5G Features

The roller coaster ride called telecom

5G is now upon us, bringing with it the promise of a host of exciting new services. As the boundaries between mobile and the wider digital ecosystem continue to blur, and as data monetization poses a continued challenge, many operators are moving beyond their traditional telco businesses to explore new opportunities in a fast-changing competitive landscape.

2019 is the year when leading communications service providers in Asia, Australia, Europe, the Middle East, and North America switched on their 5G networks. South Korea has already seen a big 5G uptake since its April 2019 launch. More than three million subscriptions were collectively recorded by the country’s service providers by the end of September 2019. China’s launch of 5G in late October has also led to an update of the estimated 5G subscriptions for the end of 2019, from 10 million to 13 million.

Ericsson, in the November 2019 edition of the Ericsson Mobility Report forecast that the global number of 5G subscriptions shall top 2.6 billion within the next six years, driven by sustained momentum and a rapidly developing 5G ecosystem. Given its current momentum, 5G subscription uptake is expected to be significantly faster than that of LTE. The most rapid uptake is expected in North America with 74 percent of mobile subscriptions in the region forecast to be 5G by the end of 2025. North-East Asia is expected to follow at 56 percent, with Europe at 55 percent.

Fredrik Jejdling, executive vice president and head of Networks, Ericsson, says: “It is encouraging to see that 5G now has broad support from almost all device makers. In 2020, 5G-compatible devices will enter the volume market, which will scale up 5G adoption. The question is no longer if, but how quickly, we can convert use cases into relevant applications for consumers and enterprises. With 4G remaining a strong connectivity enabler in many parts of the world, modernizing networks is also key to this technological change we’re going through.”

5G and LTE shall co-exist. The private LTE and 5G network market is expected to reach USD 4.7 billion in annual spending by the end of 2020, and USD 8 billion by 2023. While as much as 30 percent of private network market investments – approximately USD 2.5 billion – will be directed toward the build-out of private 5G networks; organizations across the communications and industrial IoT domains are making significant investments in private LTE networks. These areas include public-safety agencies, militaries, oil and gas companies, mining groups, and manufacturers. However, 3G remains the dominant technology, at 48 percent of all subscriptions, while LTE subscriptions grew by 70 percent during 2018, taking a share of 26 percent.

In India, 2G remained the dominant technology till 2018, accounting for around 56 percent of total mobile subscriptions at the end of the year. However, the country has experienced strong growth in the number of LTE subscriptions over the last couple of years, and at the end of 2018, LTE accounted for close to 30 percent of all mobile subscriptions, and is expected to shoot to 80 percent by 2025.

Indian operators have invested heavily in their LTE networks; Jio has built a greenfield LTE network over the last four years, while Bharti Airtel and Vodafone-Idea are investing in adding coverage and capacity to their LTE networks. All the operators are deploying the most advanced versions of LTE. Bharti Airtel and Jio are deploying LTE Advanced, which uses carrier aggregation to increase data speeds. Vodafone Idea is deploying massive MIMO in a number of cities, while looking to increase cloudification of the network core and trialing SDN and NFV. These would enable an easier and more cost-effective migration to 5G.

GSMA has recently released a report, providing insights, based on its global perspective, on how India can best become 5G-ready.

5G deployment models. Two 5G deployment models have been standardized to meet initial market requirements – non-standalone access (NSA) and standalone access (SA). NSA and SA 5G deployments are optimized for different needs. While NSA configuration is suitable for providing more broadband capacity, since 5G NR can act as a supplementary capacity overlay to the 4G network, SA configuration allows operators to fully exploit the features of NR as well as the capabilities of the new core network architecture.

It is likely that operators in India will follow the NSA deployment model, which allows both lower overall investment levels and an initial focus on eMBB services. Operators are able to use existing macro sites and LTE spectrum as an anchor connection, with a densified network of small cells and use of mid-band (1–6 GHz range) and upper-band (above 6 GHz) spectrum to facilitate high-speed data services.

Initial deployments are likely to focus on utilizing mid-band frequencies in urban areas with high-capacity needs, reflecting the surging demand for mobile data services in the country. While spectrum refarming and moves toward network densification can increase the capacity of existing 4G networks, in the medium term 5G networks represent the most cost-effective way to accommodate the likely future growth in data traffic in India. As revenue per gigabyte of data traffic is already extremely low in India, 5G networks offer the promise of lower OpEx costs and, therefore, a lower cost per gigabyte for operators.

There is an equally pressing objective to provide greater mobile broadband coverage in rural areas in India – 5G networks utilizing sub-1 GHz bands (and particularly the 700 MHz band) will also be used to address this. The 700 MHz band has yet to be successfully assigned in India, and may be used initially for 4G networks. Refarming to 5G can then be done on a dynamic basis, as 5G supports the use of a specific band for both 4G and 5G simultaneously, depending on the proportion of devices on each generation in a cell.

4G and 5G networks are likely to co-exist in India for a number of years. In common with many markets around the world, 4G networks will continue to service a significant share of mobile data traffic, leaving 5G with the dual remit of absorbing increasing demand for capacity and underpinning consumer and enterprise services that require higher speeds and/or lower latencies, such as immersive reality, remote surgery, or autonomous transport. Alongside eMBB, fixed wireless access is an important early stage use case for 5G.

5G market readiness. Though operators recognize the potential for 5G to transform aspects of the consumer and enterprise experience, they also have concerns around identifying specific business models and how much scope there is to monetize the new services that 5G will enable.

A number of indicators suggest that the mobile ecosystem still needs to develop further for India to be truly ready for 5G launches. These include the relatively low levels of 4G adoption across the Indian market as a whole, and low network-download speeds. However, 4G adoption is accelerating rapidly and by 2025 will exceed averages globally and for developing markets. This highlights the importance of operators continuing to invest in the latest LTE network technologies, including network densification and additional fiber deployments, as building blocks for 5G.

An additional factor is the relative lack of fiber in India. India has a mere 1.5 million kilometers of optical fiber cable, with only 22 percent of the towers connected by fiber. Indian operators typically rely on microwave for backhaul. The government has put a huge thrust and aims to increase fiber footprint to five-fold, 7.5 million kilometers by 2022 and also fiberize at least 60 percent of telecom towers.

The rapid technology migration, currently underway in India toward 4G networks and smartphones, means that the 5G-readiness score will improve significantly over the next few years. This in turn highlights the need for operators, governments, and policy-makers in India to begin creating the right environment for 5G deployments today.

GSMA Intelligence forecasts suggest that the first commercial 5G service will launch in India in 2020, with gradual uptake in the first few years, reflecting likely constraints including limited network coverage and relatively expensive devices. The cost of handsets will be an important factor in a price-sensitive market such as India. The first 5G handsets are likely to be at a premium to existing 4G devices, but prices will fall as the technology scales and matures.

5G connections in India are forecast to reach 88 million by 2025, equivalent to around 7 percent of the total connections base in the country. This will leave India trailing regional peers, such as China, which is set to see almost 30 percent of its total connections base on 5G by 2025, making it by some way the largest 5G market in the world.

It has been a rough ride for India. The Indian administration had planned to hold a 5G auction in 2019 but was unable to do so. Authorities had scheduled to launch 5G services at the same time as more developed nations, but this was not possible.

Last week, on December 20, 2019, Digital Communications Commission cleared the 5G spectrum auction for March-April 2020, anticipating Rs 5.22 lakh crore if bids for all the 8300 units of 4G and 5G airwaves are received. The DCC has not reduced the prices from what was recommended by TRAI.

Successful bidders will have to pay 25 percent of the amount upfront for sub 1 GHz, and 50 percent upfront for higher frequency bands. Instalments will be spread over a period of 16 years. There will be a two-year moratorium for payment after the upfront amount is given. Instalments will have to be paid from third year, in 16 annual instalments.

Successful bidders will have to pay 25 percent of the amount upfront for sub 1 GHz, and 50 percent upfront for higher frequency bands. Instalments will be spread over a period of 16 years. There will be a two-year moratorium for payment after the upfront amount is given. Instalments will have to be paid from third year, in 16 annual instalments.

The telecom services sector is reeling under Rs 7 lakh crore debt and will have to cough up an additional Rs 1.47 lakh crore (including spectrum usage charges) following the Supreme Court ruling upholding the DoT definition of revenue. Given the high reserve prices, acute balance sheet stress of the carriers and absence of an immediate 5G business case, it remains to be seen how the auction plays out.

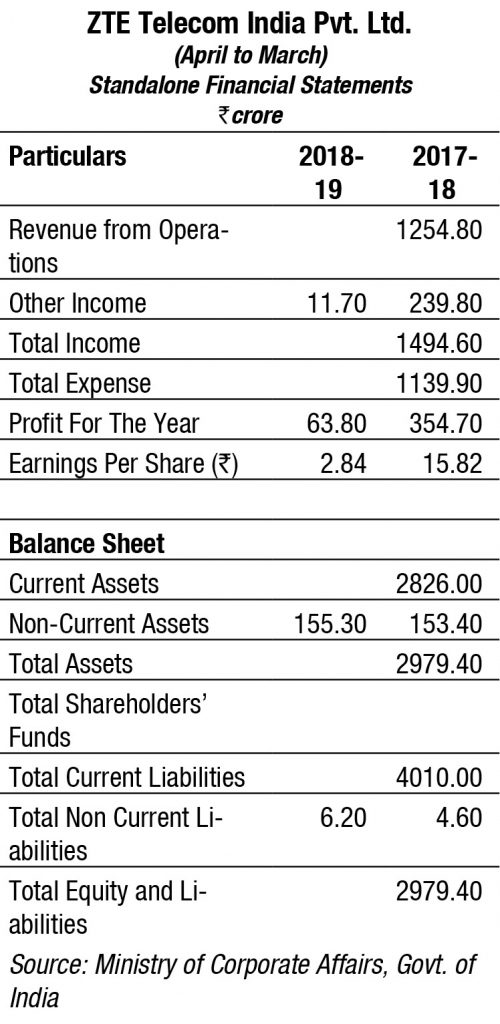

The government was also supposed to carry out 5G trials and had invited vendors, including Nokia, Ericsson, Samsung, NEC, Qualcomm, and Cisco to participate in these. Huawei and ZTE, two Chinese vendors, were left off the list amid security concerns. Huawei, which countries including Australia and the US have banned, has been trying to get an invitation from the government for the 5G trials. Authorities have yet to make their position clear, generating further uncertainty for Indian operators.

Huawei on the global platform has gone on record that it would be willing to license its 5G technology (existing patents, code, production techniques), allowing a third party to control and alter the code, building 5G kit based on these assets and ensuring that Huawei would have no control over any infrastructure that results. The vendor is making an attempt at a solution and is actively looking for ways to get past current trust concerns and potential geo-political technology splintering.

Moving away from supplier concentration

Vendors are making serious attempts that the service providers move away from Huawei, Ericsson, Nokia, and ZTE, the obvious four global OEMs and select them for new deployments. Now that the eco system in India is ready, Vihaan Networks Limited, HFCL, Tejas Networks, Paramount Wires and Cables, some of the established home-grown equipment manufacturers in India, have come forward and are making a play. The vendors have sourced technologies from overseas and tied up for 5G backhauling to make sure customers get the desired quality. Earlier this year, HFCL received a purchase order for Rs 2467 crore from BSNL for setting up of the converged nationwide IP/MPLS backbone and access network.

On the international front, Vodafone UK has spurred interest in OpenRAN. The UK-based operator has been working with a Facebook-led group, Telecom Infra Project (TIP), whose goal is to spur innovation and reduce costs in the market for network equipment. Taking advantage of open technology interfaces and a community-based approach to product development, it today boasts hundreds of members, including most of the world’s big service providers and numerous startups. Now Vodafone is taking some of the fruits of TIP’s labor into global field trials.

OpenRAN, the technology in question, promises an alternative to the Chinese and Nordic giants in the radio access network (RAN), one of the costliest parts of the infrastructure.

The cost attractions of OpenRAN could prove important in low-income markets. “Forecasts show 5G deployment costs falling 30 percent between now and 2022 if a network is built in the traditional way, but 50 percent if open architecture is used,” says Eugina Jordan, the vice president of marketing for Parallel Wireless, one of the vendors involved in Vodafone’s trials. “Twenty percent is a huge difference when we are talking about billions of dollars,” says Jordan.

Moving ahead

While the industry continues to struggle to keep its head above water, hats off to its survival instinct. And the pack is led by none other than Sunil Bharti Mittal, chairman, Bharti group. In 2019 too he did not disappoint. After his bold statement in October that Huawei’s products are significantly superior than Nokia’s and Ericsson’s, last week, while seeking government intervention in tackling the Rs 4.3-lakh crore debt, which the industry is reeling under, reiterated that, despite the slowdown, Bharti Airtel would invest Rs 20,000 crore in telecom in 2020, as it does every year!

HUAWEI

Bring digital to every person, home, and organization for a fully connected, intelligent world

Guo Ping

Guo Ping

Rotating Chairman,

Huawei

In a digital world where all things are connected, every person and home will have the opportunity to enjoy a highly personalized experience based on data and pervasive intelligence. Every organization will be able to use digital platforms to increase efficiency and develop more forward-looking business models.

Against this backdrop, security and trustworthiness are critical to the long-term prosperity of the digital economy. As a global community, if we can not effectively manage evolving security risks, the digital world we are trying to build will collapse. We need to work together – as a society and an industry – to build an approach to managing cyber security risks based on fact and verification.

Focusing on ICT infrastructure and smart devices. Moving forward, our carrier business needs to seize the first wave of business opportunities for 5G. We need to leverage our end-to-end strengths to achieve strategic leadership and enhance trust. As always, we need to strive to create greater value for our customers. We need to use innovative business solutions to help them increase profitability.

Our enterprise business needs to focus on a specific set of application scenarios, starting with customer pain points and working with our partners to provide competitive solutions. Let us make Huawei Inside a practical reality, and integrate with local communities by working more closely with governments, industries, and enterprises.

Our cloud business needs to further develop its AI capabilities and hone its competitive edge in enterprise services. It needs to establish a stronger presence in e-government, automotive ICT components, and safe-city domains, and maintain high-speed growth with healthy gross margins. With smartphones as the pillar and AI as the driver, our consumer business will continue to develop an ecosystem that builds on chip-device-cloud synergy for both hardware and services, improve its brand image, and deliver a better experience. We aim to become a leader in delivering an intelligent, connected lifestyle across all scenarios.

Inspiring passion, growing the harvest, and cultivating long-term business fertility. We must have highly capable teams and well-organized business structures. We need to focus on frontline teams and equip them with the tools and capabilities they need to succeed. Our top leaders need to come from outstanding generalists who have strategic insight, the ability to think structurally, and a successful track record. To make this happen, we need to get rid of organizational formalities, have less coordination, reduce decision-making layers, hold fewer and shorter meetings, and reduce the number of non-operational personnel. We won’t survive without these changes. Our organization needs to be structured in a way that’s conducive to business operations and success. All of our teams need to focus on growing the harvest and cultivating long-term business fertility. We also need to remove unnecessary organizational layers and processes, because perfectionism is likely to interfere with our ability to seize the strategic high ground. The easiest way to bring down a fortress is to attack it from within and the easiest way to reinforce it is from outside.

Moving forward, we will do everything we can to shake off outside distractions, improve management, and make progress toward our strategic goals.

We are in a race against time to make our vision a reality – to bring digital to every person, home, and organization for a fully connected, intelligent world.

Huawei Investment & Holding Co., Ltd.

In 2018, the global economy saw relatively stable growth, but was facing a possible slowdown. The company stayed focused on ICT infrastructure and smart devices, and continued investing to create value for customers, deliver better experiences to consumers, and improve the quality of operations.

Business Review – 2018

Business Review – 2018

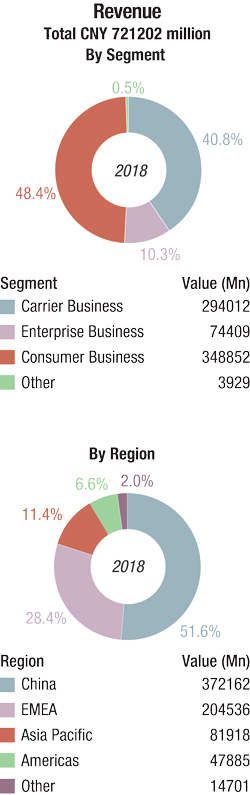

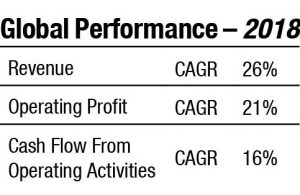

Revenue in 2018 totalled CNY 721,202 million, representing an increase of 19.5 percent year-on-year (YoY). Net profit grew by 25.1 percent YoY to CNY 59,345 million. This was mainly attributable to increasing revenue, higher operating efficiency, and improvements in the quality of our operations.

- As the consumer business grew rapidly and contributed a larger share to total revenue, the company’s gross profit margin dropped by 0.9 percentage points from 2017.

- Although the company increased investment in future-oriented research and innovation and in building its brand and sales channels, total operating expenses as a percentage of revenue dropped by 1.7 percentage points compared with 2017. This was attributable to efficiency gains enabled by ongoing management transformation.

- As interest income grew, other net finance losses declined sharply over 2017. As a result, the company’s net finance expenses decreased significantly compared with 2017.

In 2018, Huawei continued to increase its investment in research and development for the future, such as in 5G, cloud, artificial intelligence, and smart devices. Despite this, the company’s R&D expenses as a percentage of revenue decreased by 0.8 percentage points YoY owing to the rapid growth of revenue. The company also increased investment in building its brand and sales channels for the consumer and enterprise businesses; however, the higher operating efficiency made possible by ongoing management transformation resulted in a decline of 0.8 percentage points in selling and administrative expenses, as a percentage of revenue. Total operating expenses, as a percentage of revenue, dropped by 1.7 percentage points.

Net finance expenses in 2018 amounted to CNY 253 million, a decrease of CNY 826 million compared with 2017. Due to the depreciation of currencies in emerging markets, net foreign exchange losses grew by CNY 951 million over 2017. As interest income increased, other net finance losses declined by CNY 1777 million.

In 2018, the company continued to invest more in R&D and increased its inventory. As a result, cash flow from operating activities in 2018 declined by 22.5 percent YoY to CNY 74,659 million.

Carrier business. In 2018, the company maintained a solid performance in its carrier business, generating revenue of CNY 294,012 million. Through heavy investment and continuous innovation, the company will continue to work with its carrier customers and partners to drive the robust and rapid development of the telecom industry.

5G is on. By the end of February 2019, the company had signed more than 30 commercial contracts for 5G with leading global carriers, and shipped more than 40,000 5G base stations to markets around the world.

In September 2018, Huawei was the first vendor to complete all three phases of China’s 5G technology R&D test on non-standalone and standalone 5G architecture, organized by the IMT-2020 (5G) Promotion Group.

In September 2018, Huawei was the first vendor to complete all three phases of China’s 5G technology R&D test on non-standalone and standalone 5G architecture, organized by the IMT-2020 (5G) Promotion Group.

By the end of 2018, Huawei worked with major industry vendors to complete the first interoperability testing between 5G devices, networks, and chipsets, laying a solid foundation for carriers’ large-scale deployment of 5G.

In recognition of Huawei’s 5G technologies and products, more than 50 carriers around the world, including Vodafone, Telefónica, China Mobile, China Unicom, and China Telecom, have partnered with Huawei on 5G commercial tests to drive the commercialization of 5G.

In addition, Huawei has been actively exploring new applications for 5G and has teamed up with more than 280 industry-leading partners on more than 50 projects. The vendor is working with partners in industries including electricity, manufacturing, transportation, and fishing to deploy innovative 5G solutions in the real-world scenarios.

In addition, Huawei has been actively exploring new applications for 5G and has teamed up with more than 280 industry-leading partners on more than 50 projects. The vendor is working with partners in industries including electricity, manufacturing, transportation, and fishing to deploy innovative 5G solutions in the real-world scenarios.

Wireless networks. The company has built efficient, agile, and automated mobile broadband networks targeting the 5G era, and helped carriers drive the digital and intelligent transformation of industries. In 5G, Huawei has continued to build core capabilities. By the end of 2018, the company had deployed LTE-Advanced Pro (4.5G) networks for 182 carriers worldwide, and worked with more than 1000 partners from around the world to build a sustainable ecosystem for the industry. It also incubated new services like IoT, AR, and VR to help carriers seize new business growth. By the end of 2018, the company had deployed the WTTx solution on more than 180 networks in more than 120 countries and regions, connecting more than 40 million home users. The WTTx solution is expected to be widely adopted in multiple scenarios, including households, small- and medium-sized enterprises, and wireless verticals.

Fixed networks. Carriers are now facing fierce competition from OTT and IT players. In response to carriers’ new requirements, Huawei has helped build converged transport networks that are automated, intent driven, and support ultra-high bandwidth. With these networks, carriers can provide high-quality broadband and private line services that meet SLAs to achieve high-value growth. By the end of the year, Huawei’s CloudFabric solution had been commercially deployed in more than 1200 data centers in more than 120 countries and regions, building flexible, open, and secure intelligent data centers. This solution has helped carriers and enterprises remain competitive in the cloud service market.

Cloud core networks. Huawei’s cloud-based core network solutions adopt an innovative cloud-native software architecture and support smooth evolution toward 5G core networks. They help carriers speed up service launches, improve the efficiency of network operations, and maximize resource utilization. The company has signed more than 480 NFV commercial contracts around the world.

IT. In the IT domain, Huawei is committed to being an innovator of cloud data centers in the 5G and AI eras. In the cloud-computing domain, Huawei’s cloud-computing solutions have a unified architecture for private clouds, public clouds, and hybrid clouds. We have deployed cloud platforms for more than 270 carriers and their subsidiaries worldwide. In the storage domain, two Huawei storage products stand out – OceanStor Dorado V3 all-flash storage system and FusionStorage distributed-cloud storage solution. In the intelligent computing domain, Huawei launched its Atlas intelligent computing platform, an all scenario AI solution that provides superior computing power to meet customer expectations.

Network energy. To adapt to the 5G era, Huawei launched the industry’s first 5G power solution, spearheading the application of the one band, one blade and one site, one cabinet site construction models. By adopting innovative technologies, including intelligent synergy between energy and networks, intelligent peak shaving, and dynamic voltage boosting, the solution reduces deployment costs, improves network energy efficiency, and ensures faster, simpler, and more cost-effective network evolution toward 5G.

Global services. Huawei continues to increase investments in the services domain, building a unified digital platform and expanding ecosystem partners. The company has developed a wide array of scenario-specific solutions that are integrated into carriers’ business processes, including network planning, building, O&M, optimization, and operations, to help them accelerate their digital transformation and achieve greater success. By the end of 2018, more than 30 carriers, including China Mobile, Celcom in Malaysia, and MTN South Africa, signed contracts for commercially deploying AUTIN with Huawei, and over 6600 operations developers worldwide used the OWS platform for innovation and development.

Enterprise business. In 2018, revenue from enterprise business was CNY 74,409 million, a YoY increase of 23.8 percent. Enterprise business is gradually becoming a major engine behind Huawei’s growth. By the end of 2018, 211 Fortune Global 500 companies – 48 of which are Fortune 100 companies – selected Huawei as their partner for digital transformation.

Cloud service. 2018 was a year of rapid growth for Huawei Cloud. The online cloud services provided by Huawei Cloud are injecting new vitality into Huawei’s 30 years of experience in ICT infrastructure. By the end of 2018, Huawei Cloud’s portfolio consisted of more than 160 cloud services and more than 140 solutions, such as Huawei Cloud Stack, SAP, and HPC. Huawei Cloud has implemented over 200 projects across 10 industries.

Consumer business. In 2018, revenue from its consumer business was CNY 348,852 million, a YoY increase of 45.1 percent. In 2018, Huawei shipped 206 million Huawei and Honor smartphones, up 35 percent YoY.

Companywide transformation

The company has set up a transformation project team for Improving software engineering capabilities. The board of directors has granted USD 2 billion in funding to this transformation program. Through this transformation, Huawei aspires to improve software-engineering capabilities across all aspects of its business, from culture, awareness, policies, organizations, and processes to appraisal mechanisms, technologies, and specifications, thus ensuring Huawei becomes synonymous with trustworthiness and quality and earns its place as the most trustworthy supplier and partner in the ICT industry.

1H2019

In the first half of 2019, Huawei generated CNY 401.3 billion in revenue, a 23.2 percent increase over the same period last year. The company’s net profit margin for 1H2019 was 8.7 percent.

In its carrier business, 1H sales revenue reached CNY 146.5 billion, with steady growth in production and shipment of equipment for wireless networks, optical transmission, data communications, IT, and related product domains. To date, Huawei has secured 50 commercial 5G contracts and has shipped more than 150,000 base stations to markets around the world.

In its enterprise business, 1H sales revenue was CNY 31.6 billion. Huawei continues to enhance its ICT portfolio across multiple domains, including cloud, artificial intelligence, campus networks, data centers, Internet of Things, and intelligent computing. It remains a trusted supplier for government and utility customers, as well as customers in commercial sectors like finance, transportation, energy, and automobile.

In its consumer business, 1H sales revenue hit CNY 220.8 billion. Huawei’s smartphone shipments (including Honor phones) reached 118 million units, up 24 percent YoY. The company also saw rapid growth in its shipments of tablets, PCs, and wearables. The company is beginning to scale its device ecosystem to deliver a more seamless intelligent experience across all major user scenarios. To date, the Huawei mobile services ecosystem has more than 800,000 registered developers, and 500 million users worldwide.

Huawei Telecommunications (India) Company Private Limited

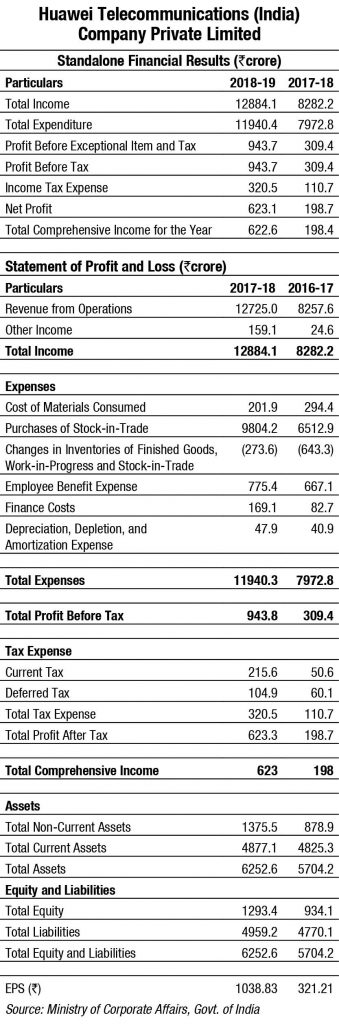

The company’s India income jumped to Rs 11,940.4 crore in FY19, from Rs 8282.2 crore in FY18. During this financial year, the company recorded a net profit (after tax) of Rs 623.1 crore, up from Rs 198.7 crore in FY18.

The directors did not recommend declaration of dividend as the company planned to plough back the profits. The company had not accepted any deposits from the public during the year.

The company had a surplus of Rs 622.6 crore for the financial year March 31, 2019. The foreign exchange earnings for the year were Rs 6227.53 crore and foreign exchange outgo Rs 16,090.25 crore.

Some major orders secured

In November 2018, Vodafone Idea Ltd. placed 4G network equipment supply contracts for about Rs 9500 crore. Huawei emerged a major gainer at the expense of European rivals Nokia and Ericsson as the service provider focussed on costs in a bid to realize Rs 14,000 crore worth of annual synergies two years ahead of time. Huawei bagged the order for seven circles. The vendor was also awarded the latest contracts for both Delhi and Chennai metros, and shares the Tamil Nadu circle with Nokia. Huawei, which earlier met only 33 percent of VIL’s network gear requirements in Delhi, Kerala, Punjab, and Orissa, and 50 percent in Chennai, is now handling 100 percent gear supplies in all these markets.

In November 2018, Vodafone Idea Ltd. placed 4G network equipment supply contracts for about Rs 9500 crore. Huawei emerged a major gainer at the expense of European rivals Nokia and Ericsson as the service provider focussed on costs in a bid to realize Rs 14,000 crore worth of annual synergies two years ahead of time. Huawei bagged the order for seven circles. The vendor was also awarded the latest contracts for both Delhi and Chennai metros, and shares the Tamil Nadu circle with Nokia. Huawei, which earlier met only 33 percent of VIL’s network gear requirements in Delhi, Kerala, Punjab, and Orissa, and 50 percent in Chennai, is now handling 100 percent gear supplies in all these markets.

The Huawei deal with Vodafone Idea Ltd. went beyond wireless networks in 2018-19, with the telco awarding wireline contracts to them. In May 2019, Huawei got a pan-India national long-distance network expansion for capacity augmentation worth about USD 25 million. Huawei was already managing the pan-India NLD network – optical transport, OTM, and WDM – for both Vodafone and Idea brands in the country before the merger. Huawei also won some new business from Vodafone Idea for packet core. VIL was expected to come with new request for proposals (RFPs) for NLD expansion among others, but now it may or may not happen.

BSNL plans to invite bids from Huawei to purchase equipment for its fourth-generation (4G) commercial roll-out which is expected in six months. BSNL will spend Rs 1200 crore on network equipment over a two-year period. The service provider, which recently received a Rs 74,000-crore revival package from the government, is planning to deploy more than 50,000 new 4G mobile sites at 70,000 locations. It plans to launch the data network in the first half of 2020 and, as part of a phased approach, is currently ramping up its existing network even as it prepares the contours of the tender offer.

At India Mobile Congress 2019, held in New Delhi in October 2019, Huawei announced the deployment of artificial intelligence (AI)-based Massive MIMO optimization technology in the Vodafone Idea network – a first in India. AI-enabled Massive MIMO enables Vodafone Idea to add automation capabilities to its network, greatly improving optimization efficiency, boosting cell capacity, and enhancing end-user experience of the network. Massive MIMO leverages 5G technologies in 4G network. The Massive MIMO AI solution uses random forest algorithm for modelling and prediction, collecting and analyzing data to optimize MIMO performance. Vodafone Idea has been consistently unlocking spectrum efficiencies and user experiences by applying a number of 5G-ready technologies like Massive MIMO and CloudAIR dynamic sharing of spectrum in 4G network. Today the Vodafone Idea network has large Massive MIMO deployment.

Huawei also showcased a deep-dive into end-to-end 5G ecosystem with networks – featuring both front-haul and back-haul best solutions in 5G All Scenario Network that is powerful, compact, and green, while also enabling re-use of existing investments to build the best 5G.

The company also unveiled Huawei Cloud Wi-Fi 6, which backs 5G coverage for indoor environment, supports 200+ concurrent connections, and large throughput. Plus, the company’s sub-brand Honor has unveiled Honor Vision Smart TV with a pop-up camera and Harmony OS for the Indian market.

The 5G trials are likely to be held later this year.

Outlook

As Huawei has claimed that it had globally gained 50 5G commercial contracts and shipped more than 150,000 base stations, end-June 2019, the vendor received a major stimulus when Sunil Mittal, chairman, Bharti Airtel, at a two-day India Economic Summit, organized by the World Economic Forum (WEF), praised the telecom gear manufactured by China’s Huawei, and said they were superior to products of European suppliers Nokia and Ericsson.

Mittal’s comment came in response to US Trade Secretary Wilbur Ross’s advisory that India should refrain from awarding contracts to Huawei. Mittal said Huawei had left him surprised with the manner in which it scaled the technology curve to ensure efficient use of spectrum

with minimal power consumption. He said the US pushback had resulted in the Chinese company opening up its technology to others, an outcome that could come India’s way too to benefit its local companies.

Jay Chen

Jay Chen

CEO,

Huawei Telecommunications (India) Company Private Limited

“This is a very challenging year for the Indian industry. Not only Huawei but almost all the OEMs and telcos are facing a very big challenge. This year, I see the CapEx of the service providers declining. We hope the situation becomes positive soon.

We are very open to setting up local manufacturing facilities, not only 2G, 3G, but also 4G. We are studying the new policy.

Now as Indian industries start to explore 5G, we bring some of our globally proven use cases to India. Our vision is aligned with the Government of India’s to bring digital to every person, home, and organization for a fully connected, intelligent world.”

ERICSSON

Börje Ekholm

Börje Ekholm

President and CEO,

Ericsson

2018 was an encouraging year. The focused strategy delivered and 5G became a commercial reality. Coming up next: pursuing growth – selective, disciplined, and profitable growth.

Ericsson that closed 2018 was much more focused and slimmer; more customer-centric and efficient; faster and more agile; and financially transformed compared with the Ericsson of 12–18 months earlier. By concentrating on our core business, increasing R&D investments, and aggressively reducing costs, 2018 saw us progressing on our turnaround with improved profitability and growth. We achieved this, and increased our market share in the process, despite continued challenging market conditions with an overall market that contracted, as well as exits of contracts and businesses. As we all know, the kite lifts in headwind. With the increased focus on our core business, we partnered with One Equity Partners to develop MediaKind, formerly Ericsson Media Solutions. We retain 49 percent of the share in the company as we believe in the upside of this area. We will continue to develop RedBee Media as a focused media services entity. The year also saw 5G move from the labs and trials to the market with the first commercial deployments. In addition to being an industry-changing technology, it will also be the backbone to the digitization of society.

Customer first

Our focused strategy, launched in March 2017, starts from our customers’ needs, with relentless focus on what creates value. By executing on our strategy, we enable our customers to become more efficient, create great end-customer experiences, and find new revenue streams.

Growth

We are moving to the next stage of our focused strategy – pursuing selective, disciplined, and profitable growth. We aim to grow in our core business and in new businesses. Both are driven by our 5G and IoT capabilities, and opportunities arising from technology shifts in the market. We will remain financially disciplined to safeguard our growth ambitions do not dilute our margin targets.

5G – A commercial reality

5G became a commercial reality during 2018 with commercial launches in North America. In 2019, we will see further launches, enabled by already made and coming spectrum allocations. 5G will significantly reduce the cost per delivered-gigabyte for mobile broadband. This is the immediate compelling reason for our customers to invest as network traffic continues to grow. As an enabler of use cases beyond mobility and into IoT, 5G will also create new growth opportunities for our customers, such as virtual-reality applications, fixed-wireless access, or digitization of industries and wider society. Most telecom operators will leverage their 4G networks to set up 5G connections. We can already support 5G in our installed base of Ericsson Radio System, introduced into networks in 2015, for cost-effective coverage and capacity build-outs on multiple bands. Moreover, our new Cloud Core solutions are made to smoothly introduce dual-mode 5G Core. Service providers can leverage Ericsson orchestration solutions to efficiently and dynamically manage their networks. This provides cost-effective and fast transition to 5G. 5G is anticipated to be rolled out faster than any previous technology generation. Our Ericsson Mobility Report predicts that 5G coverage will be available to 40 percent of the world’s population by the end of 2024, with about 1.5 billion 5G-enhanced mobile broadband subscriptions, and 4.1 billion cellular-IoT connections. Meanwhile, we continue to invest in R&D to ensure we can help our customers with those opportunities.

5G standardization

Technology leadership has always been important to Ericsson. Through early and significant investments in R&D, we are recognized as a leader in 5G standardization. Through the end of 2018, Ericsson has submitted the most 5G-related contributions to the key 3GPP working groups, and we have many industry-firsts behind us. Ericsson has been fundamental in stabilizing specifications for both non-standalone and standalone 5G so that we, together with our device partners, can now implement 3GPP-compliant and interoperable products. We continue to strongly promote open standards, by licensing our cutting-edge technology as the 5G ecosystem develops.

Growth in core and new businesses

We anticipate that the majority of our growth in the coming years will come from our core business. We believe that even small growth in this area will add significant value to the company. This includes capitalizing on the strength of our Networks business, with the competitive Ericsson Radio System offering, as the radio access market comes back to growth. It also includes building on our profitable Managed Services business, in which we now take the next steps through investments in artificial intelligence and automation. In Digital Services, our top priority remains reaching profitability before growth, supported by stabilizing the top-line, continued cost reductions, efficiency improvements, critical projects reviews, and disciplined investments in a 5G-ready and cloud-native product portfolio. In Digital Services, there has been solid progress in most portfolio areas. However, the Business Support Systems (BSS) area has not shown satisfactory progress. We are now progressing to reshape the business. To speed up the restructuring, additional measures were communicated in January 2019, including provisions and restructuring charges in 4Q2018 of SEK –6.1 billion. Disciplined growth in new areas will be built on a horizontal technology – and platforms-led approach in Emerging Business and Other, where we aim to capture new revenues through rapid and disciplined innovation, building on 5G and IoT. In cases of attractive new business opportunities, we may decide to scale up investments. This is also the reason why we believe it is better to manage Emerging Business and Other to maximize the net present value of cash flows rather than setting firm financial targets. Our growth ambitions are being supported by our own digital transformation, giving our employees the digital tools and processes to best drive customer centricity and value-adding customer engagements.

Financial targets

At our Capital Markets Day in November, we announced an increase in our 2020 net sales ambition by SEK 15 billion to SEK 210–220 billion, driven mainly by an improved market outlook in Networks.

We set out our long-term target of more than 12 percent operating margin to 2022, at the latest. At this level we generate economic value as a company.

Outlook

2018 was a turnaround year. We saw improvements across all business segments. We strive to continue to execute diligently on our focused strategy with the aim of building a stronger Ericsson long-term. Strategic contracts and costs for field trials have already negatively impacted our results in 2018, and we expect to see an increased proportion in 2019 to further position us for 5G leadership.

While this will weigh on near-term performance, it will strengthen our business long term, including our ability to reach both our 2020 and 2022 financial targets.

5G commercial reality is a significant landmark for Ericsson, the industry, and for society globally. Market uncertainty remains a factor as we move into 2019. However, as a 5G leader, as shown by our 5G patent contributions and our 5G commercial contracts, we take the strong momentum behind the technology with us into the year with confidence and motivation.

Ericsson

Ericsson has been at the forefront of innovation for more than 140 years and as the market continues to transform and user demands continue to change – so does Ericsson.

Business in 2018

Business in 2018

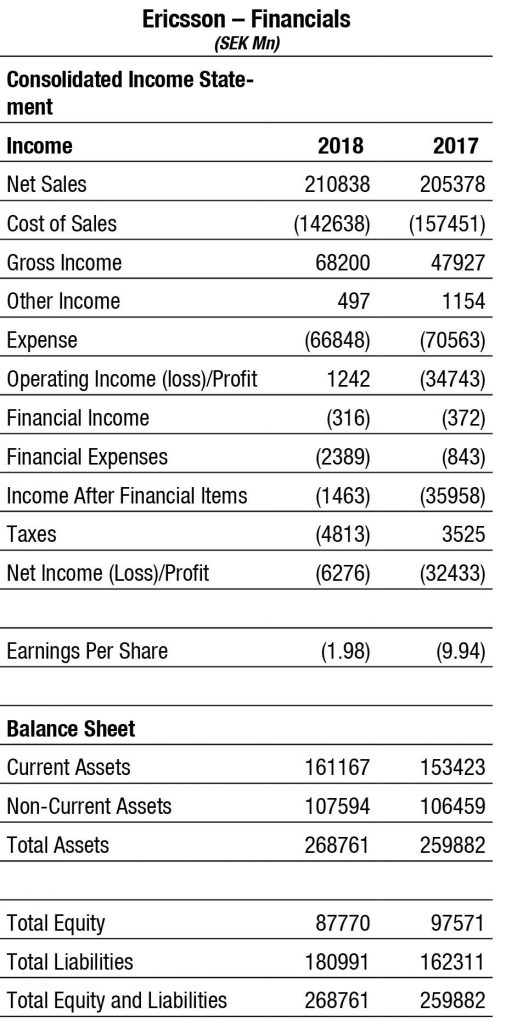

In 2018, sales increased by 3 percent driven by sales growth in Networks. Sales increased by 5 percent in Networks and were mainly due to increased demand for radio access network (RAN) equipment in North America and in Europe and Latin America. Sales declined in Digital services by –2 percent due to lower sales of legacy products. Managed Services sales declined by –3 percent as a result of exited non-strategic contracts.

IPR licensing revenues were SEK 8 billion.

Gross margin improved to 32.3 percent supported by cost-reductions, ramp-up of Ericsson Radio System product platform, and good progress in the review of low-performing Managed Services contracts.

The cost reduction program, launched in 2Q2017, was completed as planned. The number of employees decreased by 5376 to 95,359 mainly because of the cost-reduction program. The effect from the program was visible in improved gross margin and lower SG&A expenses, mainly through lower service-delivery costs and common costs. R&D expenses increased mainly due to increased investments in Networks R&D to improve competitiveness and profitability of the product portfolio.

Operating income (loss) was SEK 1.2 billion including restructuring charges of SEK –8 billion. Write-down of assets, as well as provisions and adjustments related to certain customer projects had a significant negative impact on operating income in 2017.

Ericsson delivered a full-year cash flow from operating activities of SEK 9.3 billion. Free cash flow excluding M&A amounted to SEK 4.3 billion. Net cash at the year-end was SEK 35.9 billion.

Financial highlights

Net sales. Sales increased by SEK 5.5 billion or 3 percent to SEK 210.8 billion. Networks sales increased by SEK 6.3 billion (5 percent), Digital Services sales decreased by SEK –0.7 billion (–2 percent), Managed Services sales decreased by SEK –0.7 billion (–3 percent) and Emerging Business and Other sales increased by SEK 0.5 billion (7 percent).

The sales increase in Networks was mainly driven by higher demand for radio access network equipment. Networks sales growth adjusted for comparable units and currency was 3 percent.

The sales decrease in segment Digital Services was due to lower sales in legacy products. The sales decline in Managed Services was mainly a result of exit of low-performing and non-strategic contracts. The sales increase in segment Emerging Business and Other was driven by growth in iconectiv business due to the multi-year number portability contract in the United States.

In the geographical dimension, sales grew in North America and in Europe and Latin America.

Sales adjusted for comparable units and currency increased by 1 percent. The sales mix by commodity was: software 21 percent, hardware 37 percent and services 42 percent.

Gross margin increased to 32.3 percent with improved margins in hardware and services mainly driven by cost reductions, ramp-up of Ericsson Radio System product platform and good progress in the review of low-performing managed services contracts. A reduced share of services sales had a positive impact on gross margin. Restructuring charges included in the gross margin increased to SEK –5.9 billion. Costs of SEK –5.9 billion, of which SEK –3.1 billion were restructuring charges, impacted gross margin in Digital Services.

Due to technology and portfolio shifts, the company has since 2017 reduced the capitalization of development expenses and the deferral of hardware costs, which had a net impact on gross income of SEK –0.9 billion. Write-down of assets, as well as provisions and adjustments related to certain customer projects had a significant negative impact on gross margin in 2017.

Operating expenses decreased to SEK –66.8 billion with SG&A expenses of SEK –27.5 billion, R&D expenses of SEK –38.9 billion, and impairment losses on trade receivables of SEK –0.4 billion. Restructuring charges included in operating expenses were SEK –2.1 billion. R&D expenses increased due to increased investments in R&D for Networks. The increase was partly offset by R&D reductions in Digital Services. Higher amortized than capitalized development expenses had a negative effect on R&D expenses of SEK –1.7 billion. SG&A expenses were reduced as a result of cost-reduction activities. The reduction was more than offset by higher provisions for variable compensation, increased costs related to revaluation of customer financing, and increased costs for 5G trials.

Other operating income and expenses was SEK –0.2 billion. In 2017, write-down of intangible assets had a significant negative impact on other operating expenses.

Consequences of technology and portfolio shifts. Because of technology and portfolio shifts, the company is reducing the capitalization of development expenses for product platforms and software releases and the deferral of hardware costs. As a consequence, higher amortization than capitalization of development expenses and higher recognition than deferral of hardware costs had a negative impact on operating income of SEK –2.6 billion. The amounts related to capitalized software releases were fully amortized in 2017.

Restructuring charges amounted to SEK –8.0 billion, which was higher than the earlier estimate of SEK –5 to –7 billion. The restructuring charges in 2018 mainly relate to the cost-reduction program announced in 2017 and costs related to revised BSS strategy. Total restructuring charges for 2019 are estimated to be SEK –3 to –5 billion.

Operating income improved to SEK 1.2 billion. Higher gross margin and sales and lower operating expenses had a positive impact. Write down of assets, as well as provisions and adjustments related to certain customer projects had a significant negative impact on operating income in 2017. Operating margin was 0.6 percent . Operating margin excluding restructuring charges of SEK –8.0 billion was 4.4 percent.

Business results – Segments

Networks represented 66 percent of net sales in 2018. The segment delivers products and services that are needed for mobile and fixed communication, several generations of radio networks and transmission networks.

Sales increased by 5 percent to SEK 138.6 billion. Sales adjusted for comparable units and currency increased by 3 percent. The sales increase was due to sales growth in North America and in Europe and Latin America, driven by telecom operator investments in 5G-readiness and LTE networks. The Networks share of IPR licensing revenues was SEK 6.5 billion.

Digital Services represented 18 percent of net sales in 2018. The segment provides solutions consisting primarily of software and services in the areas of Digital Business Support Systems (BSS), Operational Support Systems (OSS), Cloud Communication, Cloud Core, and Cloud Infrastructure.

Sales decreased by –2 percent. Sales in BSS declined by –11 percent while sales in OSS and Cloud Core grew, driven by demand for the 5G-ready portfolio. Sales adjusted for comparable units and currency decreased by –4 percent.

Managed Services represented 12 percent of net sales in 2018. The segment delivers managed services and network optimization to telecom operators. Through these offerings, customers entrust Ericsson to run the operations of their network/IT systems and optimize network performance.

Sales decreased by –3 percent. Sales adjusted for comparable units and currency decreased by –5 percent, as a result of contract exits, partly offset by sales growth in Managed Services IT.

Emerging Business and Other segment represented 4 percent of net sales in 2018. The segment consists of four businesses: Media Solutions, Red Bee Media, Emerging Business, and iconectiv.

Sales increased by 7 percent. Sales adjusted for comparable units and currency increased by 3 percent, driven by growth in the iconectiv business through a multi-year number-portability contract in the United States. Sales in Emerging Business grew by more than 25 percent. Media Solutions sales declined by –14 percent owing to lower sales in the legacy portfolio. Red Bee Media sales declined by –4 percent due to renegotiations and changes in scope of contracts.

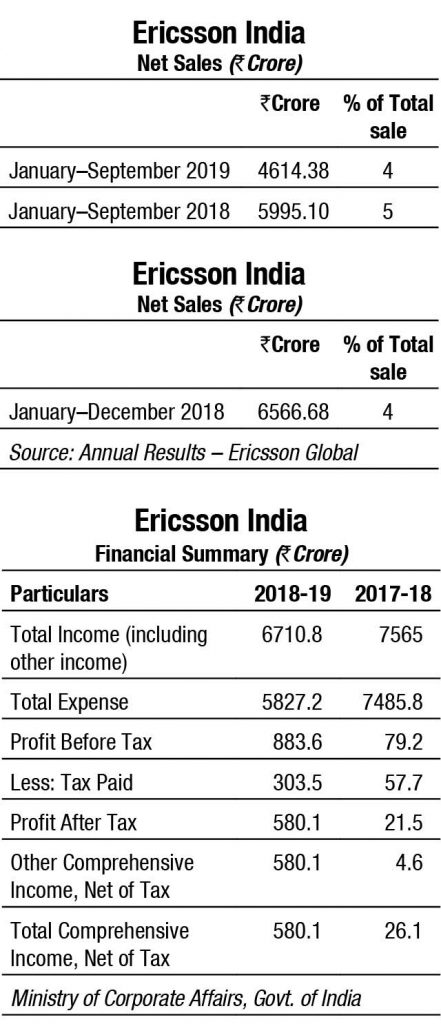

Ericsson India Private Limited

In 2018, sales for Ericsson declined, mainly due to the timing of major projects in India. Managed Services sales grew slightly mainly due to a new contract, while sales in Digital Services remained flat.

From a business standpoint, one of the company’s key focus areas is to accelerate investments in networks and establish a leading position in 5G. India is a very important market for Ericsson, both business-wise and from a technology perspective. The vendor has three R&D centers here. It also has a manufacturing setup in Pune that is producing and exporting 5G-ready equipment to Southeast Asian markets.

From a business standpoint, one of the company’s key focus areas is to accelerate investments in networks and establish a leading position in 5G. India is a very important market for Ericsson, both business-wise and from a technology perspective. The vendor has three R&D centers here. It also has a manufacturing setup in Pune that is producing and exporting 5G-ready equipment to Southeast Asian markets.

In October 2018, Ericsson started exporting 5G-ready telecom equipment from its manufacturing facility in Pune, Maharashtra, to markets in Southeast Asia. The initial shipments, consisting of Ericsson’s 5G-ready radio base stations and microwave equipment for 2G, 3G, and 4G technologies, have been delivered to Indonesia, Singapore, and Thailand. Ericsson had set up a state-of-the-art manufacturing facility in Chakan, Pune, in 2016 with an initial investment of USD 20 million. This facility has been catering to the domestic demand so far, and the company plans to ramp up capacity once the export volumes pick up.

Following the July 2018 opening of the Center of Excellence and Innovation Lab for 5G in Delhi, Ericsson is taking important steps in India’s 5G development together with some of the country’s biggest service providers, such as Reliance Jio, Bharti Airtel, and BSNL.

In December 2018, Ericsson announced that it has set up a Global Artificial Intelligence Accelerator (GAIA) in Bengaluru. This innovation hub set up by Ericsson in India will focus on research and development in artificial intelligence (AI) and automation. This newly launched GAIA facility will be key in accelerating the execution of Ericsson’s focused strategy by leveraging cutting-edge AI and automation technologies to create data-driven, intelligent, and robust systems for automation, evolution, and growth.

In April 2019, Ericsson showcased the future of mobile networks in India. The vendor introduced innovative new technologies – from concept radios access network products called Radio Stripes, to new AI and ML-based solutions ready to be introduced in the networks today – at its flagship technology showcase Barcelona Unboxed, held in Gurgaon.

Ericsson has expanded its end-to-end 5G platform by adding new hardware and software products to the Ericsson Radio System portfolio, further enhancing the agility and speed with which Indian operators can roll out their 5G networks. Ericsson is also strengthening its end-to-end mobile transport solutions by building on its radio expertise and adding best-in-class transport technologies from Juniper Networks and ECI.

Ericsson has launched the radio access network (RAN) Compute portfolio, which responds to service provider’s need for greater flexibility in the deployment of RAN software and hardware functions. The company has also launched the new Ericsson Spectrum Sharing software, expanding the versatility of Ericsson Radio System for 5G deployments.

Some major orders secured in 2019.

In November 2018, Vodafone Idea Ltd. placed 4G network equipment supply contracts for about Rs 9500 crore as the service provider focussed on costs in a bid to realize Rs 14,000 crore worth of annual synergies two years ahead of time. Ericsson, along with Nokia, lost some business to their Chinese counterparts, Huawei and ZTE. Ericsson bagged the order for eight circles.

In April 2019, Ericsson bagged a contract from Bharti Airtel to deploy VoLTE technology for the company and IP Multimedia Sub-systems (IMS) in one circle. This is the first time that Ericsson had bagged a VoLTE contract in India. Until now, Nokia had been the sole provider of VoLTE technology in India to the major three telcos, Reliance Jio, Bharti Airtel, and Vodafone Idea. Bharti Airtel had in November 2016 granted a Rs 402-crore contract to Nokia. Airtel offers VoLTE services in 21 circles in India, with Jammu & Kashmir being an exception.

Ericsson has also been Bharti Airtel’s Managed Service partner since 2004. The Swedish manufacturer also manages 2G, 3G, 4G/LTE, intelligent network, and LAN/WAN for Bharti Airtel. In the start of 2019, Ericsson and Bharti Airtel also signed an artificial intelligence and automation deal. The manufacturer will now help the telco in solving network complexity issues and boosting user experience.

BSNL plans to invite bids from Ericsson to purchase equipment for its fourth-generation (4G) commercial roll-out, which is expected in six months. BSNL will spend Rs 1200 crore on network equipment over a two-year period. The telco, which recently received a Rs 74,000-crore revival package from the government, is planning to deploy more than 50,000 new 4G mobile sites at 70,000 locations. It plans to launch the data network in the first half of 2020 and, as part of a phased approach, is currently ramping up its existing network even as it prepares the contours of the tender offer.

In February 2019, Ericsson was selected by Vodafone Idea Limited to deploy 5G-ready equipment across select markets in India. Ericsson is deploying next-generation technology with built-in customizations and innovations to deliver rich consumer experience while building a robust, future-proof network. As part of the contract, Ericsson is supplying radio access and transport equipment from its 5G-ready Ericsson Radio System portfolio, including the MINI-LINK 6000 microwave backhaul solution. These deployments will provide VIL’s network with advanced LTE capabilities, high-capacity, low-latency microwave backhaul and enable rapid deployment of 5G services in future. It will also improve VIL’s spectral and energy efficiency while increasing overall network capacity. VIL customers will enjoy higher speeds while using apps, uploading and downloading files. Ericsson India has already begun radio access and microwave network consolidation and modernization with the cornerstones of increased coverage, quality, and capacity with optimal OpEx and CapEx efficiency. Consolidation of existing deployed base (2G/3G) will be carried out to maximize spectrum on LTE, followed by ongoing optimization of the network in order to enhance end-user experience.

In May 2019, Ericsson was selected by Vodafone Idea Limited to deploy its Cloud Packet Core to enhance its existing core network. As part of this deal, VIL will benefit from Ericsson’s market-leading core network applications and network functions, such as Ericsson virtual Evolved Packet Gateway (vEPG), Service Aware Policy Controller (vSAPC), and Virtualization Infrastructure (NFVI) solution, enabling fast introduction of new services and providing full service continuity.

In October 2019, Ericsson was selected by Bharti Airtel to deploy its 5G-ready Cloud Packet Core in Airtel’s Pan India core network. Airtel will benefit from Ericsson’s market-leading packet core network applications and functions. The deployment will consist of solutions like Ericsson virtual Evolved Packet Gateway (vEPG) that follows ETSI standards. The deployment will enhance capacity in Airtel’s network and enable the network to address the rapidly growing demand for high-speed data services.

At India Mobile Congress 2019, held in New Delhi in October 2019, Ericsson and Airtel enabled a 5G-powered Connected Music performance that involved connecting two parts of a musical performance using a live 5G network and presenting it as one — for live audiences at both locations. One half of the performance had the singer and music composer, Siddharth Shankar Mahadevan perform Jai Ho from the film Slum Dog Millionaire, whilst a Swedish band played at the Ericsson booth, about 100 meters away.

Ericsson and Qualcomm Technologies completed the first ever live 5G video call in India using 28 GHz spectrum. The demonstration was done using a smartphone based on the Snapdragon 855 Mobile Platform with Snapdragon X50 5G Modem-RF system and Ericsson’s 5G platform including 5G NR radio, RAN compute products, and 5G Evolved Packet Core, set up at the IMC venue at Aerocity. The achievement is a significant milestone in the country as India gets ready for 5G. As part of the demonstration, Nunzio Mirtillo, Head of Ericsson Southeast Asia, Oceania, and India, made a video call at the Ericsson booth to Rajen Vagadia, Vice President, Qualcomm India Private Limited on site at IMC 2019. This was followed by other use cases such as connected ambulance, 5G-enabled immersive sports, fixed wireless access, and more. As per the company’s claim, it has already deployed 5G networks in 19 countries across four continents and still counting on.

Ericsson also showcased fixed wireless access, an economical alternative to fiber and private LTE network comprising of third-Generation Partnership Project (3GPP) products using the same technologies developed for public networks.

Last year, one IMC 2018 event highlight was a use case developed in partnership with Bharti Airtel, which demonstrated beyond visual line of sight (BVLOS) drone operations that showcased the life-saving potential of 5G for mission-critical applications, such as support for emergency services, disaster management, and remote surveillance.

In the lead up to IMC 2018, Ericsson and Reliance Jio Infocomm Ltd. had developed a series of ultra-low latency 5G use cases. These include remotely operated machinery and a VR-assisted-driven bus connected to a 5G network, both of which were part of the event. A 5G-connected car, made accessible at IMC for remote driving over a live 5G network in 3.5 GHz from IIT-Delhi, was also showcased.

The event also saw the signing of a 5G memorandum of understanding (MoU) between Ericsson and service provider Bharat Sanchar Nigam Limited (BSNL) to work together on developing new 5G use cases, knowledge sharing on 5G technology concepts, and industry and innovation trends including 3GPP standardization progress. The partnership will also leverage Ericsson’s 5G Center of Excellence.

Outlook

Ericsson is working with telecom operators across the world to make 5G real. And here in India, the vendor is already working toward creating a robust ecosystem to fast track 5G deployments.

Ericsson has been a key figure in the 5G standardization process and moved quickly to ensure interoperability between Ericsson Radio System commercial radios and the 5G test devices of its ecosystem partners. These tests have been conducted on all the main spectrum bands that will be deployed during the initial 5G launches, including 3.5, 28, and 39 GHz.

The company is rapidly approaching a 5G commercial reality. Through a series of significant technology and interoperability achievements, Ericsson has opened 5G up for first movers, taking this technology out of the lab and into a commercial network environment.

Nitin Bansal

Nitin Bansal

MD – India and Head – Networks, Southeast Asia, Oceania, and India,

Ericsson

“Ericsson is working with all the telcos across India toward creating a robust ecosystem to fast track 5G deployments, which we believe is a very good evolution from 4G. All the products that we have delivered since 2015 support 5G, with a software upgrade. We are ensuring that when the 5G deployments start to happen, the investments being made in basic infrastructure for 4G remain protected.

The country’s demography and the opportunities it offers suggest that enhanced mobile broadband (eMBB) and fixed-wireless access (FWA) are going to be early use cases of 5G. These will help address the limited fixed-broadband penetration levels in India, and also enhance data experience on the move. We are also evaluating relevant use cases, apart from eMBB and FWA. A lot of work is happening on making sure that the investments done today are protected and the evolution happens at the right place and without any disruption.”

NOKIA

Creating the technology to connect the world

Rajeev Suri

Rajeev Suri

President and CEO,

Nokia

2018 saw the commercial deployment of 5G move forward in lead countries, and Nokia was at the forefront of this activity. In 2019, we expect to see more organizations around the world take their first steps in creating the infrastructure for the Fourth Industrial Revolution – and Nokia is ready to be their trusted partner.

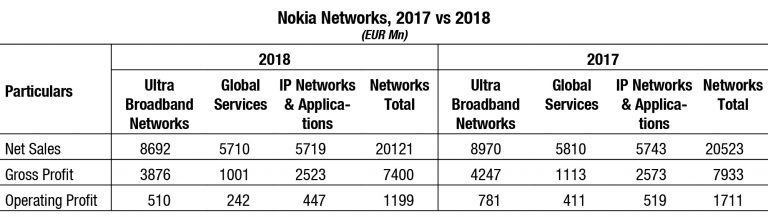

Financial highlights

Although our performance in 2018 was below our expectations overall, we exited 2018 with a strong finish, confirming our expectation of accelerated sales momentum as the year progressed. Indeed, we had a strong second half with every one of our Networks Business Groups delivering year-on-year growth, excluding the impact of changes in foreign currency exchange rates. This drove growth in Nokia’s net sales for the year of 1 percent, excluding the impact of changes in foreign currency exchange rates.

Our Networks business delivered approximately 2 percent growth in 2018, excluding the impact of changes in foreign currency exchange rates, fueled by the continued success of our end-to-end strategy and the conversion of a healthy pipeline into net sales. This allowed us to take share in certain segments of the market, while the overall market itself declined slightly. High customer engagement in multiple elements of our 5G portfolio sees us enter 2019 with a strong Networks order backlog. In Nokia Technologies, we maintained our strong growth track record with 11 percent year-on-year growth in recurring licensing revenue.

Progress in our strategy

In our first pillar, leading in high-performance, end-to-end networks with communications service providers – we have proven our capabilities as the commercialization of 5G begins. We proudly serve as a partner to most of 5G’s first-movers with over 25 5G commercial deals and nearly 100 trials and pilots of the new technologies.

In our second pillar, expanding network sales to select vertical markets – we support a wide and growing range of organizations as they evaluate how best to digitize their operations. Today, we serve approximately 1000 customers outside of our traditional communications service provider base, bringing connectivity to some of the most complex, fast-moving industries on earth, including a number of new automotive, energy, and transportation customers that placed their trust in our technologies in 2018.

In our third pillar, building a strong standalone software business at scale – we see clear signs of our strategy bearing fruit. Nokia Software is now a truly verticalized business, driven by a renewed sales organization, underpinned by simpler processes and boasting a modern, cloud-native common software foundation. The attractiveness of this proposition is borne out through strong 2018 sales momentum including wins with AT&T, BT, STC, Sky, Telenor One Europe, and Verizon. The industry analyst research firm, Analysys Mason, ranked us the leading telecoms software company by revenue.

In our fourth pillar, creating new licensing opportunities – our successes in 2018 with existing and new licensee customers have validated our direction for Nokia Technologies. This year, we have extended our patent-licensing agreement with Samsung; signed a new multi-year patent-license agreement with Chinese smartphone maker OPPO; and benefitted from continued progress made by our brand licensee, HMD Global, which unveiled a range of new products throughout 2018, with production capacity to deliver on demand. We see further potential in licensing to smartphone makers and in other markets who are using our patented inventions, such as automotive, consumer electronics, and IoT devices such as smart meters.

Accelerating our strategy

Given the considerable momentum of our strategy, and with the successful Alcatel Lucent integration and associated cost-saving program completed, we took steps during 2018 to accelerate the execution of our strategy and position our business for 5G leadership. Alongside a new program targeting EUR 700 million in annual cost savings by the end of 2020, these steps have led to a number of organizational changes that further strengthen our ability to deliver on our 2019 and 2020 guidance.

First, we have created a new business group, Nokia Enterprise, that consolidates a range of existing, fast-growing activities into one organization. Led by Kathrin Buvac, Nokia Enterprise will enhance our ability to capture higher-growth, higher-margin opportunities as companies progress with their digital transformations.

Second, we have tailored Mobile Networks’ operational focus on mobile radio products, led by Tommi Uitto, and consolidated all our cloud-core activities and accountability into Nokia Software, under the leadership of Bhaskar Gorti.

We have also realigned Nokia’s customer-facing organization into two regional groups, to make sure our customer focus is as strong as possible. The first group covers the Americas, led by Ricky Corker. The second is responsible for Europe, Middle East & Africa, and Asia-Pacific, led by Federico Guillén, who previously led Fixed Networks. The new president of Fixed Networks, Sandra Motley, is charged with continuing the operational discipline of the business group while capturing new market opportunities for its portfolio. These changes have strengthened our organization, sharpened our focus, and added strong capabilities to Nokia’s Group Leadership Team.

The 5G investment cycle

From the first trials to the first roll-outs, 2018 was the year in which 5G became a commercial reality. It is my firm belief that we now stand at the start of a meaningful, long-term technology trend that bodes uniquely well for Nokia.

5G will power networks that connect sensors, machines, platforms, systems, and people in one seamless, automated whole. This fundamental shift in network design will require several different stages of investment, each of which leads naturally to the next. Nokia’s unique, end-to-end portfolio includes products and services for each stage of this process, leading to a virtuous cycle of investment that only Nokia can truly take advantage of.

The cycle has already begun with 5G radio access network (RAN) upgrades in first-mover markets, such as the US, Korea, China, and Japan, which our Airscale portfolio enables. As well as radio, these networks also need high-capacity connectivity to data centers, requiring backhaul-network expansion. Demand in the US for our IP and Optical Anyhaul offer shows this trend already taking shape.

With networks built, operators will then need fixed-wireless access to expand last-mile connectivity. With the most complete fixed-wireless access product-set of any provider, we are well-placed to tap this opportunity.

In due course, fast-follower countries will commence their 5G roll-outs. Yet, by this point, first-mover countries will already have entered the second stage of 5G evolution. Here, the focus will shift to network virtualization and edge cloud, and smart network fabrics will be required to connect these edge clouds, all playing to Nokia’s strength in cloud deployment and packet core.

Network slicing will follow, triggering a need for enhanced software that can control networks with high degrees of automation – our standalone software business and early moves in AI will allow us to capitalize.

Simultaneously, many enterprises will choose to build their own private networks, meeting bespoke performance, reliability, and security requirements. These networks will leverage the same end-to-end technologies as CSPs, but on a smaller scale. These will need to be plugged into national or global networks, creating a seamless whole, driving even greater network traffic and shifting the cycle back to the beginning.

No other global company touches every link in this cycle. No matter how early or late stage the investment, be it a first-mover or fast-follower geography, a communications service provider innovator or a digitally minded enterprise, Nokia’s end-to-end portfolio means that we can meet every 5G investment requirement that lies ahead.

Looking ahead

Nokia exits 2018 with strength, energy, and purpose. The year has not been without challenges, but nevertheless, we have remained focused on our commitments to our customers, people, and shareholders. Our strategy is focused on the true areas of opportunity; our global team is committed, dynamic, and capable of innovating and winning at the highest level; and our end-to-end portfolio has put us in a great position to grasp the transformative 5G opportunity ahead.

Nokia Annual Results 2018

Nokia

While the year 2018 was challenging and below Nokia’s expectations, the company ended the year with a strong finish and gained market share in its primary addressable market. Nokia continued the steady progress in each of the four pillars of its strategy – Lead, Expand, Build, and Create – during the year. With the Alcatel Lucent integration now behind it, and to ensure the strong competitive position in the 5G era, the company announced plans in October to accelerate progress in its strategic growth areas, further sharpen customer focus, and significantly reduce costs. As part of these plans, Nokia established a new business group, Nokia Enterprise, effective January 1, 2019, which consolidates a range of existing, fast-growing activities into one focused organization.

While the year 2018 was challenging and below Nokia’s expectations, the company ended the year with a strong finish and gained market share in its primary addressable market. Nokia continued the steady progress in each of the four pillars of its strategy – Lead, Expand, Build, and Create – during the year. With the Alcatel Lucent integration now behind it, and to ensure the strong competitive position in the 5G era, the company announced plans in October to accelerate progress in its strategic growth areas, further sharpen customer focus, and significantly reduce costs. As part of these plans, Nokia established a new business group, Nokia Enterprise, effective January 1, 2019, which consolidates a range of existing, fast-growing activities into one focused organization.

In 2018, Nokia Technologies again delivered robust financial results. Further validating Nokia’s global licensing program, Nokia and China’s OPPO signed a multi-year patent-license agreement, and Samsung extended its patent-license agreement with Nokia. The sale of the Digital Health consumer business was closed in May 2018, following which Nokia Technologies is exclusively focused on licensing valuable Nokia intellectual property, including patents, technologies, and the Nokia brand.

During 2018, Nokia acquired SpaceTime Insight, a California-based company which provides machine learning-powered analytics and IoT applications for some of the world’s largest transportation, energy, and utilities organizations, and Unium, a Seattle-based software company that specializes in solving complex wireless networking problems for use in mission-critical and residential Wi-Fi applications. Nokia also announced plans to divest the majority of its IP Video business in 2018, and the sale was completed in January 2019.

Communications technologies provide access to better healthcare and education, more efficient industry and resource use, economic opportunity, a more equitable, secure society, and a cleaner, safer planet. So, it is pleasing that the Nokia radio networks served around 6.1 billion subscriptions worldwide in 2018, up approximately 10 percent from 2016.

Communications technologies provide access to better healthcare and education, more efficient industry and resource use, economic opportunity, a more equitable, secure society, and a cleaner, safer planet. So, it is pleasing that the Nokia radio networks served around 6.1 billion subscriptions worldwide in 2018, up approximately 10 percent from 2016.

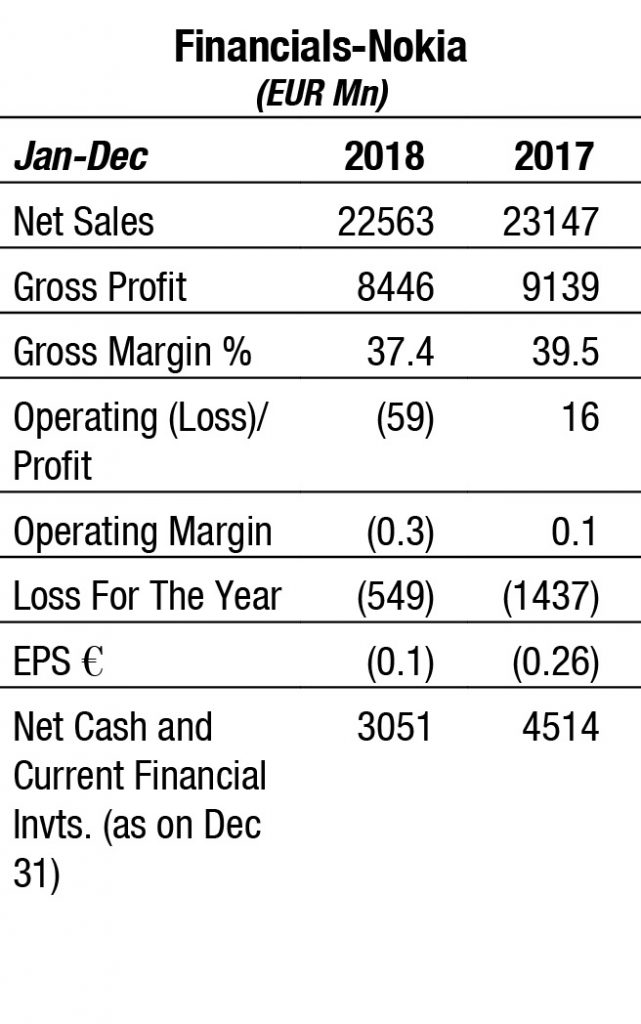

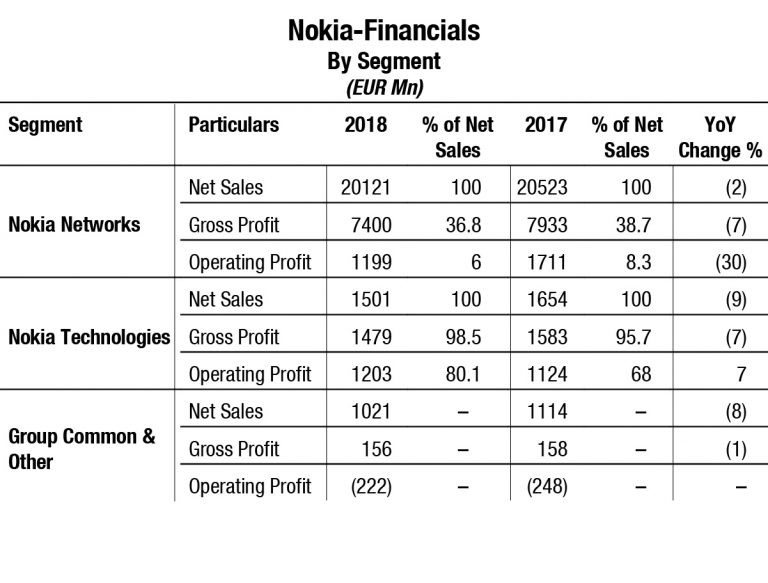

Continuing operations

Net sales. In 2018, net sales were EUR 22,563 million, a decrease of EUR 584 million, or 3 percent, compared to EUR 23,147 million in 2017. The decrease in continuing operations net sales was primarily due to a decrease in Nokia’s Networks business net sales and, to a lesser extent, a decrease in Nokia Technologies and Group Common and Other net sales.

Gross profit. In 2018, gross profit was EUR 8446 million, a decrease of EUR 693 million, or 8 percent, compared to EUR 9139 million in 2017. The decrease in gross profit was primarily owing to lower gross profit in Nokia’s Networks business and Nokia Technologies, as well as higher product portfolio integration-related costs, partially offset by lower working capital-related purchase price allocation adjustments. Gross margin for continuing operations in 2018 was 37.4 percent, compared to 39.5 percent in 2017. In 2018, gross profit included product portfolio integration-related costs of EUR 548 million and working capital-related purchase price allocation adjustments of EUR 16 million. In 2017, gross profit included product portfolio integration-related costs of EUR 453 million and working capital-related purchase price allocation adjustments of EUR 55 million.

Operating expenses. Research and development expenses in 2018 were EUR 4620 million, a decrease of EUR 296 million, or 6 percent, compared to EUR 4916 million in 2017. Research and development expenses represented 20.5 percent of net sales in 2018 compared to 21.2 percent in 2017. The decrease in research and development expenses were due to decreases in Nokia’s Networks business and Nokia Technologies research and development expenses, as well as lower amortization and depreciation of acquired intangible assets and property, plant and equipment, and product portfolio integration-related costs. In 2018, research and development expenses included amortization and depreciation of acquired intangible assets and property, plant and equipment of EUR 576 million, compared to EUR 633 million in 2017, as well as product portfolio integration-related costs of EUR 28 million, compared to EUR 57 million in 2017.