Trends

GlobalFoundries reports 9% YoY revenue decline in 2023 to $7.4 billion

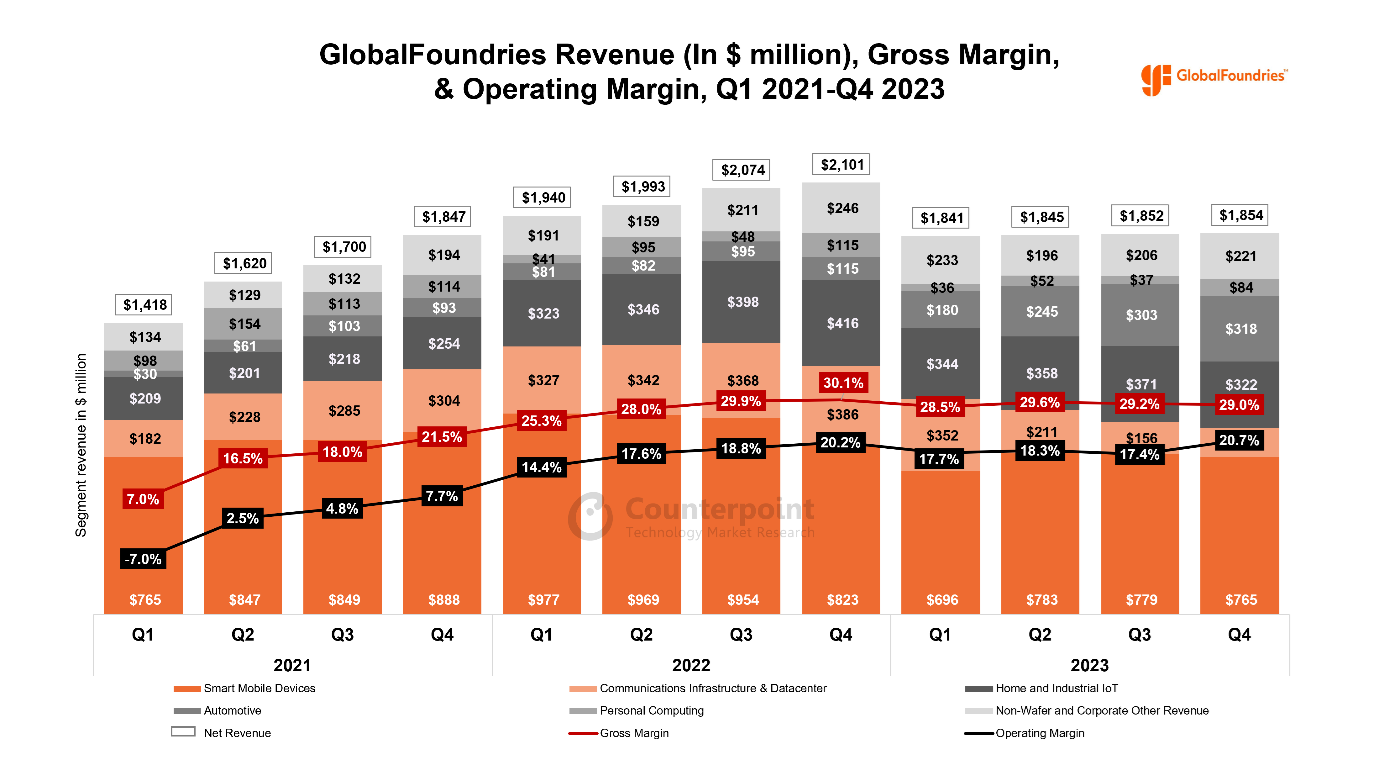

GlobalFoundries’ full-year 2023 revenue declined 9% YoY to reach $7.4 billion, primarily due to weak demand for lower-end consumer and home electronics along with global macroeconomic factors and elevated inventory. The automotive segment saw a record 3x YoY rise in revenue during the period to reach $1.1 billion, which helped limit the decline in the overall revenue.

On the competition and differentiation that GlobalFoundries offers:

CEO Thomas Caulfield: “GlobalFoundries would like to be known as a single source differentiated business. The single-digit nanometer may be accelerating in some of the FinFET businesses but at the same time, GlobalFoundries has been accelerating the deployment of bringing new technologies to its existing FAB facility so that it can easily mix that capability.”

Ashwath Rao’s analyst take: GlobalFoundries is positioned well outside the crosshairs of global geopolitics and has faced minimal damage from the export controls due to its strategic pivot to move away from leading-edge chips five years ago. GlobalFoundries has been focussing on the development and production of chips in specialty applications including 5G smartphones, RF wireless infrastructure, electric vehicles, power grids, and industrial IoT. The penetration of these differentiated technologies is expected to increase significantly enabling GlobalFoundries to capture a significant portion of the market share. GF’s single source nature of business and focus on long-term agreements to help increase market share.

On the Smartphone and IoT market:

Parv Sharma’s analyst take: There will be a slow recovery in Android volumes in 2024 as the excess finished goods inventory, which was a drag on the market throughout 2023, will allow an inflow of new models. Smartphone AP/SoC shipments are set to grow in the low-single digits in 2024. Further, the demand for global cellular IoT module shipments is expected to recover by H2 2024, with substantial growth predicted for 2025, coinciding with the mass adoption of 5G.

On government funding and benefits:

CEO Thomas Caulfield: Government programs are lining nicely with a long-term strategy to share and grow the business for the medium to longer term. GlobalFoundries will play a significant role in the US with the ambition to create more semiconductor manufacturing in the US in addition to creating a more resilient global footprint.

Ashwath Rao’s analyst take: The addition of scaled GaN manufacturing into the Fab’s capabilities will further boost GF’s leadership competences in making chips for RF semiconductor technology and high-power applications. The US government is stepping up support for the local IC manufacturing sector to revive semiconductor manufacturing for mission-critical security systems, which it sees as a key requirement for future economic growth. Further, US government accreditation as a trusted supplier and funding under the CHIPS Act, and GlobalFoundries’ focus on increasing the foundry portion in the aerospace and defense segment along with new design wins will drive revenue growth in the long-term.

Results Summary:

Revenue Highlights:

- Increased inventory levels in smart mobile devices, communication infrastructure and data center, and lower end of consumer electronics end markets dragged revenue down by 9% YoY in 2023.

- Business remix towards the premium tier of the handset market and content growth in RF and audio products limited the decline.

- Shipped 2.2 million wafers in 2023.

- Two-thirds of revenue in 2023 came from single-source agreements with customers.

Automotive Revenue Tripled in 2023:

- The automotive segment saw the strongest growth of 3x YoY rise driven by healthy growth in volumes, ASP and mix dynamics as semiconductor content and features increased across the vehicle architecture.

- Further ramp-up of processing, sensing and infrastructure applications helped boost revenue growth.

- Growth in automotive end-market revenue is expected to continue in 2024 despite demand moderation in the industry.

Gross Margin:

- Full year gross margin increased by 70 bps as compared to 2022 primarily due to the successful resolution of adjustments to customers’ near-term volume requirements and associated underutilization payments.

Long-term Agreements:

- Extended manufacturing partnership with Infineon through 2030 with focus on 40nm automotive microcontrollers, power management and connectivity solutions.

- GlobalFoundries will continue to expand automotive product offerings and support the development of critical sensing, processing and safety features for the automotive industry.

- Awarded a 10-year contract by the US Defense Department for the supply of secure semiconductors for critical applications.

Q1 2024 Guidance

Lower revenue guidance of $1.5 billion-$1.54 billion compared to Q4 2023 as customers manage down their inventory. Quarterly revenue is expected to grow sequentially throughout 2024. Short-term inventory correction in the IoT end market is expected.

CapEx:

Full-year 2023 CapEx was at $1.8 billion. Meanwhile, full-year 2024 CapEx is expected to be around $700 million, down 60% from that in 2023. Most of the CapEx utilization will be for tooling and increasing capacity to satisfy LTA demand and migrating additional capabilities into other fabs. Counterpoint Research

You must be logged in to post a comment Login