Headlines of the Day

Vi-A rescue that came too late?

The government’s decision to take an equity stake in Vodafone Idea in lieu of the interest it owed on spectrum and other liabilities may only be a temporary reprieve amid rising concentration in the telecommunications sector.

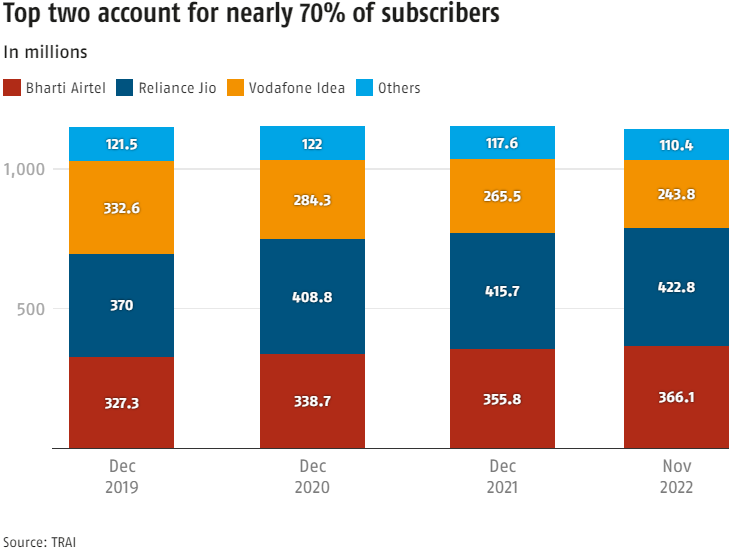

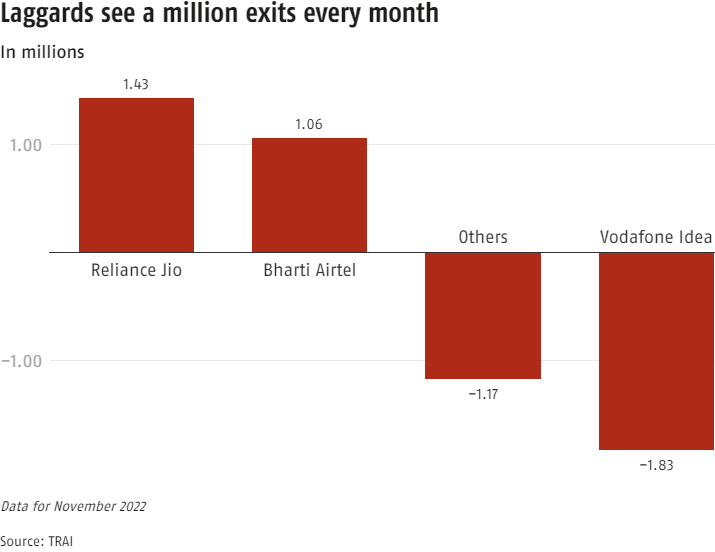

India’s third-largest telecom service provider has seen its market share drop by 7.6 percentage points since the beginning of the pandemic. The top two now account for 69 per cent of the market. The subscription figures for every month reveal a slow shift away from the third-largest player as well as others including public sector telecom provider Bharat Sanchar Nigam (BSNL). Both Vodafone and the others, for example, lost over a million subscribers in the month of November. The top two added over a million each.

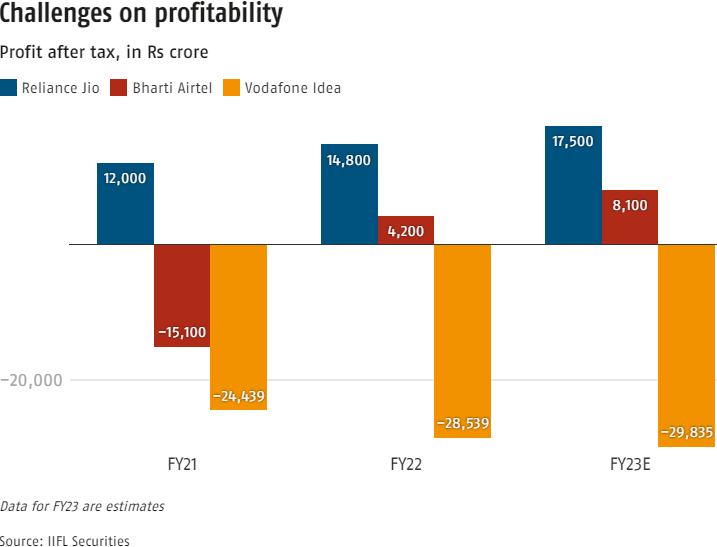

The challenges extend beyond subscription numbers. Vodafone’s losses are expected to touch Rs 30,000 crore in the financial year 2022-23 (FY23). Losses have been getting worse for the company with time, even as its rivals have managed to increase profitability and are making new investments. Vodafone’s losses in FY22 exceeded the FY22 profit of Reliance Jio and Bharti Airtel combined. It is expected to repeat this feat for FY23.

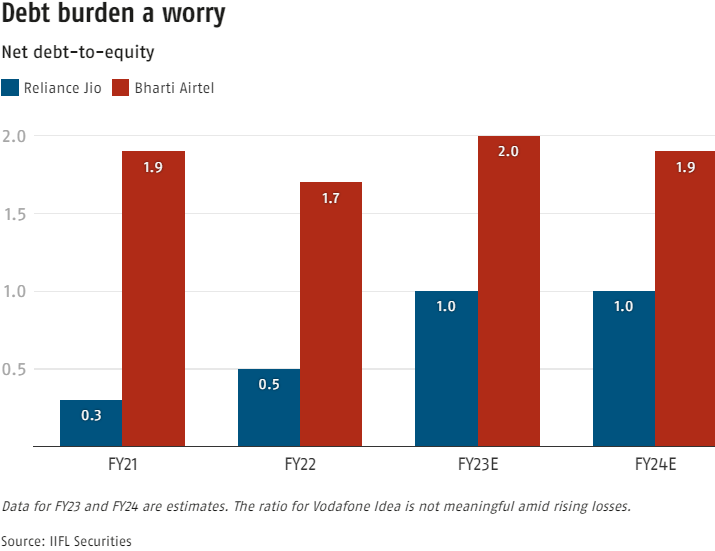

The telecommunications sector has been forced to take on additional debt to invest in infrastructure to roll out the fifth generation (5G) mobile technology. The debt-to-equity ratio, a measure of a company’s indebtedness, is estimated to rise for key players in FY23. The ratio is not meaningful for Vodafone Idea as losses have wiped out its equity.

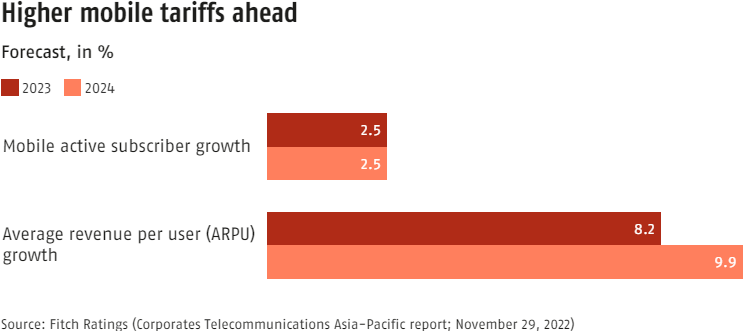

Charging more for services is the only way that the industry, and Vodafone Idea, can manage to keep their finances manageable. Tariffs are expected to rise in 2023, and again in 2024.

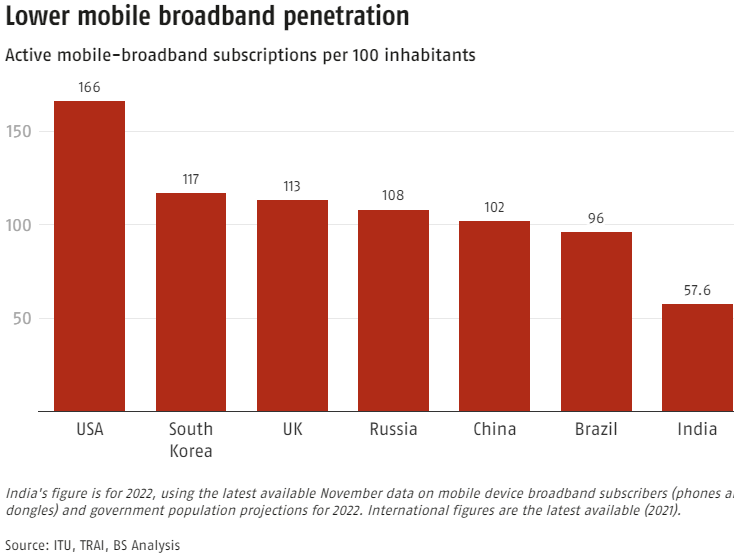

The cost of a smartphone or mobile subscription can be prohibitive to those in the lower income bracket. A larger share of India’s population has remained out of the mobile revolution than in many other key economies. Over 40 per cent of the country has not yet used mobile broadband.

Increasing pricing power in the hands of telecom providers may not help matters. Business Standard

You must be logged in to post a comment Login