Headlines of the Day

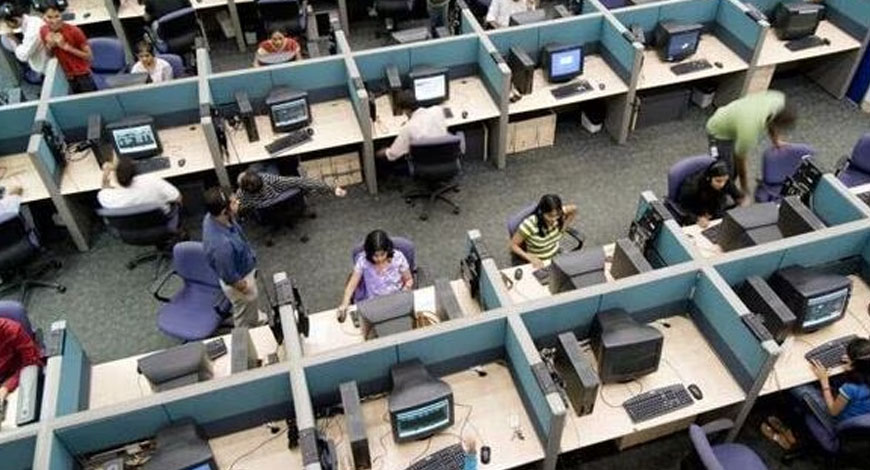

Indian IT likely to see gradual recovery, not sharp rebound, says Morgan Stanley

Morgan Stanley expects a gradual recovery in the Indian information technology sector following the pace of the 2023 slowdown, unlike the sharp bounce back the companies witnessed after the 2008 financial crisis and the coronavirus pandemic.

However, the brokerage also expects this recovery to be better than the “slow and protracted growth” after the Brexit referendum as businesses were in a transition phase, according to a note dated March 29.

Morgan Stanley said the underlying technology cycle would support recovery in the first and second quarters of the new financial year. Globally, it said, the growth is bottoming out, but the pace of recovery has come down as against previous estimates.

Over the fiscals 2024–26, the brokerage expects most Indian large caps to register annual revenue growth of 7–8%. “EBIT margins are expected to improve YoY but stay lower for most companies relative to pre-Covid levels.”

The EBIT margins of Tata Consultancy Services Ltd. and LTIMindtree Ltd. in fiscal 2026 are expected to be 104 basis points and 78 bps higher respectively than the pre-Covid levels.

The brokerage is ‘overweight’ on Infosys Ltd., TCS, HCL Technologies Ltd and Coforge. For Infosys and TCS, it sees strong deal wins to aid recovery. TCS and HCLTech are also expected to benefit from potential margin improvement.

On Coforge, the brokerage said: “We expect executable order book to revenue conversion to bottom out in FY24, setting up the stage for healthy FY25 revenue growth vs peers.”

Morgan Stanley is ‘equal weight’ on LTIMindtree. Growth in deal wins remains healthy, but revenue conversion is slow. Headcount additions have been muted over the last few quarters, it said. The brokerage expects over 17% margins in the fiscal 2026.

Tata Elxsi Ltd., L&T Technology Services Ltd., Wipro Ltd. and Tech Mahindra Ltd. are some of the stocks that the brokerage is ‘underweight’ on.

Tech Mahindra’s net new large-deal wins have been soft, driven by high telecom exposure and a deliberate attempt to pick up deals with better contractual terms. L&T Technology Services delivered better-than-expected margin, but moderate revenue growth profile at premium valuations, it said. NDTV Profit

You must be logged in to post a comment Login