Trends

Enterprise class wireless LAN—The market will shift in 2024

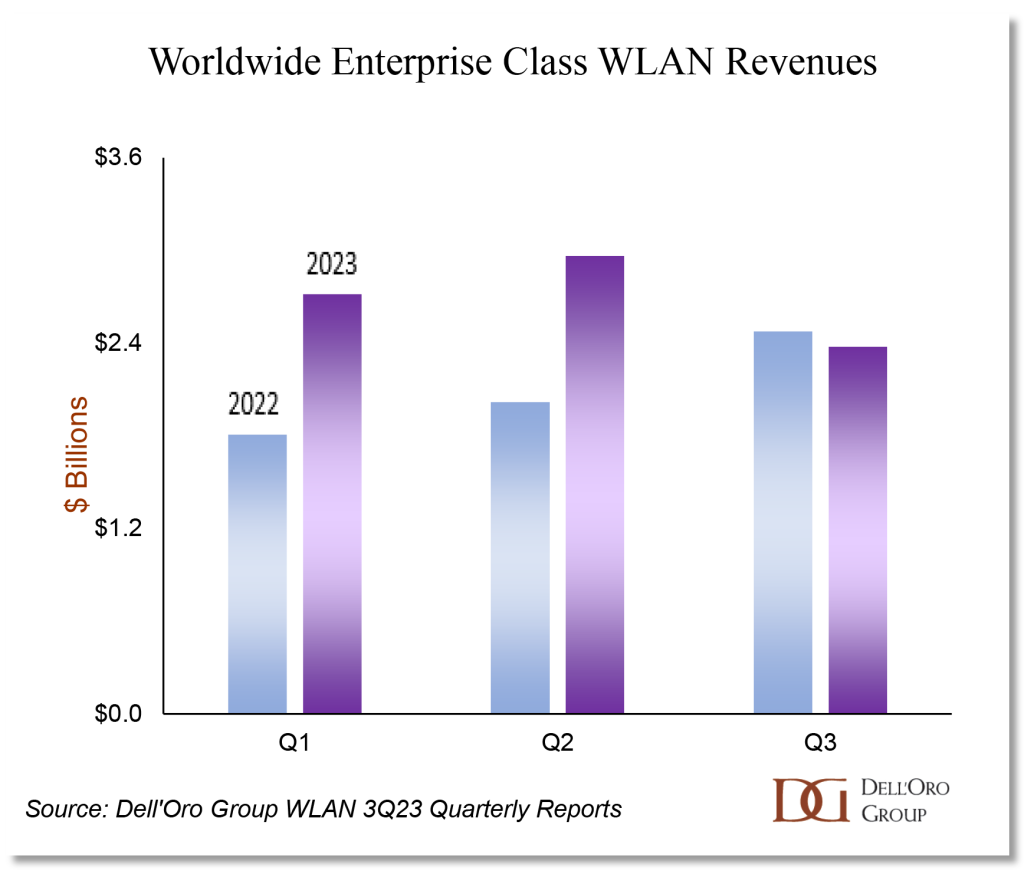

Early last year, we predicted that the enterprise class WLAN revenues would surpass $10 B in 2023 and that sales would be weighted to the first half of the year, defying the usual seasonal patterns. Although 4Q23 results have not yet been published, the first three quarters of the year indicate that 2023 is unfolding as we anticipated.

In the first half of 2023, manufacturers shipped more Access Points (AP) than any first half in history. In the aftermath of the pandemic, a lack of components had created pent-up demand, just as businesses wanted to adapt their networks to accommodate hybrid work models. With equipment in short supply, prices rose and were locked into orders awaiting fulfillment. Once the shortages were alleviated, unit shipments flooded into the channels and manufacturers recognized record revenues.

The good times showed signs of waning in 3Q23, as it became evident that the distribution channels were holding excess equipment, and enterprises needed time to deploy the high volumes of units that had shipped. This led to a drop in unit shipments from manufacturers, with the blow to revenues softened by growth in average prices.

The party may be over, at least temporarily, for the WLAN market; but scratching the surface, there were a couple of gems in 2023 that point to longer-term expansion.

First, use of the new 6 GHz band for Wi-Fi expanded. The spectrum was approved for unlicensed use in the US in 2020, but worldwide shipments of APs supporting the new band stayed below 3% until 2023. In 3Q23, Wi-Fi 6E shipments rose to 10% of units shipped, representing almost a quarter of worldwide revenues. Wi-Fi 6E shipments grew despite a lack of coordination by worldwide regulatory bodies regarding which portions, if any, of the 6 GHz band are allocated for unlicensed (Wi-Fi) use. Then, as the cherry on the 6 GHz sundae, Wi-Fi 7 APs became commercially available for enterprises in 2023. The new standard (also known as 802.11be) promises higher throughput and lower latencies and will operate in 6 GHz where available, but it will also work in the legacy frequency bands.

Second, AIOps and network automation moved to the forefront of IT decision making. Manufacturers introduced new AI-driven operations features for troubleshooting and recommending configuration changes. Startup Wi-Fi vendors marketed services based on fully automated network operations. Enterprises who deployed AIOps began reporting a dramatic reduction in network trouble tickets. In 2023, the automation of network operations became a paragon of AI’s value proposition to enterprises.

This context leads us to the following predictions for the WLAN market in 2024:

The WLAN digestion period will take hold and continue well into 2024

It will take several quarters for the excess WLAN equipment to clear itself from the distribution channels and enterprises’ inventories. In addition, some enterprises are concerned about the economic context and are elongating their decision-making. We project an overall contraction in WLAN revenues in 2024, especially given the record high sales that occurred in 2023.

Wi-Fi 6E adoption will begin to decline as the availability of Wi-Fi 7 expands

There are already 6 vendors selling Wi-Fi 7 APs to enterprises, and the rest of the major vendors are expected to introduce Wi-Fi 7 APs in 2024. Over the course of 2024, vendors will ship more Wi-Fi 6E than Wi-Fi 7 APs. However, 2024 will be the year that Wi-Fi 7 establishes a hold on the market. As a broader range of configurations becomes available, sales of Wi-Fi 7 will begin to displace sales of Wi-Fi 6E. Wi-Fi 7 adoption is expected to grow significantly over the next few years, representing 45% of the Indoor APs shipped in 2027.

Software revenues will dampen the effects of lower unit shipments

As WLAN management applications add features that enterprises value, enterprises are more likely to accept the associated recurring costs. The results from 3Q23 showed an early indication that the market is entering into a digestion period: unit shipments dropped by 14% year-over-year and AP revenues contracted by 10%. Meanwhile, Controller & Licenses revenue grew by over 20%. The recurring license fees paid by the installed base of users helped to grow this line item, even as unit shipments dropped. This phenomenon may soften the downturn, especially for the vendors who have managed to shift their customer base to a recurring model.

Campus NaaS will gain traction as enterprises focus their priorities

In last year’s predictions, we indicated that some clarity was needed to define Campus Network as a Service (Campus NaaS) offers – many manufacturers were using the term NaaS to mean different things. In our June 2023 report, we were able to broadly categorize the offers into three groups: Enabler, Turnkey, and Wi-Fi as a Utility. Since then, more vendors have begun to offer LAN equipment and software in cloud consumption model, and the offers have begun to appeal to a broader set of enterprise verticals. In 2024, the definition of Campus NaaS should become even crisper, and enterprises will begin to consider the service as a way to outsource their IT connectivity, allowing them to focus on their core business priorities. Dell’Oro

You must be logged in to post a comment Login