5G

Total CapEx requirement for 5G rollout is estimated to be INR 100b for Mumbai and INR 87b for Delhi

According to a telecom report from Motilal Oswal Financial Services, based on the TRAI’s latest reserve price, CapEx requirement for obtaining 100MHz mid band spectrum in Mumbai would be ~INR84b, which could increase if the bidding price is higher than the base price. Assuming ~9k sites would be required for coverage with cost at INR2m/site, the total CapEx requirement for the sites would be INR18b, taking the total CapEx to ~INR100b. Similarly, CapEx requirement for 5G rollout in Delhi would be INR87b – assuming 100MHz mid band spectrum at base price (INR69b).

The Indian telecom industry is seeing CapEx peak out (particularly for Bharti and RJio) and increased free cash flows (FCF). However, risks have started emerging due to the increased CapEx toward 5G technology upgrade and the upcoming spectrum renewal. According to the report, investments in three key large components for a 5G network – Spectrum, Sites and Fiber on mid/low band spectrum with pan-India coverage – would stand at INR2.3t/INR1.3t, which should reduce to INR1.3t/INR788b for coverage of only Metros and ‘A’ circles. With reduced coverage and INR1.5m cost/site, this could reduce to INR1.6t (mid-band) for pan-India coverage. Even assuming rollout starting from FY23E, a staggered deployment over the next 4-5 years (in line with 4G investment trend) could insulate the impact to a large extent.

Spectrum investments

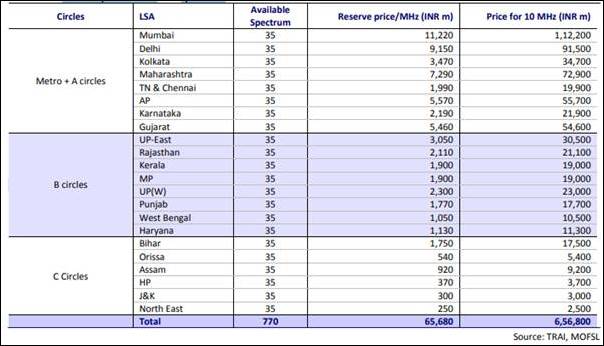

Motilal Oswal Financial Services’ report cited that investments for low band 700 MHZ spectrum, CapEx requirement would be huge due to low band spectrum being expensive as it provides more coverage and requires lesser sites. The10MHz of this spectrum band across India would require an investment of INR656.8b. This investment requirement would reduce to INR463.4b, if the spectrum is to be issued for Metro and ‘A’ circles.

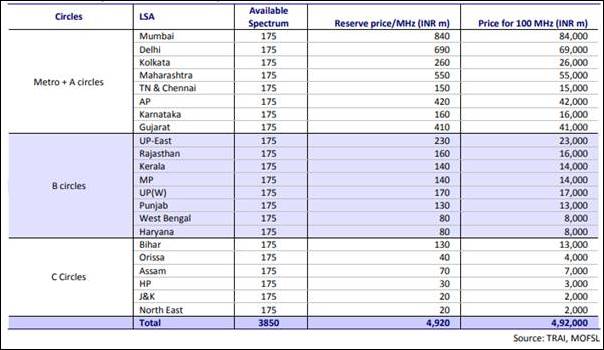

For mid band spectrum: As per the TRAI’s latest price recommendation, 100MHz mid band spectrum across India would require an investment of at least INR490b at the reserve price. This would increase in case the bidding price is higher. Investment requirement would reduce to INR348b (at reserve price), if the spectrum is to be issued for only Metros and ‘A’ circles.

Sites

Assuming lower coverage of 600k site requirement for pan-India coverage and cost/site of INR1.5m, site CapEx would be INR900b.

For pan-India coverage, on low band spectrum assuming total sites’ requirement as per 2G coverage should be ~200k. Cost/site based on some Chinese telcos’ procurement is estimated at ~INR2-2.5m. As India may not do it at such a large scale, it may not get attractive pricing. However, since the deployment may be in 2-3 years, the price of equipment should certainly reduce. Thus, at cost of INR2m/site, total investment for development of 200k sites is estimated at ~INR400b. If the sites are required for only Metros and ‘A’ circles, the total requirement of sites should reduce to half i.e. 100k, as these circles would require higher site density. Subsequently, the total investment too would reduce to INR200b.

On the other hand, site requirement could be 4x in case of mid band spectrum, taking the total site requirement to ~800k/400k for coverage of pan India/Metros and ‘A’ circles. Number of sites’ required for pan-India coverage is higher than 4G (453k in 4G) as 4G was deployed on 1,800MHz and 2,300 MHz while we are assuming 5G to be deployed on an even higher band. Thus, CapEx requirement would increase to INR1.6t/INR800b for coverage of pan India/Metros and ‘A’ circles.

Fiber CapEx

Assuming pan-India fiber requirement of ~2.5m km and cost/km of fiber layout at ~INR100,000, the total investment requirement is estimated at INR250b. Considering only Metros and ‘A’ circles, fiber requirement should be ~0.25m km and cost/km of fiber layout at ~INR500,000 (as cost of land in metros would be higher than other areas), total investment requirement is estimated at INR125b.

Renewal CapEx

The expiry of spectrum for RJio’s 115MHz quantity in the 800MHz band acquired/shared from RCOM in 19 circles, Bharti’s57Mhz quantity in the 1,800MHz band and VIL’s 37.8MHz/6.2Mhz quantity in the 1,800MHz/900MHz band are attractive good quality spectrum and would be up for renewal over the next 6-12 months. This would cost RJio/Bharti/VIL INR280b/INR129b/INR83b at reserve price.

In order to evaluate the intensity and timeline of 5G CapEx, Motilal Oswal Financial Services projected 5G investments on the basis of 4G investments timelines and intensity. Assuming telcos deploy 5G investments over a 5-year period starting FY23E, the annual site CapEx would be INR320b/INR180b in a normal/lower coverage scenario. Thus, both Bharti/RJio would be able to manage these exorbitant investments from their increased FCF generation, owing to the expected tariffs hikes. With an FCF of INR185b/INR198b, it would be manageable for RJio/Bharti in FY22. However, VIL should be in trouble with piling debt, low EBITDA and liquidity concerns.

Motilal Oswal Financial Services believes that (a) investments in 5G is still some time away and may be spread over ~5 years cushioning the impact, (b) the one-time spectrum renewal is a bit delayed and could be managed through the existing FCF of Bharti and RJio, (c) the shrinking number of telcos in India may restrict risks of over-bidding.

India lags behind developed nations in adoption of new technology

Reserve price of 3.4GHz-3.6GHz spectrum

Reserve price of 700MHz spectrum

CT Bureau

You must be logged in to post a comment Login