Headlines of the Day

Buy Bharti Airtel; target of Rs 920: Motilal Oswal

In a strategic move, Google will invest up to USD1b in a partnership with Bharti Airtel as part of its Google for India Digitization Fund. The deal includes an investment of USD700m (INR52.24b) to acquire 71.2m shares at INR734/share, implying 1.3% stake in Bharti Airtel on a diluted basis. Additionally, it will invest up to USD300m toward commercial agreements over the next five years.

Strategic focus

The partnership will focus on: a) enabling affordable access to smartphones across price ranges to Airtel customers, b) co-create India-specific use cases for 5G, and c) accelerate the Cloud ecosystem for enterprises, particularly SMEs, across India.

For Google, this could be more than an enabling investment

Airtel is already using Google’s 5G-ready Evolved Packet Core and Software Defined Network platforms. It now plans to explore scaling up deployment of Google’s network virtualization solutions to deliver a better network experience. So, this deal may be more than an enabling investment to build commercials for Google in India which may not

require investment of INR52.2b. Certainly Google sees the advantage of tying up with a large Telecom provider to create front-end solutions.

How could Bharti benefit?

Bharti could leverage Google’s tech platform to explore monetization of its digital offering. It could: a) leverage the opportunity of a large pool (over 300m) of feature phone subscribers in the market through Google enabled affordable devices, and b) leverage Google’s 5G technology solutions to offer use cases to SMEs/consumers, including Cloud services. Over time it can derive a big value through new growth areas.

Highlights from the management interaction

- The device partnership will enable it to offer: a) handset lending, b) attractive pricing through cash back and other incentives, c) e-commerce partnership led benefits, and d) data analytics, which helps in tracking potential smartphone customer upgrades.

- There are no plans to offer subsidies at present and there is no device exclusivity in the deal.

- Airtel’s contribution against Google’s USD300m investment will be part of its USD2.5b capex spends.

Valuation and view

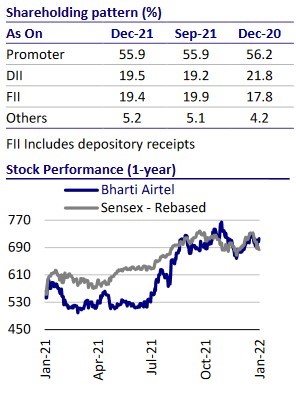

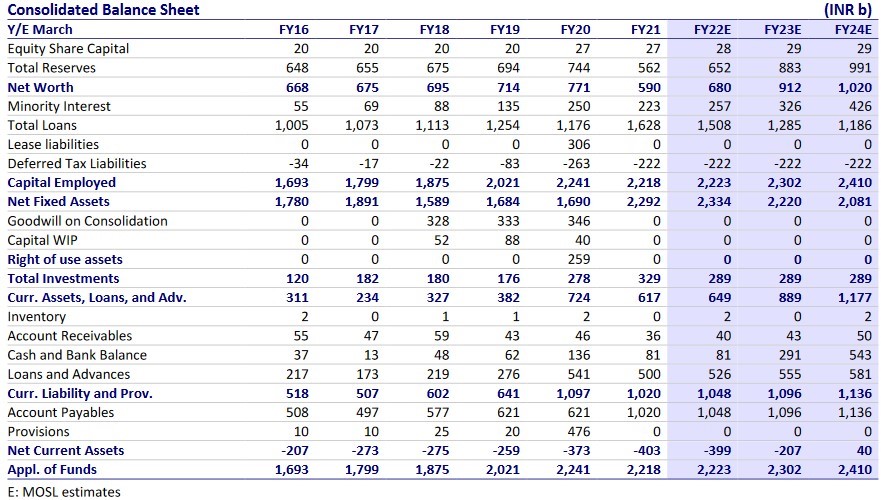

The stock is trading at 5.6x consolidated EV/EBITDA on a FY24E basis, while the implied India business is trading at 8.5x. We value Bharti’s India/Africa Mobile business at a FY24E EV/EBITDA of 10x/4x, arriving at our SoTP-based TP of INR920. We expect a 20% EBITDA CAGR for Bharti over FY22-24E. We see a potential re-rating upside in both the India and Africa businesses on the back of steady earnings growth in each region from a tariff hike, ARPU mix improvement, and market share gains. We see an additional EBITDA potential of INR100b if VIL is unable to infuse large-scale capital and improve its ARPU/revenue to sustainable levels. Strong earnings growth could drive healthy FCF of INR425.7b/INR488.1b in FY23E/FY24E as it may outpace the capex requirement.

Highlights from the management interaction

Key takeaways

- The device partnership will enable it to offer: a) handset lending, b) attractive pricing through cash back and other incentives, c) e-commerce partnership led benefits, and d) data analytics, which helps in tracking potential smartphone customer upgrades.

- There are no plans to offer subsidies at present and there is no device exclusivity

in the deal. - Airtel’s contribution against Google’s USD300m investment will be part of its USD2.5b capex spends.

Concall notes

- The deal’s focus is on three areas – devices, network improvement, and Cloud ecosystem enablement.

- The device partnership will enable it to offer: a) handset lending, b) attractive pricing through cash back and other incentives, c) e-commerce partnership led benefits, and d) data analytics, which helps in tracking potential smartphone customer upgrades.

- There are no plans to offer subsidies at present and there is no device exclusivity in the deal.

- Airtel has 1m SME customers. It aims to serve these customers via this partnership and grow the number of customers.

- Airtel’s contribution against Google’s USD300m investment will be part of its USD2.5b capex spends.

- It will not be directly competing with Google in Cloud services. Airtel caters to hyper Cloud players, apart from the SMEs.

- Airtel invests in digital startups, with distinct technology, where it believes that the technology will improve its process and provide added advantage in customer offerings.

Key charts

Financials and valuations

CT Bureau

You must be logged in to post a comment Login