Trends

Apple’s Q1 2024 revenues dip 4% YoY, services revenue hits record high

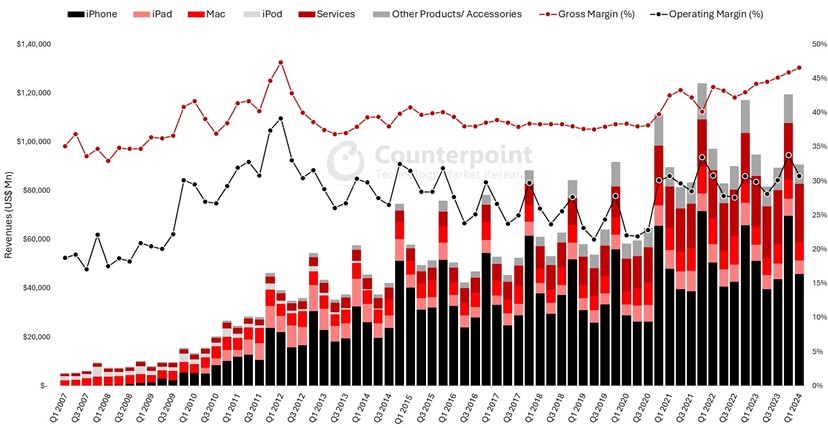

Apple’s Q1 2024 (fiscal Q2 2024) revenues declined 4% YoY. While the revenues from products declined 10% YoY, revenue from services grew impressive 14% YoY reaching the highest ever share (26%) of Apple’s total revenue. This was also the first time that services captured over one fourth of Apple’s total revenue in the first quarter.

Commenting on the results, Varun Mishra, Senior Analyst at Counterpoint Noted, “With iPhones facing competition in China, record low upgrade rates in the US, a difficult compare from last year due to lock down effects, and segments like iPads and AirPods due for refresh, the overall product revenues declined, as expected. However, there are some upsides as well. Services revenues continues to show healthy growth and Apple’s reach in emerging markets continues to rise, which could be a long-term growth opportunity for the entire Apple ecosystem. Gross margins also increased to reach the highest levels in over a decade. This was driven by higher contribution of services as well as a better product mix for iPhones with 15 Pro series performing better than its predecessors”.

Results Analysis:

- iPhone: Revenues down 10% YoY. According to Counterpoint Research Market Monitor, shipments were down 13% YoY with Global smartphone shipment market share reducing from 21% in Q1 2023 to 17% in Q1 2024. The quarter was also a difficult compare because of 14 Pro’s supply shifting to Q1 2023 because of COVID lockdowns in Q4 2022 affecting manufacturing facilities in China.

- ‘Mac revenues grew 4% YoY. The resilience was supported by M3 base models and also a recovery of the overall PC industry.

- iPad revenues declined 17% YoY. The segment is due for refresh with no new models launching in 2023. We will see new iPads launching in Q2 2024, which will drive some growth in the coming quarters.

- Wearables Home and Accessories revenues declined 4% YoY even though Vision Pro sales were likely included in the segment, indicating a steeper decline in other products in the division.

- Services: Continues to be a bright spot for Apple with 14% revenue growth YoY. It’s also an important segment for bottom line growth considering high services margins. Paying subscribers grew by double digits, reaching an all-time high. We also saw Google and Amazon’s subscription businesses deliver impressive numbers, suggesting customers are rewarding product bundles with high value. According to Counterpoint Research’s Apple 360, Services is likely to capture one fourth of Apple revenues in 2025.

Counterpoint Research

You must be logged in to post a comment Login