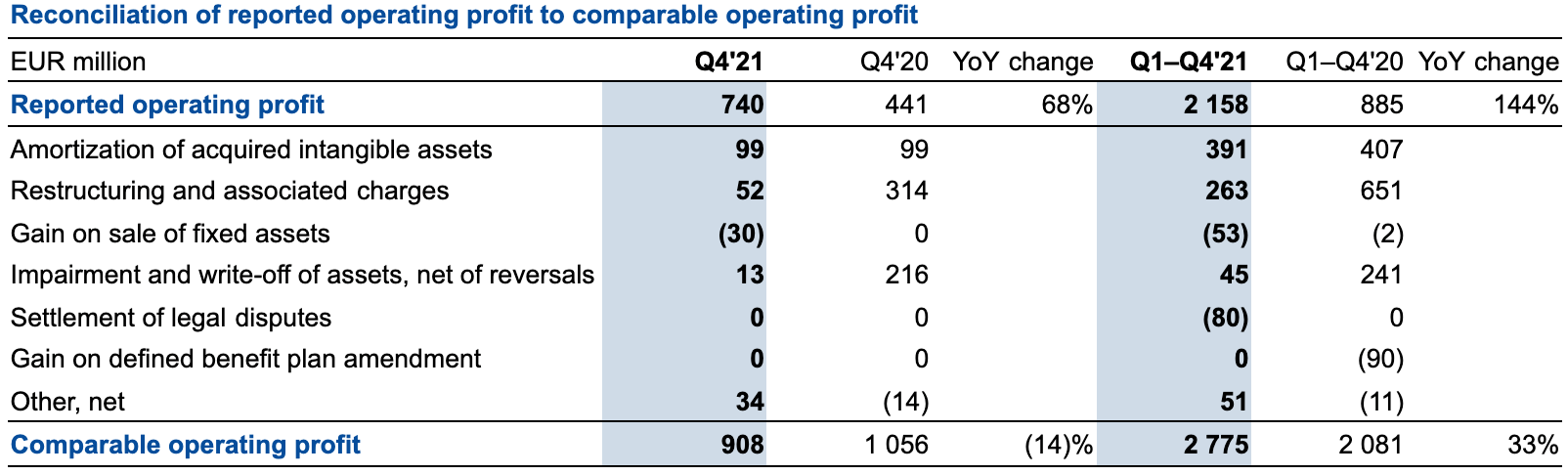

Comparable operating margin of 14.2% (reported 11.5%) in Q4 declined 190bps y-o-y (reported +480bps) due to lower Q4 seasonality as expected.

Full year comparable operating margin of 12.5% (reported 9.7%) expanded 300bps y-o-y (reported +570bps) but also benefited from approximately 150bps of one-offs.

Comparable diluted EPS of EUR 0.13 in Q4; reported diluted EPS of EUR 0.12.

Continued strong free cash flow generation of EUR 0.4bn in Q4. Full year free cash flow of EUR 2.4bn.

Guidance for 2022 net sales of EUR 22.6-23.8bn and a comparable operating margin in the range 11-13.5%.

New long-term targets to grow revenue faster than the market and a comparable operating margin of ≥14%.

Board proposes dividend authorization of EUR 0.08 per share. Share buyback program to be initiated to return EUR 600m over 2 years.

Pekka Lundmark, President and CEO, on Q4 and Full Year 2021 results:

“2021 was a strong year for Nokia driven by our growing technology leadership, robust demand and a faster than expected reset of our business. This enabled us to deliver 3% constant currency net sales growth and a comparable operating margin of 12.5%. Thanks to a solid Q4 capping off a strong 2021, we have created an excellent foundation as we begin to move into the next phase of our strategy to deliver growth and expand profitability.

All our business groups made significant progress this year to make us more competitive in all the markets in which we compete. Mobile Networks largely closed the gap to competition in 5G and improved its gross margin while continuing to step up R&D investments. Network Infrastructure extended its technology leadership with significant growth driven by Fixed Networks and Submarine Networks. Cloud and Network Services continued to rebalance its portfolio and saw encouraging growth in its key focus areas. Nokia Technologies made good progress expanding in areas such as automotive and consumer electronics.

The progress we have made with cash generation in the business has strengthened our balance sheet to the point we can look to reinstate shareholder distributions through both a dividend and share buyback program.

Nokia enters 2022 in a strong position with improved margins, faster than expected strategy execution and a high order backlog, although the global supply chain situation remains tight. We see opportunities in the 5G roll out and growing enterprise market. Accordingly, we expect 2022 to bring another year of sales growth and we are targeting a comparable operating margin of 11-13.5% in 2022.

Considering how quickly we have executed on our strategy, we are now introducing new long-term targets. We still expect to deliver progress in 2023 but we want to emphasize that is not the end of our ambition. Our long-term target is to grow faster than the market and to achieve a comparable operating margin of at least 14%. The pace of delivery will depend on both the market environment and decisions we may make on R&D investments to secure our long-term competitiveness and sustainable profitability.

Finally, I want to thank our employees whose excellence, resilience and adaptability have been critical in delivering this performance in 2021. We recognise how valuable each person is to Nokia’s performance and we will increase investment in our people through our renewed people strategy.”

Financial results

Comparable ROIC = Comparable operating profit after tax, last four quarters / invested capital, average of last five quarters’ ending balances.

Shareholder distribution

Dividend policy and 2021 proposal

In line with Nokia’s dividend policy as stated below, Nokia’s Board of Directors proposes that the Annual General Meeting authorizes the Board to resolve on a dividend of EUR 0.08 per share be paid to investors in respect of financial year 2021. If the resolution is approved the dividend would be paid in quarterly installments starting after the AGM.

Our dividend policy is to target recurring, stable and over time growing ordinary dividend payments, taking into account the previous year’s earnings as well as the company’s financial position and business outlook.

Share buyback program

In 2020 and 2021, Nokia has generated strong cash flow which has significantly improved the cash position of the company. To manage the company’s capital structure, Nokia’s Board of Directors is initiating a share buyback program under the current authorization from the AGM to repurchase shares, with purchases expected to begin in Q1. The program targets to return up to EUR 600m of cash to shareholders in tranches over a period of two years, subject to continued authorization from the AGM.

Outlook

- Outlook assumptions

- Long-term targets

- Risk factors

- Forward-looking statements

CT Bureau

You must be logged in to post a comment Login