Trends

Global PC shipments show early signs of recovery in Q4 2023

The global PC market ended Q4 2023 with a 0.2% YoY shipment decline, according to the latest Counterpoint Research data. This was the eighth consecutive quarter of a YoY shipment decline. The year-end holiday season failed to trigger a meaningful shipment recovery. Both OEMs and ODMs expect that shipment momentum will come back in H1 2024.

For the full year of 2023, the global PC market saw a 14% YoY shipment decline due to a slowdown in commercial and consumer sectors both. Besides, there were several product launches in the second half of 2023, most of which will start shipping in 2024. This affected the shipment momentum in 2023. On the other hand, PC inventory level normalized to a healthy level, paving the way for upcoming new products.

Mixed performance in Q4; shipment correction cycle in 2023

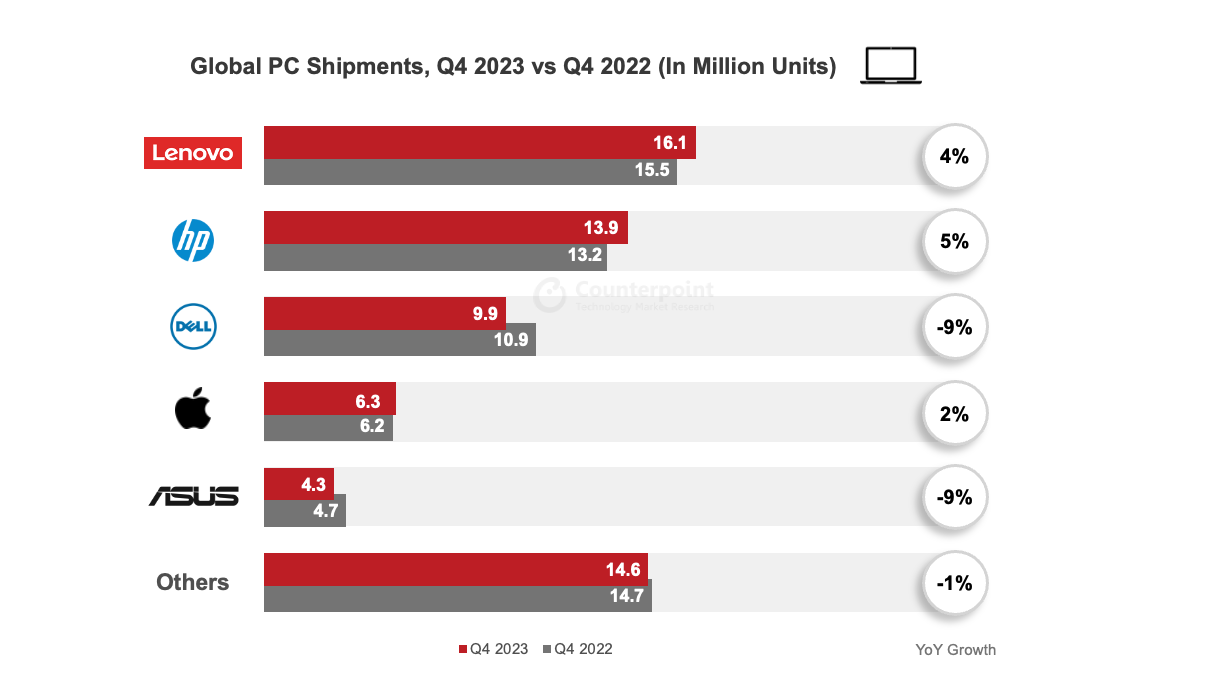

PC OEMs’ rankings remained unchanged throughout 2023 as soft demand and inventory digestions held back shipment performance across the market. However, we still saw different growth trajectories of top PC vendors. Lenovo and HP both had around mid-single-digit YoY shipment growth in Q4 2023 thanks to market recovery and warm restocking momentum in North America. Dell saw a 9% YoY shipment decline due to the commercial sector slowdown, while Apple remained resilient in the quarter with a 2% YoY shipment growth.

For the full year of 2023, Lenovo and HP continued to lead the market with 24% and 21% market shares, respectively, with the latter reporting a relatively resilient 5% YoY shipment decline thanks to warm restocking momentum in the North American market. Dell had a 16% market share while suffering weak commercial demand which resulted in a 20% shipment decline. Apple also left 2023 with a 14% shipment decline while maintaining its market share at around 9%.

AI PC to be major driver of PC industry in 2024

We believe AI PC will be in the spotlight in 2024 as Intel and AMD both have CPU solutions (Meteor Lake and Hawk Point) for next-generation AI PCs. In Q4 2023, PC vendors also continued to announce new AI PC products across different segments. After CES, more AI PC products will be launched by vendors, though we expect the major replacement cycle will be backend-loaded in H2 2024. We expect to see a 50% AI laptop sales share in 2025, with at least an NPU or an AI accelerator (AI engine) equipped in the PC in addition to its major CPU and GPU.

Enterprise spending slowdown and the process of destocking in 2023 will trigger PC vendors’ restocking demand, which would be a driver for the commercial PC sector. On the other hand, Qualcomm’s Nuvia-based Snapdragon X Elite solutions for Arm PC would be an additional driver throughout 2024. This will potentially mark another milestone for Arm PCs, followed by Apple’s success in its M-series MacBook series. Counterpoint Research

You must be logged in to post a comment Login