Headlines of the Day

Vodafone Idea Q3 net loss widens to Rs 7234.1 crore

Highlights for the Quarter

- Revenue grew to Rs. 97.2 billion, a QoQ growth of 3.3% supported by several tariff interventions including tariff hikes effective November 25, 2021

- ARPU for the quarter stands at Rs. 115 vs Rs. 109 in prior quarter, a QoQ increase of 5.2%

- EBITDA (pre Ind AS 116) improved to Rs. 16.2 billion, compared to Rs. 14.1 billion in Q2FY22 (post adjustment for one-off of Rs. 1.5 billion in Q2)

- Continued network capacity expansion supported by spectrum refarming and network upgrade to 4G

- Vi GIGAnet continued to offer superior network experience on both, data and voice, as reflected in independent external reports

- Achieved 90% of targeted opex savings on run rate basis in Q3FY22 against Rs. 40 billion annualized opex savings target

- Opted for upfront conversion of the interest arising on the deferred spectrum and AGR instalments into equity

Ravinder Takkar, MD & CEO, Vodafone Idea Limited, said “We are pleased to announce second consecutive quarter of revenue growth driven by several tariff interventions taken in last few months. While the overall subscriber base has declined as a result of the tariff interventions, the 4G subscriber base remained resilient on the back of superior data and voice experience offered by Vi GIGAnet. We remain focused on executing our strategy to improve our competitive position and win in the marketplace. Separately, we have opted for upfront conversion of interest arising from deferment of spectrum and AGR dues into equity.”

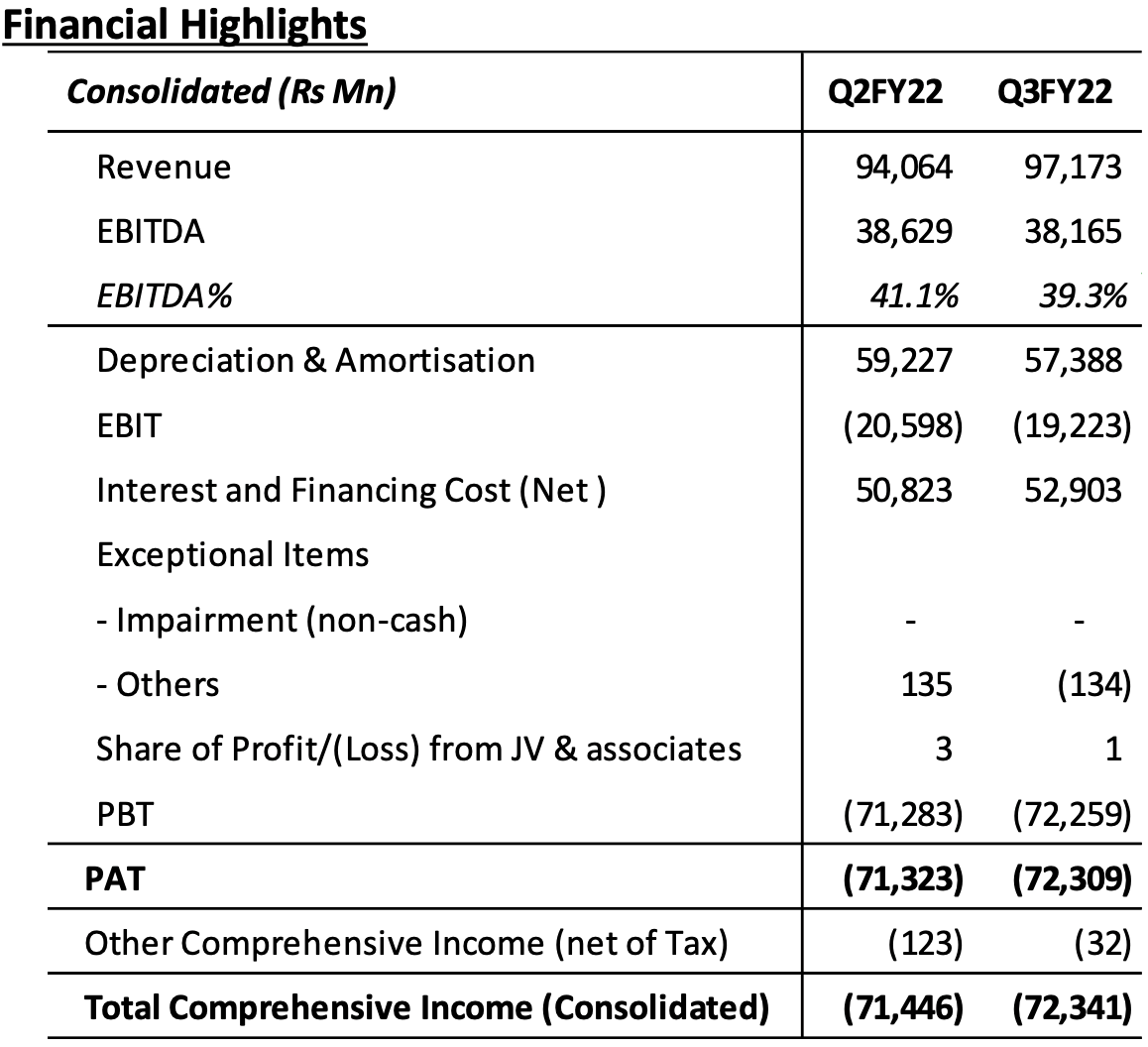

Financial highlights

Revenue for the quarter was Rs. 97.2 billion, a QoQ improvement of 3.3%, aided by several tariff interventions including the recent tariff hikes taken by all operators in November 2021. On a reported basis, EBITDA for the quarter was Rs. 38.2 billion. EBITDA excluding Ind AS 116 impact improved to Rs. 16.2 billion, compared to Rs. 14.1 billion in Q2FY22 (post adjustment for one-off of Rs. 1.5 billion in Q2), aided by improvement in revenue and higher savings on account of cost optimization exercise, which is partially offset by higher marketing expenses. Capex spend for Q3FY22 was Rs. 10.5 billion vs Rs. 13.0 billion in Q2FY22.

The total gross debt (excluding lease liabilities and including interest accrued but not due) as of December 31, 2021 stands at Rs. 1,989.8 billion, comprising of deferred spectrum payment obligations of Rs. 1,113.0 billion, AGR liability of Rs. 646.2 billion that are due to the Government and debt from banks and financial institutions of Rs. 230.6 billion. Cash & cash equivalents were Rs. 15.0 billion and net debt stood at Rs. 1,974.8 billion.

Operational highlights

We continue to invest in 4G to increase our coverage and capacity. During the quarter, we added ~4,000 4G FDD sites primarily through refarming of 2G/3G spectrum to expand our 4G coverage and capacity as well as continued to upgrade our core and transmission network. Our overall broadband site count stood at 450,330, marginally lower compared to 450,481 in Q2FY22 as we continued to shutdown our 3G sites in a phased manner. Till date, we have deployed nearly 67,000 TDD sites in addition to the deployment of ~13,850 Massive MIMO sites and ~13,150 small cells. Further, we continue to expand our LTE 900 presence in 12 circles at multiple locations, including through dynamic spectrum refarming, to improve customer experience. Our 4G network covers over 1 billion Indians as of December 31, 2021 (4G coverage is the population reached/covered by VIL with its 4G network).

These network investment initiatives continue to deliver a significant capacity uplift with our data capacity now over 2.8x compared to September 2018. Our relentless pursuit to have a superior 4G network in the country, through integration and incremental network investments post-merger, are clearly visible through our top rankings on 4G download speeds in independent external reports. We also have the highest rated voice quality in the country as per TRAI’s “MyCall” app data for 12 out of 14 months between November 2020 and December 2021. Our unified brand “Vi”, thus continues to garner strong awareness building brand affinity across all customer segments in the country.

In line with our digital offering strategy, we continue to add to our array of content offerings and digital products and services through partnerships. During the quarter, we launched our music offerings on the Vi App in association with Hungama Music, offering 6 months premium subscription of Hungama Music at no extra charge to all our postpaid and pre-paid customers.

During the last two quarters, we have done several tariff interventions to improve ARPU. We had increased the tariffs on entry level prepaid plans from Rs. 49 to Rs. 79 as well as increased tariffs on certain postpaid plans across retail and enterprise segments during Q2FY22. In November 2021, we increased the prepaid tariffs across all price points including unlimited plans as well as combo vouchers, moving the entry level prepaid plan to Rs. 99. Resultantly, ARPU improved to Rs. 115, up 5.2% QoQ vs Rs. 109 in Q2FY22. The subscriber base declined to 247.2 million vs 253.0 millionin Q2FY22, because of these tariff interventions. However, the 4G subscriber base continued to grow and with 0.8 million customers added in Q3, 4G base now stands at 117.0 million. Subscriber churn increased to 3.4% in Q3FY22 vs 2.9% in Q2FY22. Data usage per 4G subscriber is now at ~14 GB/month vs ~12 GB/month a year ago.

Cost optimization initiative

After successfully achieving targeted merger opex synergies of Rs. 84 billion, we had undertaken a cost optimization exercise across the company in line with the evolving industry structure and business model. Through several initiatives, we have achieved ~90% annualised savings on a run-rate basis by the end of Q3FY22 against the target of Rs. 40 billion. With this, we have achieved the desired cost optimisation in line with our operating model.

Government reform package

On September 15, 2021, the Government announced a comprehensive reform package for the Indian telecom sector including measures to address the structural, procedural and liquidity issues. To address the immediate liquidity concerns of the sector, Government has provided an option of up to four years of moratorium on AGR dues and spectrum instalments due between October 2021 and September 2025 with an option to convert interest arising from such deferment into equity upfront. Other reforms include clarity on AGR definition, reduction in bank guarantees, removal of penalty and reduction of interest for delay in payment of LF and SUC etc. All these reforms are expected to provide long term benefit to all the operators, including the company. The reforms package and the implementation has been welcomed by all the company stakeholders including the banks and investors.

We had opted for 4 years of deferment for both Spectrum and AGR dues in October 2021. This will provide us liquidity support and direct the cash flow generation towards capex investment. Further, on 10th January 2022, our Board of Directors approved the upfront conversion of the full amount of interest arising due to deferment of spectrum instalments and AGR dues into equity. NPV of this interest is expected to be about Rs. 160 billion as per our best estimates, subject to confirmation by DoT. The conversion of this DoT debt to equity will reduce the overall debt of the Company.

CT Bureau

You must be logged in to post a comment Login