Trends

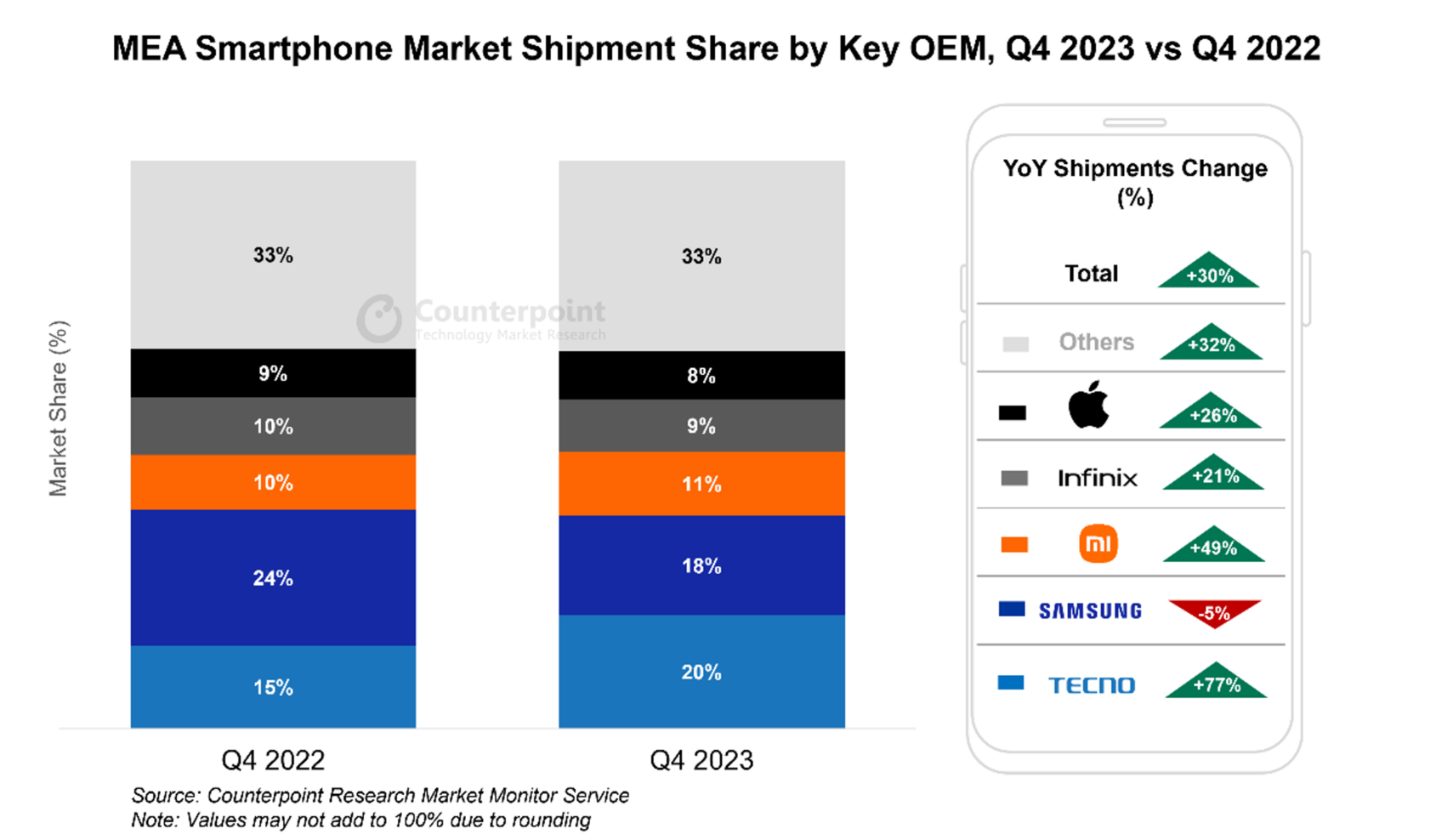

MEA smartphone shipments surge 30% YoY, 9% QoQ in Q4 2023

Smartphone shipments in the Middle East and Africa (MEA) region increased 30% YoY and 9% QoQ in Q4 2023, according to the latest research from Counterpoint’s Market Monitor Service. Globally, MEA was the region showing the highest YoY growth during the quarter, driven by improving economic conditions and rebounding consumer demand.

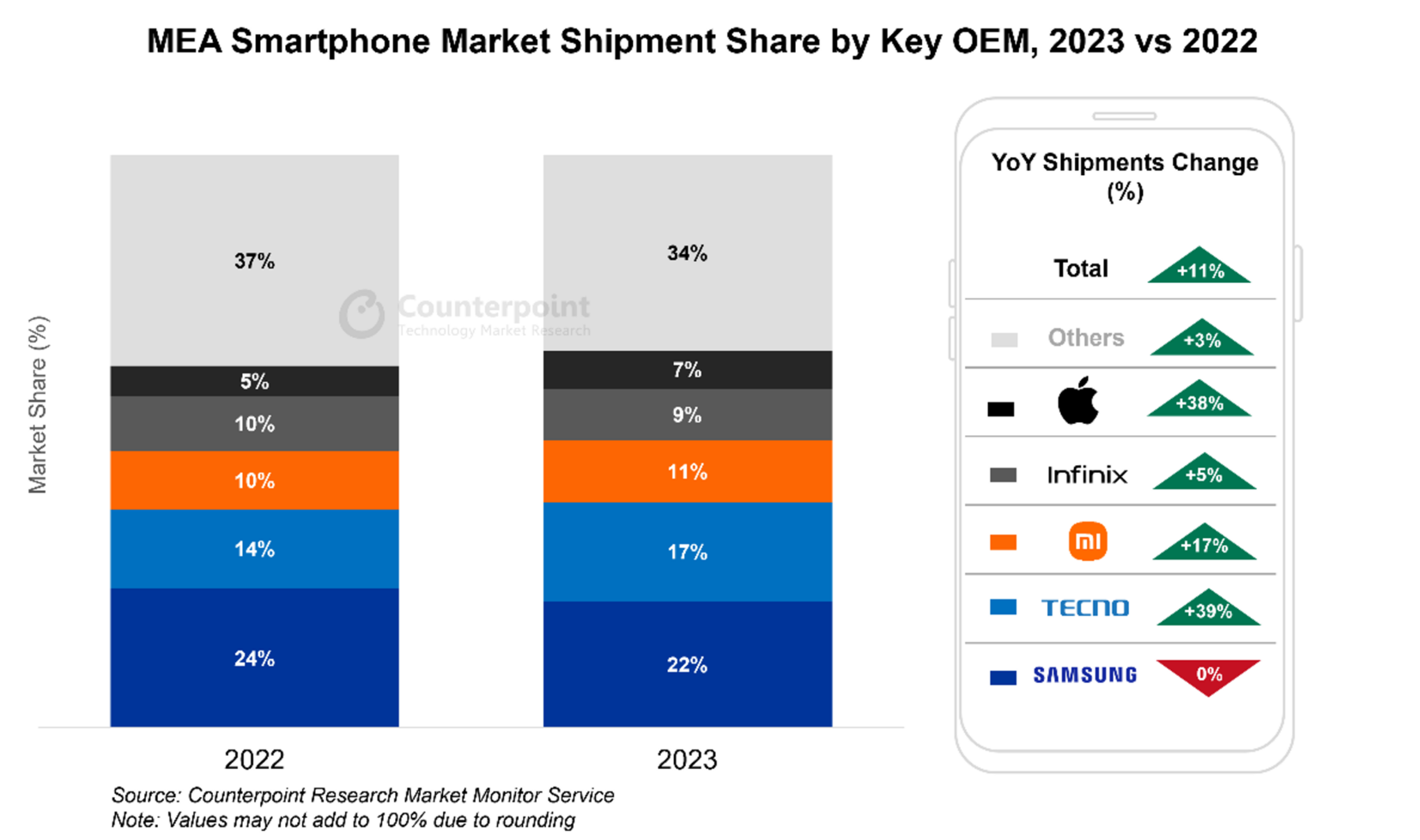

For the full year of 2023, the shipments grew 11% YoY as consumer sentiment steadily improved through the year with decreasing inflation and stabilizing local currencies. Vendors, which were sitting on high levels of inventory, returned to a more manageable footing after successfully executing multiple sales events and hefty discounts during the year.

Commenting on the market’s dynamics, Senior Analyst Yang Wang said, “MEA experienced remarkable growth, outpacing other regions due to the strong momentum since Q2 2023, as economies steadily recovered. The popularity of smartphones, proliferation of digital services like mobile money and social media, big infrastructure projects, and the expansion of services sectors also proved to be key catalysts, disproportionately benefitting lower-income groups.”

Notably, 5G smartphone penetration has been rapidly increasing over the past few years. In the MEA region, 5G shipments grew 60% YoY in Q4 2023, largely due to broader availability and declining component prices, narrowing the price gap between 4G and 5G chipsets. Many OEMs aggressively introduced 5G technology in lower-price tiers, recognizing this as a significant growth opportunity and enabling consumers to access future-ready devices at more affordable prices.

During the quarter, TECNO saw 77% YoY growth, overtaking Samsung to secure the number-one spot in the MEA market for the very first time. This lead was mainly driven by the <$150 price band, which grew by 68% YoY for TECNO, with models like the TECNO Pop 7 and Camon 20 Pro receiving good response from consumers. Apple further solidified its position in the top five, growing 26% YoY. This success was mainly due to the popularity of its latest iPhone 15 series in addition to its older series, driven by promotional offers and increased financing options. Moreover, Apple has begun establishing distribution channels in key markets like South Africa, Nigeria and Kenya, forging partnerships with operators and key distributors to expand its reach. Commenting on the premiumization trend in the MEA region, Wang further added, “Premiumization has significantly favored OEMs such as Apple and Samsung. Being an aspirational brand for many in the region, iPhone has become a status symbol across MEA countries. Samsung also enjoyed notable success in Q4 2023 with the launch of the Galaxy Z Flip 5 and Z Fold 5, resulting in a 51% YoY jump in its sales in the >$600 range.”

Transsion Group solidified its status as the region’s dominant OEM, capturing over 36% share in Q4 2023 and 32% during the entire year. Strong marketing campaigns and higher specifications in the affordable segment extended the company’s lead in the region.

Xiaomi grew 49% YoY mainly due to widening product availability and geographic reach. The Redmi 12 series has been particularly successful. HONOR and Motorola grew 426% YoY and 68% YoY, respectively, in the region, driven by their product portfolios’ expansion to cover various price points, particularly in the sub-$200 range. Counterpoint Research

You must be logged in to post a comment Login