Trends

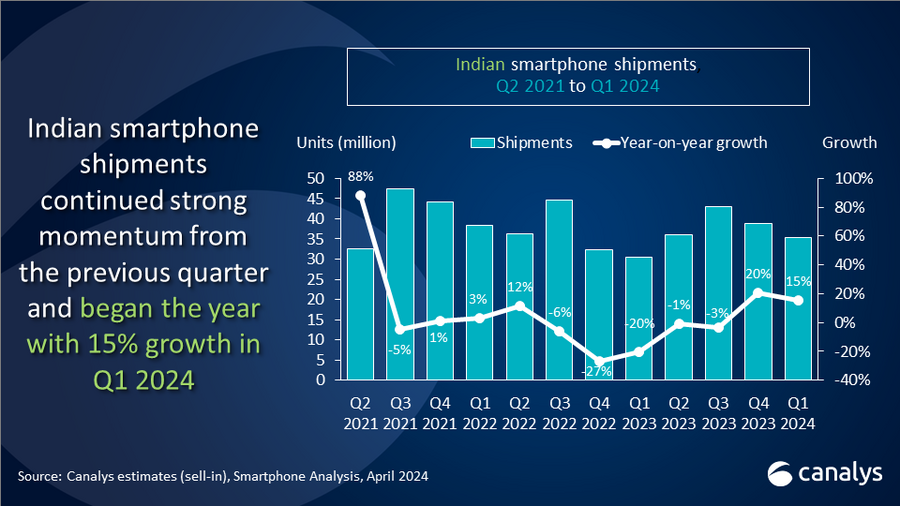

Indian smartphone market surges, registers 15% growth in Q1 2024

The latest Canalys research shows the Indian smartphone market maintained its strong performance in Q1 2024, reaching 35.3 million units. Vendors entered 2024 with an improved inventory situation, which allowed channels to embrace multiple new offerings launched during the quarter. The market saw a 15% year-on-year growth, owing to the lower base of Q1 2023, which faced inflationary pressures, weak demand, and stockpile issues. Samsung maintained top position in Q1 2024 with a 19% share and 6.7 million units shipped. Xiaomi secured second spot, shipping 6.4 million units, driven by its ongoing mass-market 5G strategy. vivo claimed third position with 6.2 million units shipped. OPPO (excluding OnePlus) and realme completed the top five with shipments of 3.7 million and 3.4 million units, respectively.

“While most brands achieved double-digit growth in Q1, brands outside the top 5 continue to challenge the market share of leading players,” said Canalys Senior Analyst Sanyam Chaurasia. “Vendors’ price correction and promotional strategies towards the end of Q4 2023 assisted inventory management in Q1. Republic Day sales in January accelerated the momentum, with brands leveraging promotions to push their latest offerings. Samsung’s latest flagship Galaxy S24 had a stronger volume than its predecessor, owing to lucrative pre-booking offers on upgrade value, Samsung Finance+ and extensive AI features marketing. Xiaomi saw a robust Q1 resurgence fueled by the Redmi 13C 5G and Redmi Note 13 5G series, along with POCO’s early launch of the X6 series. OPPO saw a modest decline, having streamlined its portfolio with fewer new releases in the mid-high price ranges. Out of the top 5 – Motorola, Infinix, and Apple achieved high double-digit growth, narrowing the market share gap from top players. Apple’s growth was driven by its cashcow iPhone 15 model which received multiple price cuts and promotional deals on the e-commerce platform.”

“Mass-market brands are prioritizing value-driven strategies in response to sluggish demand growth in the volume-driven segment,” said Chaurasia. “In Q1, brands such as Xiaomi, vivo, and OPPO introduced their latest models – Redmi Note 13, V30, and Reno 11 series – at a higher price compared to the previous generation models. Vendors are aggressively pricing their products to capitalize on the premiumization trend fueled by wider channel access and easy financing options. Price hikes are expected to continue as operational pressures rise due to higher component costs, despite import duty reductions on a few parts. Brands are also prioritizing channel incentives and retail investments, driving costs up further. This year, brands will look to justify incremental pricing beyond the 5G capabilities. This will be mainly through design language, user experience and other integrated smartphone AIoT offerings.”

“Emphasis on localization in the Indian smartphone ecosystem has become inevitable,” said Chaurasia. “While in 2024 growth catalysts seem to be limited to just 5G device upgrades and premiumization, vendors must focus on long-term strategies for share sustainability. Amid the government localization push, vendors must further focus on restructuring local distribution, leveraging local manufacturing partners and appointing Indian leadership. Additionally, they need to prioritize enhancing user experience and educating consumers for effective device engagement. Expanding into smaller cities, bolstering mainline retail, and building channel confidence will be crucial.”

|

Indian smartphone shipments and annual growth |

|||||

|

Vendor |

Q1 2024 |

Q1 2024 |

Q1 2023 |

Q1 2023 |

Annual |

|

Samsung |

6.7 |

19% |

6.3 |

21% |

6% |

|

Xiaomi |

6.4 |

18% |

5.0 |

16% |

29% |

|

vivo |

6.2 |

18% |

5.4 |

18% |

14% |

|

OPPO |

3.7 |

10% |

3.9 |

13% |

-4% |

|

realme |

3.4 |

10% |

2.9 |

9% |

17% |

|

Others |

8.9 |

25% |

7.1 |

23% |

25% |

|

Total |

35.3 |

100% |

30.6 |

100% |

15% |

Canalys

You must be logged in to post a comment Login