Company News

Ciena: Even with 5G revolution, there are supply chain risks

Ciena Corporation (CIEN) is exposed to the 5G revolution, which will most likely push the demand for their products up. The company has cash to finance the development of new products, and finance marketing efforts. With that, the risks are not small. The company is currently facing supply chain issues, and the customer base is not that diversified. In the worst-case scenario, my DCF model resulted in a valuation of $25-$179.

Ciena’s 5G And mobile backhaul services may experience significant demand in the coming years.

Based in Hanover, Maryland, Ciena is a networking system, services, and software company. It provides large communications providers and Web-scale providers with transport, routing, switching, aggregation, service delivery, and management of video and data among other services:

Source: Ciena’s Website

I believe that it is the right moment to carefully study the company’s services for the 5G industry. Experts believe that 5G solutions could experience more than 58% sales from now until 2026. With this in mind, CIEN may see significant demand for its products in the coming years:

As per this research report, the Worldwide 5G Industry is expected to grow with a massive CAGR of 58.70% from 2020-2026. Source: Global 5G Technology & Volume Forecast Report 2021.

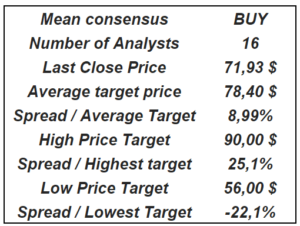

At the same time, the company’s Platform Software is also receiving significant demand. CIEN does not only offer software-based automation of network and IT infrastructures, but also automates network lifecycle operations, data analytics, and domain control.

Beneficial estimations from analysts

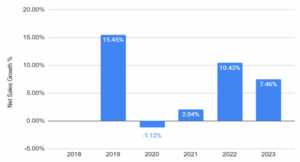

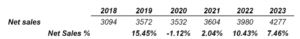

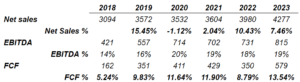

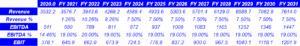

With the global Managed Network Services Market expecting to grow at a CAGR of 7.5%, CIEN is expected to report even more sales growth. Market estimates include 10.43% sales growth in 2022, and 7.46% sales growth in 2023:

The global Managed Network Services Market size to grow from USD 57.4 Billion in 2021 to USD 82.3 Billion by 2026, at a Compound Annual Growth Rate (CAGR) of 7.5%.

Services Market size to grow

Source: Ycharts

Source: Ycharts (All numbers in Million of Dollars)

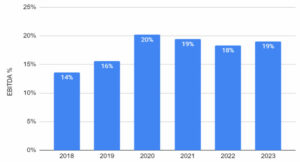

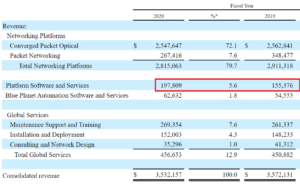

The EBITDA margins expected by other investors are also significant, and they seem to be growing quite a bit. The EBITDA margin is expected to grow from 14% in 2018 to 19% in 2023. I used some of these numbers for my DCF model as given below:

Source: Ycharts

Source: Ycharts (All numbers in Million of Dollars)

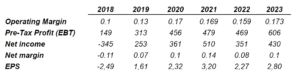

It is also very relevant that CIEN is expected to report positive EPS of $2.27 in 2022 and $2.8 in 2023. With these figures, it makes more sense that 16 analysts reported an average target price that is higher than the current market price:

Source: Ycharts (All numbers in Million of Dollars)

Source: Ciena Corporation: Target Price Consensus and Analysts

With more innovative solutions and new markets, my target price is $101

Under my base case scenario, I would expect CIEN’s R&D efforts to lead to new offerings of programmable hardware, analytics, control, and automation. I am not really thinking out of the box here. Note for instance that in 2020, management brought the 5th coherent modem technology that delivers 800 gigabits of capacity per second. More products will most likely mean more revenue:

Source: 10-k

That’s not all. The company is also entering new growing markets, which may become a significant catalyst for revenue. In this regard, management is actively designing applications for its Converged Packet Optical portfolio:

Source: Converged Packet Optical – Ciena

We are advancing our Converged Packet Optical portfolio for applications in data center interconnection and submarine networks, and bringing to market and seeking adoption for our footprint-optimized WaveLogic 5 Nano (WL5n) 100G-400G coherent pluggable transceivers. Source: 10-k

Finally, under this case scenario, I would also expect CIEN to successfully design and sell the next-generation metro and access applications as well as 5G cross-haul and edge computing. Under this particular assumption, I believe that the company’s revenue growth would go above a CAGR of 7-8%.

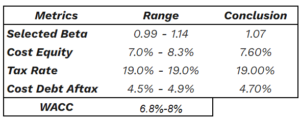

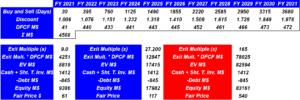

If we use sales growth of 8.26%-7.5% from 2023 to 2031, I would be expecting revenue of $7.614 billion in 2031. Notice that I also used an EBITDA margin of 19%, which results in an EBITDA of $1.447 billion in 2031:

Source: Hohaf (All numbers in Million of Dollars)

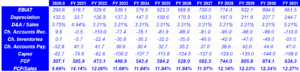

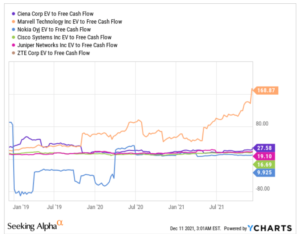

With a D&A/Sales ratio of 3%, changes in inventories up to $51 million, and capital expenditures growing to up to $158 million in 2031, the 2031 FCF would stand at $934 million. Finally, notice that the FCF/Sales ratio would stand at 14%-12%. Note that my FCF/Sales ratio is not far from that reported by peers:

Source: Hohaf (All numbers in Million of Dollars)

Source: Ycharts

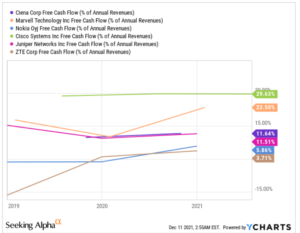

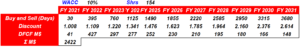

If we use a WACC of 7% and the previous FCF assumptions, the sum would stand at close to $4.56 billion. It represents close to 51% of the current market capitalization, so I wouldn’t say that the company is expensive.

Source: WACC for Ciena Corporation (NYSE:CIEN) | finbox.com

With peers trading at 9x-168x, I used 2031 exit multiples around these trading multiples. In my view, the most appropriate exit multiple may be close to 27x, which implied a valuation of $117. With that, the valuation ranges from $61 to $540:

Source: Ycharts

Source: Hohaf (All numbers in Million of Dollars)

Delays in cien’s global supply chain and any problem with a few clients may lead to a valuation of $25-$179

I believe that one of the biggest risks for CIEN is the disruption and delays in the company’s global supply chain. Take into account that the company relies on third-party manufacturing partners in Canada, Mexico, Thailand, and the United States. Besides, CIEN also relies on many vendors, which may suffer supply disruptions. Under the worst-case scenario, I would be expecting sales growth to be close to 2.5% from now to 2031. Notice that management is not sure whether risks will continue or not:

We took a number of steps, some of which remain ongoing, including multi-sourcing and pre-ordering components and finished goods inventory, in an effort to reduce the impact of the adverse supply chain conditions we experienced. However, there can be no assurance that these efforts will be successful or that supply chain disruptions will not continue, or worsen, in the future. Source: 10-k

Finally, under this detrimental case scenario, I would also be expecting some trouble with some of the company’s largest customers. It is a bit dangerous because the company does not seem to have a diversified customer base:

For example, our ten largest customers contributed 54.5% of our revenue for fiscal 2020 and 59.3% of our fiscal 2019 revenue, and we have seen a further concentration in our orders during the second and third quarters of fiscal 2020. Source: 10-k

Under the previous assumptions, I also included an EBITDA margin of 15%, which implied an EBITDA of $780 million in 2031:

Source: Hohaf (All numbers in Million of Dollars)

The reduction in sales and EBITDA margin would also lead to a reduction in free cash flow and FCF margins. In 2031, I will be expecting FCF of $385 million, and FCF/Sales ratio around 7%:

Source: Hohaf (All numbers in Million of Dollars)

With a WACC of 10% and exit multiples at 6.25x-167x, I obtained a fair price of $25-$179. With traders currently buying shares at $70-$80, there is an upside potential, but the downside risk is also quite significant:

Source: Hohaf (All numbers in Million of Dollars)

Source: Hohaf (All numbers in Million of Dollars)

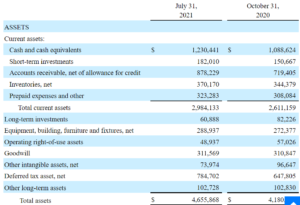

CIEN reports $1.23 billion in cash to finance the development of new 5G solutions

CIEN reports an asset/liability ratio of more than 2.7x, $1.23 billion in cash, and $182 million in short-term investments. In my view, management has sufficient resources to develop new 5G solutions, and launch marketing campaigns:

Source: 10-Q

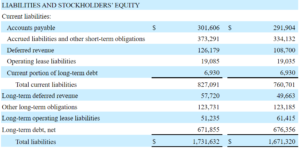

I also believe that CIEN does not report too much debt. In my view, bankers would offer more financing if needed. As of July 31, 2021, the company reports long-term debt worth $671 million, and other long-term obligations worth $123 million:

Source: 10-Q

My takeaway: There are some risks

With the explosion of the 5G industry, CIEN would most likely receive significant demand for its new products. I will be a buyer because I believe that revenue growth will trend north. With that, there are some risks. Delays in CIEN’s global supply chain and any issue related to CIEN’s clients may lead to a valuation of $25-$179. It is not a stock for conservative investors, but an investment for the risk-takers. Seeking Alpha

You must be logged in to post a comment Login