Company News

Apple: One big time sale

Apple designs, manufactures, and distributes smartphones, personal computers, wearables, and related services. Apple has been one of the most valuable companies in the world for a while and has leadership positions in numerous fields. Its massive installed device base (1.8B active devices) is pushing Apple’s service revenue upwards at a rapid pace, and the overall company’s profit margin is also improving. Furthermore, Apple is moving to become self-sufficient to reduce costs and mitigate supply chain disruptions, and the effort has been paying off. I expect Apple to continue its success well into the future, and the current volatility in the tech sector is presenting a huge opportunity to grab Apple shares at a discount because:

- Apple’s high margin businesses (Mac and Service segments) are growing at a rapid pace, contributing to great revenue growth and margin expansion.

- Revenue growth trajectory remains solid with an increasing subscription base and new product releases (iPad Air, iPhone SE, and etc.).

- The market volatility and tech sector sell-off dragged Apple’s stock down, and it is now being sold under its pre-pandemic level. This presents a great opportunity.

Growing in right segments

Since I wrote my last article, Apple reported quarterly earnings in late April, and the results continue to demonstrate that Apple is focusing on the correct segments for growth and profitability. Overall revenue grew 9% YoY to $97.3 B, and they generated a whopping $28 B operating cash flow. Particularly, their Mac segment and services segment led the charge.

Apple has been working on becoming self-sufficient and manufacturing key product components internally. A couple of years ago Apple took the noteworthy action of severing ties with Intel and making their own computer chips. The effort has been paying a great dividend. The Apple M1 (their own chip) has been performing very well against Intel and other chips on the market, and Mac sales have been very strong. Additionally, producing their own chips boosted the profit margins on Mac products.

Strong performance by Apple Services segment (advertising, AppleCare, Cloud, Digital Content, Payment) is also welcome news for investors. The services segment is a 2x higher gross margin business (72.6%) than the products segment (36.4%), and it has higher growth potential from cloud and digital content. Assisted by its massive installed device base (1.8 B active devices), AppleCare has great potential for increasing revenue as well. Overall, the strong performance from Mac and Services shows that there are good days ahead.

Strong revenue growth trajectory

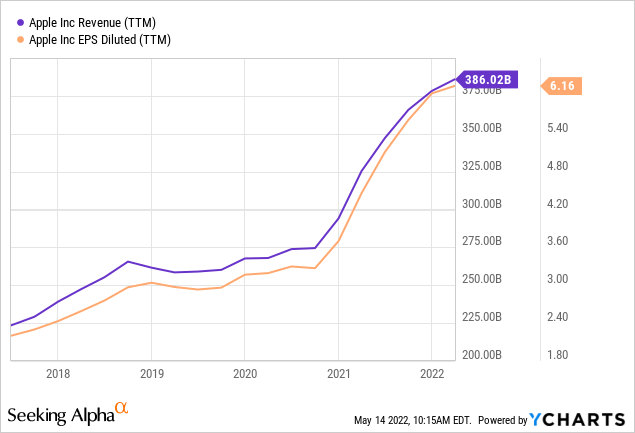

Apple has been growing at a solid pace (10% per year, 5-year average) in the past several years, and the revenue growth is accelerating. This acceleration is due to multiple factors. The first one is the continuing strong performance from new products, and there is no sign that this trend is going to end. During the last quarter, Apple released iPhone SE with 5 G technology, iPad Air with M1 chip, all-new Mac Studio, and all-new Apple Studio Display.

As mentioned before, Apple currently has 1.8 B active device bases, and the number is expected to grow with the release of new products. The active base has been growing at about 100-150 million per year (1.4 B, 1.5 B, 1.65 B, and 1.8 B in 2019, 2020, 2021, and 2022, respectively). Also, this larger installed base will translate into greater revenue growth from AppleCare, advertising, and cloud services. Currently, Apple has about 785 M subscribers to these services.

Favorable valuation

Ongoing volatility caused by supply chain disruption, inflation, war, and Federal Reserve’s changing policies dragged the whole tech sector severely down. Nasdaq index is down from 16,000 in November 2021 to below 12,000. This volatility dragged great companies like Apple along, and now Apple stock is trading below its pre-pandemic level (current P/E ratio of 23.8x vs. pre-pandemic P/E around 25.5x). This presents a great opportunity for investors to grab Apple shares at a bargain.

Intrinsic value estimation

I used DCF model to estimate the intrinsic value of Apple. For the estimation, I utilized current EBITDA ($130 B) as a proxy for cash flow and WACC of 9.0% as the discount rate. For the base case, I assumed EBITDA growth of 20% (Sector median) for the next 5 years and zero growth afterwards (zero terminal growth). For the bullish and very bullish case, I assumed EBITDA growth of 22% and 24%, respectively, for the next 5 years and zero growth afterwards.

The estimation revealed that the current stock price presents 20-30% upside. Given their technological superiority, organic/inorganic growth, and market dominance, I expect them to achieve this upside with ease. Seeking Alpha

You must be logged in to post a comment Login