5G Features

The Promise of 5G

These technologies have the potential to alter how consumers communicate, consume content, work together, and interact with the environment. As well, they are poised to shift the dynamics of industries, both inside and outside of telecommunications.

5G services have been launched in 1662 cities across 65 countries. The pandemic has had little impact on 5G momentum; in some instances, it has even resulted in operators speeding up their network rollouts, with governments and operators looking to boost capacity at a time of increased demand. 2021 has already seen a 20-percent increase, since the beginning of the year, with next-generation cellular technology extended to an additional four countries – Cyprus, Peru, Russia, and Uzbekistan – and 301 cities worldwide.

China remains in the lead with 376 cities covered by 5G, followed by the United States at 284. Notably, the Philippines has surpassed South Korea for the first time, with 95 and 85 cities covered, respectively.

The APAC region remains in the lead with 641 cities, closely followed by EMEA at 623, while the Americas region can only claim 398 cities covered. In addition, more than one-third of the world’s countries now have at least one live 5G network.

By the end of May 2021, 443 operators in 133 countries/territories were investing in 5G. 188 operators had announced they had deployed 3GPP-compliant technology in their live networks. Of those, a total of 169 operators in 70 countries/territories had launched one or more 3GPP-compliant 5G services.

Governments have been freeing up spectrum for 5G. Operators have been swift to deploy C-Band spectrum for 5G with 178 operators licensed/deployed/deploying networks. mmWave at 26/28 GHz follows with 112 licenses and 27 deploying/deployed. 700 MHz is increasingly important with 33 auctions/assignments expected by end 2022.

The vendor community has been working overtime. There has been rapid growth in the numbers and types of 5G devices being announced and launched – there are currently 822 announced 5G devices from 128 vendors, of which 511 are commercially available (up 176 in 2021). The device support spans all the major bands. Currently, 395 devices support mid C-Band, while there is also growing momentum in an additional mid band 4.4–5 GHz and 77 commercially available devices supporting high-mmWave spectrum (122 announced).

Against this global 5G momentum, 5G standalone (SA) networks are continuing to emerge, with devices with stated 5G SA support announced and commercially available across multiple form factors.

Over 70 auctions/assignments will be underway or expected by the end of 2022 – 33 involving 700 MHz, 36 involving C-Band spectrum and 20 involving mmWave spectrum.

GSMA Intelligence expects 5G connections to reach 500 million by 2021 (Ericsson Mobility Report pegs it at 580 million), 1 billion by 2023, and 1.8 billion by 2025, constituting 20 of the expected total of 8.8 billion SIM connections (excluding licensed cellular IoT), while 5G, expected to be launched in 2022 in India, will account for 26 percent of mobile subscriptions in India at the end of 2026 at about 330 million subscriptions.

According to the GSMA, operators are expected to spend USD 900 billion worldwide between 2021 and 2025 in mobile capital expenditures (CapEx), roughly 80 percent of which will be in 5G and much of it could run on cloud infrastructure. Along with 5.1 billion 4G connections, this translates to a USD-4.4 trillion contribution of mobile to world GDP, accounting for 5.1 percent share.

Michael Porowski

Michael Porowski

Senior Principal Research Analyst

Gartner

“The COVID-19 pandemic spiked demand for optimized and ultrafast broadband connectivity to support work-from-home and bandwidth-hungry applications, such as streaming video, online gaming, and social media applications.”

4G – LTE has peaked and, in some cases, begun to decline. In many countries, particularly in developing regions, 4G still has significant headroom for growth. Much of the growth in 4G will come from existing 4G – LTE infrastructure, as 5G will account for 80 percent of total CapEx over the next five years. Globally, 4G adoption will peak at just under 60 percent by 2023 as 5G begins to gain traction in new markets.

Worldwide, 5G network infrastructure revenue is on pace to grow 39 percent to total USD 19.1 billion in 2021, up from USD 13.7 billion in 2020, according to the latest forecast by Gartner, Inc. Communications service providers (CSPs) in mature markets accelerated 5G development in 2020 and 2021, with 5G representing 39 percent of total wireless infrastructure revenue this year.

5G is the fastest growing segment in the wireless network infrastructure market. Of the segments that comprise wireless infrastructure, the only significant opportunity for investment growth is in 5G. Investment in legacy wireless generations is rapidly deteriorating across all regions and spending on non-5G small cells is poised to decline as CSPs move to 5G small cells.

Regionally, CSPs in North America are set to grow 5G revenue from USD 2.9 billion in 2020 to USD 4.3 billion in 2021, due, in part, to increased adoption of dynamic spectrum sharing and mmWave base stations. In Western Europe, CSPs will prioritize on licensing spectrum, modernizing mobile core infrastructure and navigating regulatory processes, with 5G revenue expected to increase from USD 794 million in 2020 to USD 1.6 billion in 2021.

Greater China is expected to maintain the No.1 global position in global 5G revenue reaching USD 9.1 billion in 2021, up from USD 7.4 billion in 2020. With China’s government funding 5G development for the three state owned carriers, that is no surprise. The big beneficiaries of China’s 5G infrastructure spending are its domestic equipment makers, Huawei, ZTE, and state-owned Datang Telecom.

While 10 percent of CSPs in 2020 provided commercialized 5G services, which could achieve multiregional availability, Gartner predicts that this number will increase to 60 percent by 2024, which is a similar rate of adoption for 4G – LTE in the past. With the price difference with other technologies narrowing, CSPs are willing to invest in XGS-PON to differentiate themselves in customer experience and network quality. Gartner estimates that by 2025, 60 percent of Tier-I CSPs will adopt XGS-PON technology at large scale to deliver ultrafast broadband services to residential and business users, up from less than 30 percent in 2020.

Evidence thus far suggests the market is progressing slowly on small cells’ contribution to the overall 5G infrastructure segment.

Private 5G networks. Some organizations do not want telcos involved in 5G. Instead, they have bought their own spectrum licenses and plan to build and operate private 5G networks. According to a research report by the Beyond by BearingPoint and Omdia, only 16 percent of enterprise projects are telco-led, while a fifth of businesses plan a do-it-yourself 5G private network approach.

Private 5G networks offer much more robust security as they need not be connected to the larger telecom network, and hence are attractive to companies, which have very high security requirements, such as power plants and other critical infrastructure. They are also highly customizable and can, therefore, be built to exact company specifications as opposed to having to select from telco offerings. Also, wireless data can be managed and analyzed internally. Given that 5G SA/core network deployments will take years and will all be different, private networks can deliver robust connectivity now. Another important advantage is that many private 5G networks are being designed to operate indoors as well as outdoors.

While the Dell’Oro Group expects private 5G NR revenues to surpass USD 1 billion by 2025, ABI Research is more bullish and expects revenue to grow from USD 1.6 billion in 2021 to an astonishing USD 65 billion in 2030, with a compound annual growth rate (CAGR) of 60.1 percent. IDC forecasts worldwide revenue from sales of private LTE/5G infrastructure will grow from USD 945 million in 2019 to an estimated USD 5.7 billion in 2024, with a five-year CAGR of 43.4 percent.

The telcos are finding their role diminish in 5G to dumb pipe providers (of only the RAN) of two-way wireless transport. 5G is clearly seen as primarily a B2B or B2B2X opportunity. The challenge for telcos is to capture some of that market. Private 5G network equipment suppliers including Nokia, Cisco, and NEC are strong contenders for this pie. The biggest risk is that such partnerships diminish the telco’s role in 5G as all the intelligence and key functions are implemented by the cloud providers. Most 5G network operators are teaming up with public cloud giants (AWS, Azure, and Google Cloud) for multi-access edge computing (MEC) and/or implementation of (non-standardized) 5G SA core networks. That business partnership requires telcos to split revenues with those cloud giants and/or pay them a fee.

Operators moving to the cloud can save on hardware and development, benefit from cloud-enabled automation and data analytics, and manage real-time responses and peak traffic on demand. The delivery of new services can be accelerated through cloud-driven AI and IoT.

Joe Barrett

Joe Barrett

President

Global mobile Suppliers Association

“A year ago, there were 90 vendors who had announced 5G devices, today this ecosystem has grown to be over 140, across form factors that serve the consumer, business and industrial markets,”

Investments in spectrum. Spectrum in the 2300–2400 MHz range is widely used for mobile services, and during 2021 more countries are considering or planning to assign spectrum in this range for use in LTE and 5G networks.

Network providers globally have invested heavily in spectrum and are looking for solutions to develop and gain 5G services faster. According to the Global Mobile Suppliers Association, the total value of spectrum auctions reached over USD 27 billion in 2020.

5G drives competitiveness. Tough competition and advantages of scale will drive consolidation in the telecoms industry ahead of higher 5G investments.

The 5G technology will favor larger operators with strong balance sheets. It will be difficult for smaller telcos to take on 5G infrastructure investments without an immediate ROI (return on investment) payback. Data monetization remains a challenge in most markets, aggravated by price competition and the lack of differentiation among product offerings. The outlook has worsened for three countries – Singapore, Thailand and Indonesia – according to Fitch Ratings. The telcos are likely to bolster cash generation ahead of their 5G investment upcycles, supporting stable competition in most markets.

5G devices. The momentum of 5G devices is strong, in both the vendor line-up and the products brought to the market. And it is still in the acceleration phase. Based on current trajectory Barrett expects to see the 1000 mark of announced devices be broken by the end of 3Q this year, and the number of commercially available products exceeding the thousand mark toward the end of 2Q 2022. It may be surprising to note that over half of both all announced products and commercially available products already claimed to support 5G SA in sub-6 GHz bands.

Core Networks

In practice, most operators today are following a strategy of converged core that enables CSPs to benefit from shorter time-to-market, network monetization, greater flexibility, scalability and reliability.

The first few years of 5G build-out have seen rapid deployment of non-standalone (NSA) networks, which still rely on the 4G-evolved packet core (EPC). To achieve true 5G performance, and to enable many services that look beyond just mobile broadband, operators will need to migrate to the 5G core, and most are envisaging this as a stage in their adoption of fully cloud-native architectures.

The 5G core will support a service-based architecture (SBA) that can enable network slicing, and many of the 5G capabilities that are central to developing new revenue streams, rather than just bolstering or defending existing ones.

The 5G core will enable capabilities, such as ultra-low latency and will be implemented as microservices, which allow network resources to be scaled up and down on-demand to suit the needs of individual services or users, and enables the operator to create virtual slices of the network, optimized for the needs of a particular sector, enterprise, or use-case.

So, 5G core will be essential to support the really transformative promises of 5G, such as agile service delivery, full multilayer convergence with wireline and other wireless networks, critical communications, and network slicing.

However, migrating to that core will be a significant and complex process, and only a few have already embarked on the journey. According to a March 2021 update from the GSA, about 68 operators in 38 countries have been investing in public 5G standalone (SA) networks in the form of trials, planned, or actual deployments. This compares with over 400 operators known to be investing in 5G licenses, trials or deployments.

The number of large-scale 5G SA roll-outs that will take place in 2021-22 will remain low, and we expect significant momentum only after 2023. Some operators will adopt a multi-stage approach even in the primary core that supports mobile broadband consumers and services. This typically involves virtualizing the 4G-evolved packet core (EPC) and enhancing it for 5G NSA, rather than taking a single step to 5G SA.

In the US, for instance, T-Mobile’s 5G service became more widely available after it switched on its SA service, according to research carried out by OpenSignal. With NSA, the operator had to maintain a connection with 4G, which it provides over mid-band spectrum. Standalone meant it could make full use of its low-band frequencies, far better for coverage (if not speed). Unfortunately, due to a lack of smartphones that support standalone carrier aggregation, T-Mobile has not been able to run 5G services on low- and mid-band spectrum simultaneously. Coverage has been good. Connection speeds have not.

Forthcoming devices will address that problem. But if various network efficiencies and marginal performance improvements turn out to be SA’s main benefits, it will rank alongside NSA as another major telco disappointment. “5G standalone will allow us to launch new services not even contemplated today,” said Howard Watson, the chief technology officer of the UK’s BT, during a recent press conference. The time for contemplation is long overdue.

5G SA core networks to run on cloud service provider platforms. In June 2021, AT&T tied up to run its 5G SA core network on Microsoft’s Azure public cloud computing platform. Microsoft Azure, which is the second-largest cloud computing provider by revenue behind rival Amazon Web Services, has been building out specific cloud computing offering to attract carriers. AT&T was Microsoft’s first major deal in the 5G SA core network space.

In June, TIM too said it was building its 5G SA core network on Google’s cloud solutions. The project will use TIM’s telco cloud infrastructure, Google’s cloud solutions, and Ericsson’s 5G core network and automation technologies.

In late May, Telefónica validated AWS Outposts as option for 5G SA core deployment in Brazil. In late April, Dish Network had made a similar deal to have Amazon run its 5G core network on AWS.

And all of 5G core is expected be cloud-native, and that too mostly container-based (rather than virtualized network functions/VNF). And since there are no standards or implementation specs for 5G cloud-native core network or true 5G functions, like network slicing, the result will be multiplicity of 5G SA carrier-specific software running on different cloud service providers’ compute servers. And as each network provider’s 5G core network will be different, a unique, carrier-specific 5G core download will be required for 5G endpoints for each 5G SA core network provider.

Once a full cloud-native 5G core is implemented, these secondary cores will become merely instances of the main platform, with precise user plane functions (UPFs), deployed in each location depending on application requirements. Secondary cores to support enterprises or new services will often be sources of experimentation with new vendors or architectures, before these are allowed into the main core networks and subscriber bases.

New suppliers will be important as many operators look to cloud-native 5G core and RAN as the opportunity to shake up their ecosystems and work with a wider range of partners. The 5G core will be the trigger to rethink the supply chain for most operators.

O-RAN Going Global

In a traditional mobile network ecosystem, the RAN (radio access network) is proprietary. A single vendor provides their package of radio hardware and software to enable the mobile network to function. The latest approach to mobile infrastructure, however, is all about Open RAN (O-RAN), an architecture that allows mobile networks to be built using new combinations of hardware and software, including those from a new emerging generation of agile tech-centric vendors.

Once the horizontal disaggregation of the network functions (RU/DU/CU) with open interfaces, O-RAN is combined with the vertical disaggregation of hardware and software with virtualization technologies, or vRAN, the dynamics will bring tremendous advantages to the CSPs.

It will open doors to a diverse, innovative selection of products as well as enable the implementation of a more scalable, intelligent, and resilient network that can significantly increase the flexibility and efficiency of CSPs’ deployments and operations.

With hardware and software vendors developing and offering solutions based on open protocols and interfaces, the mobile industry is on track to see benefits that include improved network performance and security, as well as reductions in the cost of construction and operations, ultimately leading to cost savings for retail customers.

As the operators ensure continuity of the excellent customer experience that their customers are paying them for, they look at the opportunities outside the microcellular network in the course of the next few years. And the technology works hand-in-hand with private networks, neutral hosts, and small cells to ensure that the entire ecosystem may be brought together. The technology must allow them to work on their operating model as they work in a hybrid scenario, where customers need access to a private network and bot mobility to the macro network.

As O-RAN, ultimately an open ecosystem, drives down the complexity and the cost sometimes associated with a single vendor scenario, it brings with it additional types of risks and potential threat vectors associated with a multi-vendor environment. Also, there are many capabilities that are only dependent on RAN itself; it is highly scalable and terminates not at the edge compute side but at the multi-axis edge sites.

Telcos’ O-RAN advancement plans will be driven by factors such as – where they are in the lifecycle of their legacy networks, what is their CapEx vs OpEx split in networks investment, are they looking to upgrade brownfield networks or building a greenfield 5G network. According to the GSMA Intelligence Operator in Focus Network Transformation survey, telcos also see ownership/coordination, lack of internal expertise, and integration into existing systems as the top challenges for adoption of O-RAN. While cost saving is often advocated as one of the benefits of O-RAN, a lack of clarity on ROI also acts as a hurdle.

And in the present, telcos still need to get the ball rolling by forging partnerships that allow them to undertake R&D on existing networks, understand use-cases with O-RAN deployments, and undertake trials to better inform their deployment decisions.

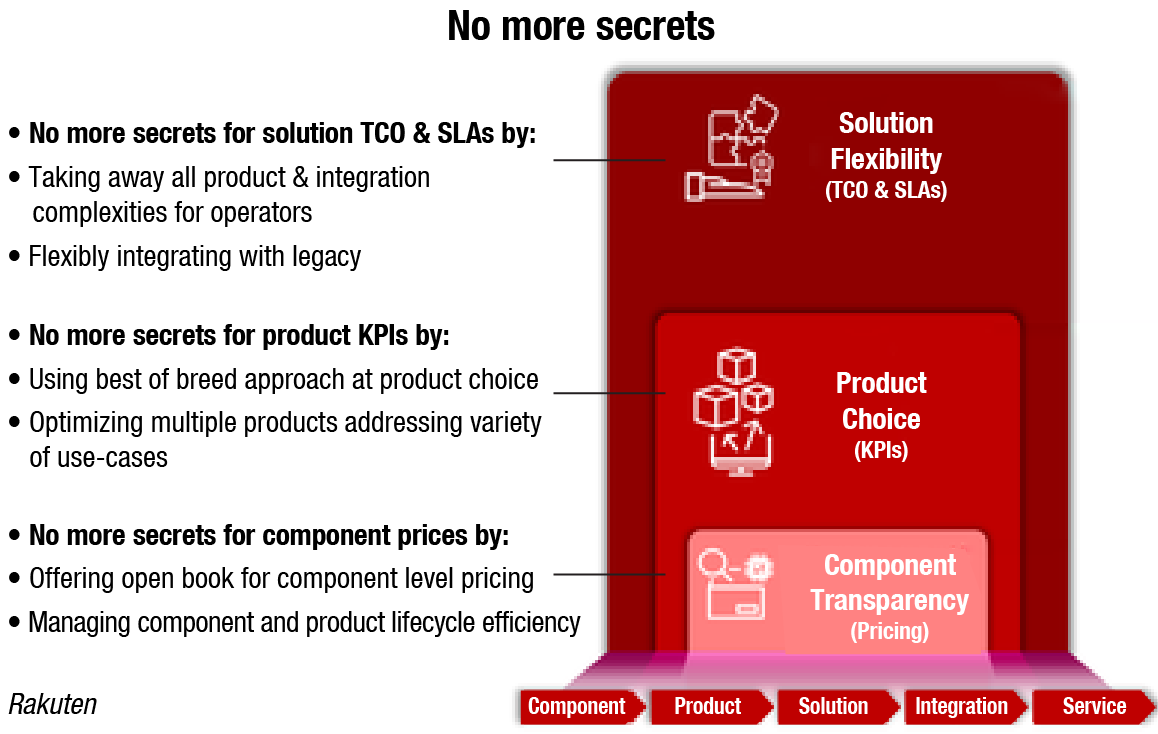

After building an unorthodox mobile network, Tareq Amin, chief technology officer of Rakuten Mobile, has taken it upon himself and made one of the goals of O-RAN to spur competition and lower costs. No more secrets, seems designed to exert pricing pressure on the equipment sector and prevent any margin stacking.

He does not plan to stop at exposure, either. The full idea is to create an open book for component-level pricing. Other service providers would be able to order validated and certified products directly through Rakuten, or identify the factories that make components, if they do not want Rakuten involved. Rakuten undoubtedly stands to gain from this. Besides collecting some kind of commission, it could also bundle its own software with the equipment provided. It owns a majority stake in Altiostar, a US developer of open RAN software.

In India too, the telcos are looking beyond traditional vendors. While RJio is testing its own 5G O-RAN solutions in several Indian cities, Jio Platforms has partnered with chipmakers Qualcomm and NXP to make virtualized RAN and small cell to support its 5G network, enabling various use-cases including fixed wireless access; Airtel has forged a strategic alliance with Tata Group and TCS to build 5G networks based on O-RAN technology. Airtel will also leverage Qualcomm’s 5G RAN platforms to rollout virtualized and Open-RAN 5G networks in India. Vodafone Idea too has indicated its focus toward O-RAN; in fact Vodafone Group has announced partnerships with Dell, NEC, Samsung Electronics, Wind River, Capgemini Engineering and Keysight Technologies to jointly deliver the first commercial deployment of O-RAN in Europe.

Indian vendors are not far behind. Chris Rice, SVP, AT&T Labs, is now CEO, STL Access Solutions, STL’s business unit for O-RAN and 5G. The manufacturer is ready with its end-to-end multi band radio solution for 5G networks.

The Tatas have also joined the bandwagon, with leveraging the opportunities that flow through O-RAN. Tata Sons’ subsidiary, Panatone Finvest recently acquired 43.3 percent in Tejas Networks for ₹1850 crore, with further plans to buy another 26 percent of the voting capital through an open offer.

As of today, 73 operators from 38 markets have either deployed or committed to O-RAN deployments. Scanning through the list of operators and their geographical presence, it is clear that O-RAN is now going global, touching developed and developing markets alike. Be it Axiata announcing plans to deploy O-RAN in multiple countries by end 2021, MTN announcing its O-RAN plans across its footprint, or the partnership between Airtel and Tata to deploy indigenous O-RAN solutions, highlighting the rapid global spread.

The momentum continues in other parts of the world also with UK government funding a 5G O-RAN testing lab and Deutsche Telekom switching on its O-RAN town with massive MIMO radio units for high performance. The foundation of O-RAN was laid with the creation of TIP in 2016, but 2021 is clearly the year when we are seeing O-RAN gain global momentum.

Cloud Infra

5G and the massive increase of compute power in the network will transform the telecom industry like never before. Service providers, offering the most value-add in emerging edge ecosystems, stand to gain most from lucrative new pathways into 5G cloud revenue streams.

As 5G infrastructure gets deployed, and cloud computing resources are extended to the edge of the network, cloud infrastructure and communications networks are becoming increasingly integrated and merged, a trend that is likely to continue with the expansion of 5G deployments. 5G means more data – the fuel for cloud applications around the world. Cloud providers and service providers all want to extend infrastructure and services to capture, transport, and process this data.

The most promising applications and use-cases for 5G that will emerge from edge cloud from 2021 to 2025 include wireless broadband, streaming media, cloud gaming, connected vehicles, smart anything (Smart X), immersive experiences (VR/AR), Multi-access Edge Compute (MEC) as-a-service, and private wireless networks.

Cloud resources are the key to agile and elastic 5G deployment. By tapping into compute and storage resources as a service, operators can adapt quickly and cost-efficiently to shifts in customer demand.

The fast, frictionless scalability offered by the cloud also helps operators accommodate the vast amounts of data needed to make effective use of AI-powered network automation. Moving customer workloads closer to the consumer will reduce latency for 5G-enabled enterprise and vertical industry applications. Migrating OSS/BSS systems to the cloud can lower costs while increasing agility.

At the same time, growing cloud operations can also increase management complexity as well as the risk of security breaches and a growing regulatory burden. To take full advantage of the agility and elasticity of the cloud, operators need to be able to migrate data to and across environments easily and securely, optimize the placement of cloud-based workloads for performance and cost, ensure business continuity, maintain data privacy, and ensure the integrity of business-critical data.

Here again, intelligent automation and AIOps are critical for addressing key aspects of 5G networking. Automated infrastructure management can simplify cloud operations and accelerate cloud migration. Automated cloud remediation and compliance enable operators to detect and close security gaps and prevent regulatory lapses across constantly-changing cloud environments and applications.

By deploying cloud PODS (programmable, open and disaggregated solutions)-based modular architecture and deployment models, the custodians of the network are able to control their destiny through agile, automated, vendor-neutral infrastructure.

A key consideration relates to how much of the cloud infrastructure is under the network operators’ management or outsourced to others, particularly the hyperscaler trio of AWS, Microsoft Azure, and Google Cloud. Another is the impact of cloud-native as 5G core deployments and the introduction of O-RAN architectures expose telco teams to new operational processors and containerized functions.

The world’s leading cloud providers hastened their collective rise in mobile operator’s 5G networks and business models throughout 2020. As software permeates every network layer and element, and mobile network infrastructure increasingly evolves to adopt webscale architecture, hyperscalers are poised to soon become the most important vendors – and potential threats – for carriers at large.

The respective strategies for mobile edge computing and 5G among the hyperscalers crystallized throughout 2020. There remains little trust between network operators and cloud providers, but there is now widespread acknowledgement among carriers that the edge and core 5G functions will be tightly interwoven and fueled by public clouds.

As edge computing takes hold, operators will also be determined to not repeat previous mistakes in the cloud, and try to compete with the cloud providers and fail. Mobile industry standards bodies that are developing common approaches to some of the interfaces and components of edge competing also have little confidence that cloud providers will embrace common frameworks.

The intent, with the backing of global operators and vendors is there, but the astronomical rise and power of hyperscalers effectively makes those efforts moot.

Amazon, Microsoft, and Google all made moves during 2020 that underline their strength and clarify goals in mobile infrastructure.

Edge Computing

The move of part of the computing power from the cloud to the edge could to a large extent be seen as an operator-centric technology shift, which builds on previous developments such as the softwarization and virtualization of networks and plays into 5G deployments.

Following industry-wide efforts to define MEC and the associated standards, MEC technology is increasingly being explored across various industry applications, with the expectation that 5G and MEC will drive greater integration between connectivity and computing.

While it is difficult to define hard boundaries, there are now clear signs that a new wave – edge computing – is developing. This would mark a shift back toward decentralization, with computing power and resources deployed nearer to customers. At its heart, it represents a pivot from a network-centric service model to a more workload-centric model, with localization the key principle. This is not an either/or scenario. The centralized cloud data centers will remain and indeed will likely expand in overall capacity, but new demands (such as from IoT and enterprise) and in particular the potential for ultra-low latency services in the 5G era are drawing computing back toward the end user.

Around the world, carriers are deploying 5G wireless technologies, which promise the benefits of high bandwidth and low latency for applications, enabling companies to go from a garden hose to a firehose with their data bandwidth. Instead of just offering the faster speeds and telling companies to continue processing data in the cloud, many carriers are working edge-computing strategies into their 5G deployments in order to offer faster real-time processing, especially for mobile devices, connected cars, and self-driving cars.

Wireless carriers have begun rolling out licensed edge services for an even less hands-on option than managed hardware. The idea here is to have edge nodes live virtually at, say, a Verizon base station near the edge deployment, using 5G’s network-slicing feature to carve out some spectrum for instant, no-installation-required connectivity. Verizon’s 5G Edge, AT&T’s Multi-Access Edge, and T-Mobile’s partnership with Lumen all represent this type of option.

Gartner’s 2021 strategic roadmap for edge computing highlights the continued industry interest in 5G for edge computing, saying that edge has become part and parcel of many 5G deployments. Partnerships between the cloud hyperscalers like Amazon and Microsoft and the major wireless ISPs will be key to realizing widespread uptake of this type of mobile-edge.

It is clear that while the initial goal for edge computing was to reduce bandwidth costs for IoT devices over long distances, the growth of real-time applications that require local processing and storage capabilities will continue to drive the technology forward over the coming years.

5G and edge computing will help define the winners in the digital economy. Integrating connectivity and computing near to where data resides is key, but so is the ability of CSPs to adapt to the changes. The study of 500 telecommunications executives identified a small group (14 percent) of high performers, which IBM defined as those expected to outperform the rest of the field on 5G and edge computing.

Fifty-nine percent of these high performers agreed they must become secure clouds infused with artificial intelligence and automation, while half of the high-performing CSPs agreed they must become strategic cloud platforms blending a diverse partner ecosystem.

“If CSPs are to thrive, most will need to develop new competencies and assert themselves in new roles in value chains,’’ the study said. “CSPs should seek new ways to make money, beyond metering connectivity and access to data, as these traditional mainstays of CSP business models are likely to commoditize.”

Additionally, 71 percent of telco CEOs surveyed said cloud computing is a core technology to help deliver results over the next two to three years, while 61 percent viewed 5G similarly.

CSPs have much to offer in the burgeoning 5G-driven platform economy – experience, points of presence, enterprise systems, unique data, and customer trust, the study said.

The so-called high-performing CSPs “seem to value the strategic importance of digital platforms, automation, emerging partner ecosystems, and hybrid cloud,’’ the study said.

The concept of moving intelligence to the edge didn’t really catch on until three or four years ago, when telecommunications companies began making plans for 5G wireless – and realized that 5G’s speeds only help in the last mile.

Data travel time to and from a cell tower is of 12 to 15 milliseconds over 4G. With 5G, vendors are touting latency levels of just 2 to 3 milliseconds – but the trip to and from a distant data center can still take 100 to 500 milliseconds or more. That makes edge computing crucial for the rollout of 5G networks and new mobile edge computing (MEC) services.

Experts say it’s important to realize that edge computing and 5G are not connected at the hip. While 5G networks absolutely require edge computing technologies in order to succeed, edge computing can operate on different networks, including 4G LTE, Wi-Fi, and other network types.

When you combine the speed of 5G with edge computing’s processing capabilities, it is only natural to focus on applications that require low latency. This is why early use-cases tend to involve AR/VR, artificial intelligence, and robotics, which require split-second decisions from computing resources. But there is potential for a variety of business apps to benefit from both edge and 5G.

“In on-premises edge, there are many applications that already exist, which could potentially be ‘moved’ or leverage a mobile edge compute,” said Dalia Adib, principal consultant and practice lead for edge computing at STL Partners. “There is a sweet spot of use-cases – for example, those that use video, IoT, and AI.”

The development of edge-native applications that are built to take advantage of edge computing’s strengths, such as low latency and bandwidth scalability can be foreseen. These apps will likely drive demand for 5G networks and edge computing growth.

Beyond the benefits of low latency, edge computing can provide businesses advantages, including bandwidth cost savings, better privacy options, and regulatory compliance, and support for situations when network connectivity is inconsistent.

On the bandwidth front, IoT device can process their data on the edge, and then send only essential data back to cloud servers. Data privacy is another benefit. Storing and processing data at the edge keeps it from being sent to a distant cloud server in a data stream from which personal information could be extracted via machine learning algorithms. What is more, in some instances, edge computing is a method of achieving compliance with government or industry regulations, says IDC’s McCarthy.

Edge computing also benefits companies whose workers need to use mobile apps in situations where network connectivity is inconsistent. Additional examples include disruptions that follow a natural disaster, or for military applications where an enemy would take out an internet connection to disrupt communications. Finally, the flexibility and scalability of edge computing can be a key benefit for enterprises looking to move computing resources off centralized dedicated appliances.

Despite all these advantages, businesses may still see 5G and edge computing as on the fringe. But another, more immediate use for edge computing is emerging – it can help support employees who find themselves working at home as a result of COVID-19 lockdowns or work-at-home orders.

5G Rollouts

Of a total 580 million 5G global subscribers forecast in the Ericsson Mobility Report by end 2021, four countries combined, China, USA, South Korea and Japan expect to account for 568.92 million subscribers, a 98 percent share. By 2021, China expects 495.15 million, USA 41.3 million, South Korea 16.47 million and Japan 16 million 5G subscribers.

Due to the rapid take-up of 5G in China, the region sits among global leaders in terms of adoption. In 2020, the region added more than 200 million 5G connections, taking its share of global 5G connections to 87 percent. 376 Chinese cities are covered by 5G in contrast to 284 cities in the US.

The combined number of 5G subscribers of China’s top three telcos reached 420 million in April 2021. Combined revenue of these telcos rose 6.5 percent year-on-year to RMB 360.1 (USD 55.46 billion) in 1Q, up 4.7 percentage points from the same period the previous year.

For the first quarter of 2021, China Mobile Limited reported operating revenue of RMB 198.4 billion, up by 9.5 percent over the same period last year, of which revenue from telecommunications services was RMB 177.7 billion, up by 5.2 percent over the same period last year. EBITDA was RMB 72.1 billion, up by 5.2 percent over the same period last year. At the end of March 2021, it reported 940 million mobile subscribers, of whom 188.76 million were 5G subscribers. In June, the figure was 946 million subscribers, 251 million being 5G subscribers.

China Telecom Corporation Limited, for the first half of 2021, reported operating revenue of RMB 219 billion, up by 11.6 percent over the same period last year. Its EBITDA was RMB 66 billion, up by 4.8 percent over the same period last year. At the end of March 2021, it reported a total of 365.25 million subscribers, of whom 111.23 million were 5G subscribers. In June, the figure was 362.49 million subscribers, 131.5 million being 5G subscribers.

For the quarter ending March 2021, China United Networks Communications Group Company reported RMB 82.3 billion in operating revenue. Its operating revenue for the same period in 2020 stood at RMB 73.8 billion. The company’s EBITDA for the first quarter of 2021 was RMB 23.6 billion, up from RMB 23.5 billion in the same quarter last year. In June, it had 310.4 million mobile subscribers, of whom 113.33 million were 5G subscribers.

China is expected to be among the leaders in 5G adoption by 2025, with 822 million 5G subscribers by 2025, an increase from 202 million subscribers in 2020 by GSMA. With a 5G penetration rate of 47 percent, it trails South Korea, Japan, and the US at 5G penetration rates of 67 percent, 50 percent, and 55 percent, respectively. In annual mobile data consumption, China’s 5G annual data traffic is forecast to reach 782 exabytes by 2025. This will represent nearly 60 percent of the world’s total 5G data consumption.

With the deployment of 5G network and the increase in mobile station sites (more tower leases), China’s three operators’ network operating costs grew rapidly, and network costs grew much faster than the network revenue. How to rationally control network construction and operation and maintenance costs will be a major problem for China operators to address in 2021.

Xiao Yaqing, the minister of Industry and Information Technology, claimed that based on the number of base stations, network quality, and manufacturing levels of telecom equipment, China has taken the global lead in 5G network construction. According to a 2021 GSMA Intelligence report, mobile operators in the China region will invest nearly USD 210 billion in aggregate network CapEx (including RAN, core, and transport) over five years. A whopping 90 percent of that is going to 5G.

China has deployed a total of 961,000 5G base stations as at the end of July 2021, representing approximately 80 percent of the total number of 5G sites deployed globally. As the cost of building 5G base stations falls, Chinese telcos are expected to build upwards of 600,000 base stations in 2021.

China Broadcast Network and China Mobile have recently (July 2021) completed a tender to deploy 400,000 5G base stations this year, as part of the companies’ efforts to launch a shared 5G network. The contracts had been won by Huawei, ZTE, Datang, Nokia, and Ericsson.

The two companies expect this shared network to reach nationwide coverage within the next two years. China Broadcasting Network was established in October 2020 in Beijing, becoming the country’s fourth mobile operator.

5G is beginning to be seen as a process of transition to 6G, and technological evolution is occurring at an ongoing pace.

The US had 15.8 million 5G mobile service subscriptions in December 2020, with 284 cities covered by 5G. This figure is expected to skyrocket by 161.4 percent to 41.3 million in 2021.

AT&T Incorporated, Verizon Communications Incorporated, and T-Mobile US Incorporated are the three major wireless networks in the US. T-Mobile had the early lead, but Verizon has caught up and may eventually pull ahead. In 2020, T-Mobile US Incorporated and Verizon Communications Incorporated each had 5.5 million users on their 5G networks, while AT&T Incorporated had 4.4 million. In 2021, Verizon is poised for 15 million 5G users, T-Mobile 13.2 million, and AT&T 10.7 million.

T-Mobile had 102.1 million subscribers at the end of 2020 and added 5.6 million customers. Its revenues in 2020 were USD 68.4 billion, and net income USD 3.1 billion. The company’s half-yearly revenues at the end of June 2021 were USD 39.7 billion.

Verizon at 98.9 million subscribers had consolidated revenue in December 2020 of USD 128.2 billion and consolidated net income was 18.3 billion. It had 94.2 billion subscribers at the end of June 2021.

AT&T at 182.5 million subscribers had consolidated revenue for 2020 of USD 171.7 billion with a loss of USD 3.8 billion last year.

There are an estimated 64,000 5G base stations in the USA today.

South Korea ranks No.1 with 449 Mbps in 5G median download speeds, based on tests conducted during February–March 2021 by Speedcheck. An important factor contributing to its successful deployment is the spectrum allocation in 3.5 GHz and 28 GHz bands. The telecom regulatory authority released enough chunks of the spectrum (100 MHz and 800 MHz in 3.5 GHz and 28 GHz, respectively) to power the telecom sector in SK.

The three telecom operators got 280 MHz in 3.5 GHz and 2400 MHz in 28 GHz bands. They took advantage of the 3.5 GHz (C-Band) spectrum for 5G services due to its radio propagation characteristics, providing a perfect balance between coverage, capacity, and speed. On top of that, SK operators used a 28 GHz (mmWave) frequency spectrum to ensure faster internet to a more extensive customer base in dense urban areas.

The operators implemented an aggressive 5G rollout strategy since April 2019. As a result, the total 5G subscriptions in SK surpassed 15 million at the end of April 2021, which is more than 20 percent penetration, given 52 million people. Today, 5G is available in 85 cities of SK. The big boost in 5G subscriptions in 2021 came due to Samsung Electronics’ latest flagship Galaxy S21 smartphone. Three SK operators have deployed more than 166,250 5G base stations.

The contribution of local industry and R&D from telcos, such as Samsung makes it easier to deploy and cheaper to roll out. And there is no restriction on any company. ZTE and Huawei are allowed to participate, which provides a level playing field to all the telcos irrespective of the country of origin. Thus, SK benefits from state-of-the-art technologies at a lower cost.

Till today, only the three players, namely SK, KT, and LGU+, dominate the Korean market. Recently the SK government has come up with a novel idea to further boost the 5G competition by allowing MVNOs to offer 5G data plans independently. The MVNOs will be offering 5G data plans (30 GB) at the cost of USD 35. The three leading operators do not currently provide 5G data plans at a similar price for the same amount of data. On the other hand, though many MVNOs are already operating in the US, they are not independent of legacy telcos, thus cannot provide the data prices freely.

South Korea ended May 2021 with a total of 15.84 million 5G subscribers, that accounted for 22 percent of the total 71.45 million mobile subscriptions in the country. The country’s largest carrier, SK Telecom, ended May with a total of 7.39 million subscribers in the 5G segment, followed by KT with 4.8 million and LG Uplus with 3.6 million. The growth in terms of 5G subscribers in recent months had experienced a slowdown due to the lack of new flagship devices. Samsung Electronics is expected to launch its new foldable smartphones in August.

South Korean telecom operators currently provide 5G services via NSA 5G networks, which depend on previous 4G LTE networks. The country’s three operators launched 5G technology in April 2019, and 5G networks are available mostly in large cities. SK Telecom, KT, and LG Uplus are currently preparing to commercialize new 5G technology, including standalone versions of the 5G networks and mmWave 5G.

The mmWave 5G service will be initially available for the business-to-business segment. Operators have not yet finalized investment plans for the business-to-consumer sector, as the cost of building additional infrastructure still represents a major issue, according to the reports.

In July of 2020, Korean mobile operators SK Telecom, KT, and LG Uplus agreed to invest a total of KRW 25.7 trillion (USD 22 billion) through 2022 to boost 5G infrastructure across the country.

South Korea’s Ministry of Science and ICT plans to award 28 GHz and sub-6 GHz spectrum in November to boost the use of 5G-related services across the country. The frequencies will be available for mobile operators and for companies operating in different verticals. A total of 600 megahertz in the 28 GHz band and 100 megahertz in the 4.7 GHz band will be made available. The 28 GHz band will be divided into 12 blocks and the 4.7 GHz band into 10 blocks, respectively. The spectrum in the 4.7 GHz band will be offered to non-telecom companies. The allocation of these new frequencies will allow companies to operate 5G networks across various industries and offer new services, such as smart factories, healthcare, robotics, and smart farms.

In Japan, NTT Docomo Incorporated is the oldest mobile carrier with the largest number of subscribers. For the three quarters ended March 2021, with 1.41 million 5G subscriptions the telco earned operating revenues of Yen 3513 billion, a drop of 0.1 percent from the same three quarters the previous year. Its operating profit was Yen 821.8 billion.

KDDI Corporation reported operating revenue of Yen 5312.5 billion for the year ending March 31, 2021, an increase of 1.4 percent from the same period last year. For the same period, the company reported an operating income of Yen 1037 billion, an increase of 1.2 percent.

SoftBank Group Corporation, Japan’s third largest mobile carrier for the fiscal year ending March 31, 2021 reported net sales of Yen 5628 billion, an increase of 7.4 percent from the same period last year; and a net income of Yen 5078 billion.

Rakuten Mobile launched its 5G services in Tokyo in September 2020, offering customers 4G and 5G combined in one simple plan at the same low price as 4G. By 2025, Rakuten Group Incorporated plans to invest over USD 1.8 billion to expand its network to roughly 56 percent of the populated areas of the country. It plans to install 15,787 base stations in the 3.7 GHz and 4.5 GHz bands and 7948 base stations in the 28 GHz band.

From 2020 to 2025, the four Japanese mobile carriers will spend more than USD 14 billion combined in capital expenditures to build out their 5G networks. This includes investments in base stations, servers, and fiber optics. GSMA forecasts that in Japan, by 2025, 49 percent of mobile connections will be 5G. Fitch Research forecasts that by 2029, there will be 151 million 5G subscriptions in Japan.

The Philippine Long-Distance Telephone Company and Globe Telecom Incorporated are the two major telecommunication carriers in the country.

In June 2021, Globe Telecom Incorporated reported 700,000 5G subscribers, with 81.7 million total mobile customers; PTDT Wireless’ Smart Communications reported XXXX 5G subscribers, with 71.6 million total mobile subscribers.

Qualcomm and Huawei are perhaps the two largest wireless 5G competitors on a global scale. They are both in the business of building out and upgrading the wireless experience. They are the builders who upgrade networks, smartphones, tablets, and other technology in the 5G world. That means they work with everyone including networks like AT&T, Verizon, and T-Mobile in USA, and many others globally. They also work with smartphone and tablet makers like Apple and Samsung.

Ericsson and Nokia are leading 5G wireless players. Samsung makes chip sets as well but is a smaller competitor. There are a few more, but not many. Apple is entering the chip set sector with their new MacBook Air and MacBook Pro using their own chips.

The Indian telecom annual equipment market is estimated at USD 10 billion, with only 30 percent being catered to by indigenous players.

The production-linked incentive (PLI) scheme for telecom and network manufacturing offers a good opportunity to domestic players. Both they and global players are being offered a 4-–6 percent incentive for five years, totaling over ₹12,195 crore. DoT has also reserved three out of the 10 slots among the large players to domestic players, provided 50 percent of the equity comes from Indians.

Dixon Technologies plans to concentrate on telecom customer premises equipment. The company will make routers, Wi-Fi and IoT devices, which is a ₹7000-crore market and of which imports account for half. A joint venture with telecom major Airtel is expected to provide Dixon with a ready market.

Three other home-grown players, Saankhya Labs, HFCL, and Sterlite Technologies are already working with partners to design and manufacture 5G radios for both domestic and export markets. Sterlite Technologies has tied up with VVDN Technologies, and is designing the radio and a systems-integration software. HFCL is designing and manufacturing macro and small cells to improve 5G coverage. For every tower, India has 600,000, telcos would require about 25 small cells so that customers can be delivered high-speed 5G with low latency. HFCL has applied for a patent for the technology. Centre for Development of Telematics, has also designed the core (and has also partnered with ITI) and PertSol is ready with a solution, too. Besides, the Tatas have developed O-RAN 5G radio as well as standalone and NSA core, which can be manufactured by Tejas.

These manufacturers are optimistic as the Chinese players may not be allowed to have a play, and the increasing preference for O-RAN, based on open standards not proprietary platforms, gives them a foot in the door along with Nokia and Ericsson. And Jio, keen to push its own 5G technology, may seek them out for hardware manufacturing.

Also, the networks are expected to be dominated by software that provides flexibility and ease in scaling up as well as more automation in operating networks, and will be less about hardware. It is expected that 70 percent of the cost of the next-generation 5G network would be for software and system integration; the rest is for hardware. Earlier, that ratio was in reverse. That is also why Indian IT companies see an opportunity now.

However, it is not that simple. 5G trials are being held by the telcos in collaboration with Nokia, Ericsson, and Samsung. The WPC wing of DoT had allotted 5G trial spectrum end May 2021 to the three telcos, Reliance Jio, Bharti Airtel, and Vodafone Idea. 100, 800 and 10 units of experimental 5G airwaves were allocated in the 3.5 GHz, 26 GHz mmWave and 700 MHz bands respectively to develop India-specific use-cases. Testing will need to be completed in six months, according to the spectrum license conditions.

June 2021 saw Reliance Jio kick off with its 5G test trials in Mumbai using indigenously developed technology, just after Airtel had conducted 5G network trials in Gurgaon, Mumbai, and Kolkata, and demonstrated a throughput of over 1 Gbps during the live trial.

Jio is using standalone 5G architecture for its trials and this will include testing of core and radio network for peak speed, latency, and data loads. The telco has tied up with multinational vendors, including Ericsson, Nokia, and Samsung for trials in Delhi, Pune, and Gujarat, and has achieved 1 gigabit per second download speed during the tests. Vodafone Idea has also started 5G trials in Pune and Gandhinagar.

It is highly debatable, now with the launch of 5G services across the world, whether the trials have relevance now. It may be more prudent for the telcos to focus on increasing fiberization, and for the towercos to add more towers; 5G requires nearly three times more towers than 4G.

To make 5G a success story in India, it is essential to invest on network densification heavily through provisioning of fiber, small cells, and mobile towers. Foremost among reasons for India lagging behind is the ecosystem’s non-readiness in terms of adequate infrastructure – towers, fiber, and spectrum.

Low fiberization. Crisil Research estimates a total industry-wide CapEx of up to ₹2–2.5 trillion on fiber over a 10 year CapEx cycle, with 70 percent front loaded in the first five years. Against a target of 7.5 million kms of fiber required to be deployed, only 2.68 million kms have been deployed to date.

Towers. Currently, around 33 percent of telecom towers are connected with fiber in India, which needs to reach at least 70 percent to fully utilize the potential, which 5G services could offer. According to an E&Y report, the CapEx requirement will be around ₹45,000 crore to reach 70 percent tower fiberization by 2024. The current capacity per tower site is about 300 Mbps for 2G/3G/4G services while for 5G, the capacity required for each site will increase to 1–5 Gbps, which will require fiberized backhaul. A clear RoW policy is equally important as the expense on RoW permissions extends up to ₹50 lakh–1 crore per km in dense urban areas.

Spectrum. While the government is yet to announce the dates, the 5G spectrum auction is expected to be held in 2022, with the base price of airwaves still a thorny issue for telcos. And the initial 5G launch is expected to be restricted to specific urban-dominant circles, and gradually increased to other areas as use-cases mature.

With the ITU having approved the 5Gi standards developed by IITs under the aegis of the TSDSI, it remains to be seen if they will be included in Release 17 scheduled in 2022. The telcos now seem to be unanimous that with 5Gi not having a device ecosystem, it should only be considered as optional and 5Gi standards not be made mandatory, for it may limit the adoption of 5G and increase the end-user cost of ownership.

Of course, if the local 5G standard is globally harmonized, it will help in lowering the cost of devices and achieving scale, and also make India an export hub for 5G handsets.

Harmonization with 3GPP is crucial too. Currently, the Indian technology remains devoid of the 3GPP stamp. As commercial rollouts begin, telcos can choose to ignore 5Gi, which requires a minor upgrade in the software for base stations and a tweak in the firmware on user devices like cell phones. Operators can also prevail upon their respective telecom vendors and insist on these tweaks. Apart from the increase of the network cost, adoption of 5Gi would impact interoperability between networks if two different technologies are used.

And the pressure is not only coming from the telcos but also from the international trade bodies as Information Technology Industry Council (ITI), Telecommunications Industry Association (TIA), US Chamber of Commerce US-India Business Council (USIBC), UK India Business Council (UKIBC), and US-India Strategic Partnership Forum (USISPF).

Although large vendors as Qualcomm, Mediatek, and Samsung have informally prepared to implement 5Gi in case it gets enforced in India; now that the standards are frozen internationally, technology has been accepted, the Indian vendors are wary. The vendors have not forgotten China’s experience when it had taken a beating with its own standard, TD-SCDMA, when the two other standards in use then were W-CDMA from Europe and CDMA2000 from the US.

Also, that is definitely a concern for the end consumer. Most brands have started offering 5G devices. If 5Gi does come, chances are these phones will not be compatible with local bands for 5G. And the consumer will have to buy a new 5G phone.

It makes sense to align the device ecosystem and make guidelines so new 5G devices sold in India support all spectrum bands. Currently, the 5G devices sold in India support just a 3.5 GHz band, which is a restricting factor. The government should consider putting a framework where device manufacturers can roll out 5G devices that can support any of the bands available with telcos.

The three Indian telcos already have 5G-ready networks. On January 28, 2021, Airtel became India’s first telco to demonstrate and orchestrate LIVE 5G over a commercial network in Hyderabad. Airtel did this over its existing liberalized spectrum in the 1800 MHz band through the NSA (non-standalone) network technology. Using a first of its kind, dynamic spectrum sharing, Airtel seamlessly operated 5G and 4G concurrently within the same spectrum block. This demonstration has emphatically validated the 5G readiness of Airtel’s network across all domains – radio, core and transport. Airtel 5G is capable of delivering 10× speeds, 10× latency, and 100× concurrency when compared to existing technologies.

Through Airtel’s network vendors and device partners, the telco will utilize the Qualcomm 5G RAN platforms to roll-out virtualized and O-RAN-based 5G networks. In addition, Airtel and Qualcomm Technologies will collaborate to enable a wide array of use-cases, including 5G Fixed Wireless Access (FWA) that is designed to deliver broadband connectivity at Gigabit speeds to homes and businesses.

Bharti Airtel and Tata Group have formed a strategic partnership for implementing 5G networks solutions for India. Tata Group has developed a state-of-the-art O-RAN based radio and NSA/SA core and has integrated a totally indigenous telecom stack, leveraging the Group capabilities and that of its partners. This will be available for commercial development starting January 2022. The collaboration with Tata Consultancy Services is aimed at using O-RAN to roll out networks and solutions for Airtel and then for the rest of the world. TCS brings its global system-integration expertise and helps align the end-to-end solution to both 3GPP and O-RAN standards, as the network and equipment are increasingly embedded into software. Airtel will pilot and deploy this indigenous solution as part of its 5G rollout plans in India and start the pilot in January 2022, as per the guidelines formulated by the Government of India.

Airtel also has sewn up other alliances that both can leverage, given that no one company can provide all the elements or equipment. So, Airtel has a tie-up with Altiostar to build small cells, cloud player Red Hat, and US-based Mavenir, which has developed a core and is willing to transfer technology for manufacturing. The Tata group can offer to manufacture these products via Tejas.

Earlier, it had discussions with Tech Mahindra to engage it as a system integrator and software partner. It has also tied up with global partners including Japanese hardware giant NEC, Taiwanese major Sercomm, IBM, cloud player Red Hat, and start-ups like the US-based Mavenir, apart from Rakuten of Japan. The group has also signed up with Dixon Technologies for manufacturing a range of telecom products under the PLI scheme.

Reliance Jio is determined to be the first company to launch 5G services in India. Jio Platforms has collaborated with Qualcomm Technologies to localize the manufacturing of critical 5G equipment in India. Radisys Corporation, a wholly-owned subsidiary of Jio Platforms, along with Qualcomm, has developed a next-generation 5G solution with a virtualized radio access network (vRAN). Jio has in place an end-to-end 5G stack, including 5G radio and core network solutions. Jio Platforms is also working with original equipment manufacturers (OEMs) on standardiszing 5G device configurations. Jio has also entered into a 5G partnership with Google Cloud that will provide a complete end-to-end solution for fully automating and managing Jio’s 5G network and services, which will run on its Cloud. Google will integrate Google Edge Cloud with Reliance Jio to provide a scalable platform for edge applications. Jio will also migrate its core businesses as Reliance Retail, JioMart, Jio Saavn to Google Cloud.

In collaboration with Google as a strategic partner and investor, Jio Platforms is also developing an entry-level affordable smartphone with optimized operating system. Jio also has in place a tie-up with Intel for co-innovations for its 5G RAN, NXP Semiconductors to implement a 5G NR O-RAN small cell solution that incorporates NXP’s Layerscape® family of multicore processors and a collaboration with Spirent Communications to validate its cloud-native 5G standalone core network for real-world workloads and traffic conditions using Spirent Landslide.

Vodafone Idea has tested dynamic spectrum sharing as a feature between 4G and 5G with its existing 4G spectrum. The telco has been deploying equipment, which is 5G ready for both radio and core, so that it has the advantage of having the latest 4G equipment, which is capable of upgrading to 5G. “We have made progress in deploying several 5G-ready technologies, such as massive mimo, dynamic spectrum refarming, and cloudification of core, etc. They are very much central to our future growth,” said Ravinder Takkar, CEO, Voda Idea. “We also have the opportunity to leverage technology innovations and best practices globally from the Vodafone group, which has commercially deployed 5G services in 10 European markets,” he added. The telco had continued with the largest edge cloud deployment in the country and is deploying 5G-ready equipment on both radio and core, and is well prepared for the 5G rolloutin India.

Vi has in place a collaboration with Cisco to simplify and automate its network to support 4G and, in the future, 5G use-cases. Vi is working with Cisco to design and build a cost-efficient network architecture to drive greater speed-to-market with emerging opportunities in 4G and 5G, cloud, and IOT.

The telcos, Airtel and Vi, have since April 2021 launched Internet of Things (IoT) solutions comprising connectivity, hardware, network, application, analytics, security, and support for enterprises that seek to digitize their businesses. And have signed up with many customers.

Use Cases

The biggest challenge will be how to monetize 5G for consumers. Most 5G operators have yet to bundle 5G-rich apps, or even roll out their first 5G-rich app.

Of those that have bundled, they have a differentiated pricing model and have bundled at least one 5G-rich service. Bundling a 5G-rich app, e.g., 3D AR shopping/e-books, or VR cloud gaming, alongside more expensive 5G plans, will make consumer upselling easier for telcos, advises Omdia. In turn, this can lead to mobile ARPU growth/stability, lower churn, and incremental revenue as consumers buy more expensive 5G plans and a 5G handset.

Some other advice that the global research leader doles out is:

The service providers think about 5G as more than speed; 5G apps offer visibility and transparency for consumers that will churn if bill shocked, and 5G apps need marketing – a culture of service-based marketing initiatives that showcase (not overhype) how 5G enhances the customer experience of services, such as AR and VR.

Some rebound in consumer confidence as COVID-19 challenges ease is expected. Once this is coupled with more affordable 5G handsets, a window of opportunity for telcos to launch either new 5G pricing models or bundle 5G-rich services to drive upselling to more expensive 5G plans will open up.

In 2021, it will be essential for 5G operators to innovate more to grow revenue, through new pricing models (e.g., speed tiers) and bundling new services. Amid continued economic uncertainty due to COVID-19, telcos need to justify to consumers that 5G is worth it. Bundling services of value will help justify charging a 5G premium.

The content owners not to delay partnerships with telcos on 5G content, go ahead and choose the right telco partners, and monetize the telco partnership.

There will be more opportunities to collaborate with 5G operators in 2021, particularly Tier-I operators. However, even Tier-II telcos and operators in emerging markets will start to experiment with, and partner on, 5G-rich content.

It would be prudent to explore the nuances of different markets and what consumers want in each market. Engage operators within those markets to ensure the right partnership and content fit.

The economic impact. The promise of 5G has been echoed throughout the business world for years. 5G’s faster speed, lower latency, and ability to connect vastly higher numbers of devices than previous generations of mobile technology offered executives a glimpse of a more efficient and productive future. By providing the basis for ubiquitous ultra-fast broadband, 5G opens up possibilities far beyond the reach of 4G or Wi-Fi 6. This promise has only grown more critical today, as leaders consider how best to repair, rethink, and reconfigure their business for the post-COVID-19 world.

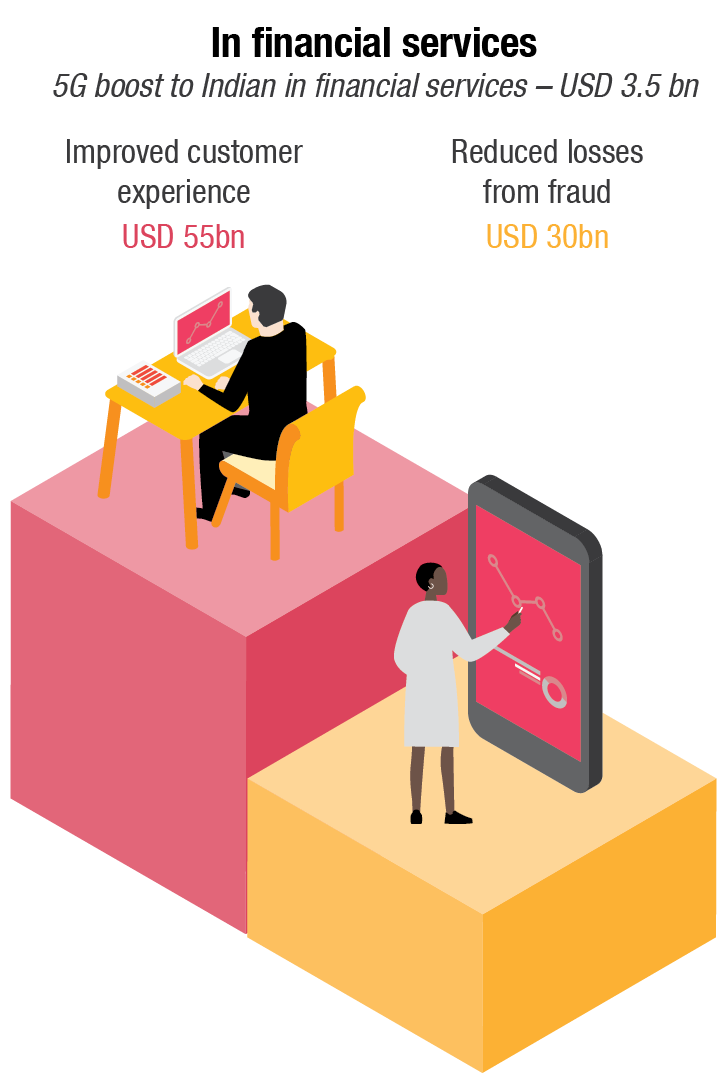

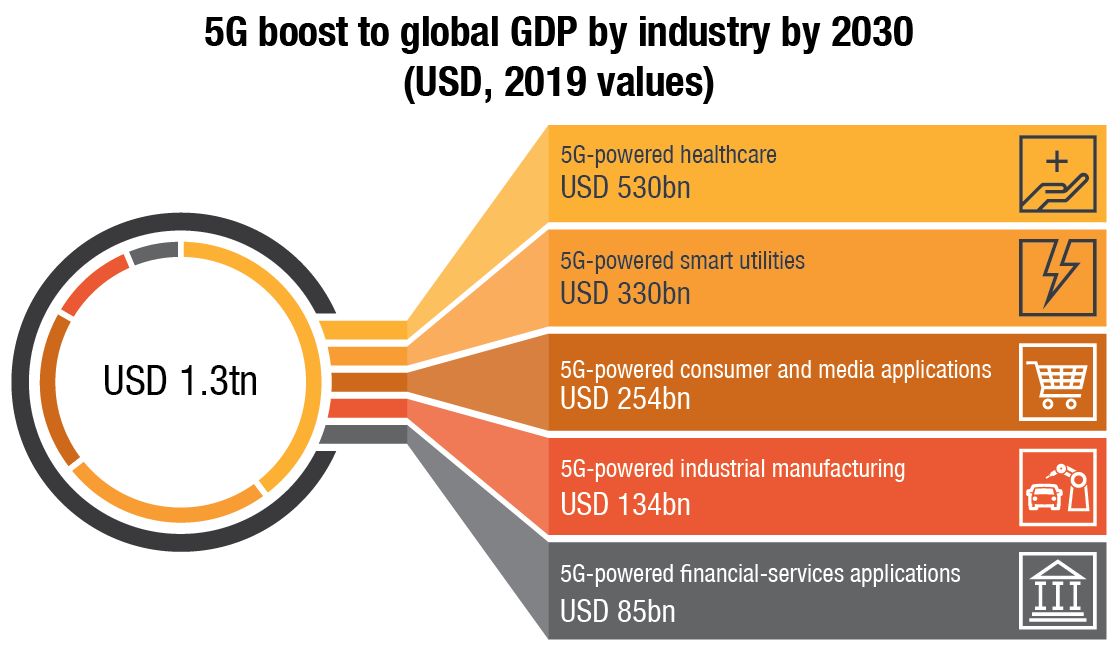

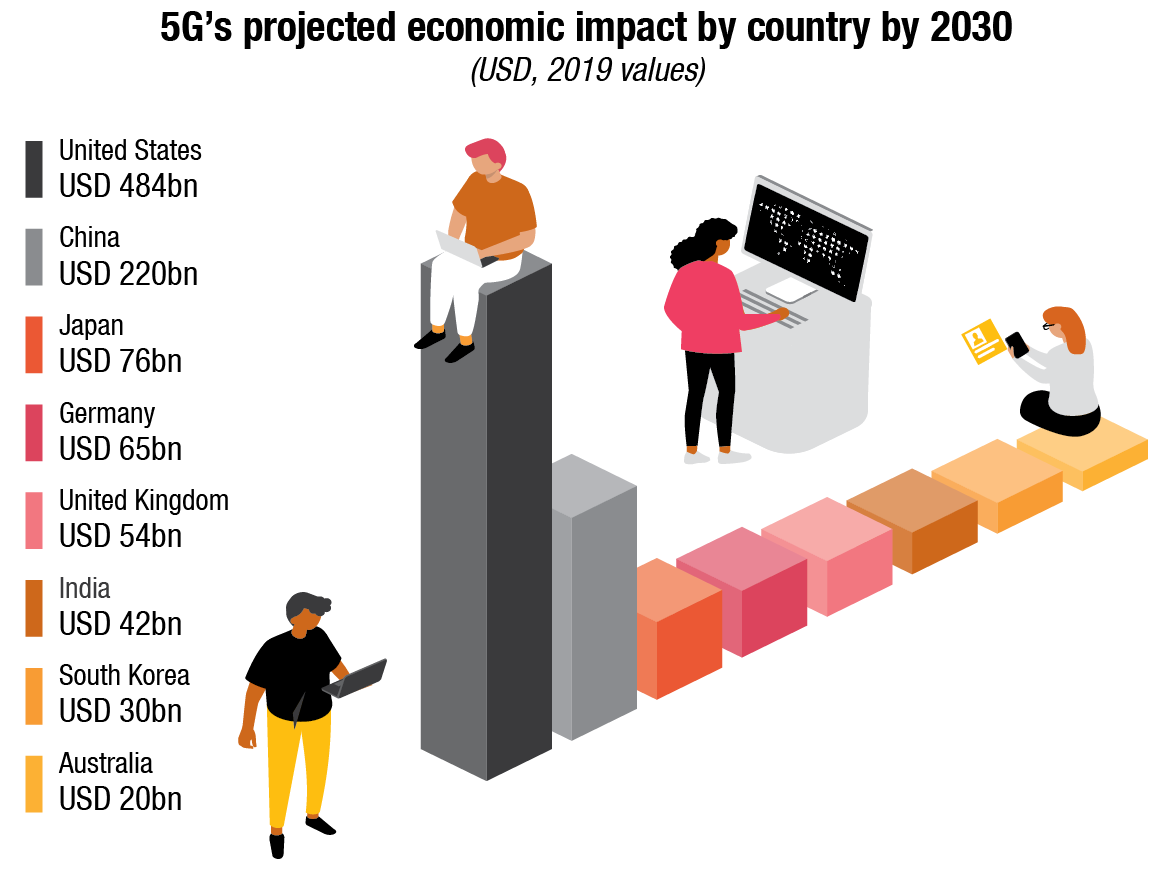

Drawing on expert insight and using economic modelling, PwC has begun to quantify the technology’s potential impact at use-case level in economic terms. Five industries – healthcare, smart utilities, consumer and media, industrial manufacturing, and financial services stand to benefit significantly from 5G technology. As with any such analysis, the absolute figures can only be directional and are most interesting when looked at in relation to one another. More than 80 percent of the economic potential appears to lie in healthcare applications (projected to contribute USD 530 bn to global GDP), smart utilities management (an additional USD 330 bn), and consumer and media applications (USD 254 bn more) through 2030. Smaller contributions from the other industries bring the total estimated uplift to USD 1.3 tn.

As with any such analysis, the absolute figures can only be directional and are most interesting when looked at in relation to one another. More than 80 percent of the economic potential appears to lie in healthcare applications (projected to contribute USD 530 bn to global GDP), smart utilities management (an additional USD 330 bn), and consumer and media applications (USD 254 bn more).

Smaller contributions from other industries in our study bring the total estimated uplift to USD 1.3 tn. As leaders contemplate the decade ahead, 5G demands strategic attention – both to where and how it can create competitive advantages, and to the implementation and integration imperatives that must be met for it to generate value.

Reinventing the future with 5G. The potential for impact across industries is enormous, but to realize these gains, companies will need a strategic approach – one underpinned by a clear view of the use-cases that will deliver the greatest value over time. This is true for both of the key stakeholder groups shaping the future usage of 5G: enterprises and policy makers.

Be it the individual consumer, enterprises, governments, or the global economy, to power their respective tomorrow, each must be ready to seize the opportunities offered, concludes PwC.

You must be logged in to post a comment Login