Daily News

Titans Fight Back

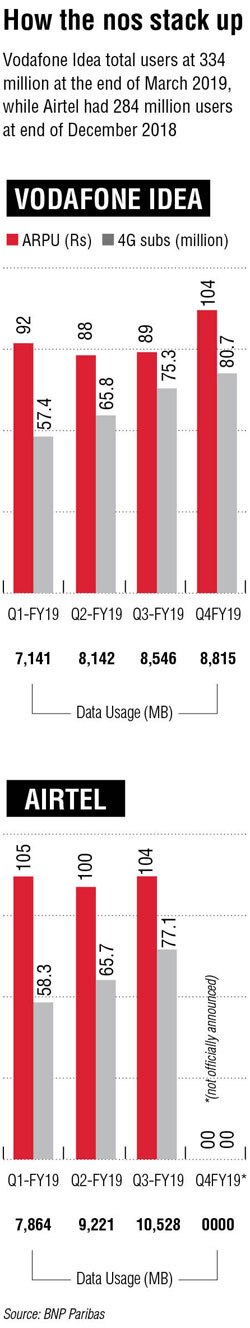

India’s largest telecom player Vodafone Idea lost about 88 million mobile users in the last two quarters while the earlier top player Airtel lost 48.5 million in the third quarter (fourth quarter numbers have not been declared by the company due to ongoing rights issue). It may seem to be a big loss for the telecom players who are bleeding since the entry of new player Reliance Jio, but it actually isn’t. It’s quite the opposite.

The churn has helped both the incumbents in improving their average revenue per user (Arpu), a key matrix for profitability.

For the fourth quarter, Vodafone Idea’s Arpu stood at Rs 104, almost 17% up quarter on quarter. For Airtel, it is estimated by Edelweiss Research that Arpu levels have reached Rs 125 in the fourth quarter (numbers not released by Airtel), a 20% increase sequentially. The revenues of Vodafone Idea, though, reported flat growth while Airtel recorded a 4% jump.

These may be the green shoots the incumbents have been waiting for long. According to experts, a recovery in the telecom sector is not far away, and this year would offer much-needed stability to the plunging financial health of the incumbents.

“The worst is over for the Indian telecom sector. And after losing revenues worth Rs 40,000 crore over the last two years, which is since the launch of Reliance Jio, the sector is on a recovery path and the recovery would be led by an increase in Arpus,” Hetal Gandhi, director, Crisil Research told DNA Money.

Crisil Research says the Indian telecom industry will reverse a two-year declining trend with a 7% revenue growth in fiscal 2020, which will ride on an increase in Arpu by 11%, though the overall subscriber base is expected to shrink by 4%.

Rajan Mathews, director general, Cellular Operators Association of India, said it would be prudent to say that stabilisation has come in the metrics of incumbents, which means for the next two quarters at least, we will not see revenues or Arpus declining for both Vodafone Idea and Airtel but stabilise and provide some time for an uptick.

Last year, both Vodafone Idea and Airtel had introduced minimum recharge plans at Rs 35 to weed out low paying subscribers, who were mainly dual SIM.

“The minimum recharge is proving to be a prudent strategy. This, along with the increasing shift of feature phone subscribers to smartphones and the thrust on improving the mobile broadband share (with re-launch of ‘Airtel Thanks’), augurs well for Bharti’s India wireless business….there has been a strong turnaround in quarter four,” Motilal Oswal said in an analyst note.

“Quarterly results of most telecom carriers are already showing either stabilisation or an improvement in Arpus. This trend is only expected to firm up over the next three quarters of this fiscal. Arpus will increase, supported by two key factors – minimum recharge plan and the continued increase in the data subscribers and average data usage,” Gandhi said.

The focus of incumbents has been on improving 4G network coverage, bundling mobile services with content offerings and rationalising tariff packs. Though Vodafone Idea also has integration issues to take care off.

An April report by OpenSignal has said Bharti has bridged the gap with Reliance Jio on the 4G/LTE coverage area quite significantly in the past one year. Bharti’s LTE availability now stands at 85.6%, compared to 66.8% in April 2018. Though Jio remained at the top with 97.5%, Vodafone and Idea have has also improved their LTE availability up to 76-77% from 68-69% levels a year ago.

Tariff hike to provide momentum

With aggressive competition, players were left with no room to raise tariffs. But of late, both incumbents have rationalised their tariff offerings and came up with a minimum plan, which has effectively raised tariffs through different means. Now, with Reliance Jio close to achieving the highest revenue market share in all circles, there is a possibility that pricing aggression may cease to exist allowing incumbents some breathing space.

The entry of Reliance Jio led to a massive increase in data subscribers and users, but it did not result in any substantial gains to Vodafone Idea and Airtel because of low tariffs.

“The aggression shown by the new player Jio would moderate in fiscal 2020. If you look at the statistics at a local level, on a revenue share basis, Jio already has a leadership position in more than 50% of circles. This will make it very selective while entering into pricing aggression. Prices or innovative plans may be introduced by players only to finish their fight in Metros and urban circles,” Gandhi said.

But does it mean that the era of falling tariffs is over? Gandhi differs.

“Difficult to say that there will no decline, but there would be new packs that might be introduced only in urban areas or metros or Circle A, because their leadership position still may go some changes.

Whereas in Circle B’s and C’s, Jio has achieved revenue market share leadership, and therefore it would have less reason to get aggressive in terms of pricing in those circles giving an impression that pricing aggression might be limited.”

Apart from introducing minimum recharge plans, Airtel has significantly reduced the number of plans available for postpaid subscribers, besides migrating off the lower pricing plans for postpaid users. While postpaid users might be a smaller proportion of the total subscriber base, but they do contribute 20 to 25% to the revenues.

Content strategy

The entry of Reliance Jio in late 2016 spurred the consumption of mobile data on smartphones like before and with data being the silver lining, all the telecom players are latching on to it to boost their revenues. According to Nokia’s annual Mobile Broadband India Traffic (MBiT) Index, the mobile data traffic in India grew 109% in 2018, with 4G alone contributing 92%. The average data usage grew by 69% in 2018 to touch 10GB a user per month in December.

With rising data consumption, telecom players are increasingly focusing on content offerings — be it music or videos to drive data usage.

While Airtel has been quite vocal about its strategy related to content offerings, Vodafone Idea is yet to make any significant move.

Airtel has recently launched music and video streaming app Wynk Tube – targeting entry-level smartphone users, which is available in many regional languages. The company aims to target 200 million smartphone users in tier II and III cities and rural areas. It also launched an app Airtel Books – which will allow mobile users to access over 70,000 e-books on their smartphones.

Also, it is focusing big time on data analytics to generate customer intelligence. It also relaunched its AirtelThanks programme under which it will offer differentiated services and customised content to its mobile subscribers depending upon their monthly tariff plan. Higher tiers will open bigger and more exciting benefits, besides content, device and security services, financial services, VIP customer care and surprise offers from top brands. For the first time, Amazon Prime membership will be available to Airtel prepaid users as well as part of its Thanks programme at just Rs 299.

Analysts say the objective of most players would now be on improving content offerings and providing niche offerings by which they will not leave any opportunities of increasing the Arpus.

Going forward, the difference between telecom players would be in positioning of pricing packs which will keep changing and evolving over the next four quarters through which telcos will rationalise offerings to the customers. This will also ensure that costs keep coming down because maintaining more number of plans means more costs, Gandhi said.

The things for the telecom industry went awry after the entry of Reliance Jio into the sector in late 2016. The cumulative debt of the industry remains high at Rs seven lakh crore. Continuous investment in their networks has become difficult for Airtel as well Vodafone Idea, which is still in the process of integrating the two networks. Vodafone Idea has recently raised funds from a rights issue while Airtel is in the midst of raising funds.

Two or three market players?

With a sustained need for capex, will all telecom firms survive or we are moving towards a two private player market plus one telecom PSU, from three private players now. Experts said many factors would determine this including upcoming auction pricing, telcos asset sale plans and others.

“Investment over the next three to four years will be very critical to decide if the industry will continue to be a three player market or, two and so. Any significant jump in capital expenditure on investment numbers may be detrimental to players,” Gandhi said.

Mathews said it would be too early to say about the market dynamics. If the government decides to rationalise various taxes and levies on the telecom industry, that will be a much-needed support for the sector to survive, he said.

But at the current growth levels, it might take years for incumbents to reach pre Jio Arpu level, which was in the range of Rs 160-180.

“For telcos, having Arpu at over Rs 100 will be a relief. Pre Jio Arpu will not be possible in the next one year. What is important is every Re 1 increase in Arpu will drive Rs 1,000 crore to Ebidta at an overall level,” Gandhi said.

- Telecom industry to reverse 2 year declining trend with a 7% revenue growth in 2020 fiscal

- ARPU to go up by 11% owing to higher data usage and introduction of minimum recharge plans.

- Though, overall subscriber base is likely to shrink by 4%

- EBITDA margins to improve by about 350 basis points to 31% in 2020 fiscal.―DNA India

You must be logged in to post a comment Login