CT Stories

The pandemic is forcing the industry to re-invent itself

Telecom services have become even more critical to everyday life since the outbreak of COVID-19. Communication networks have allowed many employees to work from home. Fixed and mobile broadband have enabled an unprecedented rise in video conferencing, a vital tool for communication and social connection amid lockdowns and physical distancing. Healthcare and retail services have increasingly shifted online. Telcos have helped governments monitor and fight the spread of the virus. In short, telcos’ networks have kept societies and economies going.

While telcos rose to the challenge—connecting people to work, school, family, and healthcare—the pandemic accelerated and amplified trends that were already redefining the basis for success.

Over the past decade, telcos have been under continuous pressure as their traditional value pools have gradually eroded and new growth horizons have proven elusive, driving return on investment capital (ROIC) ever closer to weighted average cost of capital (WACC). 2021 is a critical year for operators, a unique opportunity to fundamentally reimagine their business or, alternatively, risk another decade of decline.

The pandemic amplified the urgency of profound, accelerated reinvention for the telcos. It provided a blueprint for a faster, leaner new operating model, made possible by rapidly shifting behaviors. And it put telcos front and center, as almost every aspect of human interaction moved online amid lockdowns and physical-distancing measures.

It acted as a catalyst for transformation, forcing businesses to push through their plans for digitalization much sooner than originally planned. Where once digital transformation was a matter of staying competitive, it is now a matter of survival. In order to fulfil demand, operators started looking inwards and pushing forward their own plans to digitalize themselves.

At the same time, the industry is experiencing seismic, irrevocable shifts. Customer behaviors have leap-frogged five to ten years ahead. The importance of digital-enabled sales interactions doubled, with consumers moving online and increasingly embracing self-service customer care.

Bandwidth-heavy activities like remote learning, gaming, and videoconferencing grew dramatically, a change that is expected to be permanent. More than half of companies expect to see increasing migration of assets to the cloud, creating demand across both operator and adjacent value pools. And consumers are paying more attention to how companies do business, with issues like sustainability or values increasingly factoring into their buying decisions.

On the flip side, while tech companies (including digital natives like Tencent and Amazon and large, tech-centric businesses like Samsung, Sony, and Qualcomm) increased their investments by more than 30 percent in 2020, supporting long-term changes and new growth vectors, operators reduced their capital-expenditure investments by around 2 percent, on average, observes McKinsey. This response made sense while navigating 2020’s challenges, including supply-chain shortages and call-center closures. Nonetheless, 2021 demands a wholly different approach: a doubling down to emerge stronger.

The pandemic came at a time when operators were already dealing with money constraints and increasing CapEx spending for extensive network rollouts, not to mention mounting pressures on revenues from OTTs. In order to fulfil the connectivity demands of the new normal, telco operators are pushing forward. They are revisiting business models, embracing agility and embarking on digitalization journeys faster than ever before. Cost reduction, new revenue streams, enhanced customer experience, acquisitions, better targeting are but a few of the benefits that lie ahead if operators get digital transformation right. They are already heading in this direction, boosting budgets from this new fiscal year onwards to reach their customers via digital.

Telcos can either tinker around the edges to achieve incremental gains or make a bold choice to reinvent their value-creation formula and bravely, firmly commit to that choice—seizing the opportunity to create a permanent new role for themselves in a world reshaped by a pandemic that put them at the center.

Reimagining and reverse engineering the telco future is the way forward. To design a new, value-creating role for themselves in a post-COVID-19 world, operators must first define a detailed vision of what the reimagined telco will look like. From there, leaders have to take a future-back approach, reverse engineering their vision by making three to four bold moves that fundamentally change the DNA of their organization. These carefully orchestrated moves, undertaken simultaneously, build on one another—shifting performance, yielding new service models rooted in new capabilities and success factors, and delivering growth as well as cost and capital efficiencies.

Organizations that move early to restructure and change during times of crisis come out ahead in the subsequent decade. The next generation of telcos will be defined by leaders who act now, risking short-term incumbency advantages to seize untapped growth. The current moment demands a holistic, future-back approach to transformation, in which leaders deliver on four or five bold, integrated changes to reset their organization’s DNA.

As enterprises increasingly turn to 5G to drive transformation agendas forward, it is the IT services and application/platform vendors that are being perceived as digital transformation experts by the enterprise, reiterates EY in a recent study. Telecommunications operators will need to take steps to improve their transformation expertise, recognize that businesses want suppliers to act as partners that provide end-to-end solutions. Operators need to explore new ecosystem positions while focusing on the opportunities for business model overhaul that 5G can enable.

Global telecom giants currently find themselves at a critical crossroads. Although coverage is improving and speed is increasing with investment in 5G networks, revenue growth from voice and data is slowing in many markets. At the same time, the industry continues to have difficulty with meeting rapidly changing customer expectations, which are shaped by simple, personalized interactions that are made available by digital giants such as Airbnb, Amazon, Apple, Netflix, and Uber. Telecom operators’ average net promoter score (NPS), a key customer-satisfaction metric, has typically been in the 20s, versus more than 50 for many digital powerhouses, observes a McKinsey report.

There is nothing simple about most telcos’ product portfolios, and complexity is part of their problem. What started as a broad range of plans for a diverse customer base has evolved into a dizzying array of options that are difficult to understand and navigate, damaging the customer experience, especially in comparison with that offered by ascendant digital-native alternatives.

To better satisfy and hold onto their customers, some operators have started to build their own separate digital-native-attacker units. This approach has turned out to be less expensive and disruptive—and in some cases, more successful—than a holistic digital transformation of the core business. The nimble, new brands are also proving to be strong growth vehicles for their parent companies. Within four quarters from launch, the typical digital attacker has contributed close to 25 percent of overall gross additional subscribers (gross adds) to the incumbent operator, while showing total profitability that is more than five percentage points higher.

On one hand, operators are building digital roadmaps and changing management strategies. However, it is unclear how this will play out, when 75 percent of them do not have clear KPIs, translating their strategies into concrete metrics. Even with no digitalization metrics in place, and other hands-on mishaps, they will be increasing their digitalization investments going forward.

At the same time, in a new -forcibly augmented and brought forward- digital reality, operators see some big challenges lying ahead. The jury is still out whether further digitalizing their businesses will bring the results they anticipate. Operators identify cost reduction, automation, improving the customer experience, driving revenue growth all with a clear and direct impact on operator bottom lines- as the top benefits digitalization can bring.

It is interesting that operators, who are usually quite cost-conscious, place security and technology integration above cost and ROI, showing how real the struggle is. All of these are fine lines that MNOs need to balance, should they want to create value out of digitization and not just make it a catch phrase that looks good in their investor and analyst reports.

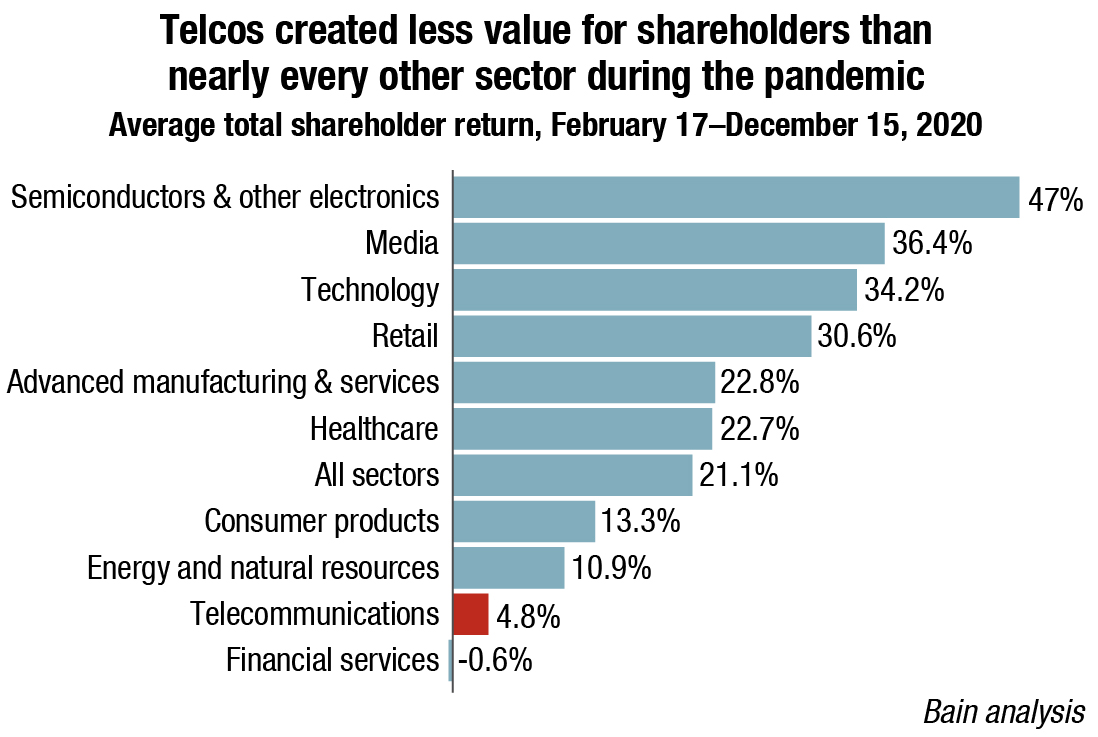

Paradoxically, telcos’ crucial societal role hasn’t translated into strong returns for their shareholders. During the pandemic, telcos globally have created less value for shareholders than every sector but one, financial services. From last February to mid-December (2020), telcos’ total shareholder return (TSR), which measures the total return a shareholder receives from share price changes and dividends over a certain time period, trailed the average of all sectors by 16 percentage points. What’s more, telcos have fallen further behind the longer the pandemic continues. From April to mid-December, telecommunications was the worst-performing sector as measured by TSR.

That means the pandemic has only exacerbated a trend that has frustrated industry stakeholders for years: Despite telcos’ massive investments in infrastructure and services aimed at realizing the vision of a digital economy, the financial rewards appear to accrue to others. The stark contrast between the sense of pride that many telco leadership teams and employees have deservedly felt about their pandemic response, and the subsequent financial outcomes, is telling.

Telcos, like all businesses, started this year surrounded by immense uncertainty. The trajectory of the pandemic remains the single most important factor for economic growth. In 2020, global GDP contracted sharply and trailed the pre-pandemic forecast by USD 6 trillion. Recovery from this health and economic crisis will be uneven. While many large economies are expected to return to growth in 2021, the timing and rate of recovery will likely vary widely. Telcos that carefully monitor the impact of the uneven recovery on their customers, employees, and partners can position themselves to respond more effectively.

Notably, TSR wasn’t poor for all telcos last year. In fact, the top quartile of telcos managed to outperform the cross-industry TSR average by 9 percentage points, according to a Bain & Co. analysis.

Yet even the telcos that have fared better can’t afford to sit still. That’s because the sector’s basis for competition is fundamentally shifting. And these emerging changes in technologies, customers, market structures, and regulation are further accelerating in 2021, with a few dynamics standing out in particular.

The road ahead won’t be easier. As we look to the coming year and beyond, telcos face unprecedented challenges in responding to the continuing COVID-19 crisis while simultaneously trying to stay ahead of a rapid industry transformation that began before the pandemic. Leading companies will navigate this tumultuous period by making strategic choices to secure the future of their business and improve their value creation—even if it requires a bold transformation.

In India specifically, the industry average revenue per user (ARPU) which was in the range of ₹74-₹79 in the first 3 quarters of FY20 increased to the level of ₹91 in the Q4FY20 (sequential growth of 16.3 percent) primarily backed by price hikes (up to 40 percent) undertaken by the telcos for its prepaid users from the month of December 2019 onwards. Following this, the ARPU continued with the level of ₹90 for the next 2 quarters and crossed ₹100 mark in Q3FY21. The ARPU however is estimated to have declined to about ₹96 in Q4FY21 due to the application of bill & keep regime (January 1, 2021 onwards) from the earlier Interconnect Usage Charges (IUC) regime. Subsequently, the ARPU for FY21 is estimated to have averaged at ₹96, an increase of 20.6 percent on a YoY basis.

The IUC charges were fixed at 6 paise per minute with effect from October 1, 2017 from the earlier 14 paise per minute charge.

However, these charges were abolished to 0 paise per minute with effect from January 1, 2021. This, in turn, reduced the ARPU of the telcos in Q4FY21 but at the same time, it also prevented the telcos from incurring this expense.

The price (ARPU) hike was undertaken by telcos primarily to subside financial stress in the industry and was supported by an upward momentum in data consumption, data prices and an increase in share of 4G subscribers. The share of revenues from data in ARPU has grown tremendously for the telecom industry over the years. It has increased from 21.6 percent in the December 2016 quarter to 78.1 percent in the December 2020 quarter.

Data consumption. The average data consumption per subscriber per month improved sequentially in each of the quarters during FY20 from 9.8 GB per month in Q1FY20 to 11.2GB per month in Q4FY20 and averaged at 10.4GB per month during FY20. The data consumption increased further in FY21 as it averaged almost at 12GB per month per subscriber in each of the first 3 quarters during the year and is estimated to have averaged at around similar level in Q4FY21. Thus, data consumption in FY21 is estimated to have rose by a strong 17.5 percent y-o-y and averaged at 12.2GB during the year.

Data prices. The growth in data volumes because of need of more data at each individual end aided the uptick in data prices as can be seen in Chart 1 above. The price of per GB data that was around ₹7-₹8.5 during the first 3 quarters of FY21 moved beyond this level in Q4FY21 where it saw a sharp increase of 32.9 percent to ₹11.2 per GB on a sequential basis backed by price hike. In the following quarters, this price level sustained, and it revolved around ₹10-₹11 per GB which is estimated to have stood at ₹11.1 per GB in Q4FY21. The data price thus is estimated to have averaged at around ₹10.9 per GB for FY21, which is growth of 26.9 percent on a yearly basis.

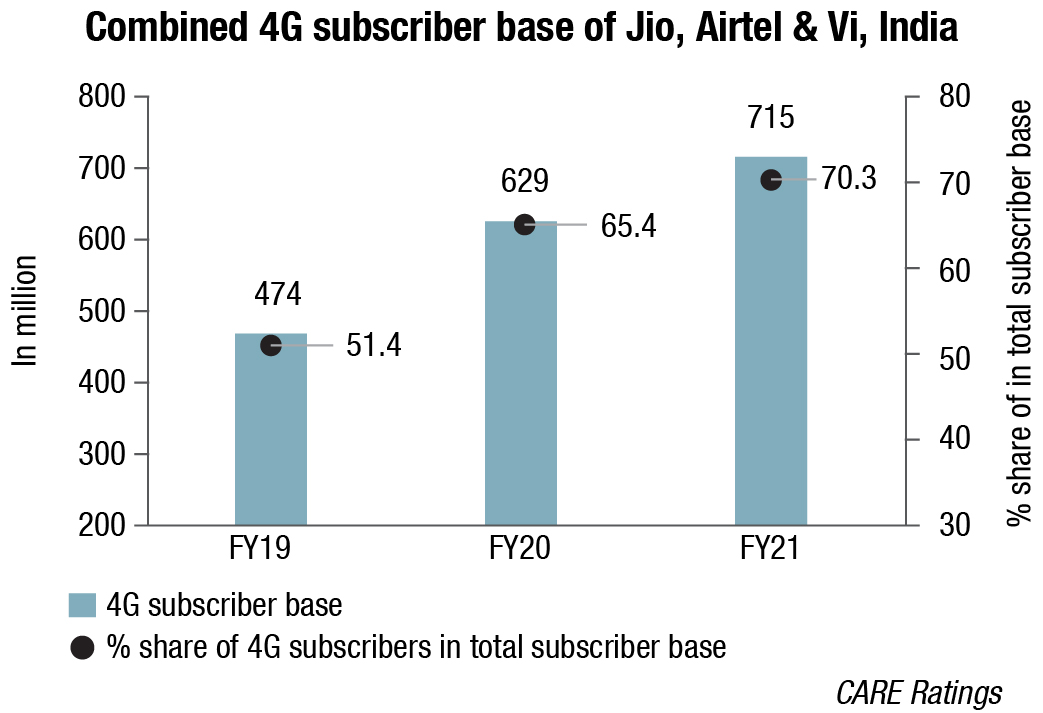

Increase in share of 4G subscribers. Any upward movement in the share of 4G subscribers is auguring well for the telecom industry as this set of users are better paying customers compared to 2G and 3G network users. During the past 3 years (FY19 to FY21), the aggregate 4G subscriber base of the top 3 telcos increased by a healthy 50.8 percent from 474 million in FY19 to 715 million in FY21, thereby, expanding the share of 4G subscribers in their total subscriber base from 51.4 percent in FY19 to 70.3 percent in FY21. Spectrum reframing practice of the telcos to upgrade the users to make them more revenue generating and the need of users to have access to higher speed and volume of data thus resulted in augmentation of 4G subscriber base during these years.

The combined share of 4G subscribers in the aggregate subscriber base of the top 3 telcos can be considered as representative of the industry. The aggregate telephone subscriber base of these top 3 telcos accounted for close to 90 percent of the total telephone (wireless + wireline) subscriber base of the industry as on February 2021.

Various factors supported and prompted the industry ARPU to move up in the past quarters. The growth in ARPU however needs to be sustained for the betterment of industry where the telcos aim to increase their respective ARPU levels to at least ₹200 per subscriber per month. The ARPU of the top 3 telcos is estimated to have averaged at around ₹138 during FY21, an increase of 11.6 percent on a YoY basis. Thus in order to achieve the level of ₹200, a hike in ARPU appears imminent in the coming months and the price growth needs to be much more during FY22 than seen in FY21.

However, it remains to be seen if the telcos increase ARPU prices or wait for the government’s decision on floor tariff or pricing.

India is still looking to hold 5G trials, while 5G commercial rollouts reach 158 local operators with active networks in 67 markets worldwide as of March 2021. The WPC wing of the DoT allocated spectrum to Bharti Airtel, Voda Idea and Reliance Jio on May 27 for conducting 5G trials with Ericsson, Nokia, Samsung and C-DoT. In addition, Reliance Jio Infocomm will be conducting trials using its own indigenous technology. Each has been allotted 10 units in 700 MHz, 100 units in 3.5 GHz and 800 units in 26 GHz bands.

During the trials, application of 5G in Indian settings will get tested. This includes tele-medicine, tele-education and drone-based agriculture monitoring etc. Telecom operators will be able to test various 5G devices on their network. The duration of the trials, at present, is for a period of 6 months. This includes a time period of 2 months for procurement and setting up of the equipment. Delhi, Mumbai, Kolkata, Bengaluru, Gujarat, and Hyderabad have been decided as locations for trials. None of the telecom operators has been allocated spectrum in Punjab, Haryana and union territory of Chandigarh.

The permission letters specify that each telecom service provider will have to conduct trials in rural and semi-urban settings in addition to urban settings so that the benefit of the 5G technology proliferates across the country and is not confined only to urban areas.

The homegrown 5G standard, 5Gi, developed by the Indian Institute of Technology under the aegis of Telecommunications Standards Development Society India (TSDSI), has become an issue of contention between India’s top two telcos, Reliance Jio and Bharti Airtel.

Whereas, Airtel has strictly opposed 5Gi arguing that 5Gi will increase the costs of network and mobile devices, and will seriously impact the interoperability between networks based on two different network technologies, Jio supports it, that it does not compromise on the network quality and increase costs.

While a COAI note mentions that the TSDSI has not yet demonstrated if 5Gi is an improvement over 3GPP standards in rural India, Jio maintains that the TSDSI has demonstrated to the ITU that 5Gi does show improvements over 3GPP.

India’s 5G spectrum auction is likely to be pushed to the first quarter of 2022, and the launch of 5G services to the second half of 2022. That may not be such an undesirable development from the service providers point of view, as it gives them more time to get their finances in order for the auction. As of now, the base price for the 5G spectrum in India is one of the highest in the world.

Going forward, consumer and enterprise customers’ service needs and patterns of use will further evolve as pandemic restrictions ease and economies open again. Enterprises’ growing demand for the Internet of Things, automated operations, and edge computing will require many telcos to augment their capabilities across networks and services.

In order to better serve customers’ new demands, telcos are expected to continue making large infrastructure investments in areas such as 5G, fiber-network expansion, and network virtualization. Assertive capital expenditures (CapEx) will be a positive for the industry, on balance. One of the big questions is how to fund these investments. The most feasible CapEx funding source over the next decade will be reductions in operating costs.

This will present a big challenge in two ways. First, some industry analysts expect telcos’ global operating expenditures to increase by billions of dollars this year. Second, the next wave of material reductions in operating costs will likely come from substituting computer processing power for people.

For many telco carriers, this will involve a difficult transition and represent an enormous political challenge, as they’ll no longer be among the largest employers in their markets.

However, unless they can meaningfully reduce operating expenditures, many telcos will face a high-wire balancing act to secure higher CapEx investments while simultaneously protecting cash flows to fund both debt-laden balance sheets and dividends.

Another heightened challenge for telco operators will be managing the infrastructure supplier network in light of geopolitical tensions.

For example, trade conflicts and cybersecurity concerns are affecting the role of Chinese manufacturers in the telecom network buildout in many regions. At the same time, telcos will likely face more questions from investors, employees, and business partners about their long-term strategies to meet global challenges involving sustainability and diversity, equity, and inclusion. Increasing their focus on public relations and managing government relationships can help companies navigate these issues while strengthening their reputation and their business.

On top of these challenges, telco executives are staring down tectonic industry shifts. Over the next decade, Bain & Co. expects the industry to experience some of the most profound changes since the wave of deregulation in the 1990s. At the root of this bedrock transformation is the virtualization of connectivity, similar to what began happening to compute and storage more than a decade ago.

Specifically, the communications infrastructure is no longer required to serve as the linchpin without which communications services and capabilities couldn’t function.

For example, Internet-enabled video services no longer need complex systems to reserve bandwidth and assure the quality of experience. Today, the capabilities of over-the-top media architectures surpass minimum quality-of-experience requirements, while also allowing for easier add-on functionality. This significantly enhances the overall customer experience.

In a world where network infrastructure is divorced from the service layer, integrated telco carriers become less essential.

Thus, a growing number of infrastructure-focused telecom businesses and a more vibrant industry model for wholesale networks will emerge Concurrently, owning the network will become less critical to providing telecom services, spurring the rise of more asset-light carriers. This shift in market structure will be profound, and companies that move quickly will be in the best position to succeed.

Going forward, communication services will no longer depend on fit-for-purpose networks, thus opening a new chapter in the telecommunications market.

You must be logged in to post a comment Login