International Circuit

Middle East smartphone shipments witness robust 21% growth in Q3

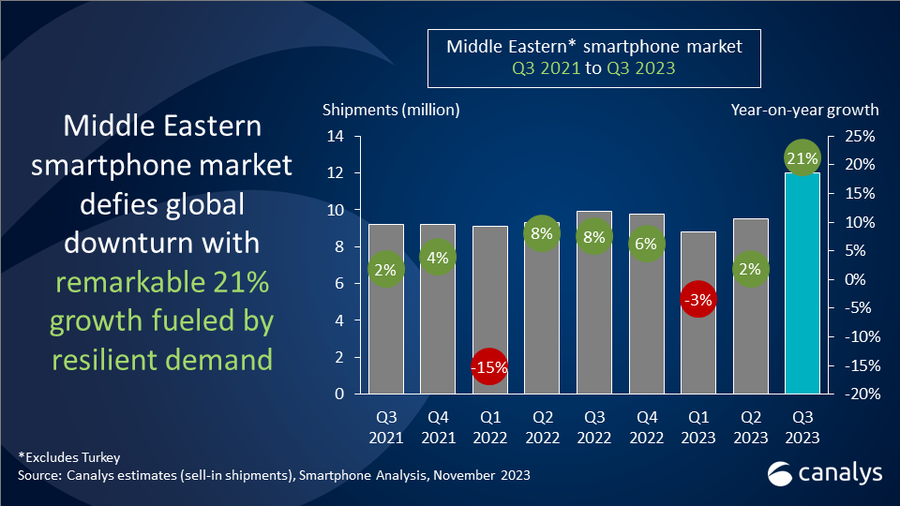

According to Canalys research, smartphone shipments in the Middle East (excluding Turkey) reached 12.0 million in Q3 2023, with a notable 21% annual growth surge. This was thanks to unwavering domestic demand, with businesses noting an increase in both their consumer bases and job opportunities. Despite falling oil prices, the non-oil sector continued to make significant contributions.

Shipments rocket in Iraq and Saudi Arabia

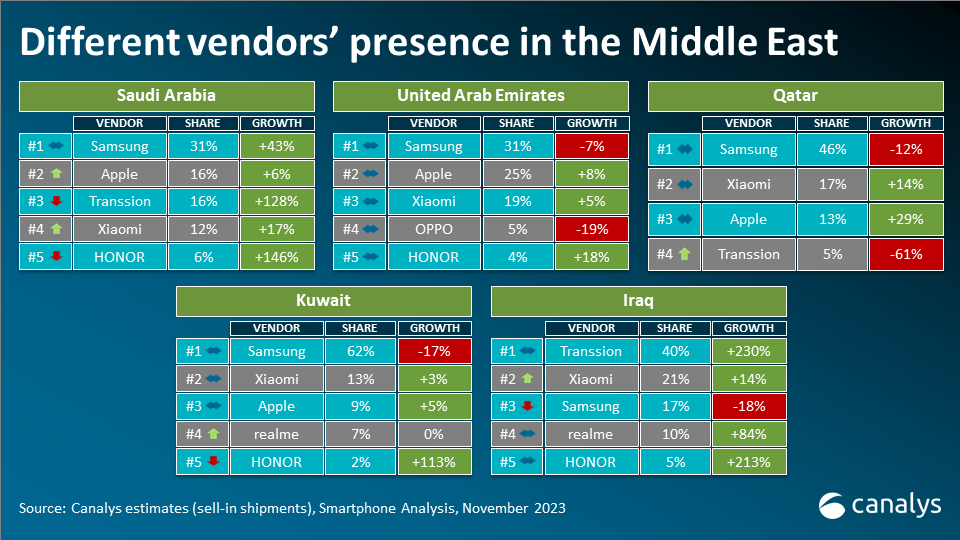

In Q3 2023, Saudi Arabia soared with strong 46% year-on-year growth in smartphone shipments, driven by increasing demand for entry-level models. Despite immediate hurdles, government spending is poised to uphold economic diversification. Shipments in the United Arab Emirates rose by a modest 2%, fueled by an expat and tourist influx, and received positive momentum from investors, consumers and the private sector. Iraq continued its strong momentum with 57% growth driven by demand for sub-US$150 phones and increased brand activities. But Iraq faces import challenges due to US dollar procurement issues and a financial access gap, with 80% of adults lacking a bank account. On the other hand, Kuwait and Qatar saw shipment drops of 4% and 2%, respectively, due to strict job regulations in Kuwait and subdued consumer demand.

Budget models in demand as mass-market segment expands

“During Q3, shipments of budget (sub-US$200) models surged, fueled by TRANSSION, Xiaomi and HONOR in lower-ASP markets,” said Manish Pravinkumar, Dubai-based Senior Consultant at Canalys. “TRANSSION is steadily increasing its footprint in response to the expanding mass-market segment amid broader economic uncertainties. Infinix introduced exclusive models with Noon in Saudi Arabia, while Tecno promoted its Camon 20 with enhanced incentives in Iraq. While Xiaomi and HONOR strive to penetrate the premium market with enticing incentives and aggressive promotions, luring customers away from established brands demands persistent investment. Meanwhile, Motorola is growing its consumer and enterprise businesses significantly, particularly in the GCC region. Its strategic partnership with Logicom distribution aims to provide enterprise-ready solutions with the cutting-edge ThinkPhone. On the other hand, Samsung and Apple maintained their market positions. Samsung’s extensive distribution network and Apple’s full-stack device services and ecosystem strategy solidified their dominance in the region. Notably, the demand for used Apple and Samsung devices remains high, viewed as lucrative investments due to high resale value.”

Emerging brands take advantage as retailers broaden portfolios

“Retailers are keen to broaden their product portfolios, reducing dependence on incumbent brands. They aim to entice additional investment through in-store branding and improved profit margins,” said Pravinkumar. “Emerging brands have taken the initiative and are launching flagship devices in the region. OPPO and HONOR are venturing into the foldable segment to compete with established incumbents such as Samsung. But consumers in markets such as Qatar, Kuwait and Saudi Arabia will still hesitate to switch brands. Affordability, aspirational value and availability will be pivotal factors for emerging players, with schemes such as Buy Now Pay Later gaining traction through platforms such as Tabby and Tamara, proving beneficial for both retailers and consumers.”

Retail set for major growth in Saudi Arabia and UAE

“Despite oil price challenges caused by the current geopolitical situation, the GCC region’s non-oil sectors are poised to bolster the consumer market,” said Sanyam Chaurasia, Senior Analyst at Canalys. “The GCC’s non-oil economy is thriving due to digital transformation in sectors such as retail, manufacturing, healthcare and entertainment. The retail industry in the UAE and Saudi Arabia is set for significant growth in the next five years. But vendors must recognize that retail space in the region will be expensive. To ensure a stronger presence in the market, they should form robust partnerships with local entities in the early stages. Developing local expertise in on-site teams is vital, rather than relocating staff from elsewhere. While physical stores remain central, online retail and B2B marketplaces are gaining traction, driven by trends such as the emergence of Gen Z consumers, increasing wealth in the GCC and higher female workforce participation.”

|

Middle Eastern* smartphone shipments and annual growth |

|||||

|

Vendor |

Q3 2023 |

Q3 2023 |

Q3 2022 |

Q3 2022 |

Annual |

|

Samsung |

3.8 |

31% |

4.1 |

42% |

-9% |

|

TRANSSION |

2.7 |

22% |

1.2 |

12% |

130% |

|

Xiaomi |

1.8 |

15% |

1.6 |

16% |

9% |

|

Apple |

1.3 |

11% |

1.2 |

12% |

9% |

|

realme |

0.5 |

4% |

0.2 |

2% |

133% |

|

Others |

2.0 |

17% |

1.6 |

16% |

29% |

|

Total |

12.0 |

100% |

9.9 |

100% |

21% |

Canalys

You must be logged in to post a comment Login