Headlines of the Day

IT: Topline growth strong, lower utilisation impacts margin, ICICI Securities

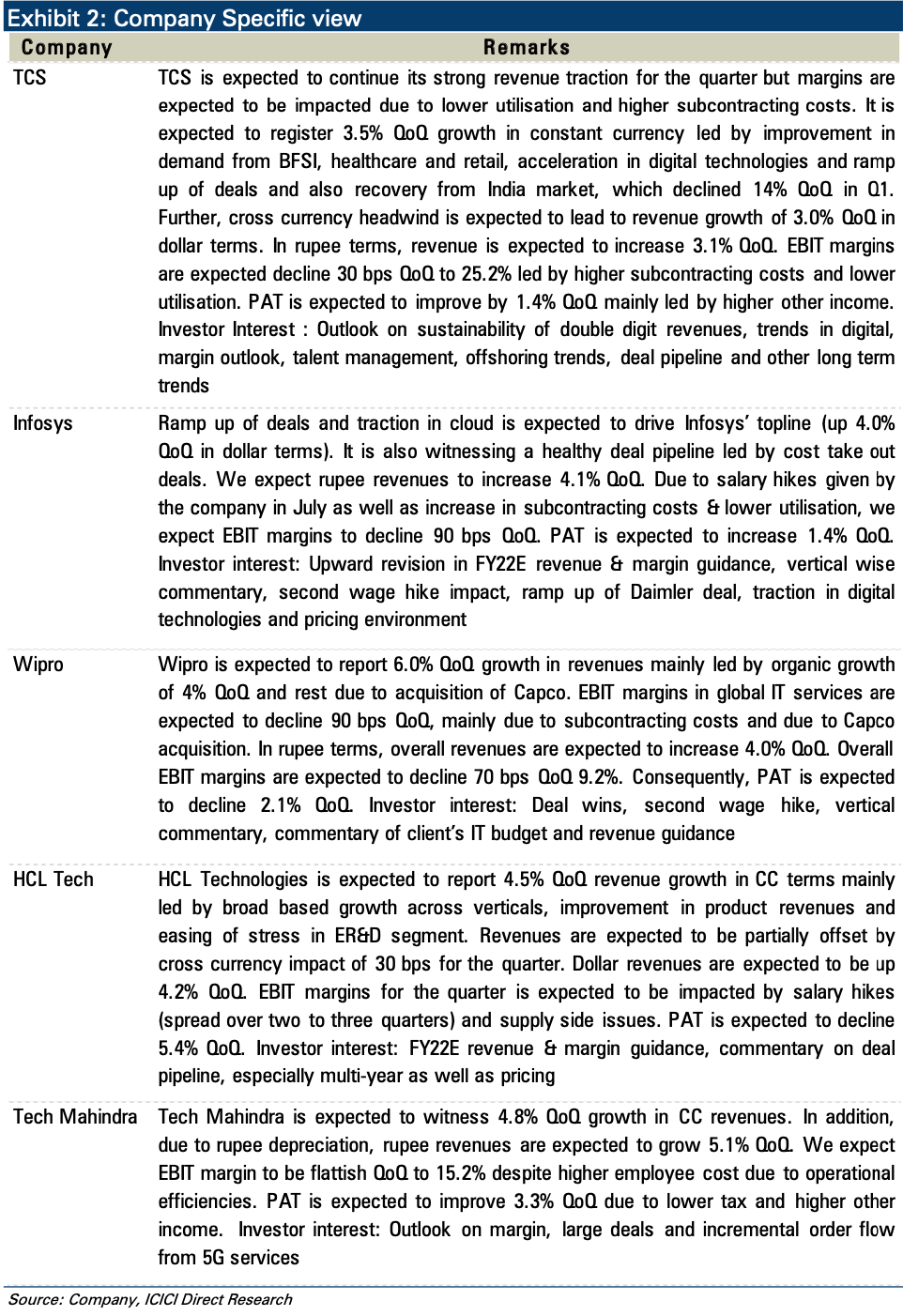

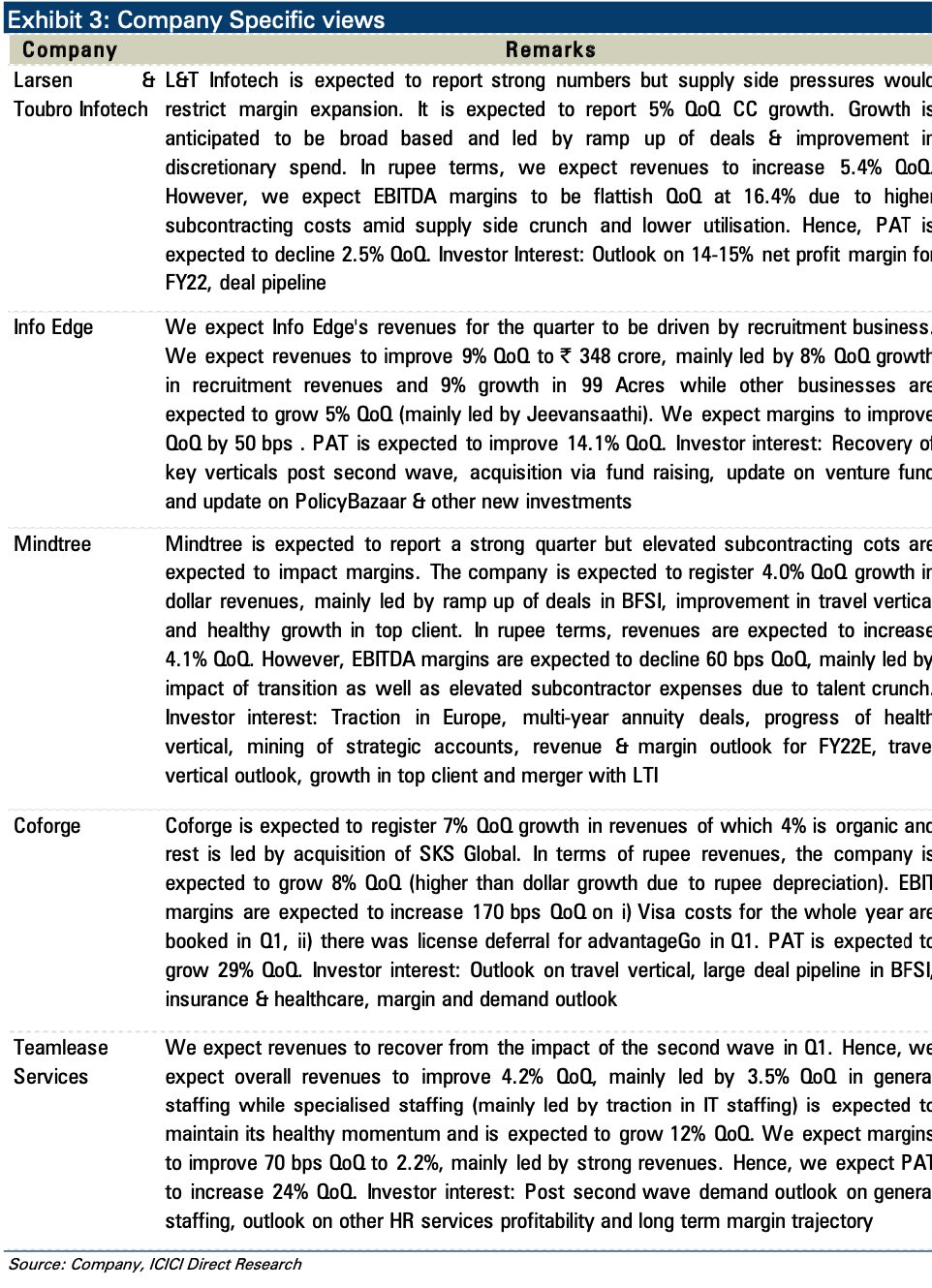

IT companies are expected to continue their revenue growth momentum in Q2, which is a reflection of strong deal signing momentum. We expect BFSI, retail, manufacturing, hi tech and life-science to drive revenues in the quarter.

On the currency side, we expect some headwinds from unfavourable cross currency movements. Since demand continued to be strong in IT companies, the supply side crunch is expected to have an impact on margins. Since companies accelerate fresher hirings to cater to increasing demand, utilisation of companies is expected to take some hit while subcontracting costs are expected to accelerate, which will have an impact on margins.

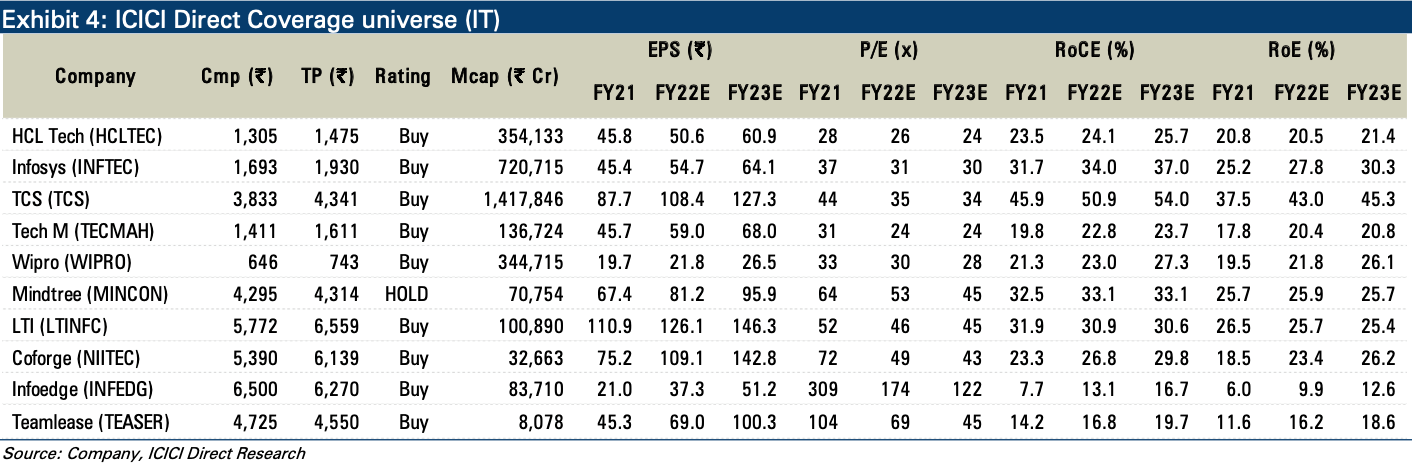

We expect Tier-1 IT companies to see revenue growth in the range of ~3- 6% QoQ (on an organic basis) in constant currency terms. However, there would be cross currency headwinds in the range of 30-40 bps, which would impact dollar revenue growth negatively. Among tier 1, TCS, Infosys & Wipro are expected to see dollar revenue growth of 3-4.2% QoQ, respectively. If we add inorganic revenues Wipro will grow at 6.0% QoQ.

HCL Technologies (HCLT) is expected to witness dollar revenue growth of 4.2%. Among Tier 2, LTI & Mindtree are expected to see dollar revenue growth of 5.0% and 4.0% QoQ followed by Coforge, which is expected to witness organic revenue growth of 4% QoQ (7% including acquisition). We prefer Infosys, Wipro in tier-1 and Coforge in midcap.

Margins to remain under pressure on high subs costs

HCL Tech, Infosys and Wipro’s margins are expected to be impacted by wage hikes. For TCS, we expect margins to be impacted by lower utilisation and higher subcontracting costs. For Wipro, additionally margins would be impacted by the Capco acquisition earlier. For Infosys, we expect a margin decline due to salary hike for the quarter. HCL Tech’s margins are expected to be hit by >100 bps QoQ due to wage hikes, supply side issues and higher discretionary cost.

Revenue, margin guidance outlook key monitorable

In the current quarter, key thing to watch will be improvement in deal pipeline, upgrades in double digit guidance, hiring & attrition trends, margin outlook and revival in developed markets post vaccination. Further, outsourcing trend in Europe, trends in digital technologies, vertical specific commentary, offshoring and long-term IT trends become important from an investor’s perspective.

CT Bureau

You must be logged in to post a comment Login