Trends

India PC market exits 2022 with 5% growth

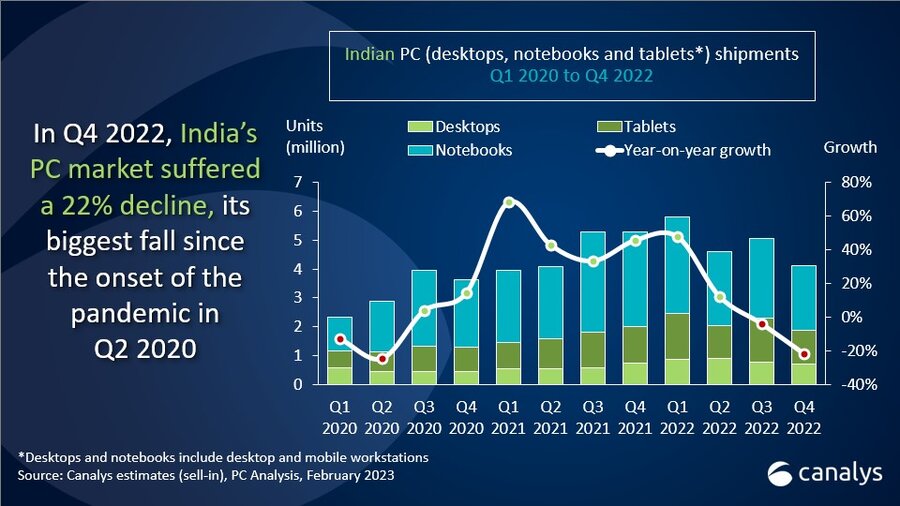

The Indian PC market (desktops, notebooks and tablets) suffered a major decline of 22% year on year, with 4.1 million units shipped in Q4 2022, according to Canalys estimates. This was due to a steep fall in notebook shipments, which were down 31% to 2.3 million units. Desktop shipments fell by 5% to 695,000 units, while tablet shipments decreased by 7% to 1.2 million units. But, overall, 2022 was a successful year for the industry in India, with shipments up 5% on 2021. While notebook shipments fell 7% to 11 million units, desktop and tablet shipments increased significantly by 37% and 21% to 3.2 million and 5.4 million units respectively in 2022.

The main ongoing concerns are fears of recession and inflation, which rose again after easing toward the end of 2022. “Indian consumers spent on devices in the first half of 2022, but demand quickly tailed off, leading to a weak holiday season for vendors and retailers,” said Canalys Analyst Ashweej Aithal. “Meanwhile, the commercial sector continued to struggle with inventory and supply chain issues, but the fall in demand is helping to lessen procurement delays. Pockets of enterprise spending in the aftermath of last year’s lockdowns have helped desktops maintain some momentum, while education deals have buoyed tablet shipments.”

|

India PC (including tablets) shipments (market share and annual growth) Canalys PC Market Pulse: Q4 2022 |

|||||

|

Vendor |

Q4 2022 shipments |

Q4 2022 |

Q4 2021 |

Q4 2021 |

Annual |

|

HP |

957 |

23.2% |

1,321 |

25.0% |

-27.6% |

|

Apple |

575 |

13.9% |

359 |

6.8% |

60.2% |

|

Lenovo |

563 |

13.6% |

1,151 |

21.8% |

-51.0% |

|

Dell |

474 |

11.5% |

805 |

15.2% |

-41.1% |

|

Acer |

364 |

8.8% |

362 |

6.8% |

0.7% |

|

Others |

1,195 |

28.9% |

1,286 |

24.3% |

-7.1% |

|

Total |

4,128 |

100.0% |

5,283 |

100.0% |

-21.9% |

|

|

|

|

|

|

|

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), February 2023 |

|||||

|

India PC (including tablets) shipments (market share and annual growth) Canalys PC Market Pulse: 2022 |

|||||

|

Vendor |

2022 |

2022 |

2021 |

2021 |

Annual |

|

HP |

4,498 |

22.9% |

4,677 |

25.1% |

-3.8% |

|

Lenovo |

3,753 |

19.1% |

4,287 |

23.0% |

-12.5% |

|

Dell |

2,041 |

10.4% |

2,590 |

13.9% |

-21.2% |

|

Acer |

2,040 |

10.4% |

1,261 |

6.8% |

61.7% |

|

Apple |

1,582 |

8.1% |

1,070 |

5.8% |

47.8% |

|

Others |

5,710 |

29.1% |

4,727 |

25.4% |

20.8% |

|

Total |

19,624 |

100.0% |

18,613 |

100.0% |

5.4% |

|

|

|

|

|

|

|

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), February 2023 |

|||||

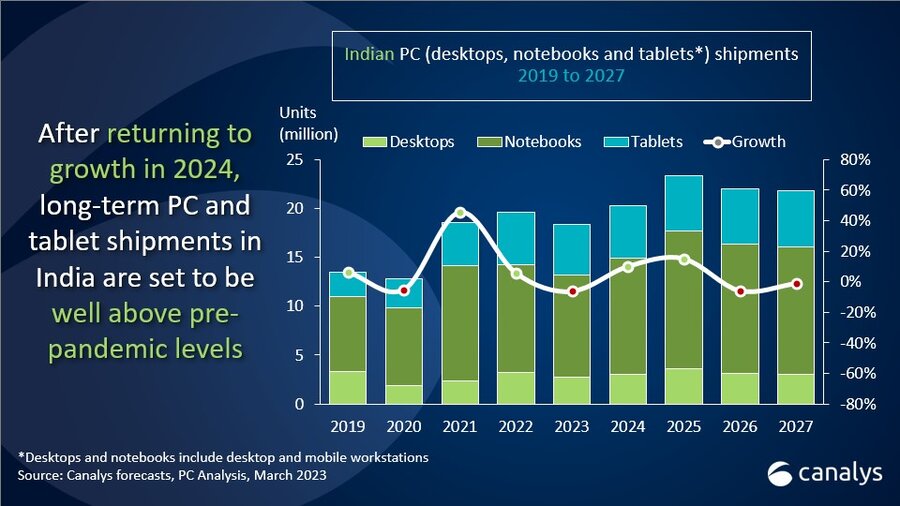

Looking ahead, Canalys anticipates that PC and tablet shipments in India will fall by 6% in 2023, to 18 million units. This represents a smaller drop than for the global market, which is expected to contract by 9%. While weakness in the global economy this year will affect India, GDP growth forecasts for the country remain relatively positive compared with other major markets.

“Education will be an important segment for PCs and tablets in India this year and beyond,” said Aithal. “With the full list of tenders the government has offered, the tablet industry has enormous potential. Bridging the digital divide to provide wider education access is a key public sector goal, with investment expected to ramp up at all levels over the next few years. Meanwhile, enterprise deals that are on hold due to current economic conditions are set to re-emerge and boost the market recovery in 2024.”

“One emerging development to look out for is the rise of locally manufactured, Android-powered notebooks, such as Reliance’s JioBook and the new Primebook 4G,” added Aithal. “Despite very competitive price points, these devices have so far not gained major traction, mostly due to their basic specifications and issues around the OS experience on a PC. But with quality improvements and a stronger go-to-market strategy, they have the potential to offer an alternative option for education deployments and to draw in first-time PC users.”

|

India desktop and notebook shipments (market share and annual growth) Canalys PC Market Pulse: Q4 2022 |

|||||

|

Vendor |

Q4 2022 shipments |

Q4 2022 |

Q4 2021 |

Q4 2021 |

Annual |

|

HP |

957 |

32.3% |

1,321 |

32.8% |

-27.6% |

|

Lenovo |

495 |

16.7% |

714 |

17.7% |

-30.7% |

|

Dell |

473 |

16.0% |

804 |

20.0% |

-41.2% |

|

Acer |

295 |

9.9% |

340 |

8.4% |

-13.2% |

|

Apple |

171 |

5.8% |

187 |

4.6% |

-8.4% |

|

Others |

573 |

19.3% |

662 |

16.4% |

-13.4% |

|

Total |

2,965 |

100.0% |

4,028 |

100.0% |

-26.4% |

|

|

|

|

|

|

|

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), February 2023 |

|||||

|

India desktop and notebook shipments (market share and annual growth) Canalys PC Market Pulse: 2022 |

|||||

|

Vendor |

2022 shipments |

2022 |

2021 |

2021 |

Annual |

|

HP |

4,498 |

31.6% |

4,677 |

33.0% |

-3.8% |

|

Lenovo |

2,817 |

19.8% |

2,733 |

19.3% |

3.1% |

|

Dell |

2,038 |

14.3% |

2,588 |

18.3% |

-21.3% |

|

Acer |

1,499 |

10.5% |

1,160 |

8.2% |

29.2% |

|

Asus |

992 |

7.0% |

873 |

6.2% |

13.6% |

|

Others |

2,402 |

16.9% |

2,134 |

15.1% |

12.6% |

|

Total |

14,245 |

100.0% |

14,165 |

100.0% |

0.6% |

|

|

|

|

|

|

|

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), February 2023 |

|||||

HP led the Indian PC (excluding tablets) market, with a 30%-plus market share in both Q4 and full-year 2022. Lenovo took second place but suffered a large shipment decline of 31% in the last quarter of the year. But total 2022 shipments for Lenovo were up 3% on 2021, with its commercial business gaining traction. Dell and Acer took third and fourth place respectively, while Apple secured the final spot in the top five in Q4 2022, overtaking Asus.

|

India tablet shipments (market share and annual growth) Canalys PC market pulse: Q4 2022 |

|||||

|

Vendor |

Q4 2022 shipments |

Q4 2022 |

Q4 2021 |

Q4 2021 |

Annual |

|

Apple |

404 |

34.7% |

172 |

13.7% |

135.1% |

|

Samsung |

354 |

30.4% |

317 |

25.3% |

11.5% |

|

Lava |

75 |

6.5% |

110 |

8.8% |

-31.8% |

|

Acer |

69 |

6.0% |

22 |

1.8% |

214.3% |

|

Lenovo |

68 |

5.8% |

436 |

34.8% |

-84.4% |

|

Others |

193 |

16.6% |

197 |

15.7% |

-2.0% |

|

Total |

1,164 |

100.0% |

1,255 |

100.0% |

-7.3% |

|

India tablet shipments (market share and annual growth) Canalys PC market pulse: 2022 |

|||||

|

Vendor |

2022 |

2022 |

2021 |

2021 |

Annual |

|

Samsung |

1,411 |

26.2% |

1,344 |

30.2% |

5.0% |

|

Apple |

976 |

18.1% |

547 |

12.3% |

78.6% |

|

Lenovo |

936 |

17.4% |

1,554 |

34.9% |

-39.8% |

|

Lava |

752 |

14.0% |

110 |

2.5% |

582.1% |

|

Acer |

541 |

10.1% |

101 |

2.3% |

436.1% |

|

Others |

762 |

14.2% |

791 |

17.8% |

-3.7% |

|

Total |

5,379 |

100.0% |

4,447 |

100.0% |

20.9% |

Apple surpassed Samsung in Q4 2022 to take the lead in the Indian tablet market, with its new iPad launches a big success during the holiday season. Despite ceding the top spot, Samsung had a relatively good quarter, with shipments up 12% year on year. Its tablets have performed well in the commercial segment, and it is likely to gain further traction in this space. Lava came third in the quarter and fourth in 2022. Its strong position in the education space will drive growth in 2023 and beyond. Acer and Lenovo took the final two spots in the top five vendor rankings in Q4.

CT Bureau

You must be logged in to post a comment Login