CT Stories

T&M – A challenging environment, but not for long

The service provider overall spend environment remained constrained in 2022. In the next fiscal, investment demand from US operators for 5G-SA, a recovery of capital investment in Asia especially in China, along with an IoT-centered increase in investment for 5G utilization areas is expected.

5G services have become mainstream in early-adopting countries and customers. The most prominent use case is eMBB, and the rising star is 5G FWA as the fixed wireless access alternative to cable broadband, utilizing FR1 and FR2 effectively. However, the full value of 5G is yet to come.

5G is at the point of transitioning from early adoption to the mainstream on a larger scale. The industry needs to accelerate 5G SA deployments, and develop and proliferate new types of 5G equipment and functions, such as industrial devices, reduced capability (RedCap) NR devices including sensors, non-terrestrial networks, and augmented reality and extended reality functions, enabling new use cases and verticals. Accelerating new technology has its challenges, as RAN performance, network quality of service and quality of experience, and the ability of devices to aggregate and sustain a large number of band combinations efficiently.

Meanwhile, the 6G research journey is already well underway, with key directions spearheading the way; the fusion of artificial intelligence (AI) and machine learning (ML) with wireless, high frequencies above 100 GHz, joint communications and sensing, and reconfigurable intelligent surfaces.

The recently held Mobile World Congress in Barcelona had active participation from T&M manufacturers. The makers with their wealth of valuable knowledge displayed a keenness to help the telcos’ ideas come to life. Together, they can apply state-of-the-art wireless technologies for implementing powerful solutions, overcoming even the most demanding challenges.

Viavi Solutions showcased its Lab-to-Live test and optimization solutions across fiber, 5G, and cloud. Many of the displayed solutions are enabled by the network integrated test, real-time analytics and optimization (NITRO) platform, and are available directly and through partners, including AWS, Supermicro, Capgemini and Intel, VMware, Rohde & Schwarz, and Analog Devices.

Anritsu Corporation showcased advanced solutions, supporting the latest 5G standards and network deployments. The vendor demonstrated how its solutions underpin new use cases, such as smart factories and autonomous driving, the metaverse, and digital twins, while also providing thought leadership and opportunities to learn about emerging technologies. The T&M vendor is participating in multiple projects and consortia for work on 5G-Advanced from Release 18, and with the industry and academia already evaluating technologies for 6G to help define and shape future telecoms technologies and related measurement requirements. These include metaverse user experience over 5G with real-world mobility in partnership with InterDigital test solution for 5G-enabled automated valet parking, in partnership with dSPACE and Apposite, and RIS Measurements with PhaseLync Technology in partnership with Greenerwave.

Keysight Technologies demonstrated 5G new radio reduced capability (RedCap) for IoT, emulation of non-terrestrial networks (NTN), and emulation for testing of metaverse AR/VR devices, as well as support for open-RAN testing and various areas of 6G research and development, among others.

EXFO demonstrated cloud-native service-assurance solutions, enabling service providers to move to 5G standalone with confidence. These included cloud-native 5G standalone service assurance, topology-aware transport assurance, full-stack service assurance, and remote fiber testing and monitoring.

Recent earnings results announced by leading players

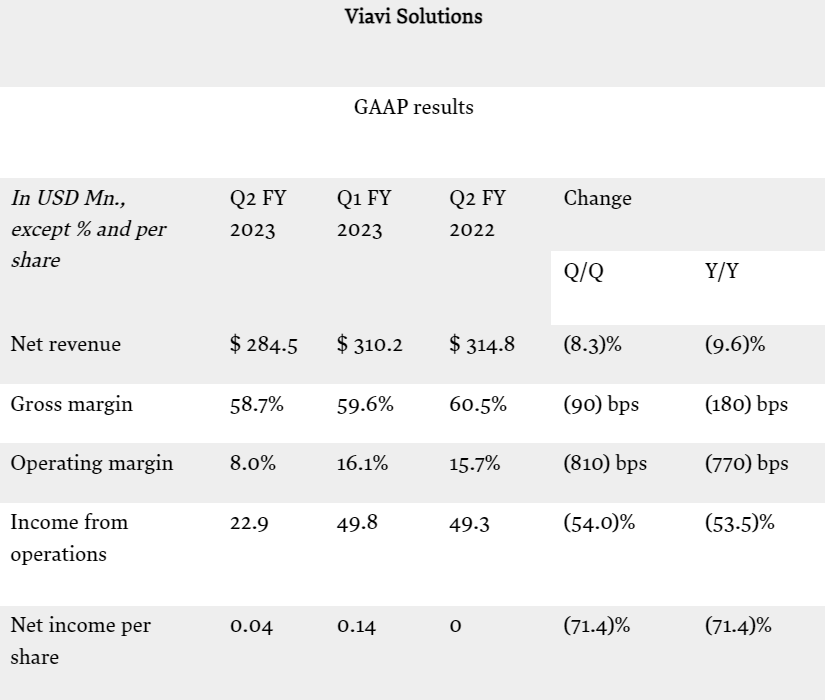

Viavi Solutions

The fiscal Q2 2023 revenue, ending December 31, 2022 slightly exceeded the lowered expectations from the company, with USD 284.5 million in revenue. Although this is down 9.6 percent year-over-year (YoY), it is above the guidance range of USD 261 million to USD 281 million. The operating profit margin for VIAVI was 16.2 percent, which is a decrease of 550 basis points from last quarter and 710 basis points from the prior year, but it is within the guidance range of 13.9 percent to 14.9 percent. EPS came in at USD 0.14 per share, down 41.7 percent from the prior year and 39.1 percent from the prior quarter, but above the guidance range of USD 0.10 to USD 0.12 per share. The current share count was 227.1 million during the quarter, down from 242.3 million shares in the prior year, which shows improvement in the quality of the balance sheet.

Oleg Khaykin

President and Chief Executive Officer,

Viavi Solutions

“Partial recovery in the service provider spend drove fiscal second quarter revenue, operating profit, and EPS above the high end of our guidance. While the overall service provider spend environment remained constrained, we saw initial signs of stabilization and recovery in our NSE business segment, coming in above the high end of our guidance for both revenue and non-GAAP operating margin. The OSP business segment, on the other hand, grew YoY and came in-line with our expectations. We also initiated a limited restructuring positioning at VIAVI for accelerated revenue and profitability growth as end markets recover.”

In terms of cash flow, the company had USD 46.2 million in cash flow from operations, which is up from USD 22.2 million in the prior year. Year-to-date, cash flow from operations continues to be strong at USD 72.8 million, compared to USD 75.6 million last year during the first half.

Looking at the business segments, the Network and Service Enablement quarterly revenue was impacted by lower service provider spend at USD 207.1 million, which is a decline of 15.2 percent YoY, but slightly ahead of the guidance range of USD 187 million to USD 203 million. NE revenue of USD 179.7 million declined 16.2 percent YoY due to the weakness in service provider spending. SE revenue at USD 27.4 million decreased 8.1 percent from last year. NSE gross profit margin at 64.4 percent decreased 90 basis points YoY, and the NSE gross profit margin –operating profit margin at 8.9 percent exceeded the guidance range of 5.5 percent to 6.5 percent, albeit down 980 basis points YoY.

Turning to OSP, second quarter revenue at USD 77.4 million was up 9.6 percent YoY, near the high end of the guidance range of USD 74 million to USD 78 million. Gross profit margin at 52.3 percent decreased 390 basis points from the prior year, mainly result of start-up costs in the new Arizona facility. Operating profit margin at 35.5 percent was within the guidance range of 35 percent to 37 percent, down 370 basis points from a year ago. The company also approved a restructuring and workforce reduction plan to improve operational efficiencies and better align the company’s workforce with current business needs and strategic growth opportunities, which is estimated to affect around 5 percent of its global workforce, with charges of approximately USD 15 million in connection with this plan.

Finally, the ending balance of total cash and short-term investments was USD 489.7 million, down USD 27.4 million sequentially, as a result of capital deployment toward both acquisitions and stock repurchases. Overall, while there are some decreases in certain areas, the company’s results seem to be in line with their guidance ranges, and they are taking steps to improve operational efficiencies.

Outlook. VIAVI expects the fiscal third-quarter revenue to be approximately USD 266 million, plus or minus USD 10 million. Operating profit margin is expected to be 13.6 percent, plus or minus 60 basis points, and EPS to be in the range of USD 0.10 to USD 0.12 per share, with NSE revenue to be approximately USD 197 million, plus or minus USD 8 million, with operating profit margin at 7.7 percent, plus or minus 50 basis points, and OSP expected to be approximately USD 69 million, plus or minus USD 2 million, with operating profit margins of 30.5 percent, plus or minus 100 basis points. Demand softness is expected to persist in the quarter as many of Viavi’s customers are continuing to pare back their CapEx and OpEx in the face of weakening end-market conditions. With the service provider spend stabilization, the company is starting to see early signs of near-term recovery.

Anritsu Corporation

In the third-quarter, ending December 31, 2022, orders increased 1.0 percent YoY to ¥84,033 million, and revenue increased 7.7 percent to ¥81,683 million. Operating profit decreased 26.9 percent to ¥7998 million, profit before tax decreased 20.9 percent to ¥8775 million. Profit decreased 23.8 percent to ¥6225 million, and profit attributable to owners of parent decreased 23.5 percent to ¥6249 million.

Outlook. During the cumulated third quarter of FY23, the development and production-related demand for high-speed network transmission in data centers, as well as the demand for general-purpose test instruments was growing. However, due to temporary slow down of mobile market growth, soaring raw material prices, as well as increased fixed costs and sales promotion expenses, caused by global inflation, rising labor costs, etc., revenue increased and operating income decreased.

Consequently, segment revenue increased 2.4 percent YoY to ¥54,812 million; operating profit decreased 24.0 percent to ¥7801 million.

Anritsu announced its revised business forecast on October 28, 2022. There are concerns of a decline in the global economy as the result of rising prices, financial tightening policies, rising geopolitical risks, and other factors. In the T&M business, Anritsu Group’s main business segment, mobile market growth has temporarily slowed due to factors, such as delays in investment decision-making by customers as a result of the uncertainty of economic situation produced by the sudden rise of inflation. They are offsetting soaring material costs and global cost increases by reflecting them from companies’ prices; however, Anritsu is not expecting the results of their profitability improvement measures until the latter half of the fourth quarter. On the other hand, they are diversifying their procurement in order to handle parts procurement risks, and the situation now seems to be improved. Due to these conditions, and from the results of the third quarter, Anritsu have revised revenue forecast and operating income forecast for the T&M business downwards by ¥5.0 billion and ¥4.0 billion, respectively. The assumed exchange rates for the fourth quarter have been revised to ¥125 to the US dollar and ¥135 to the euro.

Keysight Technologies

Keysight delivered exceptional results in fiscal year 2022, ended October 2022, with revenue growth of 10 percent, compared to fiscal 2021, with full-year revenue of USD 5.42 billion. Profits for the full-year period hit more than a billion, USD 1.12 billion, compared with USD 894 million for fiscal 2021.

Satish Dhanasekaran

President and CEO,

Keysight Technologies

“Keysight delivered strong first quarter financial results, with revenue and earnings per share exceeding the high end of guidance. Our consistent performance is due to the resilience of our business, deep customer collaborations, and differentiated solutions portfolio. With demand moderating, we are staying disciplined and remain confident in the secular, long-term growth trends of our markets.”

Keysight Technologies’ first fiscal quarter ending January 31, 2023, financial results:

- Revenue grew 10 percent to reach USD 1.38 billion, compared with USD 1.25 billion last year, or 14 percent on a core basis, which excludes the impact of foreign currency changes and revenue associated with businesses acquired or divested within the last twelve months.

- GAAP net income was USD 260 million, or USD 1.45 per share, compared with USD 229 million, or USD 1.24 per share, in the first quarter of 2022.

- Non-GAAP net income was USD 363 million, or USD 2.02 per share, compared with USD 305 million, or USD 1.65 per share, in the first quarter of 2022.

- Keysight acquired 711 thousand shares in the open market at an average share price of USD 176.44, for a total consideration of USD 125 million.

- As of January 31, 2023, cash and cash equivalents totaled USD 2.23 billion.

By business segment. Communications Solutions Group reported revenue of USD 939 million in the first quarter, up 7 percent over last year, with strength in 5G, O-RAN, 800G, and terabit communications solutions, as well as increased US government spending and strength in space and satellite, including new applications for non-terrestrial networks. CSG reported growth across all regions.

Electronic Industrial Solutions Group reported revenue of USD 442 million in the first quarter, up 19 percent over last year, driven by growth in next-generation automotive and energy solutions, and general electronics. EISG reported growth across all regions.

Outlook. Keysight’s second fiscal quarter of 2023 revenue is expected to be in the range of USD 1.37 billion to USD 1.39 billion. Non-GAAP earnings per share for the second fiscal quarter of 2023 are expected to be in the range of USD 1.91 to USD 1.97.

NI

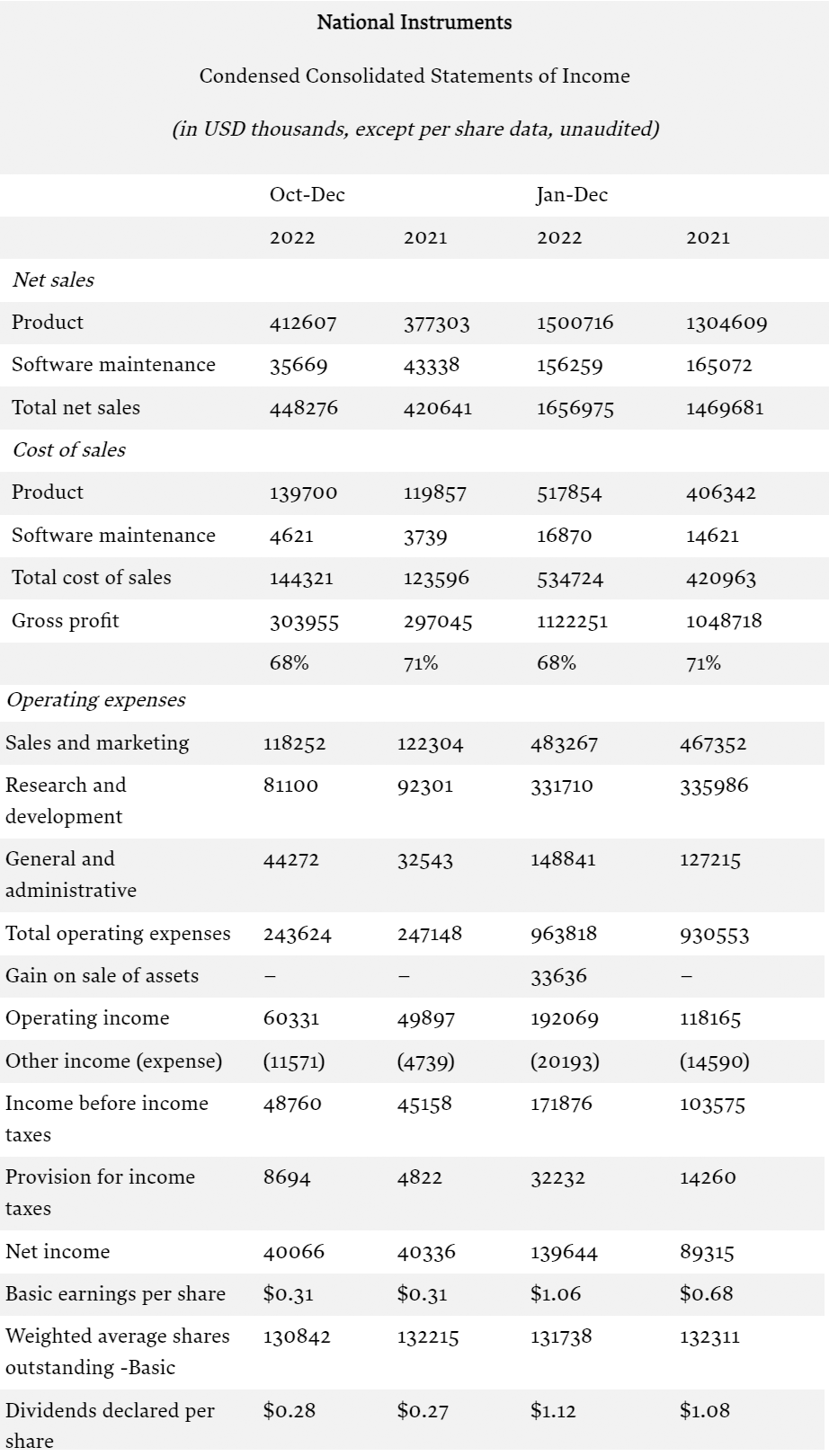

NI (National Instruments Corporation) has been approached by potential buyers and its board of directors has begun a review of its strategic options. The comprehensive review will include consideration of a full range of available strategic, business, and financial alternatives, including solicitation of interest from potential acquirers and other transaction partners, some of whom have already approached the company.

Eric Starkloff

CEO,

NI

“The company’s implementation of strategic initiatives over the past few years and its focus on software and services has transformed NI into a company with higher growth, better profitability, and lower cyclicality. These changes have enabled deliberate focus on high-growth sub-segments, including electric and autonomous vehicles, wireless communications, and new space technology.”

In the meantime, the test equipment company headquartered in Austin, Texas, has also put into place a “shareholder rights” plan that the company says the measure is meant to help ensure that all interested parties have the opportunity to participate fairly in the strategic review and to provide the board and shareholders time to make informed decisions. That plan is also intended to reduce the likelihood that any person or group gains control of the company through open market accumulation or other tactics, and reduce the likelihood that actions are taken by third parties that are not in the best interests of the company and all of its shareholders – essentially, to prevent a hostile takeover.

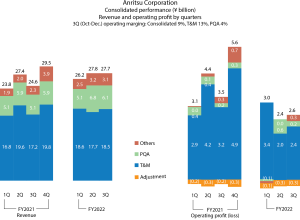

The company announced its most recent results for the fourth quarter and full year of 2022 on January 31, 2023. Its Q4 2022 revenue of USD 448 million, up 7 percent YoY was an all-time quarterly record.

In Q4 2022, the value of the company’s total orders was down 3 percent YoY. Geographic order growth for Q4 2022 compared with Q4 2021 was down 7 percent in the Americas, down 9 percent in APAC, and up 7 percent in EMEA.

2022 was a strong year as it continued to make strides in transforming NI into a higher-growth, more profitable, and more resilient company. Despite ongoing global macroeconomic uncertainty, the vendor delivered on the 2022 targets we shared at our September investor conference with record revenue of USD 1.7 billion, up 13 percent YoY, and non-GAAP operating margin of 20 percent, up 130 bps as compared to 2021,” Eric Starkloff, president and CEO, NI. “As we head into 2023, even in a recessionary environment, we now expect to exceed our 300 bps non-GAAP margin expansion target.”

“In my first few weeks at NI, I’ve been impressed with the high level of talent in the organization, as well as the NI culture of engineering and commitment to its customers,” said Daniel Berenbaum, CF, NI. “My focus will be on accelerating operational improvements to achieve our margin targets, improving working capital management and cash-flow generation, and building investor confidence in our ability to execute. We have already undertaken a number of initiatives, which underpin our confidence in being able to generate significant operating margin improvement in 2023.”

NI’s non-GAAP results exclude, as applicable, the impact of purchase accounting fair value adjustments, stock-based compensation, amortization of acquisition-related intangibles, acquisition-related transaction and integration costs, taxes levied on the transfer of acquired intellectual property, foreign exchange gain/loss on acquisitions, restructuring charges, tax reform charges, disposal gains on buildings/assets and related charitable contributions, tax effects related to businesses held for sale, gain on sale of businesses, and capitalization and amortization of internally developed software costs. Reconciliations of NI’s GAAP and non-GAAP results are included as part of this news release.

|

Keysight Technologies, Inc. Consolidated statement of operations (in USD millions, except per share data) |

|||

| Year ended October 31 | |||

| 2022 | 2021 | 2020 | |

| Revenue | |||

| Products | $4474 | $4050 | $3432 |

| Services and other | 946 | 891 | 789 |

| Total revenue | 5420 | 4941 | 4,221 |

| Costs and expenses | |||

| Cost of products | 1617 | 1522 | 1373 |

| Cost of services and other | 353 | 350 | 315 |

| Total costs | 1970 | 1872 | 1688 |

| Research and development | 841 | 811 | 715 |

| Selling, general and administrative | 1283 | 1195 | 1097 |

| Other operating expense (income), net | (8) | (17) | (44) |

| Total costs and expenses | 4086 | 3861 | 3456 |

| Income from operations | 1334 | 1080 | 765 |

| Interest income | 16 | 3 | 11 |

| Interest expense | (79) | (79) | (78) |

| Other income (expense), net | 14 | 6 | 63 |

| Income before taxes | $1285 | $1010 | $761 |

| Provision for income taxes | 161 | 116 | 134 |

| Net income | $1124 | $894 | $627 |

| Net income per share-Basic | 6.23 | 4.84 | 3.35 |

Q4 2022 highlights

- All-time record revenue of USD 448 million, up 7 percent YoY

- Q4 GAAP operating margin of 13 percent; Q4 non-GAAP operating margin of 25 percent

- Strong diluted GAAP EPS of USD 0.30; all-time record diluted non-GAAP EPS of USD 0.63

- Cash and cash equivalents of USD 140 million as of December 31, 2022

FY 2022 highlights

- All-time record revenue of USD 1.66 billion, up 13 percent YoY

- GAAP operating margin of 12 percent; Non-GAAP operating margin of 20 percent

- Strong diluted GAAP EPS of USD 1.05; record diluted non-GAAP EPS of USD 1.93

- Returned USD 300 million to stockholders through dividends and stock repurchases

In 2022, GAAP operating expenses were USD 964 million, up 4 percent YoY, and non-GAAP operating expenses were USD 836 million, up 1 percent YoY. GAAP net income in 2022 was USD 140 million, up 56 percent YoY, and non-GAAP net income was USD 255 million, up 14 percent YoY.

As of December 31, 2022, NI had USD 140 million in cash with USD 43 million in cash generated from operations in 2022. During Q4, NI paid USD 37 million in dividends. For the year, we returned USD 300 million to our stockholders through dividends and stock repurchases, including the repurchase of 3.8 million shares at an average price of USD 40.04 per share. The NI Board of Directors approved a dividend of USD 0.28 per share payable on March 6, 2023, to stockholders of record at the close of business on February 13, 2023.

Q1 2023 Guidance

- GAAP revenue to be in the range of USD 415 million to USD 445 million, up 12 percent YoY at the midpoint

- GAAP diluted EPS to be in the range of USD 0.14 to USD 0.28, up 2 cents YoY at the midpoint

- Non-GAAP diluted EPS expected to be in the range of USD 0.48 to USD 0.62, up 34 percent YoY at the midpoint

Rohde & Schwarz

In November 2022, announced that it ended its fiscal year with increased revenue and strong order intake.

R&S is privately held, but the company nonetheless reports a few of its financial and operating highlights each year. For its fiscal 2021-22 year, the company said that revenues were up to 2.53 billion euros (about USD 2.5 billion), or about compared to 2.28 billion (about USD 2.26 billion) in its previous fiscal year. The company said that each of its three divisions achieved double-digit growth, but converting orders to billable sales was impeded by the tight supply chain situation. Having vertically integrated plants in Germany, Czech Republic, Singapore, and Malaysia helped the company stay stable, however.

Rohde & Schwarz said that it saw strong demand for high-performance wireless testers, signal generators, spectrum analyzers, and oscilloscopes in the wireless communications and automotive technologies sectors, and that its businesses providing security scanners military communications systems and air traffic control systems also were on solid footing.

Weaker near-term demand environment is expected to continue this quarter ending June 2023, as customers continue to pare back their CapEx and OpEx. However, the T&M business is not much impacted by CapEx. With the service provider spend stabilizing, and a lot of the equipment already coming in that needs to be installed, deployed, and turned on, which requires the tools, and for that the T&M makers need to get involved. Calendar 2023 spend overall seems fine, as the industry is starting to see stabilization and the right signals coming out with the demand for field equipment.

Recovery and growth in fiber and cable spend is expected this year, as compared to last year when cable was de minimis. Over the next two years, there is expected mid-cycle upgrade of network before the DOCSIS 4.0 reallocate spectrum in the cable will be reallocated to have more symmetric bandwidth up and down. And in about two years, DOCSIS 4.0 is expected, which would take the speed on the cable network up to 10 gigabit. Some upsides, starting in the middle of this year and going on beyond, in fiber and cable are expected. And, the 5G C-band deployment is ongoing. Now that equipment is there, the demand for field instruments will be forthcoming and

continue long-term.

The T&M sector is finally getting the respect that it deserves!

You must be logged in to post a comment Login