International Circuit

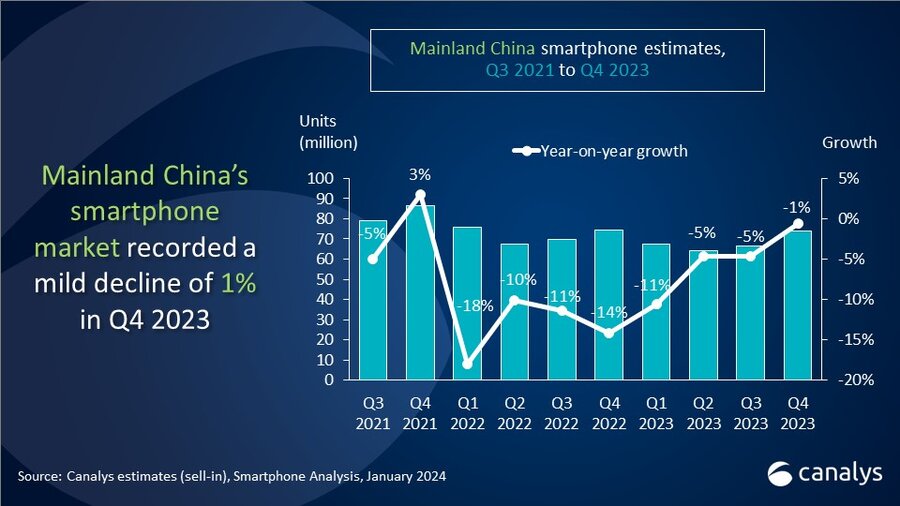

Mainland China’s smartphone market decline narrows to 1% in Q4 2023

The latest data from Canalys reveals that in Q4 2023, the decline in Mainland China’s smartphone market narrowed further, with total shipments reaching 73.9 million units, signaling a year-on-year decrease of just 1%. Apple took the pole position, shipping 17.5 million units. With an adequate supply of the new iPhone 15 series, Apple’s shipments increased by 6% year-on-year. HONOR followed closely with a 16% market share, ranking second, shipping 11.7 million units. vivo shipped 11.3 million units and rose to third place. Huawei, breaking into the top five and ranking fourth, shipped 10.4 million units, witnessing a year-on-year increase of 47% due to its flagship new products. Thanks to the stellar performance of the Xiaomi 14 series, Xiaomi maintained fifth place with a shipment of 9.5 million units.

In 2023, Apple took the top spot for annual shipments in the Chinese market for the first time, with a slight year-on-year increase of 1%. Its annual market share increased further to 19%. vivo, OPPO and HONOR competed closely, each capturing a 16% market share, with annual shipments of 44.5 million, 43.9 million and 43.6 million units, respectively. Xiaomi held fifth place in the annual market with a 13% market share. Huawei, ranking sixth, witnessed its full-year market share jump from 8% in 2022 to 12% in 2023, with a year-on-year increase of 48%.

“Huawei has become the biggest dark horse this quarter, returning to the top five league table of Mainland China’s smartphone market after 10 quarters,” said Lucas Zhong, Research Analyst at Canalys. “The Mate 60 Pro, with its in-house Kirin chip and innovative features such as satellite calling, has become the leading model driving Huawei’s shipment recovery. In addition, from January 2024, Huawei has extended the Kirin chip to the Nova series, which will also help to drive more demand in the mid-end market in the future. The enthusiasm of the Chinese market for Huawei’s new products reflects the local consumers’ demand for software and hardware innovation. Other local vendors are also building their brand stronghold by accelerating the iteration of new flagship products and unveiling their latest AI developments. The competitive landscape of Mainland China’s high-end market will further be vitalized under Huawei’s influence, which will prompt global players to accelerate their disruptive innovation strategy in the region.”

“On-device AI in smartphones has quickly become a hot topic in Mainland China’s market in Q4,” added Zhong. “Chinese Android manufacturers have successively launched flagship models with on-device generative AI capabilities in the fourth quarter, such as the vivo X100 series and Xiaomi 14 series. In the short term, the development of on-device AI features shall still be mainly led by the vendors, stimulating the early adopter demand for new experiences. In the long term, early investment into hardware and AI infrastructure capabilities will help hardware manufacturers establish a first-mover advantage in the competition.” For more insights on AI smartphones in the Chinese market, please read our previous reports.

“Looking forward to 2024, the Chinese smartphone market is expected to enter a path of moderate recovery, supported by channel profitability and exciting new products,” stated Amber Liu, Research Manager at Canalys. “At the same time, Huawei’s growing presence will intensify market competition and fuel innovation. Vendors will focus on developing in-house operating systems and investing in generative AI to build moats in 2024 while continuing to strengthen collaboration with channels to defend their market share in the mass market.”

|

People’s Republic of China (Mainland) smartphone shipments and annual growth Canalys Smartphone Market Pulse: Q4 2023 |

|||||

|

Vendor |

Q4 2023 shipments (million) |

Q4 2023 |

Q4 2022 |

Q4 2022 |

Annual |

|

Apple |

17.5 |

24% |

16.4 |

16% |

6% |

|

HONOR |

11.7 |

16% |

12.2 |

17% |

-4% |

|

vivo |

11.3 |

15% |

12.7 |

20% |

-11% |

|

Huawei |

10.4 |

14% |

7.1 |

9% |

47% |

|

Xiaomi |

9.5 |

13% |

8.5 |

13% |

12% |

|

Others |

13.5 |

18% |

17.4 |

24% |

-22% |

|

Total |

73.9 |

100% |

74.4 |

100% |

-1% |

|

People’s Republic of China (Mainland) smartphone shipments and annual growth Canalys Smartphone Market Pulse: Full-year 2023 |

|||||

|

Vendor |

2023 |

2023 |

2022 |

2022 |

Annual |

|

Apple |

51.8 |

19% |

51.3 |

18% |

1% |

|

vivo |

44.5 |

16% |

52.2 |

18% |

-15% |

|

OPPO |

43.9 |

16% |

50.4 |

18% |

-13% |

|

HONOR |

43.6 |

16% |

52.2 |

18% |

-17% |

|

Xiaomi |

35.6 |

13% |

38.6 |

13% |

-8% |

|

Others |

53.2 |

20% |

42.6 |

15% |

25% |

|

Total |

272.5 |

100% |

287.3 |

100% |

-5% |

Canalys

You must be logged in to post a comment Login