Trends

Ecuador smartphone shipments up 18% YoY in Q1 2023

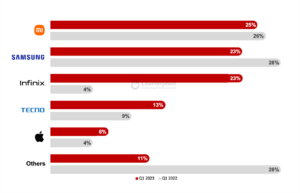

Ecuador’s smartphone shipments increased 18% YoY in Q1 2023, according to the latest research from Counterpoint’s Market Monitor service. In QoQ terms also, the shipments increased by 18%. Xiaomi strengthened its position to take the top spot while Samsung, the biggest loser, dropped 50 basis points in its market share. Transsion brands boosted their total market volume. On the other hand, LATAM smartphone shipments declined 9.9% YoY in Q1 2023 on weak consumer demand.

Commenting on the market trends, Principal Analyst Tina Lu said, “The Ecuadorian market has held strong against the global and regional downward trends. In fact, Q1 2023 was its best first quarter since 2018. The Ecuadorian government reduced mobile device import duty from 15% to 0% in 2022. It also reduced the import taxes on other telecommunication network equipment. All these stimulated the smartphone market and drove a higher rate of replacement despite the current economic deceleration and political turmoil. On top of this, the Transsion group’s Infinix and TECNO brands have successfully penetrated the country with their affordable smartphones, driving higher overall market shipments.”

Research Analyst Andres Silva said, “HONOR doubling its volume this Q1 is a pleasant surprise. This will make the market more competitive. Apple too has been slowly increasing its volume in the country since 2018. Over the years, many OEMs like Motorola and Huawei have unsuccessfully tried to penetrate the market. Ecuador’s macroeconomic performance, such as a comfortable level of inflation, has attracted these OEMs. The country has been perceived as a small but stable economy in South America.”

Q1 2023 market summary

- Xiaomi shipped 8% more YoY as the Redmi 12 series and the new 11S model jumped to the crowded $150-$249 price band. This price band is getting Xiaomi’s attention as it offers higher margins. The 1% loss of shipment share went to Infinix and TECNO, which lead in the low-end price segment (& $150).

- Samsung’s high-priced shipments (& $500) increased 11% YoY, while its low-end shipments declined 47% YoY. Furthermore, this decreased volume failed to match the low-end segment’s market growth in Q1 which was around 18% YoY. Samsung’s overall shipments declined 8% YoY in Q1 2023.

- The Note 12 and Hot series from Infinix inundated the market in Q1, specifically the $50-$150 segment. As a result, Infinix’s volume grew six times compared to Q1 2022 to make it the highest growing brand.

- TECNO too saturated the low-price segment with its Spark Go 2023 and Pova 4 devices. These present clear competition to the cheap Redmi devices and Samsung’s A04 series.

- Apple’s iPhone 14 series was heavily promoted and made up almost half of the brand’s shipment volume. The 14 and 14 Pro devices are seeing the biggest discounts on the operator channel. These models, launched in 2022, brought 20 basis points more to the brand’s shipment share and doubled its shipment volume YoY in Q1 2023.

- “Others” received new brands, especially Chinese brands looking to enter the LATAM region, like HONOR. Ecuador is a good entry point for the region considering its lower import costs and avoidance of currency conversions.

Counterpoint Research

You must be logged in to post a comment Login